Deng Tong, Golden Finance

On Wednesday local time, Pulte, director of the Federal Housing Finance Agency (FHFA), posted on social media: "After in-depth research and in line with President Trump's vision of making the United States the 'crypto capital', today I ordered Fannie Mae and Freddie Mac to prepare to list cryptocurrencies as recognized assets for mortgage applications."This directive marks a possible major shift in the asset review standards for U.S. government-supported companies to assess mortgage qualifications, and is also in line with the Trump administration's established goal of promoting the popularity of cryptocurrencies in the United States.

Finally, the wind of crypto assets has blown to the U.S. real estate industry.

1. Why should cryptocurrencies be listed as recognized assets for mortgage applications?

The core reason is the sluggish real estate market in the United States. Over the past 50 years, the home ownership rate in the United States has remained relatively stable, with about 62% of the population owning homes. However, the number of new housing applications has dropped sharply in recent years. The U.S. housing market has been sluggish since mortgage rates climbed from pandemic lows in early 2022. Home sales fell to a nearly 30-year low last year, marking the second consecutive year of sluggish sales. So far this year, high interest rates and housing prices have continued to suppress the market. Redfin data shows that as of April, the number of sellers in the U.S. housing market was nearly 34% higher than that of buyers.

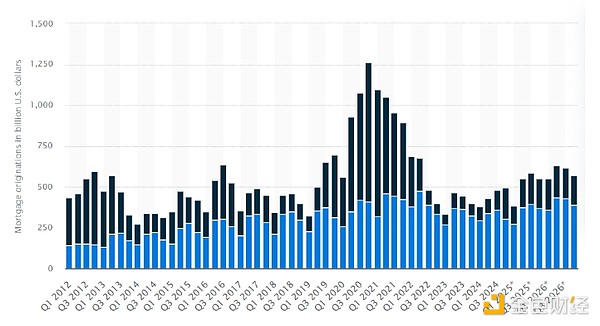

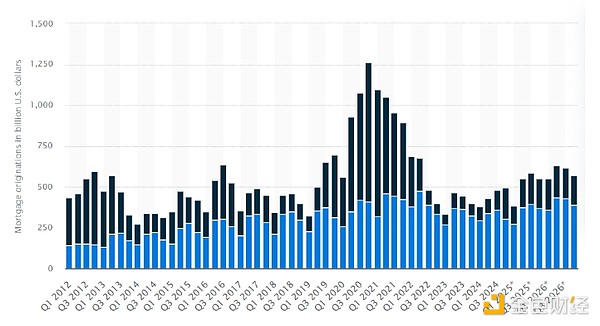

In addition, the number of mortgage originations (the process by which lenders and borrowers work together to form a mortgage) fell to near-historic lows in mid-2024 and showed little improvement in the first quarter of 2025. The decline in originations, especially refinancing, is attributed to two major factors: housing supply issues and borrowing costs.

Forecast of mortgage originations from 2012 to the third quarter of 2026. Source: Statista

First, housing supply growth is not enough to meet demand. Housing construction is lagging, more homes are purchased by investors rather than potential homebuyers, and elderly homeowners still choose to live at home rather than move to nursing homes.

Borrowing costs are also getting higher, and many people blame the decline in loan originations on the Federal Reserve's interest rate hikes to curb inflation. But due to the legacy of the subprime mortgage crisis, banks' stringent loan review cannot be ignored. For example: the down payment cannot be less than 20%, the credit score must be above 700, and there must be proof of a stable source of income. Many housing transactions were canceled because the buyer could not get a loan.

Faced with these unfavorable factors, the US government looked for ways to make it easier for homeowners to borrow money, and finally placed its hopes on cryptocurrencies.

2. A quick overview of the content of the Federal Housing Finance Agency (FHFA) directive

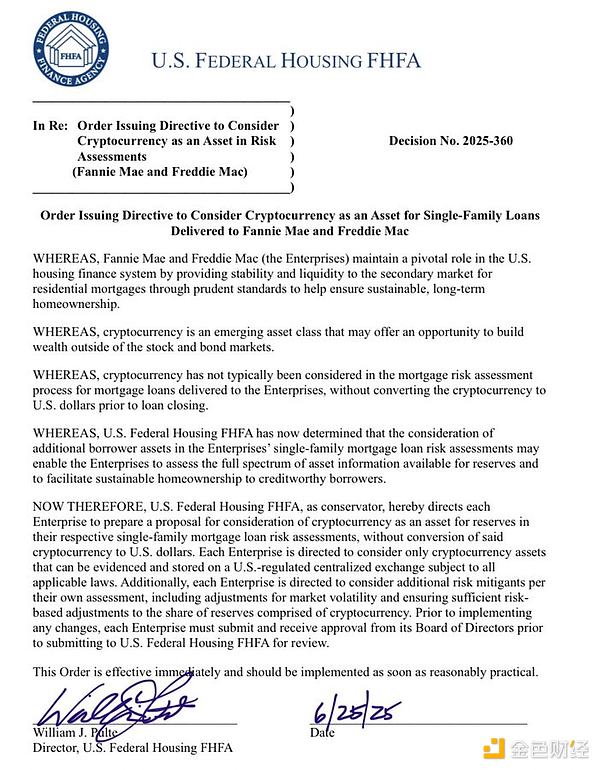

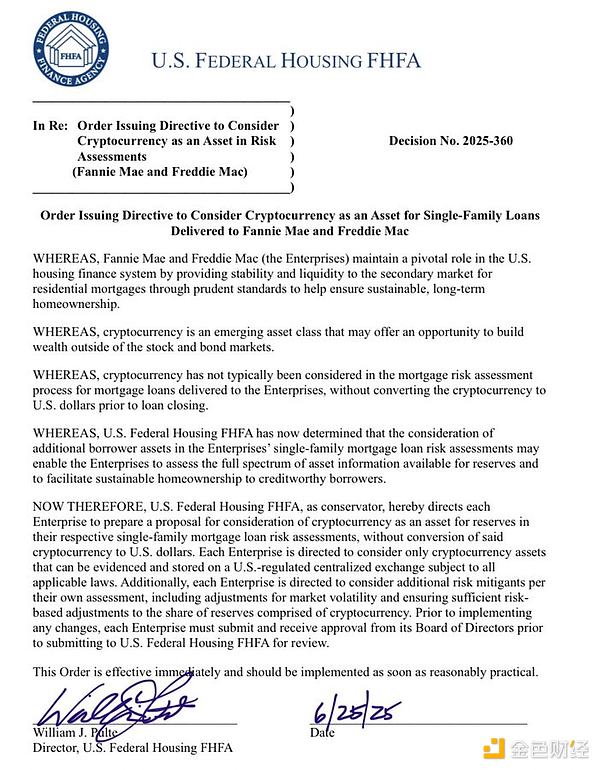

Pulte, director of the Federal Housing Finance Agency (FHFA), signed the directive on Wednesday local time to list cryptocurrencies as recognized assets for mortgage applications, marking the first time that cryptocurrencies have been included in the core system of US housing loans. Here is the original text of the order:

Federal Housing Finance Agency (FHFA)

Re: Issuing an Order to Treat Cryptocurrency as an Asset in Risk Assessments (Fannie Mae and Freddie Mac)

Decision No.: 2025-360

Issuing an Order to Treat Cryptocurrency as an Asset in Risk Assessments (Fannie Mae and Freddie Mac)

Treat Cryptocurrency as an Asset in Single-Family Residential Loans Made to Fannie Mae and Freddie Mac

18px;">Where Fannie Mae and Freddie Mac (the “Enterprises”) play a critical role in the U.S. housing finance system by providing stability and liquidity to the secondary market for residential mortgage loans through prudent standards to ensure sustainable, long-term homeownership.

Where cryptocurrencies are an emerging asset class that may offer opportunities to build wealth outside of the stock and bond markets.

Where cryptocurrencies are generally not considered in the mortgage risk assessment process for mortgage loans made to the Enterprises unless the cryptocurrencies are converted to U.S. dollars prior to loan settlement.

Where the Federal Housing Finance Agency (FHFA) has determined that consideration of additional borrower assets in the Enterprise-level single-family residential mortgage risk assessment may enable Enterprise-level institutions to assess the full range of asset information available for reserve and promote sustainable homeownership for creditworthy borrowers ... Therefore, the Federal Housing Finance Agency, as Custodian, hereby directs each corporate-level institution to prepare a proposal to consider cryptocurrency as a reserve asset in its respective single-family residential mortgage risk assessments, without converting the cryptocurrency into U.S. dollars. Each corporate-level institution should consider only those cryptocurrency assets that can be certified and stored on a centralized exchange regulated in the United States and that comply with all applicable laws. In addition, each corporate-level institution should consider additional risk mitigation measures based on its own assessment, including adjusting for market volatility and ensuring that the proportion of its reserves in cryptocurrency is adequately risk-adjusted. Prior to implementing any changes, each institution must submit and obtain approval from its board of directors and then submit it to the Federal Housing Finance Agency (FHFA) for review. This order is effective immediately and shall be implemented as soon as reasonably practicable.

William J. Pálte Director of the Federal Housing Finance Agency of the United States

III. What is the significance of listing cryptocurrencies as recognized assets for mortgage applications?

1. Improve the current situation of the real estate market

As mentioned above, the US real estate market is sluggish, and this policy may stimulate demand in the real estate market. More people holding crypto assets joining the ranks of home buyers can increase market demand, alleviate the sluggish real estate market, and play a positive role in stabilizing and promoting the development of the real estate market.

2. Good news for Cryptocurrency lenders

The Federal Housing Finance Agency (FHFA) officially recognizes cryptocurrencies, which may open up sizable federal loan programs to more borrowers. In 2024, the Federal Housing Administration alone issued more than 760,000 single-family home mortgages totaling $230 billion.

According to the Staff Accounting Bulletin No. 121 banking rule issued by the U.S. Securities and Exchange Commission (SEC), most banks will not be able to provide cryptocurrency-backed loans or mortgages until January 23, 2025. The rule requires financial institutions to account for cryptocurrencies as liabilities rather than assets on their balance sheets.

However, loans obtained through federal programs such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) currently do not allow borrowers to use their cryptocurrencies as collateral. In fact, some federal loans may not even allow the use of dollar liquidation proceeds from the sale of cryptocurrency for down payments. CJ Konstantinos, founder of Bitcoin mortgage and bond company People's Reserve, said Bitcoin could further help reduce risks in the mortgage-backed securities market regulated by the Federal Housing Finance Agency (FHFA) by regulating Fannie Mae and Freddie Mac. 3. Promote the integration of crypto assets with the traditional financial system The FHFA's directive is a major breakthrough for cryptocurrencies in the traditional financial sector, meaning that digital assets are incorporated into the core system of U.S. housing credit, and cryptocurrencies play an equally important role in people's lives as fiat currencies. It will also promote people's understanding of crypto assets and accelerate their popularization in daily life. 4. What do industry insiders think? Bitcoin supporters praised Pulte's open attitude, and some said that features that lenders like, such as transparent paper records, are already built into digital assets.

Redfin Chief Economist Daryl Fairweather: “This is a major victory for cryptocurrency advocates. It gives digital assets the same treatment as other assets.”Currently, stock investments are listed as eligible reserve assets, but lenders typically discount individual stocks or cryptocurrencies with higher volatility. "As long as the valuation is reasonably adjusted according to volatility, it is entirely feasible to include crypto assets in reserves."

Danielle Hale, chief economist at Realtor.com: "If the two giants accept cryptocurrencies as collateral, it will strongly encourage banks to change the current rules. Those who originally had to sell crypto assets to meet the requirements - perhaps this is the key reason why they gave up buying a house - can now directly qualify for loans, which actually expands the pool of qualified buyers."

Mitchell Askew, an analyst at Bitcoin mining as a service Blockware, said: The liquidity and transparent custody of the asset (that is, its public blockchain) make it a "perfect collateral" for home loans.

Some industry insiders have also expressed concerns about this.

Crypto lending in its current form carries some risks, according to Strike, a bitcoin-backed company. Volatility is a major factor. If the price of BTC drops significantly, the loan-to-value ratio will rise, "which could trigger a margin call or liquidation - a forced sale at an inopportune time."

One commenter suggested that lenders are also at risk: "The risk modeling on this is crazy. Traditional mortgages assume that the borrower's income and assets are relatively stable. Now, you're dealing with borrowers whose net worth can fluctuate 50% in a week. How do you stress test a portfolio when your collateral includes everything from Bitcoin to random DeFi tokens?"

Weatherly

Weatherly