xStocks on Jupiter:

Jupiter has integrated xStocks, allowing users to trade US stocks on-chain with low fees and self-custody. The collaboration between Kraken, Backed Finance, and Solana aligns with Jupiter’s mission to enable global, permissionless access to traditional markets.

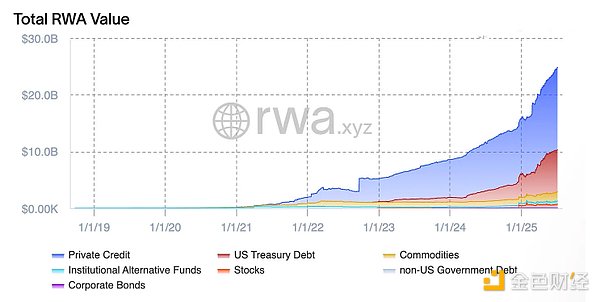

A Panorama of the RWA Ecosystem on Solana

As RWAs grow on Solana, the protocol is organized into functional categories.

Tokenized Treasury Bonds

Ondo Finance: Offering OUSG, a tokenized short-term Treasury bond.

Superstate: An institutional-grade yield asset.

Franklin Templeton: FOBXX Fund now live on Solana.

BlackRock BUIDL Fund: Issued via Securitize and bridged to Solana.

Lending and Underwriting

Maple Finance: Providing low-value collateralized loans to institutions.

Huma Finance: Backing loans with on-chain revenue.

Credix: Financing through off-chain revenue (potential Solana integration).

Infrastructure and Compliance

Custodians: Fireblocks, Copper, Anchorage.

KYC/AML: Fractal, Civic

Securitize: Legal transfer and compliance of tokenized funds.

Institutional Integration

R3’s Corda: Connecting financial giants to Solana.

Kazakhstan Stock Exchange: Exploring Tokenized Dual Listings.

BlackRock and Franklin Templeton: Actively Distributing Tokenized Funds.

Exchanges and Secondary Markets

Jupiter: RWA Liquidity Aggregation.

Phoenix, Orca, and Meteora: Supporting RWA Token Listings.

Wormhole and DLN: Cross-Chain Asset Settlement.

Solana's RWA Stack is not isolated. It's an interconnected financial infrastructure covering issuance, custody, trading, and compliance.

Global Regulatory Outlook: Reconciling Traditional Finance (TradFi) and Decentralized Finance (DeFi)

Regulators are slowly catching up to the RWA trend. United States: The US remains fragmented. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) frequently clash, but recent legislative efforts aim to clarify the status of stablecoins. Activities by BlackRock and Franklin Templeton suggest that, while rulemaking is slow, a regulated future does exist. European Union: The EU's MiCA regulation, due in 2025, will provide clarity for stablecoins and tokenized assets. With pilot programs for digital bonds and tokenized funds underway, the EU is fostering a structured and open environment for blockchain finance. Asia: Singapore supports tokenized finance through initiatives such as Project Guardian, supported by the Monetary Authority of Singapore (MAS). Hong Kong has issued licenses to cryptocurrency service providers. Kazakhstan is emerging as a frontier market through its Solana native IPO pilot.

Regulators across various regions are embracing tokenized treasuries and distinguishing between consumer-grade DeFi and institutional-grade tools. Jurisdictions that offer clear regulation and sandbox support will attract more RWA builders. Solana's compliance tools put it at the forefront.

The Opportunity and Future of RWAs on Solana

RWAs are just getting started. Solana's architecture is enabling new asset classes and more convenient financial services.

Beyond Treasuries: Real Estate, Private Credit, and Equities:

Next up is tokenized real estate and private credit. Real estate can be fractionalized to increase liquidity, while private credit can be serviced through transparent, programmable smart contracts. xStocks and Kazakhstan's dual-listing pilot demonstrate how tokenized equities will develop globally.

Composable RWA DeFi:

Solana's composability allows RWAs to be used across protocols. Tokenized treasury bonds or real estate tokens can be collateralized, traded, or staked. This transforms assets into programmable financial primitives.

Retail-Friendly Products and Yield Enhancement

In the future, applications will emerge that help users allocate their savings into tokenized asset baskets. Solana's low fees and fast confirmations enable retail-grade, user-friendly tools. It's now possible to buy US stocks, earn yield, or borrow against tokenized ETFs through a crypto-native interface.

Emerging Markets: Latin America, Africa, and Beyond:

In inflation-stricken or underbanked regions, tokenized USD or stocks are a lifeline. Solana's speed and price make it ideal for large-scale deployment of RWAs in these markets. Mobile access, native stablecoins, and community engagement are key enablers.

My Take

RWAs are gaining momentum, but face the following challenges:

Liquidity Fragmentation:

Different platforms issue assets using varying standards, making interoperability difficult. Jupiter provides assistance at the aggregation layer, but deeper cross-protocol integration is needed. Slippage and pricing mismatches also persist, especially on weekends. Legal Enforceability: Tokenizing an asset does not guarantee enforceable rights. Legal agreements and clarity are crucial for global adoption. Differences in cross-jurisdictional jurisdictions complicate asset validity and investor protection. Custody and Compliance Risks: Smart contract risks, poor wallet management, and lack of insurance are all obstacles. Institutions require a solid custody and compliance framework. Even KYC and AML hurdles can slow onboarding. Building Trust with Traditional Investors: Institutions expect clarity, control, and reliability. Blockchain user experiences must evolve to match those of traditional platforms. Education, transparency, and trust will be as important as performance or innovation. Conclusion: Solana's RWA Advantage Solana is no longer just a fast chain. It's a financial platform that actively hosts large-scale RWAs. Backed by BlackRock, Franklin Templeton, Kraken, and others, it has evolved into a legitimate foundational layer for global finance. RWAs bring familiarity and regulation to DeFi. Their emergence signals that DeFi is shifting from speculative hype to efficient capital markets. Solana's speed, composability, and infrastructure uniquely position it to lead this new wave. Robinhood's launch of tokenized stocks on Arbitrum and Solana's growing institutional support suggest this is just the beginning. Tokenized stocks, private equity, and 24/7 trading will become the norm. The wealth effect will spread to DeFi, stablecoins, and even memes. Now is the time for builders to create utility, for institutions to modernize their products, and for regulators to help build an effective framework. TradFi and DeFi are converging. Solana is the place to build this future.

Bernice

Bernice