Author: Todd Groth, CFA, CoinDesk; Compiled by: Songxue, Golden Finance

Looking back on the past, there is no doubt that 2023 is a transition year for emerging asset classes. In 2022, the positioning, leverage, and speculative excesses of the previous market cycle are cleared, creating conditions for the start of the next cycle in 2023. The market is adding more interoperability between protocols and projects, with builders and market participants working to provide greater real utility to regulated institutional investors.

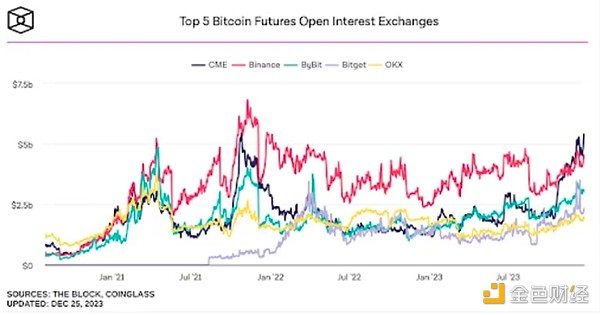

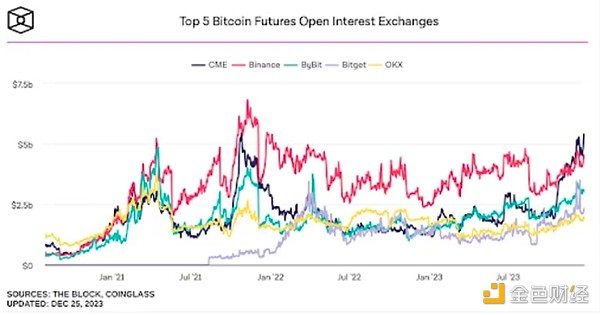

The leadership of once prominent cryptocurrency exchanges such as FTX and Binance has changed, with more regulated players such as Coinbase, Bullish (now the owner of CoinDesk), and EDX leading the market. Meanwhile, traditional futures exchanges like CME Group are seeing growing trading volumes in Bitcoin and Ethereum-related futures contracts (see chart below), and currently have more open interest in Bitcoin futures than Binance.

(The Block, CoinGlass)

We also witnessed renewed efforts to list spot ETFs in the United States, BlackRock (Blackrock) surprised the market in June by filing with the U.S. Securities and Exchange Commission (SEC). This encouraging development helps support demand for Bitcoin as a real asset and as a hedge against currency devaluation in a financial system filled with fiat liquidity and supportive stimulus, reinforcing the case for wider adoption of the digital asset.

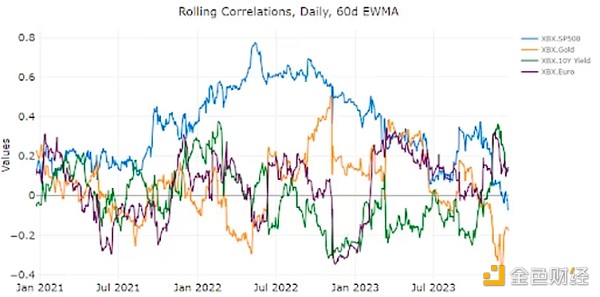

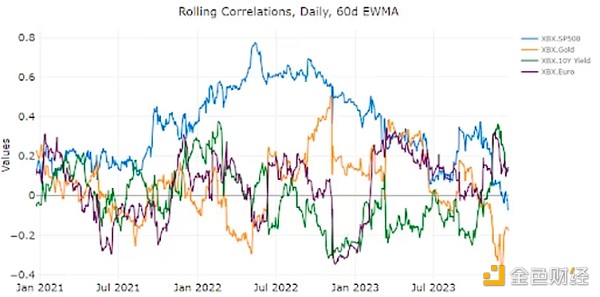

(CoinDesk Indices)

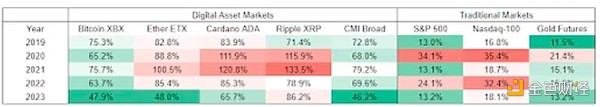

2023 is also one of the periods when the macroeconomic relevance of digital assets will decrease. one. Cryptocurrencies were allowed to become cryptocurrencies and largely decoupled from the U.S. stock market and gold over the course of the year, although achieving lower levels of volatility than in previous years. Surprisingly, Ethereum achieved almost the same level of volatility as Bitcoin in 2023, breaking the historical norm of generally being about 20% higher. Bitcoin’s volatility dropped to a level similar to that of individual stocks, and was even more volatile. In line with traditional asset classes.

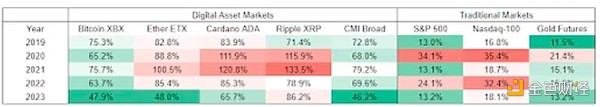

(CoinDesk Indices)

Taken together, these developments signal the maturity and direction of the cryptocurrency market. Ongoing transitions in institutional environments. The shift and expansion of the ecosystem toward more traditional, regulated market players is expected to be at the heart of the next market cycle.

2024 Outlook

We expect that 2024 will further drive the crypto market towards the maturity of institutional investors. This institutionalization coincides with a period of strong performance for Bitcoin and Ethereum, and they are still outperforming even in the final stages of the U.S. rate hike cycle and the decoupling of short-term macro risk factors, indicating thatthey are increasingly being used Treated as a unique real asset similar to gold and oil. We expect these features will drive demand for Bitcoin and Ethereum as liquid and traditional bond alternatives to diversify investors and help asset allocators provide them with a novel means of price appreciation. Inject new vitality into traditional stock and bond investment portfolios.

We expect to launch a spot Bitcoin ETF in the first quarter of 2024. While this is a consensus view, we believe the approval is unlikely to become a classic "buy the rumor, sell the news" event in the medium to long term as it introduces a path to the asset class through familiar and regulated exchange-traded products. An important source of new capital.

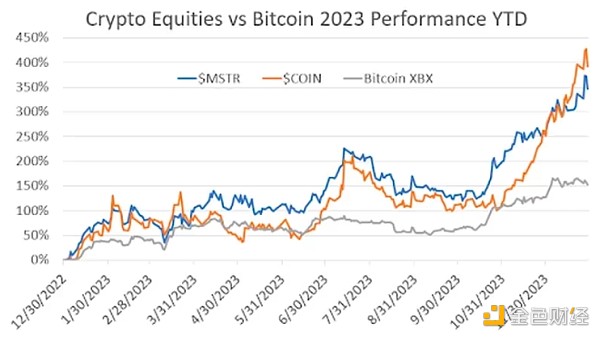

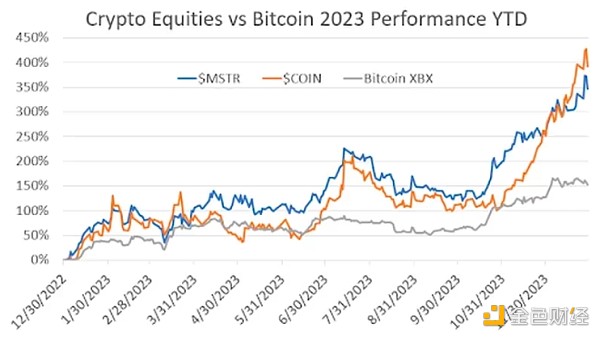

Anyone who doubts the pent-up demand for these assets in more traditional, regulated packaging should pay attention to the performance of Coinbase and MicroStrategy stocks in 2023, both of which have performed well during this period. Bitcoin’s performance more than doubled (see chart below).

(CoinDesk Indices, Yahoo Finance)

These newly launched ETFs will enable registered investment advisers (RIAs) This asset class will be more accessible to a wider range of investors, such as pension funds and hedge funds, and will allow investment banks to build new product ETF vehicles on top of it.

We believe inflows into these ETFs will provide a long-term boost to a market that has yet to fully appreciate. Current AUM under management by RIAs is expected to hover around $128 trillion by 2022 (Source: Investment Advisers Association 2022 Outlook), and assuming 1-2% of the portfolio is allocated to digital assets through spot ETF products, this May bring an additional 12.5 trillion new capital into the crypto ecosystem. However, it is worth noting thatpotential capital inflows into the market via ETFs will be limited to Bitcoin and Ethereum, which may further differentiate them from smaller digital assets, known as “altcoins.” That being said, we do believe that the appreciation in value of these two mega-coins will be distributed across the broader ecosystem to smaller protocols, as they are the primary store of value for crypto-native investors.

If the U.S. economy enters a recession in the second half of 2024 due to the lagging effects of an accelerating interest rate hike cycle and interest rates are cut accordingly, we expect digital assets to broadly benefit from the anticipated and anticipated stimulus measures. Following the 2024 halving, Bitcoin’s digital scarcity will become increasingly attractive in an environment of further increases in federal deficits and spending. Ethereum’s merged token economy is also becoming increasingly deflationary, further enhancing Ethereum’s appeal in this potential scenario.

Against this macroeconomic backdrop, we expect the smart contract platforms, decentralized finance (DeFi) and computing token industries to perform best in 2024 because All three industries benefit from increased on-chain activity as they interact:

Smart contract platform activity requires the use of its native token for blockchain transactions;

DeFi tokens benefit from transaction volume and lending transaction fees;

Price oracle tokens in the computing space (e.g. Chainlink) provide the source of price data needed across the blockchain ecosystem to facilitate transactions.

The computing field also contains protocols and projects focused on decentralized computing and artificial intelligence topics, which are further supported by the artificial intelligence-driven ChatGPT, which With this segment outperforming all others in 2023, we should expect this to be a continued backbone for the industry.

While a recession and interest rate cut scenario may be a favorable macroeconomic environment for digital assets, it will be affected by periods of low liquidity and deleveraging. As a result, we believeposition sizing and portfolio construction will be more important than predicting market direction in 2024and recommend that our readers use CoinDesk’s Bitcoin and Ethereum trends when considering allocation decisions across the asset class Indicators (BTI and ETI respectively).

Investors should also consider their risk tolerance and time investment when investing in digital assets. For those seeking more passive exposure, major tokens such as Bitcoin and Ethereum, in their intended and regulated ETF offerings, may be more attractive options for many seeking to gain beta exposure to the asset class. Safe choice. Staking allows you to generate additional revenue on top of your Ethereum positions, and our Comprehensive Ether Staking Ratio (CESR) provides an annualized staking rate and a baseline staking index.

For those looking to passively invest in smaller tokens and protocols with greater growth potential, we recommend broadly diversified indexes with limited exposure to Bitcoin and Ethereum , to manage idiosyncratic token risk while tilting towards altcoins, which tend to benefit from the mid to late stages.

All in all, we have emerged from crypto winter with a stronger ecosystem than the previous cycle and a more supportive and broader narrative.

Dante

Dante