Author: Benjamin Funk Source: archetype Translation: Shan Ouba, Golden Finance

Our brains, books, and databases are both recipients and creators of humanity's growing propensity to generate data. The latest addition to this long line - the Internet - generates and stores about 2.5 quadrillion bytes of data every day. While it's easy to marvel at this number, data points themselves have little value. They are like scattered pieces of a huge puzzle, requiring careful collection, processing, and contextual integration to become valuable information.

Today, many Internet giants have their entire business models built around this, and few companies have done it more successfully than Google. Their process goes like this: extract a large amount of priceless raw material - the "digital emissions" of billions of people, that is, private data - and run it through a proprietary algorithmic pipeline to predict the choices individuals are likely to make. The more data Google extracts and processes, the better insights they can provide to advertisers, and those advertisers bid higher in Google's ad auctions in an attempt to convert us into customers.

Through these processes, Google generates $240 billion in advertising revenue each year.

While Google intentionally removes humans from this process, there is another, potentially more effective way to produce and monetize valuable information—by engaging humans in games centered on our inherent desire to create, search for, and infer information. From sports betting to MEV to social deduction games like Among Us, we have naturally been drawn to “information games” centered around competition and coordination, which require us to cleverly hide and discover information.

Some information games are just games. But as we’ve seen, other information games can be used to generate and monetize new, valuable information, and serve as the backbone for a new generation of products and business models.

However, information games have always had an Achilles’ heel: trust. Specifically, players need to trust that other players cannot share or process information in ways that violate the rules of the game. If players of Among Us could switch from crewmate to imposter mid-game, or if block builders could compute incorrect state roots and still be accepted by validators, no one would want to play the game anymore. To solve this trust problem, we turn to trusted third parties to create and mediate information games for us. This is fine for games like Among Us with lower stakes, but limiting game creation and mediation to a single centralized party limits our trust and experimentation with the types of information games we play, and thus the types of information we can collect, exploit, and monetize. In short, there are a lot of information games that haven’t even been tried because we haven’t found a way to keep them fair and trustworthy in a decentralized setting. Programmable blockchains and new cryptographic primitives solve this problem, allowing us to create and mediate information games at scale without having to trust third parties or each other.

In turn, crypto-powered information games could rapidly increase the quantity and quality of information available to the world, improve our collective decision-making capabilities, and unlock efficiency gains at the scale of global GDP. Imagine prediction markets spread across the globe, becoming a capital allocation tool for internet-native mega-funds. Or a game that allows individuals to pool their private health data and be rewarded for any new discoveries made using that data, while protecting their privacy.

However, as this article will show, crypto-centric information games may not be ready for these high-stakes use cases just yet. But by experimenting with smaller, fun information games today, teams can focus on engaging players and building trust before scaling up to create and monetize tomorrow’s more lucrative information markets.

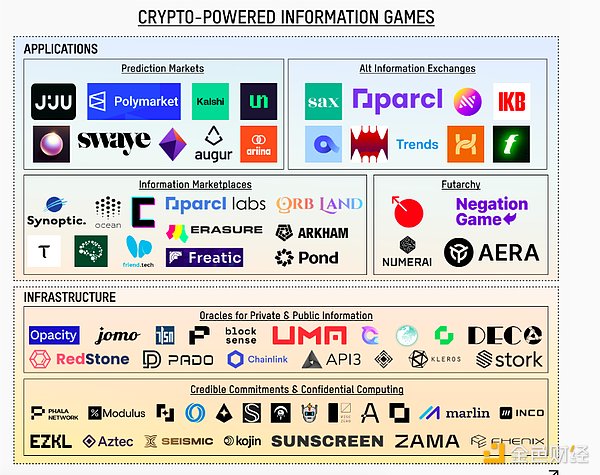

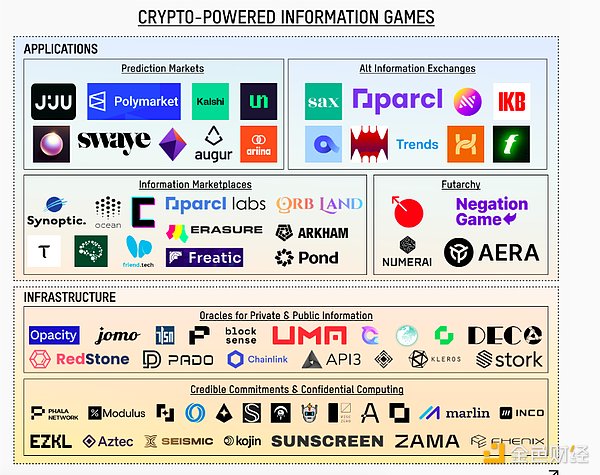

From prediction markets to game-theoretic oracles and TEE networks, this article will cover the design space for creating these crypto information games, as well as the critical infrastructure to realize their full potential.

Permissionless Markets: A Prerequisite for Information Games

From futures to information markets, blockchains allow developers to create customizable automated financial devices that power permissionless, unstoppable markets. As a result, now anyone can create mechanisms to incentivize, coordinate, and resolve value and information exchanges. This highlights the critical role of blockchains, allowing us to quickly experiment with how to best configure games to maximize value for all participants.

It is difficult to convince centralized intermediaries to adapt at this speed or allow their users to participate in these experiments. Permissionless markets will therefore become a medium through which fringe theories and cutting-edge research papers can be realized. We have already seen this in the context of prediction markets, where theoretical automated market making strategies conceptualized to combat low liquidity in prediction markets have been implemented as CPMMs on crypto rails and tested with real money.

Permissionless markets are an important tool enabler for better generation of new information and monetization of its value.

Information Games of Information Production

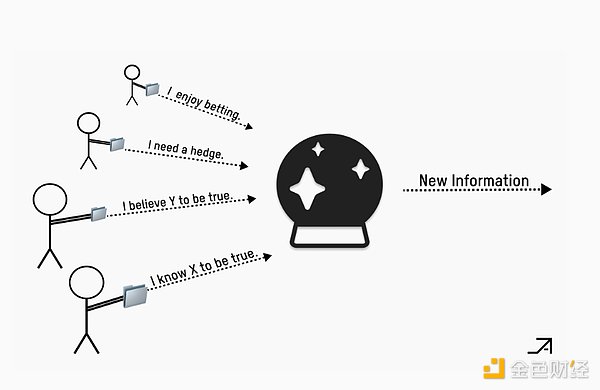

Many information games generate new information for players to make better decisions.

These information games create incentives to extract raw material (public and private data) from people, databases, and other sources, and then aggregate this data through the best information production machines (markets and algorithms). Ideally, when this information is aggregated, new information is generated and monetized by helping other players make good decisions. For example, investment DAOs use the results of prediction markets to determine whether to invest in new startups.

The games and tools used by information game designers vary depending on the type of information they may generate, and we have a broad design space to explore different challenges and opportunities.

But let’s start with the most actively developed and discussed information game today: prediction markets.

Game One: Prediction Markets as a Tool for Generating Information

One of the most popular information games we see in crypto (and beyond) is prediction markets. Polymarket is the world’s leading prediction market, facilitating over $400 million in cumulative trading volume (and growing fast) using the cryptocurrency rails.

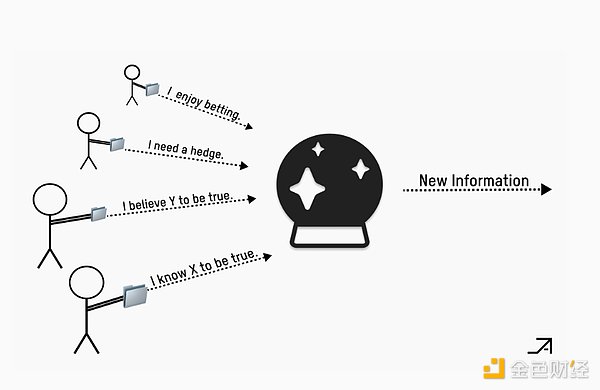

Prediction markets work by incentivizing players to place bets using their own funds (or in-game currency) on the outcomes of various events. This personal financial stake, or requirement to “have skin in the game,” helps ensure that participants are truly committed to their predictions. As traders act on their insights, by buying shares that underestimate outcomes and selling shares that overestimate outcomes, the market dynamically adjusts. These adjustments in market prices reflect a more accurate collective estimate of the probability of an event, effectively correcting any initial mispricing.

The more people betting on the market, with different but related public and private knowledge, the more prices reflect the truth. Ultimately, prediction markets harness the “wisdom of the crowd,” using financial interests to drive accurate aggregation of information.

Unfortunately, prediction markets face some key challenges, many of which boil down to various scalability issues.

Truth bottlenecks

Keynesian beauty contests (where judges aim to choose the option they think other judges will also choose) are not unique to prediction markets. However, their negative impact is more pronounced here than in traditional markets, where the goal of prediction markets is to create accurate information. Moreover, unlike traditional financial markets, where profit maximization primarily drives the behavior of participants, bettors in prediction markets are more likely to be influenced by personal beliefs, political leanings, or vested interests in certain outcomes. As a result, they are more willing to take financial losses in the markets if their bets resonate with their personal values or expectations of profits from actions outside of these markets.

Furthermore, the more people view a market or algorithm as a source of truth, the stronger the incentive to manipulate that market. This is not so different from the problem faced by social media. The more people trust the information goods provided by social media platforms, the stronger the incentive to manipulate them for profit or sociopolitical gain.

Some actors may even use the signals and incentives created by prediction markets to reprice collective beliefs and encourage collective action. For example, imagine a government using some form of “quantitative easing” to influence prediction markets on key issues like climate change or war. By buying a large number of shares in the relevant prediction market, they can shift financial incentives toward the desired outcome. Perhaps they have determined that the systemic risk of climate change is underestimated, so they buy a large number of “no” shares in a market that predicts that the climate will improve in 2028. This action may encourage more climate startups to develop technology that allows them to gain an information advantage in betting on “yes” stocks, thereby accelerating efforts to find a solution.

While the above factors have been shown to negatively affect the quality of information produced, it has also been shown that instances of manipulation can actually improve market accuracy because market manipulators are noise traders and informed market participants can make money by trading with them.

Thus, we can infer that the above problems are due to a lack of well-funded, well-informed traders to help correct the market. Allowing these informed traders to borrow and short could be a key means of making these markets more efficient.

Furthermore, in markets with longer timelines, it is harder for informed traders to resist manipulation, as manipulators have more time to influence market sentiment and actual outcomes through trading. Markets with shorter implementation times and newer settlement dates can increase trust in the game (and thus its information quality), but also make the gameplay more compelling.

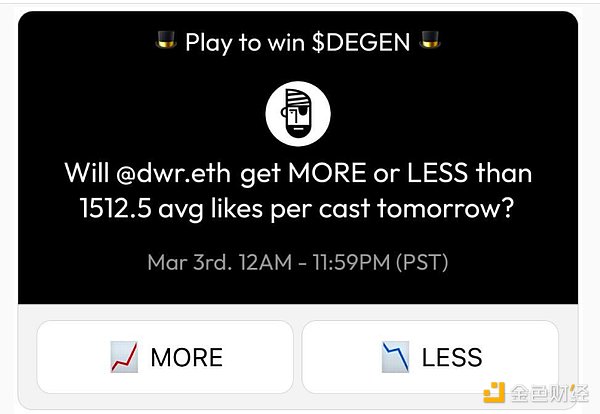

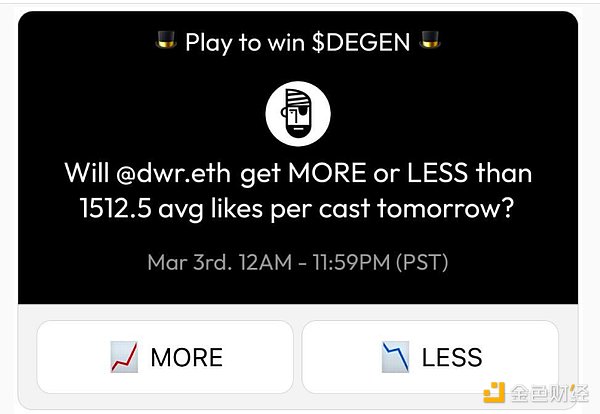

We are also seeing some early signs that in some cases players enjoy information games because market outcomes can be manipulated. Perl, the top account on Farcaster at the time of writing, leans into this model and has created an in-app platform to speculate on user engagement. Prediction markets such as "Will @ace or @dwr.eth (co-founder of Perl and Farcaster) get more likes tomorrow?" have been launched, and one can expect football teams and their fans to start trolling. Only here, the game is played asynchronously and measured in likes rather than touchdowns. While Perl’s game intentionally subverts the quality of information production in prediction markets, an interesting meta-game emerges through coordination to resolve oracles in one’s favor. Prediction games can reduce manipulation and boredom by shortening game rounds and increasing the number of game updates. However, in low-stakes games, allowing player manipulation can increase fun and become an integral part of gameplay. Finding the Right Judges and Oracles Another challenge in prediction markets is adjudication—how to properly resolve the market? In many cases, we can rely on reputation- and collateral-backed oracles that can access off-chain data feeds. To address this, prediction market designers can rely on game theory and cryptographic oracles to access a wider range of topics, including players’ private information.

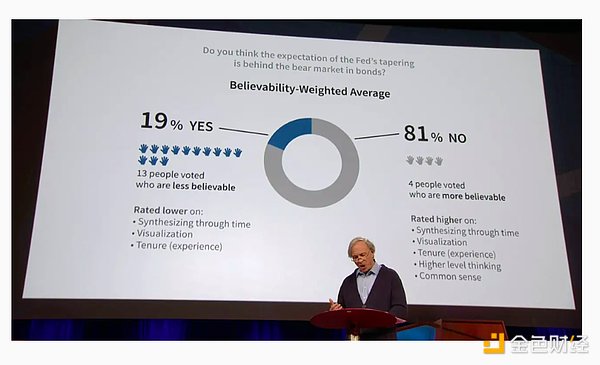

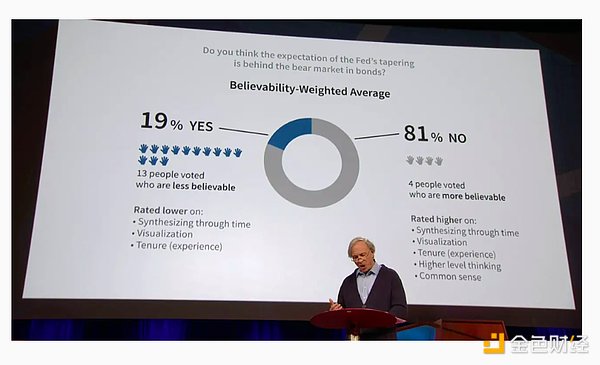

Game theoretic oracles, or Schelling point oracles, assume that, without direct communication, participants (or nodes) in a network will independently converge to an answer or outcome that they believe others will also choose. Pioneered by companies like Augur and later by UMA, these oracles encourage honest reporting and discourage collusion by rewarding participants based on how close they are to a “consensus” answer.

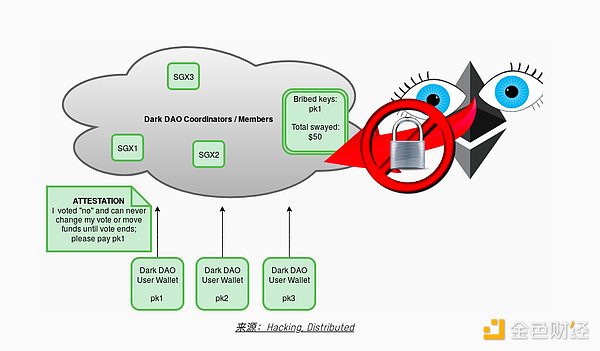

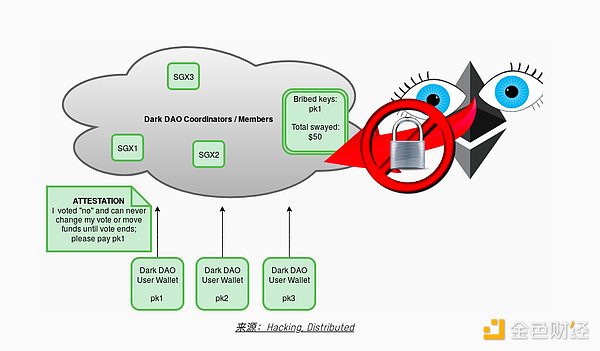

However, there are still many challenges in having these oracles reliably adjudicate bets between a small number of participants, as identifying and communicating with each other to collude becomes a potential threat. While crypto has been touted as a key tool to avoid collusion between voters, it can also be used as a tool to enable collusion and prevent prediction markets from resolving correctly. We can see this with DarkDAO’s potential to exploit Trusted Execution Environments (TEEs) for programmatic bribery and coordinated price manipulation. One team working on balancing these incentives is Blocksense, which uses secret committee selection and encrypted voting to prevent collusion and bribery.

Oracle challenges can also be solved by leveraging on-chain data. In MetaDAO, players are rewarded if they correctly predict how a particular proposal will affect the price of its native token. This price is provided by UniswapV3 positions, which serve as an oracle of the token's value.

Even so, these oracles have limitations in solving market problems based on public data. If we can solve market problems based on private data, we can unlock entirely new types of prediction markets.

One way to solve the problem of markets based on private information is to use the results of the information game itself as an oracle. Bayesian markets are such an example, which rely on the principles of Bayesian inference to infer the gambler's own beliefs about his private information by having the gambler bet on the beliefs of others. For example, setting up a market where people bet on "how many people are satisfied with their lives" can reveal the gambler's own beliefs about other people's life satisfaction. As a result, we can draw accurate conclusions about the players' private information, which would otherwise be unverifiable facts.

Another solution we can rely on is to use oracles that "import" data from private web2 APIs using clever cryptographic techniques. Some of these existing oracles are showcased in the "Public and Private Information Oracles" section of the market map. Using these oracles, prediction markets can be created around some of the players' private information, incentivizing the holders of the private information to solve a specific prediction market in a verifiable way in exchange for charging transaction fees to the bettors. More generally, being able to securely access richer off-chain data on-chain can serve as an identity primitive that helps us more effectively identify, incentivize, and match players in information games, helping us direct the necessary information to make information games relevant to players.

Innovation in Oracle Design

Liquidity Bottlenecks

Attracting liquidity into prediction markets is difficult. First, these markets are binomial markets, where participants bet “yes” or “no” on a particular topic and either receive a fixed amount or nothing. As a result, the value of these shares can change dramatically with even small changes in the price of the underlying asset, especially as they approach expiration. This makes predicting their short-term price movements important, but challenging. To counter the large risks posed by these sudden changes, traders must use advanced and constantly adjusted strategies to guard against unexpected market volatility.

More importantly, as prediction markets expand their scope to include more topics and increase their time horizons, the difficulty of attracting liquidity in prediction markets increases. Beyond politics and sports, the more diverse the markets are and the longer they last, the less people feel they have an edge when betting on them. As a result, fewer people bet and the quality of information produced declines.

Prediction markets inherently face these liquidity issues because forming prices requires discovering private information and betting based on that information, both of which are costly activities. Participants need to be compensated for their efforts and the risk they take, including the costs of gathering information and locking up capital. This compensation typically comes from those willing to accept worse odds for reasons such as entertainment (i.e. sports betting) or hedging risk (i.e. oil futures), which helps drive significant increases in liquidity and volume. However, prediction market themes with a narrower range of interests are less commercially attractive to participants, resulting in reduced liquidity and volume.

Economic Improvement: Coverage and Diversification

We can address these issues by recycling ideas from traditional finance and other existing information games.

It is worth noting that we can leverage overlays introduced by Hasu in “The Problem with Prediction Markets”. In gambling tournaments, the concept of overlays (additional value added by the casino to encourage participation) works similarly to the role of subsidies proposed for prediction markets. Overlays effectively reduce the cost of entry for players, making the tournament more attractive, thereby increasing participation from both new and experienced players.

Just as overlays in gambling tournaments promote player participation by increasing potential ROI, subsidies in prediction markets incentivize participants by lowering barriers to entry and making participation more financially attractive. Subsidies can also act as beacons, attracting a large number of views and insights from both uninformed and informed traders who can profit from correcting them. Teams implementing this strategy must systematically identify and engage with potential subsidy providers and create markets around their needs as they are willing to provide the necessary liquidity.

Similarly, fund-like structures can be implemented to achieve time and industry diversification and increase liquidity in prediction markets across a wider range of issues and time horizons. For example, many firms may find value in markets centered around how a particular lawsuit will be resolved. These firms could lower their participation costs by providing funding to legal experts, allowing them to diversify across a broad range of markets, and then rewarding them based on their long-term performance.

In this setup, traders can borrow money to make markets, and the amount borrowed can be parameterized based on the demand for information and the trader’s reputation on the topic. This can be combined with a management fee as an additional overlay for each market.

On the liquidity provider side, they will gain exposure to traders who are incentivized to bet correctly on these markets, diversifying across a large basket of uncorrelated assets of varying maturities. While principal-agent issues must be considered, this system could increase the size of the liquidity provided in these markets and the diversity of the pools of capital that distribute this liquidity. As a reward, the quality and diversity of the information good can be improved, while new information about traders’ skills and knowledge in different markets is created, accelerating returns for liquidity providers through reputational byproducts.

When the value of the information that players can generate is large, integrating composable financial markets such as lending and liquidity mining into games can serve as a key tool to lower barriers to entry.

User Experience Improvements: Simpler Interfaces and Flexible Incentives

The default, exchange-centric user experience and limited reward types in today’s prediction markets can crowd out those motivated by other types of interfaces and incentives, further limiting liquidity. From a bettor’s perspective, there are a number of interesting ways to improve the quality of prediction markets, all of which revolve around increasing reach and accessibility to different types of players.

First, we can improve the user experience of prediction markets by integrating them into larger social platforms. Perl and Swaye have shown how to free users from the cognitive burden of opening a separate application by tapping into Farcaster’s data, while information game designers can identify players and direct them to markets that are unique to them (i.e., top players in the /nyc-politics channel).

It is also possible to try to expand the range of rewards allocated to bettors and set more relaxed requirements for the amount of money they invest. This would look like rewarding individuals with proofs of stake, or expanding the range of financial rewards to "in-app utility" or equity represented by points or tokens.

While monetary incentives are essential for prediction markets to work, some literature suggests that game currencies can create prediction markets of equivalent quality. In practical terms, this tells us that we can be flexible in assuming the type of "venture capital" in which bettors are willing to take risks and are forced to profit.

In addition, there are different types of market mechanisms that can be used to make the user experience more poll-based, which would further reduce friction and lower barriers to entry. A Cambridge study evaluated this hypothesis and found that polling mechanisms led to more accurate results than prediction markets during periods of low trading activity, wide bid-ask spreads, and rapid market settlement. The study also found that combining poll-based prediction games with monetary incentives from prediction markets led to significantly higher accuracy than prediction market prices alone. Additionally, to address potential challenges of information stagnation, polls could be “updated” periodically based on some sort of push or pull system that incentivizes the dynamic reproduction of information based on new information.

Crypto information games used to scare off all but the most devoted power users. Now, with reduced costs, increased availability, and abundant data, we have the opportunity to develop more diverse and accessible games that target specific audiences.

Game 2: Producing Information through Privacy-Preserving Computation

Imagine a game played by Solidity developers where players leverage multi-party computation (MPC) to disclose their salaries and calculate average salaries while keeping individual salaries confidential. This would be a valuable way for crypto professionals to negotiate with their respective employers, as well as a source of entertainment.

More broadly, information games can leverage privacy-preserving techniques to expand the range of raw materials, particularly private data and information, that can be analyzed to generate new insights. By ensuring privacy, these tools can increase the diversity and propensity of people to share data and information, and provide the resulting value to data providers.

While this is not all-inclusive, some of the tools used by information producers include zero-knowledge (ZK), multi-party computation (MPC), fully homomorphic encryption (FHE), and trusted execution environments (TEES). The core mechanisms of these technologies are different, but they all achieve a similar purpose - enabling individuals to provide sensitive information in a privacy-preserving manner.

However, for use cases that require strong confidentiality guarantees, there are still many serious challenges in using software- and hardware-based cryptographic primitives, which we will discuss later.

Privacy-preserving cryptography greatly broadens the design space for new types of information games that were not possible before.

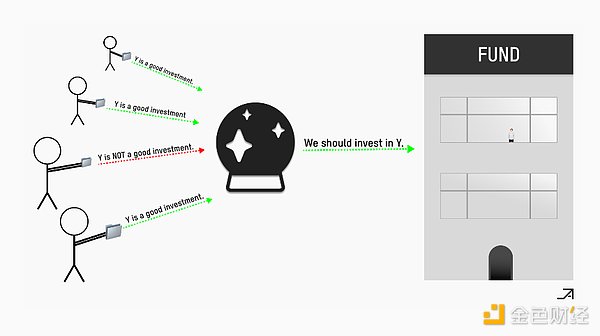

Game #3: Competition between models to increase information production

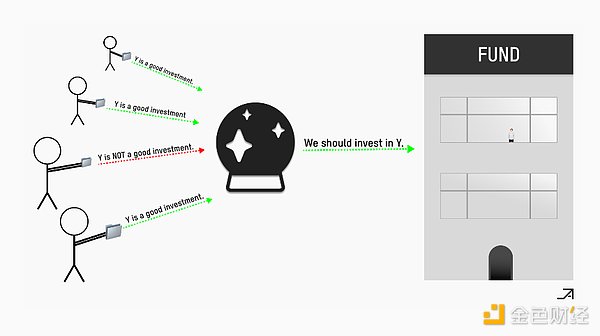

Imagine a game where data scientists compete against each other by developing and betting on trading models for a decentralized hedge fund. The blockchain then reaches consensus on the scores of specific models and rewards or cuts participants based on the correctness of the model's predictions and their impact on the fund's returns. This is the approach taken by Numerai, one of the first information games on Ethereum. In this game, Ethereum's consensus is leveraged through global competition between different models and their creators, effectively incentivizing AIs to play information games that produce valuable rewards.

Going a step further, we can also incentivize AIs to play information games for us more directly, using their encyclopedic knowledge to compete against each other to make predictions. While they may not necessarily enjoy playing these games, using intelligent machines instead of humans will greatly reduce the labor costs required to produce information. As a result, these AI models can add liquidity to more niche prediction markets where humans would otherwise be reluctant to participate. As Vitalik puts it: "If you create a market and offer a $50 liquidity subsidy, humans won't care about bidding, but thousands of AIs will easily flock to it and make the best guess they can. The incentive to do well on any one problem might be small, but the incentive to make an AI that makes correct predictions in aggregate could be in the millions." Alternatively, we can leverage consensus between ML models to create competition between them around the value of the information they create. Teams like Allora and Bittensor TAO are coordinating models and agents to broadcast their predictions to others in the network, while others are responsible for evaluating, scoring, and broadcasting their performance back to the network. In each period, the collective evaluation between models is used to allocate rewards and/or power to different models based on the quality of their predictions. Thus, entrepreneurs can use networks of self-improving models to improve the quality of information flowing through their market.

Profitable Information Games

Some information games can survive solely on the enjoyment that users derive from them. But for those who want to make money from the value of the information they produce, things need to be considered a little more. Unfortunately, the qualities of information as a commodity lead to serious market failures that prevent them from making money seamlessly:

Information is only valued after it is consumed, which makes it difficult for buyers to assess whether the seller's price accurately reflects the value of their information.

Information is non-rivalrous—its consumption does not reduce its availability, meaning it does not possess the scarcity properties that make it interesting to buyers.

The non-exclusivity of information, combined with low reproduction costs, makes it difficult for sellers to prevent unauthorized access, despite the high initial production costs.

These economic characteristics create challenges for buyers and sellers to profitably exploit information, and can result in insufficient information production. If information quickly becomes known to everyone who can exploit it simultaneously, then there are fewer opportunities for information buyers to exploit information asymmetries, either due to increased competition or the breakdown of the schemes they intended to use. Thankfully, there are cryptographic tools that can be used to address these issues, and some are already doing so.

Game #4: Trading – Profiting from Speculating on Information

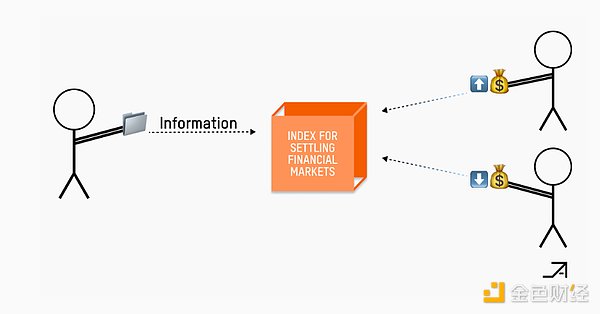

One way to monetize the production of information is to simply make it public without keeping that information confidential or restricting actions that can be taken on it, but giving people a tool to bet on how it will change – also known as a derivative.

One company actively doing this is Parcl*, whose exchange enables users to speculate on the rise and fall of the real estate market. Parcl’s marketplace is driven by real-time price information, sourced by Parcl Labs from a vast database of real estate and fed through a proprietary algorithm to generate granular, accurate information that is far superior to traditional real estate price indices.

While Parcl does monetize this information more directly through an API, they create an additional layer of monetization by allowing traders to bet on how this information will change over time. Other projects, such as IKB and Fantasy mentioned in the “Alternative Information Markets” section of the market map, focus on monetizing by speculating or hedging on how existing public information will change, from an athlete’s performance to a creator’s social engagement.

If you can sell the right to speculate on the information you generate, then you can monetize it without keeping it secret or limiting what buyers can do with it.

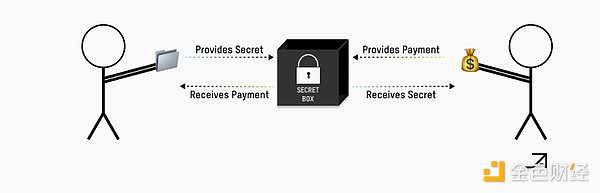

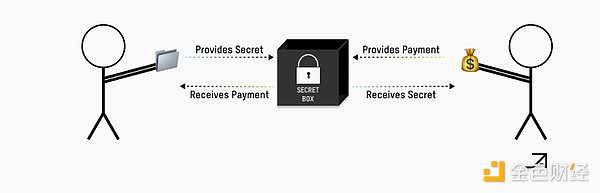

Game #5: Marketplaces for Discovering Confidential Information

Imagine a game that lets you discover the curated alphas of the latest on-chain activity and brand new crypto startups before the world knows about them. To make this happen, information needs to remain confidential to address the non-rivalry and excludability issues that come with public information. For this reason, next-generation information marketplaces are facilitating the exchange of confidential information while leveraging blockchain to discover and regulate access to all participants who can pay to access it.

Freatic’s* decentralized confidential information market Murmur embodies this approach, which controls exclusive access to information through an NFT and queue system. Information buyers first subscribe to a specific topic by purchasing an NFT presented in the form of a coupon. They then have a place in the queue to redeem confidential information from the publisher, allowing them to pay an additional fee to reduce its dissemination rate. After that, buyers can also vote on the quality of the information. Through this process, Murmur ensures the confidentiality and value of the information without restricting its sale to a single entity.

In contrast, Friend.tech uses keys and bonding curves to manage access to confidential information in group chats, which becomes more expensive as demand increases. Therefore, one could think of Friend.tech keys as a proxy for the average value of information from an individual (assuming the key market is efficient). However, players always "count in" some notion of an individual's "worth" when trading keys, which makes it difficult for buyers to price the value of the information. Perhaps this serves as another data point to support the claim that the most valuable "information market" to date is actually the memecoin market, which, if you look closely, is a prediction market around the token value of a particular trend or person.

Beyond Memecoin, one direction that teams controlling access to information could take is to allow sellers of information to design bonding curves that better tie access prices to information value. For example, pricing for information that quickly depreciates as it becomes known could be determined by a bonding curve that reflects the rapid depreciation of information value over time.

Decentralized currency exchange is challenging due to trust issues and finding double-need coincidences. Blockchain has already solved this problem for currency (Bitcoin) and will solve it for information, catalyzed by fun games centered around finding hidden information.

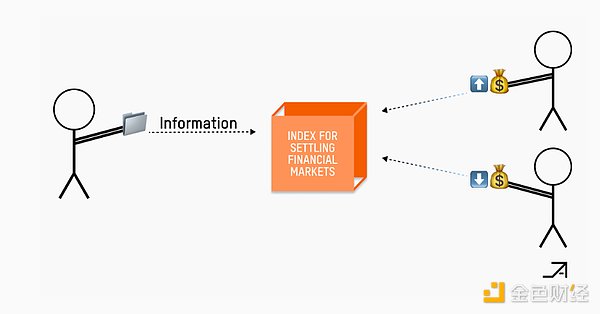

Game #6: FUTARGY - How to Make Money with Prediction Markets

One of the main ways to monetize information without explicitly keeping it secret is to produce and sell information that only one organization can use. This strategy is not new, as many companies have monetized information by restricting it to specific buyers through auctions or non-disclosure agreements. However, we are seeing a new business model for selling information commodities - producing public information that is only relevant and valuable to the organization that made the specific decision.

In fact, we are now seeing prediction markets being built on crypto rails to try to use Futarchy as an alternative mechanism to monetize the information they produce.

Futarchy offers a new way to improve decision making, at its core, by leveraging the information generated by prediction markets. The information generated by prediction markets is used to make decisions, and when the prediction market is resolved, the players with the best predictions are rewarded.

Prediction markets themselves are zero-sum games for participants, limiting the incentive for informed traders to participate in them and exacerbating their existing liquidity bottlenecks. Futarchy can solve this problem because the wealth created by better decisions can be redistributed to traders.

Crypto-native entities like MetaDAO are already experimenting with Futarchy. When a proposal is made, such as Pantera’s proposal to buy MetaDAO governance tokens, two prediction markets are created: “pass” for support and “fail” for opposition. Participants trade conditional tokens within these markets, speculating on the proposal’s impact on the value of the DAO. Resolution depends on comparing the time-weighted average price (TWAP) of the “pass” and “fail” tokens after a specified period of time. If the TWAP of the “pass” market exceeds the TWAP of the “fail” market by a certain margin, the proposal is approved, enforcing the terms of the proposal and canceling trades in the fail market. The system uses market dynamics to drive governance decisions that align with collective predictions of the proposal’s impact on increasing or decreasing the value of the DAO.

In some cases, Futarchy must be designed with confidentiality in mind. For example, if a prediction market is used to decide on the hiring of an individual, that information becomes public and becomes an information risk—competitors could poach that employee based on the market’s predictions.

Another reason to keep information confidential is its impact on motivation and organizational culture. As Robin Hanson noted in his “The Future of Prediction Markets” talk, Google’s own internal experiments were met with resistance as executives worried that public performance metrics could demotivate employees. Of course, managers are reluctant to implement something that could expose the emperor as having no clothes, and we are seeing this today. According to MetaDAO founder @metaproph3t, some people decided not to submit proposals because they did not want to be evaluated by the market. Both of these issues can be addressed by limiting access to prediction market information to specific decision makers. However, if these decision makers are given the power to autonomously determine their actions based on this information, bettors will incorporate these biases into their bets, reducing the quality of the information generated.

In other cases, futarchy may be better suited for specific industries where its advantages outweigh the cultural impact, such as Bridgewater's hedge funds. Integrating blockchain could further enhance the integrity of futarchy to prevent manipulation.

So far, prediction markets have been limited to making profits through speculation or hedging. Prediction markets could open up a whole new market by helping organizations make better decisions, although there are still unresolved questions around the role of confidential information.

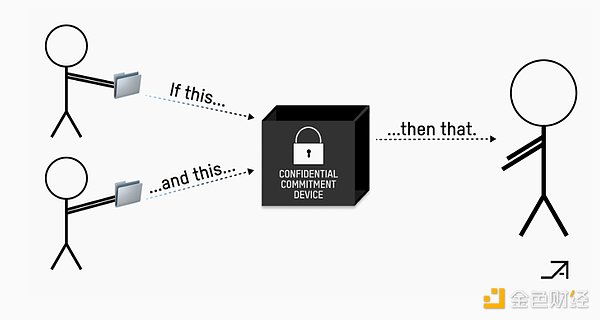

Game #7: Trusted Commitments for Programmable Information Games

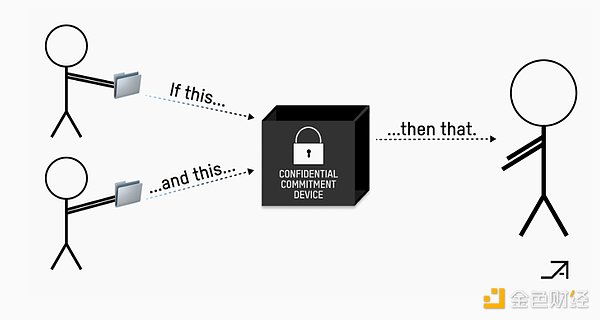

As mentioned at the beginning of this article, Google monetizes information by renting it to advertisers while limiting advertisers’ use of the information to Google’s ad auctions. Similarly, trusted commitments help sellers of information monetize by limiting the actions buyers can take based on said information.

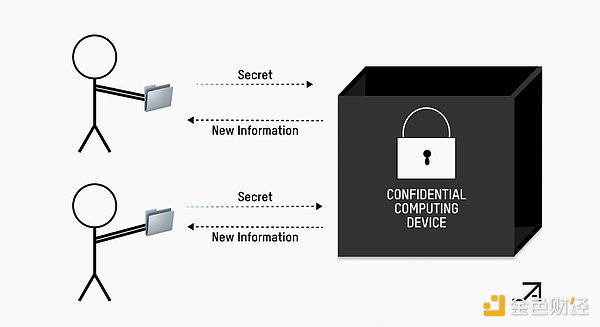

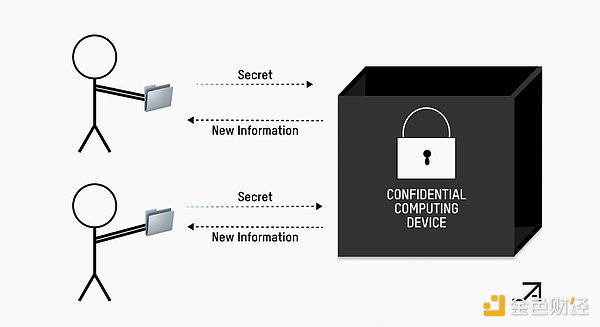

Information sellers can use cryptographic methods such as MPC, TEE, and FHE to ensure buyers’ trusted commitments to perform computations on private data. Sellers can thus delegate their information to buyers, giving them specific control over future actions on their private information, without revealing the information itself.

This rationale unlocks a wide variety of information games. Imagine that a trader (information seller) can sell the rights to a transaction sequence to an information buyer (searcher) only if the information buyer commits to simulating the transaction sequence up to a certain number of times. Going one step further, imagine allowing Netflix users to delegate the right to watch Netflix movies to others, so that they can “yield farm” rewards from their own accounts, without revealing their login information. In turn, buyers can unlock value from sellers’ private information, without sellers having to deal with the challenge of selling the information itself (information is a non-rival, non-excludable experience good).

Unlocking Google-level profitability for information game designers

Despite limited confidentiality guarantees, TEEs are currently a practical option for implementing such controls. While TEEs are not suitable for protecting large assets or sensitive data, they are suitable for use cases that require longer-term restricted access to confidential information, such as front-running protection. SUAVE, a project created by the Flashbots team, is building a TEE network that developers can use today, with the long-term vision of enabling application developers to find new ways to better monetize the value of their and their customers' information. In SUAVE's design, integrating blockchain with TEEs addresses three key TEE limitations necessary to advance information games. First, blockchain eliminates the need for trust in communications between hosts and players, as players may censor or act maliciously. Second, blockchain provides a secure mechanism for state maintenance that prevents rollback attacks that TEEs are susceptible to. Finally, blockchain is critical to ensuring permissionless, censorship-resistant creation of TEE-based information games (SUAPPs), whose smart contracts, inputs, and outputs can be trusted by all players.

While many of the early information games using SUAVE are clearly centered around MEV, there is opportunity for them to be used in information games that extend far beyond trading.

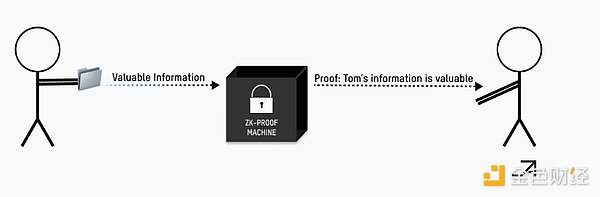

Game #8: Reputation and Zero Knowledge Facilitate In-Game Marketplaces

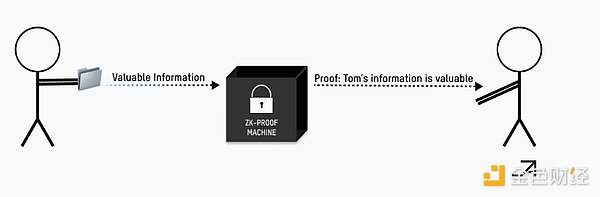

A key challenge in monetizing information is the inherent nature of information as an “experience good.” The value of an experience good is only recognized when it is used, making it difficult for sellers to price it in advance. In creating mechanisms to address this, we can also create fun gameplay for users. Some games center around having players build a reputation that is distinct from other players, such as World of Warcraft, which can be a source of fun and a key way for players to decide who to work with. Other games may want sellers to promise a price for certain intelligence (i.e. enemy locations, secret plans) without requiring them to reveal the information in advance.

To overcome this problem, designers of information games can leverage cryptographic solutions such as zero-knowledge proofs (ZKPs) to verify properties of computational information goods (e.g., the validity of a trading algorithm) without revealing the actual data or code. This can be achieved by creating cryptographic commitments, timestamped on the blockchain, and providing ZKPs of algorithmic performance. However, this approach only works for information goods whose value derives from their computational properties and can be tested on verifiable inputs.

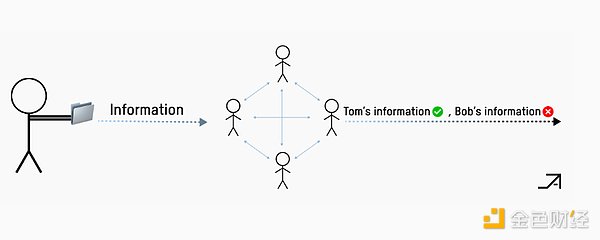

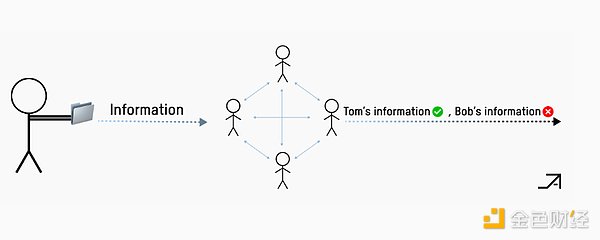

For other types of information goods, reputation and identity are critical. Consensus mechanisms among information buyers can be leveraged to build reputations around the value of the information a seller is trying to sell.

Systems such as Murmur use subscriber voting within an exclusive window to build publisher reputation, promoting them from unverified to verified status based on community feedback. This process creates a transparent and unchangeable record of interactions, building a trustworthy reputation for sellers through a tight feedback loop.

In addition, the Erasure Bay protocol requires sellers to invest funds and reputation as a signal of the reliability of their information. The protocol establishes a "bad factor" where buyers can destroy a certain percentage of the seller's shares if the information is proven to be of low quality, thereby ensuring that sellers have an incentive to provide high-quality information.

To avoid market failure and maximize sales, game designers need to provide sellers with cryptographic tools to prove the value of their information, or provide reliable and fast mechanisms to build reputations around their previous sales.

Conclusion

Information games are not new. However, before the advent of programmable blockchains, game designers could only seek permission from centralized intermediaries, and players could only play games mediated by trusted third parties.

Today, the dramatic reduction in the cost of block space allows anyone to create a Futarchy-inspired DAO or confidential information protocol and access a myriad of tools for verification, adjudication, monetization, and more. Low barriers to participation and open innovation on permissionless financial rails will unlock many unimaginable games.

This article shows the early signs and challenges of implementing this new wave of information games, and the potential for solving them using cryptographic tools. With these tools, some game designers will improve on the information games we already play, such as trading and MEV, while others will create games that simply could not have existed before.

Nevertheless, these crypto-powered messaging games are all mini-games that need to fit together to form the full game. The fun and excitement that players get from building reputations, working with teams, and competing for influence within organizations are all parts of a greater whole.

If you are creating a fun, crypto-based messaging game, please contact us to chat. I'd love to try it out, learn more, add your project to the market map, and brainstorm ideas!

Catherine

Catherine