Author: Poopman, Crypto Analyst; Translated by: Jinse Finance

Ansem declares a peak, High CT calls this cycle a “crime.”

High FDV (Fully Diluted Valuation), products with no real-world applications have squeezed every penny out of the crypto space. Memecoin bundlers have destroyed the public’s perception of crypto. Worse still, almost none of the money earned has been reinvested in the ecosystem.

On the other hand, almost all airdrops have turned into “pump and dump” schemes. The sole purpose of TGE is to provide exit liquidity for early participants and teams.

“Diamond hands” and long-term investors are being slaughtered, and most altcoins have never recovered. The bubble is bursting, tokens are plummeting, and people are furious.

Is it all over? Is it all over?>

Difficult times forge the strong.

>

To be fair, 2025 is not bad at all. We have a large number of outstanding projects: Hyperliquid, MetaDAO, Pump.fun, Pendle, FomoApp, each of which proves that there are still true builders in this industry doing things the right way.

This is a necessary purge for the industry, designed to weed out the bad apples. We are reflecting and we will improve.

Now, to attract more funds and users, we need to showcase more real applications, real businesses, and token revenue with real value capture capabilities. I believe this is exactly the direction the industry should take in 2026.

Looking Back at 2025: The Year of Stablecoins, PerpDex, and DAT

1. Stablecoins are maturing

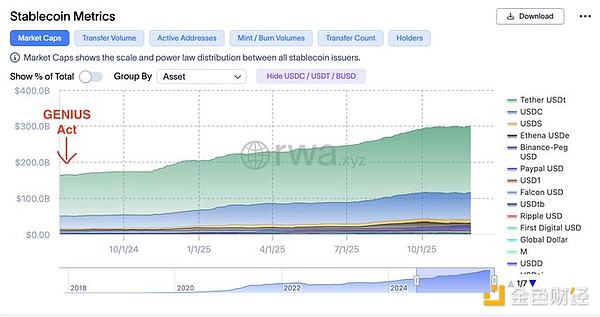

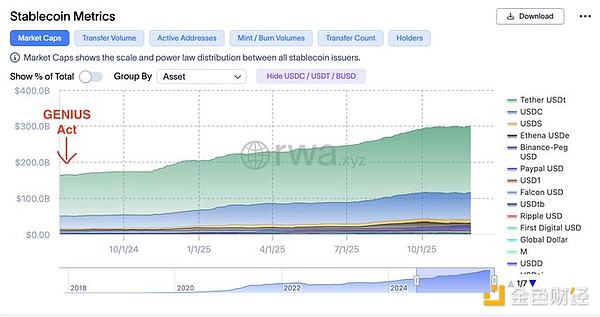

In July 2025, the Genius Act was signed, marking the introduction of the first regulatory framework for payment stablecoins. This framework requires stablecoins to be 100% backed by cash or short-term government bonds.

Since then, traditional finance (TradFi) has shown a surge in interest in the stablecoin sector, with net inflows into stablecoins exceeding $100 billion this year, a record high.

Institutions love stablecoins, believing they have the potential to replace traditional payment systems because:

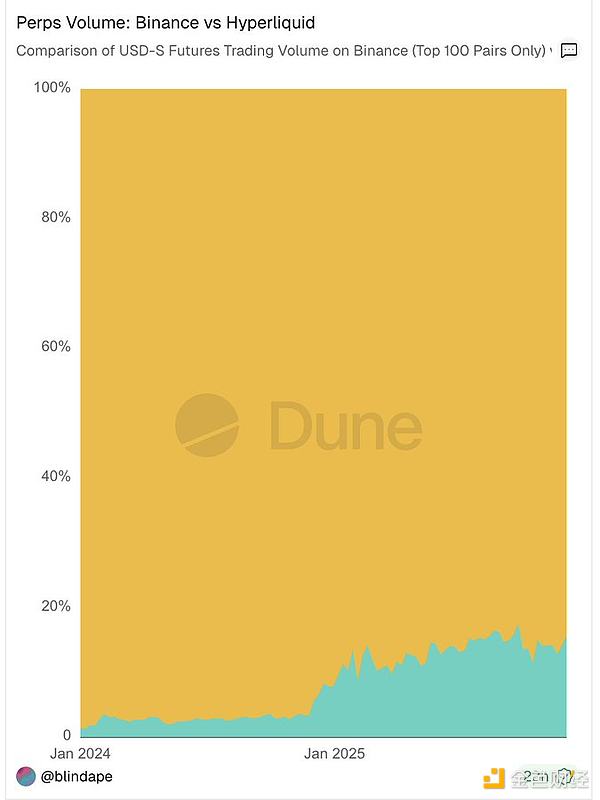

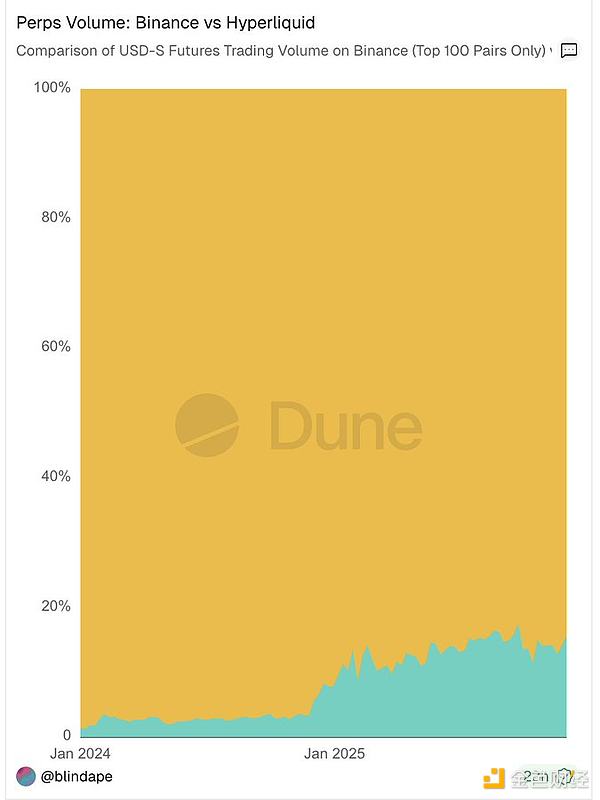

We have seen major mergers and acquisitions by tech giants (such as Stripe's acquisition of Bridge and Privy), Circle Oversubscribed IPOs and top banks collectively expressing interest in issuing their own stablecoins. Besides payments, another major use case for stablecoins is earning permissionless yields, known as "yield-based stablecoins (YBS)". The total supply of YBS has doubled this year to $12.5 billion, driven by tokens like BlackRock BUIDL, Ethena, and sUSDs. While recent security incidents (such as Stream Finance) have dampened market sentiment, stablecoins remain one of the few sustainable growth businesses in the crypto industry. 2. Perpetual Contract Exchange (PerpDex) PerpDex is the star of the year. DeFiLlama data shows that its open interest (OI) has increased by an average of 3-4 times, climbing from $3 billion to a peak of $23 billion. Weekly trading volume has surged from $80 billion to over $300 billion. The rise of PerpDex is threatening the dominance of centralized exchanges (CEXs). For example, Hyperliquid's trading volume has reached 10% of Binance's and continues to grow. Traders choose them for reasons including:

Valuation logic is also changing. Hyperliquid proved that PerpDex can have extremely high valuation ceilings, triggering a "points war." Through token buyback mechanisms (such as the $HYPE buyback), these tokens provide real value support, rather than just being overvalued, useless governance tokens.

3. DAT Benefiting from Trump's stance on crypto, Wall Street's interest has surged. DAT, emulating MicroStrategy's model, has become a key channel for traditional finance to gain crypto exposure. This year, approximately 76 new DATs were established, with total holdings reaching $137 billion (82% in BTC). Of this, over 82% of the assets are in BTC, approximately 13% in ETH, and the remainder is distributed across various altcoins. Please see the image below: Bitmine (BMNR), founded by Tom Lee, was one of the most representative highlights of this DAT wave, becoming the largest buyer of ETH among all DAT participants. However, despite the early hype, most DAT stocks experienced a "pump and dump" within the first 10 days after listing. After October 11, the funds flowing into DAT plummeted by 90% from the July high, and the price of most DAT has fallen below net asset value per share (mNAV). This indicates that the premium has disappeared, and the hype cycle for DAT has essentially ended. In this cycle, we learned: Blockchain needs more real-world applications. The core use cases for cryptocurrencies remain focused on: trading, wealth management (yields), and payments. Current preferences have shifted: protocol fee generation potential > degree of decentralization (see @EbisuEthan's viewpoint). Most tokens need stronger, protocol-based "value anchors" to protect and reward long-term holders. A more mature regulatory and legislative environment will provide greater confidence for builders and top talent to join the industry. Information has become a tradable asset on the internet (e.g., prediction markets like PM and Kaito). New public blockchains (L1/L2) lacking a clear positioning or competitive advantage will gradually disappear. So, what's the next step?

Looking Ahead to 2026: Prediction Markets, Stablecoin Payments, Mobile, and Real Revenue

I believe cryptocurrencies will evolve in the following four directions in 2026:

1. Prediction Markets Remain HotUndoubtedly, prediction markets have consistently been one of the hottest sectors in the cryptocurrency space.

These slogans have garnered significant attention for the sector, and the fundamentals reflect this. As of this writing, the total weekly trading volume of prediction markets has already surpassed the peak during the 2024 US election (even including the wash trading at that time).

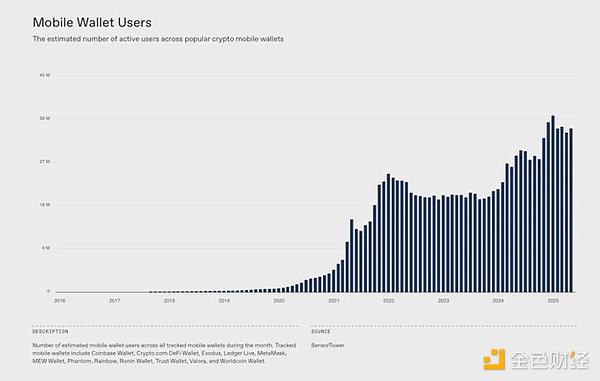

Currently, giants like Polymarket and Kalshi have completely dominated distribution channels and liquidity, leaving little room for competitors lacking substantial differentiation (except for Opinion Lab) to gain meaningful market share.

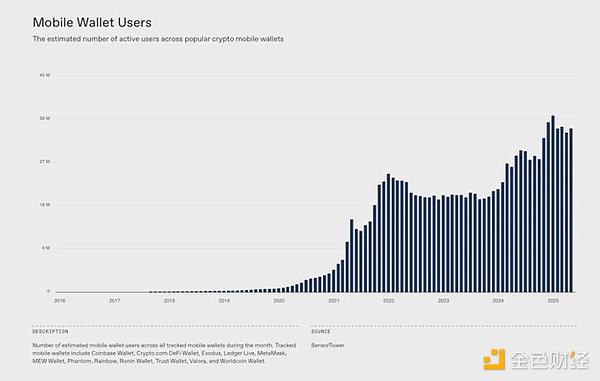

Institutions are also "fomoing": Polymarket received an $8 billion investment from ICE, bringing its secondary valuation to $12 billion to $15 billion. Meanwhile, Kalshi completed its Series E funding round, reaching a valuation of $11 billion. This momentum is unstoppable. More importantly, with the upcoming launch of the POLY token, upcoming IPOs, and mainstream distribution channels through platforms like Robinhood and Google Search, prediction markets will easily become one of the main narratives of 2026. Despite this, there is still significant room for improvement in this area, such as refining adjudication and dispute resolution mechanisms, developing methods to address "toxic flow," and maintaining user engagement during lengthy feedback cycles. In addition to these dominant players, we can expect the emergence of new, more personalized prediction markets, such as @BentoDotFun. 2. Stablecoin Payments Following the enactment of the Genius Act, institutional interest and participation in stablecoin payments surged, becoming one of the key drivers of adoption growth. In the past year, monthly stablecoin trading volume has climbed to nearly $3 trillion, and adoption is accelerating rapidly. While this may not be a perfect metric, it demonstrates the growth in stablecoin usage following the Genius Act and the implementation of the European MiCA framework. On the other hand, Visa, Mastercard, and Stripe are all embracing stablecoin payments, whether through enabling stablecoin spending via traditional payment channels or by partnering with centralized exchanges (CEXs) (such as Mastercard x OKX Pay). Merchants can now choose to accept stablecoins regardless of how customers pay, demonstrating the Web2 giants' willingness to show confidence and flexibility in this type of asset. Meanwhile, new crypto banking services like Etherfi and Argent (now renamed Ready) are also offering card products that allow users to spend their stablecoins directly. Take EtherFi as an example: daily spending has steadily increased to over $1 million, with no signs of slowing down. However, we cannot ignore the fact that new crypto banks still face high CAC (Customer Acquisition Costs) and difficulty in monetizing deposited funds due to users self-managing their assets. Some potential solutions include offering in-app swaps or repackaging yield products and selling them as financial services to users. With @tempo and @Plasma poised to launch as dedicated payment chains, I anticipate significant growth in the payments sector, especially considering the distribution and brand influence of Stripe and Paradigm. 3. The Rise of Mobile Apps Smartphones are becoming increasingly prevalent globally, and the younger generation is driving the shift towards electronic payments. Currently, nearly 10% of daily transactions globally are conducted via mobile devices. Southeast Asia, with its mobile-first culture, is leading this trend. This represents a fundamental shift in behavior within the traditional payment landscape, and I believe this shift will naturally extend to the crypto space, as mobile transaction infrastructure has improved significantly compared to a few years ago. Remember the "account abstraction," unified interface, and mobile SDKs from tools like Privy? Mobile onboarding is now much smoother than it was two years ago. According to research by a16z Crypto, crypto mobile wallet users have grown by 23% year-over-year, and this trend shows no signs of slowing down.

Besides the ever-changing consumption habits of Generation Z, we are also seeing more mobile-native DApps emerge in 2025.

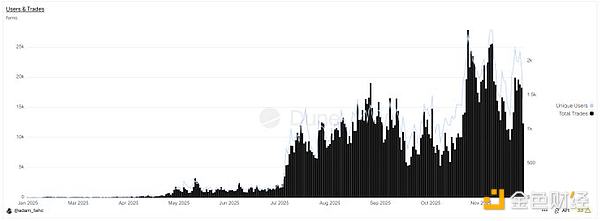

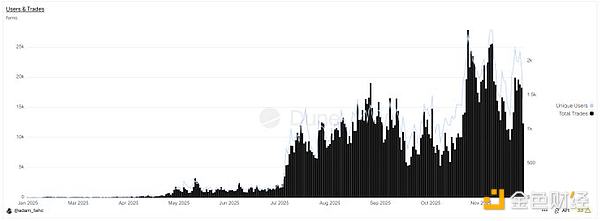

For example, the fomo app, a social trading application, has experienced explosive growth in new users due to its intuitive and unified experience that allows anyone to buy tokens without prior knowledge.

In just six months of development, they achieved an average daily trading volume of $3 million and peaked at $13 million in October.

Along with Fomo, major players like Aave and Polymarket are also prioritizing mobile-first savings and betting experiences. Newcomers like @sproutfi_xyz are experimenting with mobile-first revenue models.

With the continued growth of mobile behavior, I expect mobile DApps to be one of the fastest-growing sectors in 2026.

Bet on more applications and DEXs.

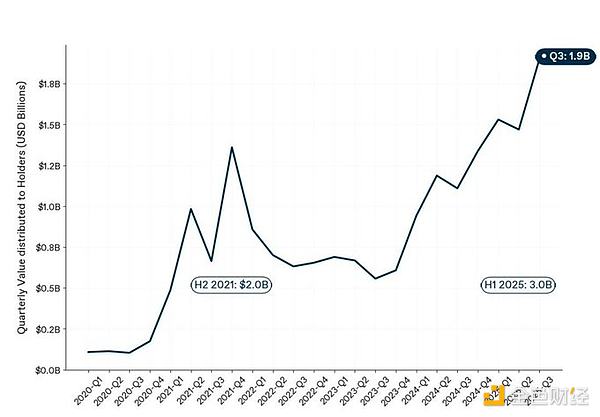

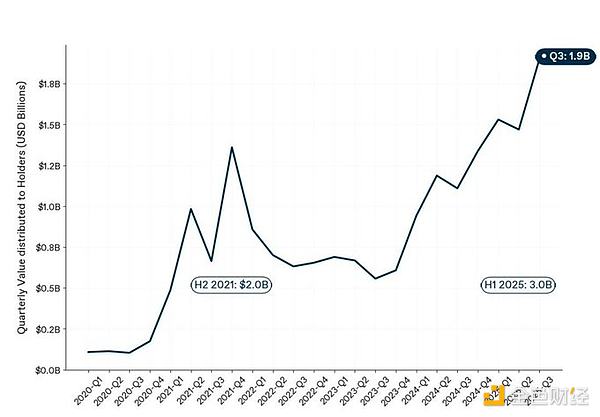

If that's not convincing enough, according to 1kx research, we are actually experiencing the highest value flow to token holders in cryptocurrency history. See the chart below.

Summary

Cryptocurrency is not over; it is evolving. We are experiencing a market cleansing that will make cryptocurrency 10 times better than before.

Those projects that survive, achieve real-world applications, generate real revenue, and build tokens with meaningful utility or value accumulation will ultimately be the big winners. 2026 will be the year of this shift.

Catherine

Catherine