Author: Lou Kerner, CryptoOracle Co-founder Source: medium Translation: Shan Ouba, Golden Finance

The crypto market enters 2025 with optimism brought by the transformative year of 2024. Increased institutional adoption and the incoming US administration, which is expected to provide a more favorable regulatory environment, have rekindled investor confidence. Against this backdrop, here are my top three predictions for the crypto industry in 2025:

The Best of Times: Optimistic Predictions

Prediction 1 - Bitcoin will exceed $1 million in 2031

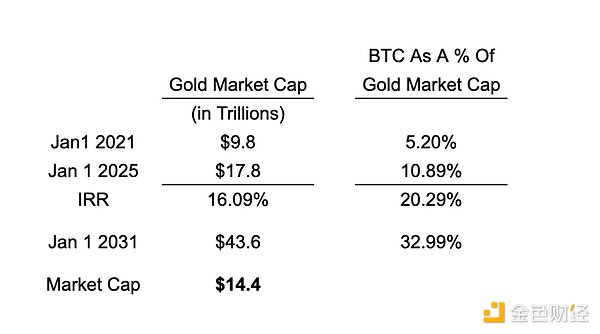

In the short term, crypto market prices are affected by too many external factors, making price predictions within a year very difficult. According to my January 2019 forecast, Bitcoin would be priced at $3,742 at the end of 2018, which is a far cry from the three most conservative forecasts in January 2018, when Bitcoin was priced at $14,156. I originally set the 10-year price target in my January 2021 post. The $1 million forecast is based on two assumptions: 1. The market value of gold continues to grow at historical levels; 2. The market value of Bitcoin reaches the market value of gold within 10 years. In these four years, the market value of gold has grown by almost three times what I assumed, while Bitcoin's share of the value storage market has been lower than expected. If these two trends continue, the $1 million target is still within reach.

It is worth noting that the above predictions are based solely on Bitcoin’s “store of value” narrative. I believe Bitcoin’s unique attributes may create tremendous value beyond store of value, and this is just the icing on this “extraordinary Bitcoin cake”.

Prediction 2 – AI Agents Will Become the Mainstream Narrative in 2025

AI agents are programs that use artificial intelligence to perform tasks autonomously, making decisions and acting based on their programming, data, and environment. These tasks can be as simple as data entry, bookkeeping, and customer service, or as complex as content generation or predictive modeling (e.g., investment or sales forecasting).

AI agents can interact with humans, other agents, or the environment to achieve specific goals. They are more efficient, accurate, and reliable than humans, and excellent AI agents can self-learn and improve through experience without human supervision.

There are already many AI frameworks that have spawned tens of thousands of AI agents.

The most representative framework, Virtuals Protocol, grew more than 80 times in the fourth quarter. In the second issue of our series of seminars, "The Rise of AI Agents", three guests conducted an in-depth analysis of Virtuals Protocol.

The most representative framework, Virtuals Protocol, grew more than 80 times in the fourth quarter. In the second issue of our series of seminars, "The Rise of AI Agents", three guests conducted an in-depth analysis of Virtuals Protocol.

Encryption plays an integral role in the AI agent technology stack, providing a range of enhanced capabilities, including:

• Payment of transaction fees - including transactions between agents;

• Providing a secure and transparent way to manage data between AI agents and users;

• Trustless interaction - blockchain allows AI agents to conduct peer-to-peer transactions without intermediaries.

All major technology companies are actively developing AI agent technology. Last week, Google released a 42-page white paper with a straightforward title: Agents.

And now, it’s just the beginning.

The Worst Times: Pessimistic Predictions

Despite the surge in crypto prices, the industry still faces many challenges. In particular, crypto assets other than Bitcoin have not yet truly achieved mainstream adoption, and crypto is still too complex. Although we have made progress in simplifying complexity, I believe that the biggest challenge facing the crypto industry has not yet been substantially broken through.

Prediction 3 - FAMGANs will continue to dominate technology value creation

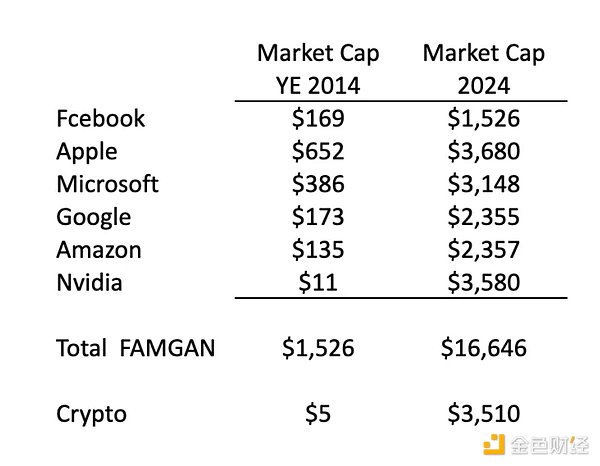

Since I first wrote in January 2017, I have always believed that the biggest risk facing technological innovation (including the crypto industry) is the unstoppable rise of the tech giants. I call these giants FAMGAN (Facebook, Apple, Microsoft, Google, Amazon and Nvidia).

These companies have contributed 70% of the tech market's market cap growth over the past decade. While the crypto industry has added $3.5 trillion in market cap over the past decade, FAMGAN's market cap has grown by over $15 trillion.

They are all massive monopolies (10x the size of the entire crypto market) and are getting more powerful every day. If they haven't grabbed market share in your industry today, it's only a matter of time.

I have been writing about the FAMGAN threat for the past eight years, most recently in my November 2024 article “The First Thing Trump Should Do: Help the Crypto Industry,” and my concerns are starting to become reality.

I feel like the broader crypto community is waging a Star Wars-level war with the FAMGANs for the soul of the Metaverse, which will be driven by crypto and AI. We are at war with the FAMGANs and other tech oligarchs (think Elon Musk, Larry Ellison, etc.). It’s a Star Wars war, with the FAMGANs as the Death Star and the crypto community as the Resistance.

Sadly, in most cases, the Death Star wins. But it’s a war worth fighting in the face of a FAMGAN-driven dystopian future.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Davin

Davin Hui Xin

Hui Xin Jasper

Jasper Jixu

Jixu Davin

Davin Joy

Joy