Author: Brayden Lindria; Source: cointelegraph; Compilation: W3C DAO

Grayscale executives said that although the crypto industry achieved "two major victories" last year with spot crypto exchange-traded funds and Republican Donald Trump's victory in the US election, 2025 may see a large number of "small victories."

A large number of "small victories"

Zach Pandl, general manager of research at Grayscale, said in a recent webinar: "This year, I expect the industry to achieve dozens of small victories." He pointed out that Bitcoin will gain more institutional adoption, more comprehensive legislation from Congress, and the potential of Bitcoin.

In a Jan. 15 interview with Ric Edelman, founder of the Council of Digital Asset Financial Professionals, Pandel also said it’s not “completely crazy” to think Bitcoin could reach $500,000 by 2030.

Institutional Growth

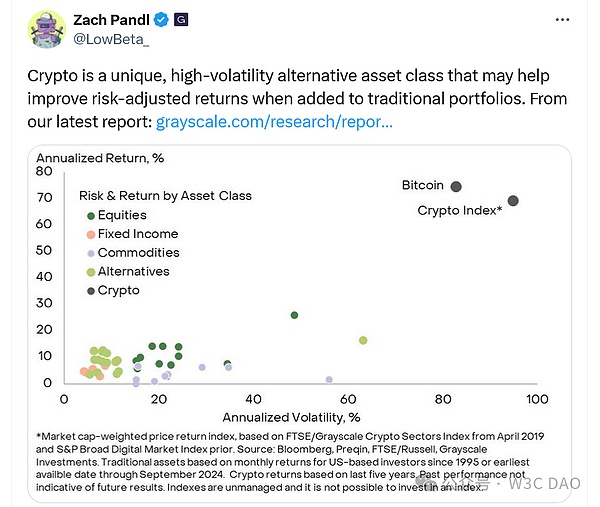

Pandel said more institutional adoption could come from pensions and endowments, and that he has been meeting with more fund managers interested in cryptocurrencies after largely ignoring the industry for a decade.

"It would have been easy for them to ignore it, deny it or put it aside over the past decade, but now they all realize they can't do that anymore."

Pandel explained that many pension and endowment funds have started the process of incorporating cryptocurrencies into their portfolios, and approval for some of these funds may take as little as six to 12 months.

Pandel said some portfolio managers have already allocated up to 5% of their funds to cryptocurrencies, although they are still "in the trial phase."

To give a few examples, according to the Financial Times, pension funds in Wisconsin and Michigan have become among the largest holders of U.S. stock market funds focused on cryptocurrencies, while some pension fund managers in the UK and Australia have also made small allocations to Bitcoin through funds or derivatives in recent months.

British pension fund advisory firm Mercer has also received a large number of inquiries, and trustees do not want to be ignorant of hot asset classes. Most pension funds have turned to regulated US spot Bitcoin or Ethereum ETFs approved last year.

In the UK, pension advisory firm Cartwright has facilitated the first Bitcoin transaction, with an undisclosed small pension plan directly investing about 1.5 million pounds in Bitcoin, hoping to fill the funding gap through excess returns.

Australia's AMP Pension Fund Management Company also uses Bitcoin to improve returns. AMP senior portfolio manager Steve Flegg said that although cryptocurrencies are high-risk and new, their size and potential cannot be ignored, so AMP portfolios have made moderate allocations to Bitcoin futures.

In addition, Pandl also expects sovereign wealth funds outside the United States to increase their investments in cryptocurrencies in the coming months.

Others

Pandl also spoke about Ethereum’s huge potential for institutional adoption, calling it one of the most important open-source software projects ever.

Decentralized finance, real-world assets and artificial intelligence tokens may also attract institutional attention on the private equity side, Pandl added.

Pandl’s optimism comes five days before Trump’s inauguration. The new U.S. president is expected to lead the most pro-cryptocurrency administration to date.

Joy

Joy