After Trump came to power, there was no significant policy-driven effect on the cryptocurrency market. In addition to the family WLFI fund constantly buying coins, there were also some scandals that "may have a conspiracy to make markets" with the project party; Trump's son called for buying ETH, and the fund "suspected of secretly selling" ETH. The Trump administration’s pressure on the Sec to cut interest rates has not worked, and the establishment of government agencies such as the cryptocurrency committee has also been a lot of noise but little action.

On the contrary, it was the Trump administration’s macroeconomic policy of a strong dollar and weak U.S. stock market that had a huge impact on cryptocurrencies. The 25% tariffs imposed on Mexico and Canada and then postponed and cancelled them made the cryptocurrency market turbulent. What was even more fatal was that when BTC rebounded, altcoins "followed the decline but not the rise", and most of the altcoins hit a new low in the past two years.

Many people are wondering: Is the bull market still there? In this cycle, the current situation is that the meme coin with the same name as Trump has created a myth of getting rich quickly. Trump came to power and called for the "eternal bull market". I can't help but think of the myth of getting rich quickly with SHIB and the listing of Coinbase in the last bull market. Everyone shouted collectively that the "eternal bull market" was over. It seems to be the same as looking for a sword in a boat. Is the bull market really still there? Will there ever be a day when the copycat market can be untied? Let’s see what traders think.

Technical Analysis

@Xbt 886

The liquidity of altcoins has not returned yet, and more altcoin liquidity has withdrawn and chosen to enter BTC liquidity.

Of the two possible paths previously recognized, it seems that the second one has been taken.

@YSI_crypto

Around $92,000 is the green area I drew in the picture. This is the lower boundary of the box in the entire box oscillation. If the price rebounds here, it can be used as an entry point, and stop loss if it falls below. At present, this is in the middle of the box, and both long and short positions are very uncomfortable, waiting for the right entry opportunity.

@Patrade_Buer

BTC has completed the plundering eqh. Please pay attention to your position, and the longs pay attention to the opportunity to step back to buy.

@CryptosLaowai

Bitcoin is in a volatile market. The market logic is to look for liquidity: the most people stop loss there + where to go for a liquidation position. Bitcoin daily line closed two long-legged cross stars. The possibility of a rise next week has increased, and there is still a possibility of a last downward trend in the small cycle. , falling to around 94,600, and then if the 95,600+ is withdrawn, then the pull-up market will begin. If the pull-up market is pulled up next week, the target will be as low as 100,500 and the highest as 103,000.

Data Analysis

@Andre_Dragosch

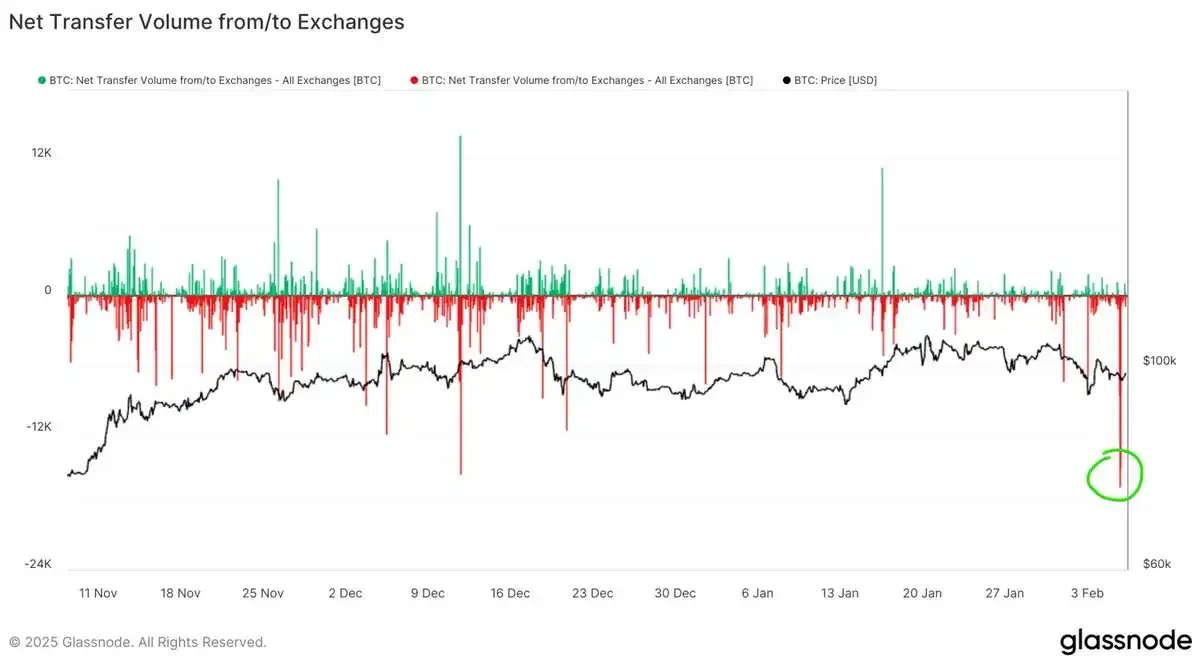

The largest BTC out of the exchange since 2024 has just happened. More than 17,000 BTC have left the exchange, of which 15,000 were removed from CoinBase. A large number of whales are buying bottom chips here.

@Phyrex_Ni

The stock of BTC on the exchange did fall sharply after the price fell below $100,000, and has almost reached the lowest point in nearly 6 years, spanning two late periods. This shows that more investors choose to hold coins and wait and see after buying.

Macro analysis

@Phyrex_Ni

The non-farm data has just been released. Basically the same as expected, the unemployment rate has dropped slightly and returned to 4% , which is lower than the previous value. This data is not very good, indicating that the current labor market is still very strong, and the number of non-farm employment is still quite large, which is significantly lower than expected. This data is still OK, and the wage growth rate is also increasing. Overall, The entire labor market has not cooled significantly, which may not meet the expectations of some Federal Reserve officials. But it also shows the strong US economy.

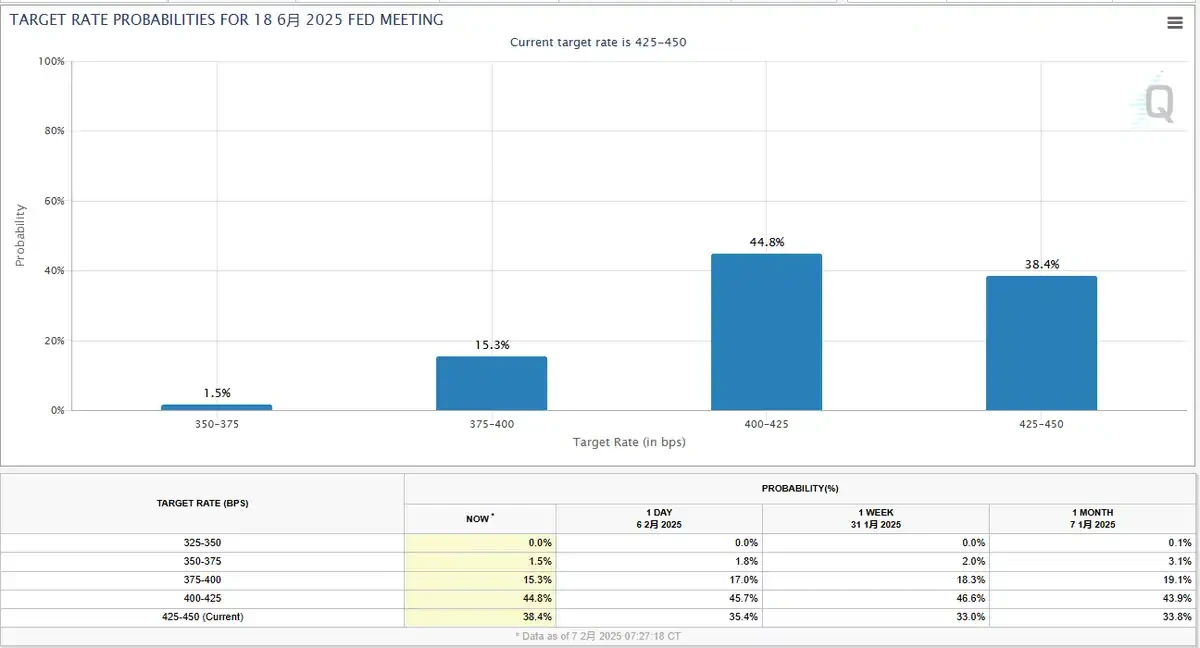

The March interest rate cuts are almost gone, of course there is no, and the current labor data will reduce the probability of a March interest rate cut, which itself is in the market. Within the expectation, let’s look at the dot map in March. To be honest, the current macro data has limited help to the market.

After all, Powell himself said that the labor market is not very concerned, so he should look at inflation data more, especially housing inflation. In general, today’s labor data It is good for the economy, but it is not conducive to the Federal Reserve's increase in interest rate cuts.

After the data was released, Kashkari of the Federal Reserve gave a speech. The main content was the same as Powell's point of view. "If we see good inflation data and the labor market remains strong, then this will prompt me to support further interest rate cuts." Interestingly, this view is completely different from Logan, who spoke yesterday and believes that a strong labor market is a good thing.

The decline in inflation mainly depends on housing inflation. Kashkari said, "If inflation goes down, I don't see why interest rates should remain unchanged." He also predicted that inflation will continue to decline this year and the Fed's interest rate cuts will also be moderate.

This basically characterizes the labor data, especially the labor data, which is good for the economy and is one step further away from recession.

@MaoShu_CN

First of all, after a week, the market value of BTC remained basically unchanged, but the market and #ETH altcoins shrunk. Through the changes in the proportions, it is clear that BTC has greatly sucked the blood of the market. The current proportion has exceeded 58% and is closer to 59%. On the other hand, ETH's proportion has directly fallen below 10%, which is terrible.

In terms of trading volume, except for BTC which still maintains a certain level of activity, the basic activity of ETH altcoins has continued to decline and the sentiment is poor.

The funds have seen a large increase, with funds increasing by 8.9 billion this week, and the total on-site stablecoins are 231.5 billion US dollars,

USDT: The official website shows that the current market value is 141.355 billion, an increase of 1.951 billion compared to last Sunday. The Asian and European markets responded to inflows this week and saw an increase inflows.

USDC: The data website shows that the funds increased by 2.817 billion, and the US funds also maintained an increase in volume. Inflow.

After the employment data was released, BTC started a rebound breakthrough with the US stock market, but inflation expectations triggered a decline in the risk market. This week, it is likely to end down. The current price is still in a weak zone!

After the employment data released tonight, although the data is not good, it is a decline this week The trend basically cleared the negative trend. As long as it was not negative, the market would rebound again.

The market also showed this after the data was released. The short-term BTC price broke through the 1 hour/4 hour range.

However, the inflation expectations of the University of Michigan immediately triggered inflation concerns in the risk market, causing US stocks to fall, and BTC followed the decline, which directly interrupted the rebound and upward momentum of BTC, resulting in Currently, BTC prices are still in a weak zone.

@CryptoPainter_X

Unemployment rate has declined, non-farms are less than expected, and the recovery rate cut nodes that traders bet on are currently stuck today In June, and it doesn’t look very stable, it means that it is the first and second quarter, and there is no need to wait for the interest rate cut. At the earliest, the interest rate meeting will be held in mid-June.

Kikyo

Kikyo