Author: Tanay Ved, Source: Coin Metrics, Translated by: Shaw Jinse Finance

Key Summary

Recently, demand from major absorption channels such as ETFs and DAT has weakened, while deleveraging in October and macro-level risk aversion continue to put pressure on the digital asset market.

Leverage ratios in the futures and DeFi lending markets have been reset, making positions clearer and reducing systemic risk.

Spot liquidity for mainstream and altcoins has not yet recovered, making the market still fragile and more prone to large price fluctuations.

Introduction

Uptober started strongly, with Bitcoin climbing to a new all-time high. However, the flash crash in October quickly dampened market sentiment, and optimism faded. Subsequently, the price of Bitcoin fell by approximately $40,000 (over 33%), while altcoins also suffered heavy losses, causing the total market capitalization of the crypto market to shrink to nearly $3 trillion. Despite strong fundamentals over the past year, price movements have diverged significantly from market sentiment.

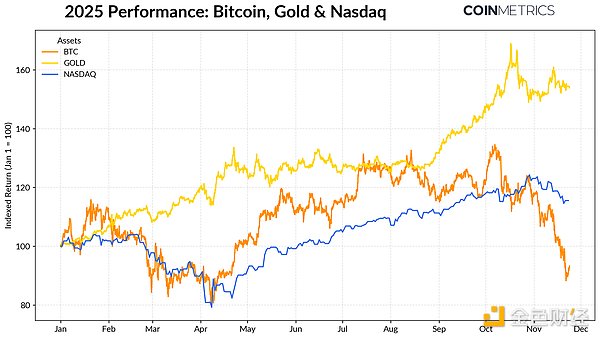

Digital assets appear to be at the intersection of multiple external and internal factors. On the macro front, the uncertainty surrounding a December interest rate cut and the recent weakness in tech stocks have exacerbated risk aversion in the market. In the cryptocurrency space, demand channels such as **exchange-traded funds (ETFs) and digital asset treasuries (DATs)**, which previously played a stable role in absorbing demand, are now experiencing capital outflows and pressure on cost bases. Meanwhile, the wave of liquidations triggered by the sharp deleveraging event on October 10th continues to have an impact, with **market liquidity remaining insufficient**. In this article, we will delve into the driving factors behind the recent weakness in the digital asset market. We will focus on ETF fund flows, leverage in perpetual futures and decentralized finance (DeFi) markets, and order book liquidity to explore the implications of these changes for the current market landscape. The macroeconomic environment is shifting towards risk aversion. Bitcoin's performance is increasingly diverging from mainstream asset classes. Gold has surged amid record central bank purchases and ongoing trade tensions, yielding a year-to-date return of over 50%, while tech stocks (Nasdaq) lost momentum in the fourth quarter as markets reassessed the likelihood of an impending Fed rate cut and the sustainability of AI-driven valuations. As our previous research highlighted, Bitcoin typically exhibits a volatile relationship with both risk-averse tech stocks and safe-haven gold, fluctuating with the current macroeconomic environment. This makes Bitcoin particularly sensitive to market shocks or catalysts, such as the flash crash in October and the recent safe-haven buying.

Source: Coin Metrics Reference Rates & Google Finance

As Bitcoin is the bellwether of the entire cryptocurrency market, its price decline has affected other assets. Although thematic sectors such as privacy have briefly outperformed the market, these assets remain closely correlated with Bitcoin's performance.

Since Bitcoin is the bellwether of the entire cryptocurrency market, its price decline has affected other assets. Although sectors such as privacy have briefly outperformed the market, these assets remain closely correlated with Bitcoin's performance.

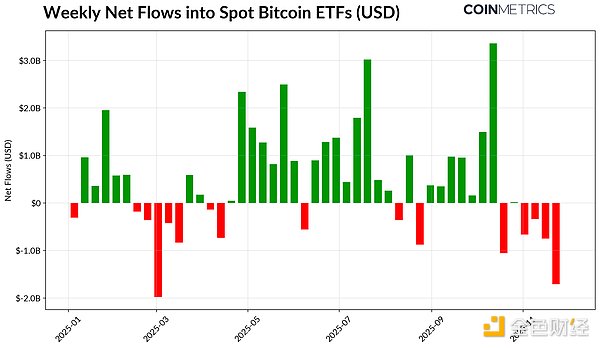

The absorption capacity of ETFs and DAT has weakened

Part of the reason for Bitcoin's recent weakness is the decline in demand for the channel that supported its price strength for most of 2024 and 2025. Since mid-October, ETFs have seen net outflows for several consecutive weeks, totaling $4.9 billion. This is the largest wave of redemptions since Bitcoin fell to around $75,000 in April 2025 (before the "Liberation Day" tariff announcement). Despite the short-term outflow of funds, on-chain holdings continue to rise, with BlackRock's IBIT ETF alone holding 780,000 Bitcoins, accounting for about 60% of the current total supply of spot Bitcoin ETFs.

If funds continue to flow back, this will indicate that this channel is stabilizing, because historically, ETF demand has been a significant absorber of supply when risk appetite improves.

Source: Coin Metrics Network Data Pro

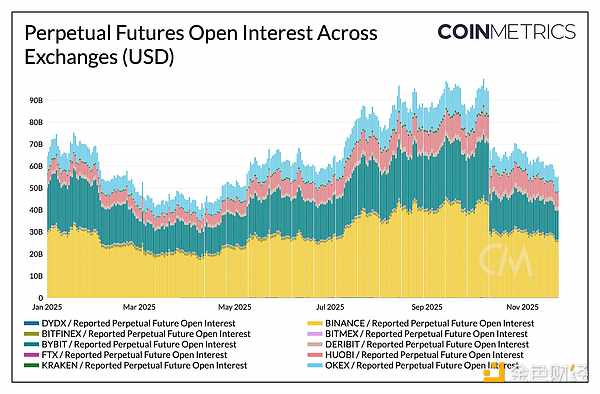

DAT is also beginning to show signs of pressure. As prices fall, the value of its shares and cryptocurrency holdings shrinks, squeezing the net asset value premium that underpins its growth. This reduces their ability to raise funds through stock issuance or debt, thus limiting the growth of their cryptocurrency holdings per share. Smaller, shorter-established DATs are particularly vulnerable to this dynamic, as changes in market conditions can lead to cost bases and stock valuations that are unfavorable for further accumulation. Strategy is currently the largest holder of Bitcoin DAT, owning 649,870 Bitcoins (approximately 3.2% of the current Bitcoin supply) at an average purchase cost of $74,333. As shown in the chart below, Strategy's purchasing pace accelerated significantly when Bitcoin prices rose and its asset valuation was strong, but has slowed recently, not due to active selling. Even so, Strategy still holds unrealized gains with a cost basis below the current market price. While Strategy may face pressure if prices fall further or it faces the potential risk of index exclusion, a reversal in market conditions could strengthen its balance sheet and valuation, thereby restoring an environment conducive to more aggressive DAT accumulation. This appears to align with on-chain profitability trends. The realized profit/loss ratio (SOPR) for short-term holders (holding for less than 155 days) has fallen to a loss level of approximately 23%, a level that historically reflects capitulation pressure from the most price-sensitive group. Long-term holders are still in a profitable position on average, but SOPR shows a slight rebound in allocation, indicating selective profit-taking. If the SOPR for short-term holders rises above 1.0 while allocation for long-term holders slows, it indicates that the market is stabilizing. Cryptocurrency Deleveraging: Perpetual Contracts, DeFi Lending, and Liquidity The liquidation wave on October 10th marked the beginning of a multi-layered deleveraging cycle in the leveraged space supported by futures contracts, DeFi, and stablecoins, and its impact continues to unfold in the cryptocurrency market. Continuous Liquidation Within just a few hours, perpetual contracts experienced the largest forced liquidation in history, wiping out more than 30% of the open interest accumulated over several months. The decline in open interest was most significant on altcoin and retail exchanges like Hyperliquid, Binance, and Bybit, where leverage had surged, consistent with the most rapid increase in leverage prior to the event. As shown in the chart below, open interest remains well below the pre-crash high of over $90 billion and has since declined slightly. This indicates that leverage in the system is decreasing as the market stabilizes and readjusts. During this period, funding rates also decreased, reflecting an adjustment in bullish risk appetite. Bitcoin funding rates have recently hovered near neutral or slightly negative values, consistent with the market not yet fully rebuilding directional confidence.

Source: Coin Metrics Market Data Pro

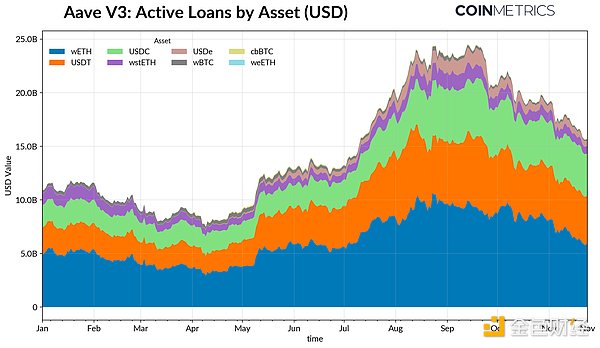

DeFi Deleveraging

The DeFi lending market has also undergone a phase of gradual deleveraging. Since peaking in late September, the number of active loans on the Aave V3 platform has been declining as borrowers reduced leverage and repaid debts amid weakened risk appetite and collateral repricing. The decline was most pronounced in stablecoin-denominated borrowing, exacerbated by the anchoring of Ethena USDe, which led to a 65% drop in USDe borrowing and triggered broader leveraged liquidation in synthetic dollars. Ethereum-based lending also contracted, with loans to Ethereum's wrapped token WETH and liquidity-staking tokens (LST) falling by approximately 35%-40%, indicating reduced arbitrage activity and a shrinking yield staking strategy.

Source: Coin Metrics ATLAS

Shallow Spot Market Liquidity

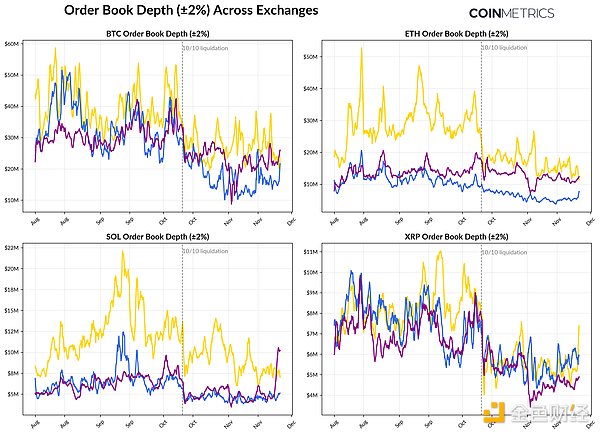

Following the liquidation wave on October 10th, spot market liquidity remains weak. On major exchanges, the bid-ask spread (±2%) for Bitcoin, Ethereum, and Solana is still 30%-40% lower than in early October, indicating that liquidity has not yet recovered along with prices.

Source: Coin Metrics Market Data Pro

Conclusion

The digital asset market is undergoing a broad correction, primarily influenced by weak demand for ETFs and DAT, a rebalancing of futures contracts and DeFi leverage, and persistently insufficient spot liquidity. These factors have put pressure on prices but have also made the overall system healthier, with lower leverage, more neutral positioning, and increasing fundamental support.

Snake

Snake

Snake

Snake Kikyo

Kikyo Joy

Joy Joy

Joy Joy

Joy Brian

Brian Kikyo

Kikyo Alex

Alex Alex

Alex Brian

Brian