Author: Rain in the Rain Source: substack

Mainly let's talk about the narratives that may be hyped in July, and my personal rating.

1/ Ethereum S-level

The most important things in July are ETH ETF and Mt. Gox. The market always reacts to events before they happen. As events come, the impact of events on the market will become smaller and smaller. This is why people often say "Buy the Rumour, Sell the News". If history rhymes, ETH may perform similarly to BTC after the ETF was passed - of course, we also have to take into account the overall macro environment and the impact of the US election on the market.

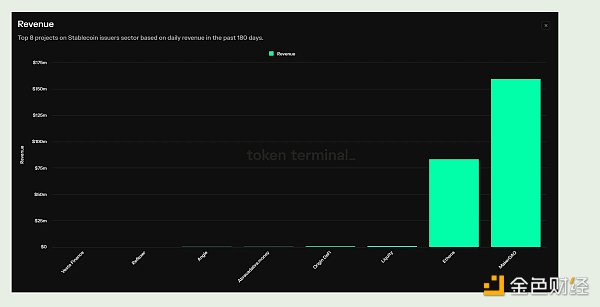

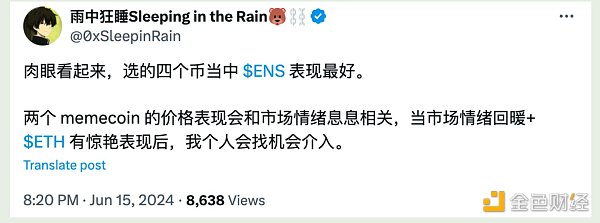

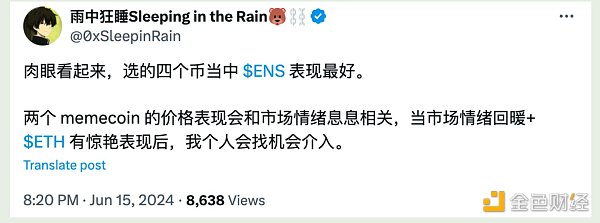

However, on the matter of Sell the news, I agree with Zhusu's point of view. Regarding ETH Beta, I previously selected four coins: $ENS $ETHFI $TURBO $MOG. The price fluctuations of $TURBO and $MOG are large, which are suitable for swing trading, while $ENS performs the best. Regarding $TURBO, I will update my understanding: it is not closely related to ETH, so it will be removed from the list. The current list is: $ENS $LDO $PEPE $MOG $MKR ($MKR is still the same split and name change narrative, and the protocol revenue/fundamentals are also great)

2/ Layer1 (A level), Layer2 (B level), Layer3 (C level)

Solana A level

I have talked about my point of view before. Solana currently has only one narrative, which is the casino of memecoin. Regarding the catalyst of ETF application, Blink, and the previous Depin and Solana Mobile, these narratives still need time to verify. In summary, Solana’s goal is mass adoption, but there is still a long way to go. At present, the market demand for Solana is only hype memecoin.

Avalanche B-level

Avalanche may launch some new activities, similar to the previous Avalanche Rush. "Proof of $AVAX Boost"

https://x.com/Flowslikeosmo/status/1805643864193351908

Fantom B Level

converted to $S, I have already talked about it in the previous tweet⬇️

https://x.com/0xSleepinRain/status/1805875415116136876

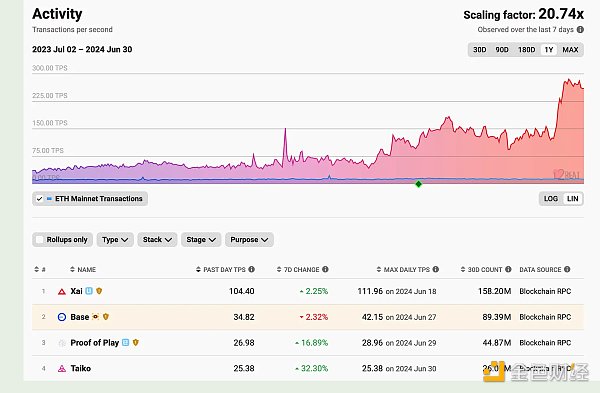

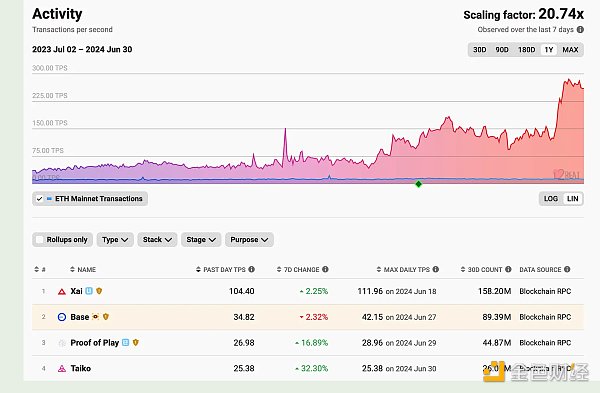

Layer2 part I don’t have much to share, mainly focusing on the wealth effect of Basechain and the Farm opportunities on Arbitrum. But there are not many opportunities for Layer2 tokens such as $ARB $OP to intervene. At the same time, if the ZK narrative breaks out, you know which target to choose :) $ZK is the best meme of ZK. I will briefly talk about my views on Layer3's $XAI. At present, the TPS on the Xai chain has reached 104, ranking first in Ethereum Layer2&Layer3. I have explained this phenomenon in my tweets before. In addition, on July 9, $XAI will unlock about 200 million tokens (accounting for 71% of the current circulation)-this is a super-large unlocking event. Conspiratorially, are these two events related? Will Xai use data to make price growth more reasonable? Everything is unknown. But I have included $XAI in my Watchlist, and I will intervene immediately once the price changes unusually.

https://x.com/0xSleepinRain/status/1803298199295369417

$DEGEN I have always been optimistic about it, but the price performance is very rubbish. So, I won’t go into details here.

In short, the price of Layer3 Tokens mainly depends on catalysts and narratives. There are not many real users (here refers to $DEGEN $DMT and $WINR), and the short-term is greater than the long-term.

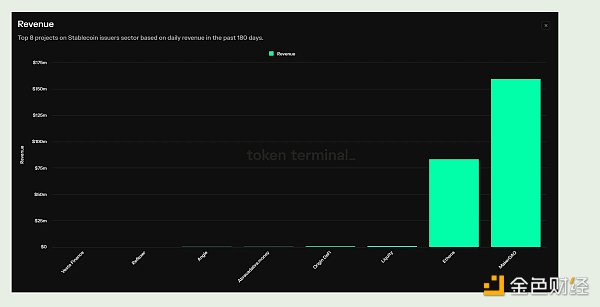

3/ RWA Class A

$ONDO is the best target and is closely related to BlackRock's things. Ondo and Ethereum are the main battlefields for BlackRock to promote tokenization.

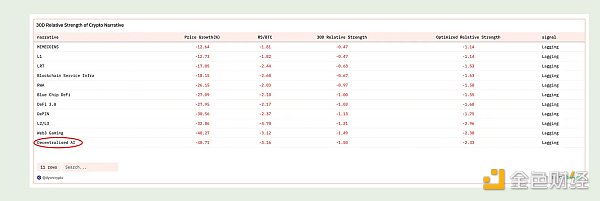

4/ AI Class A

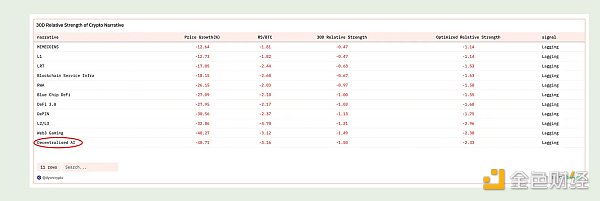

There is not much to talk about. The merger of $FET $OCEAN $AGIX is about to end, and the unlocking of $WLD has begun. If the rise of the sector depends on the release of external products/technologies, it is also short-term speculation. Among the 30-day narrative strengths and weaknesses, the price performance of AI Token is the weakest.

https://dune.com/dyorcrypto/relative-strength-crypto-narrative

5/ Social, it is still a false proposition, currently rated C.

I thought Coinbase Smart Wallet would bring a wave of hype about Basechain, but in the end, under this market sentiment, the overall performance of Basechain ecology was not impressive, and only $BRETT came out. It failed miserably in this wave of coin selection. The review is that the market liquidity and sentiment are not enough to sustain the explosion of the Basechain ecosystem. Maybe only one coin or two or three coins will have outstanding performance. It is not good to intervene too much on the left side. You can only monitor the on-chain market at any time and intervene on the right side.

6/ Games, current rating C. False proposition x2

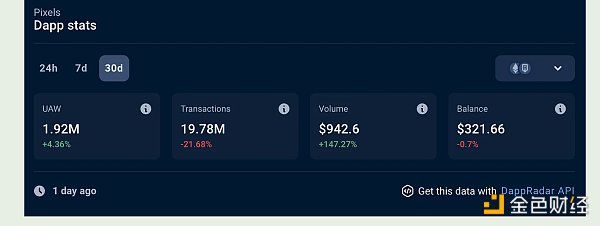

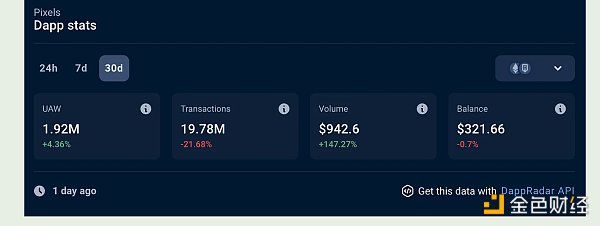

Pixels Online's performance is still strong, but the price performance is very poor.

The Beacon performed poorly - although related activities promoted the return of old players and the joining of new players, the sustainability was not good.

Mavia launched Phase 2, please refer to this tweet for details, but the market is not buying it

https://x.com/MaviaGame/status/1801857117797892497

From the comparison of narrative tokens in the past 90 days, we can clearly see that game narratives did not perform well in the last quarter (low EQ: the worst). I look forward to a reversal, but I will not intervene at this time.

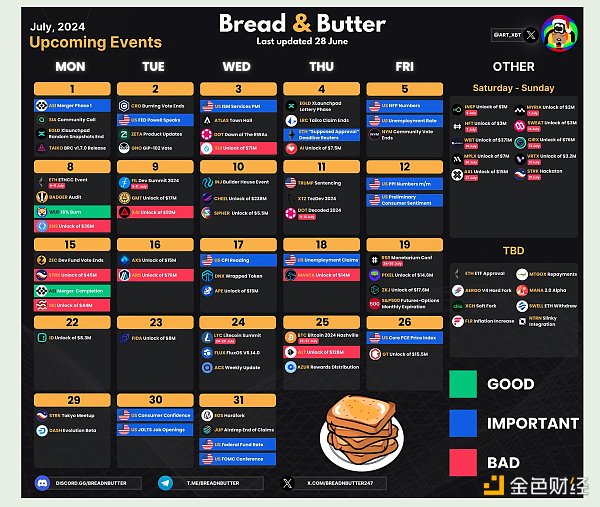

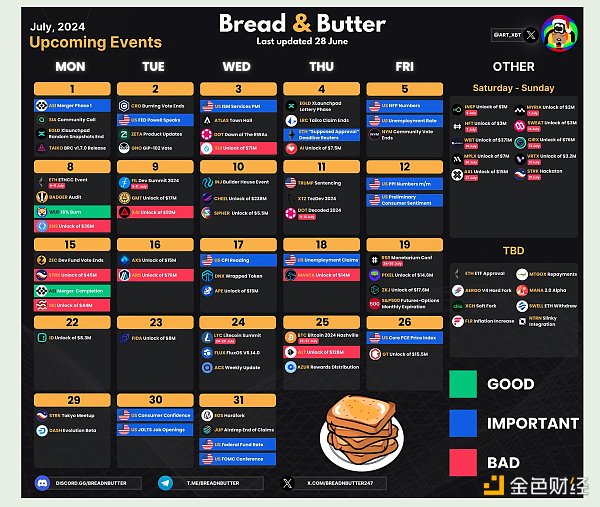

For specific events in July, please check this picture

Joy

Joy