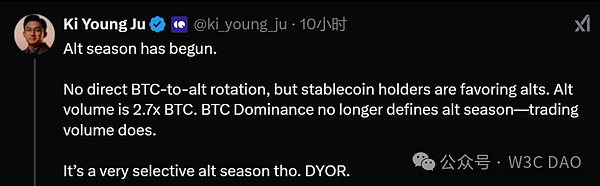

CryptoQuant CEO Ki Young Ju tweeted that the alt season has begun. There is no direct BTC to altcoin rotation, but stablecoin holders favor altcoins. Altcoin trading volume is 2.7 times that of BTC. BTC dominance no longer determines the alt season, trading volume does. However, this is a very selective alt season.

Is the alt season far away?

Citi analysts said in a report that given that Ethereum is the only major cryptocurrency approved as the basis for a spot ETF (besides Bitcoin), it may be a rotation target. Other cryptocurrencies have performed even better, and their share of the overall cryptocurrency market capitalization is also growing.

Citi added that respondents to a recent survey believe that altcoins will perform particularly well in 2025. Analysts said: "Other cryptocurrencies and altcoins have performed even more meaningfully, suggesting that some market participants expect a 'alt season' in 2025 after a strong year for Bitcoin."

Citi analysts said that new policy support will help consolidate the legitimacy of altcoins in the market and may push up prices; Bitcoin is classified as a commodity and already has traditional financial trading tools such as spot ETFs and futures; in contrast, the definition of other crypto assets is more uncertain and the range of investment options is more limited; compared with Bitcoin, further policy support will provide a huge boost to altcoins.

Bitwise Chief Investment Officer, Matt Hougan, also believes that on the one hand, institutional investors are very optimistic about the prospects of cryptocurrencies. Institutional funds are pouring into the crypto market on an unprecedented scale through exchange-traded open-end index funds (ETFs), and Washington has also transformed from one of the biggest threats to cryptocurrencies to one of the strongest supporters. However, retail investors are currently in despair. They seem to be living in another parallel reality.

But in the long run, he believes that the layout of altcoins is more solid than at any time in history. Over the past four years, altcoins have largely been in a regulatory gray area, with the U.S. Securities and Exchange Commission (SEC) claiming that most altcoins are illegal securities offerings. This has hindered their real-world application and has prevented large companies and outstanding developers from getting involved in this field.

Everything is getting better now. Today, the United States has made the development of stablecoins a national priority, which will support the growth of Ethereum and Solana. Today, the world's largest institutions are beginning to build in the crypto space, which will bring DeFi applications to the masses.

Various opinions

Panews believes that the triggering of the altcoin season does not rely on quantitative easing QE, and the altcoin season is usually triggered by the launch of the Bitcoin bull market. The first step in the flow of funds is usually an influx of Bitcoin and major altcoins. Then, the media hype attracts the attention of retail investors, who may start buying altcoins as a result. At the same time, investors who have made profits in Bitcoin will turn their funds to the altcoin market in pursuit of higher returns. According to historical data, this phenomenon usually occurs when Bitcoin breaks through a new high for the second time.

In addition, Vernacular Blockchain believes that in this cycle, the trading pattern of the altcoin market largely reflects a mainstream view that "all projects are scams." In the past two rounds of crypto market cycles, people generally believed that "this technology represents the future." But in the current cycle, this belief has been greatly weakened or even destroyed, and many people no longer believe in the long-term prospects of the crypto industry. On the contrary, the view that "everything is a scam" has become one of the mainstream perceptions.

In addition, the current innovation is more iterative, and the infrastructure is constantly being optimized, but there is no disruptive 0→1 breakthrough like when DeFi was born, and there is also a lack of major progress that makes people's eyes shine.

However, Zhu Su, co-founder of Three Arrows Capital (3AC), posted on X that "it's time to go all-in on ETH." World Free Finance (WLFI) is also currently accumulating Ethereum. It is a decentralized financial platform supported by Donald Trump that aims to democratize financial access by using a stablecoin based on the US dollar and governance managed by its WLFI token. Therefore, we see that Ethereum, the locomotive of altcoins, is being taken seriously by everyone.

Written at the end

The altcoin market is undergoing an unprecedented transformation. With institutional investors entering the market, new policy support has brought more legitimacy and growth potential to altcoins. Although the market's views and beliefs on cryptocurrencies have changed, the future of altcoins is still promising.

We can foresee that as Ethereum and other major altcoins gain more support, market trading volume will continue to increase, driving altcoins into a new period of prosperity. The world's largest institutions are building in the crypto space, bringing Web3 to the masses, and will further consolidate the position of altcoins in the market.

The future alt season will no longer rely entirely on Bitcoin's performance, but will be driven by trading volume and policy support. Although there are fewer breakthrough innovations in the current market, the continuously optimized infrastructure and policy support will lay a solid foundation for the development of altcoins. We can expect that in the near future, altcoins will usher in a new peak in the cryptocurrency market.

Joy

Joy