Article author: Tiger Research (Jay Jo & Yoon Lee) Compiler: Aiying Aiying

Japan's stablecoin market has been able to remain stable mainly due to the establishment of a clear regulatory framework. Government support and the policies of the ruling Liberal Democratic Party have further accelerated the development of the Web3 industry. Compared with the uncertain or restrictive stance of many countries on stablecoins, Japan's positive and open attitude is in stark contrast. Therefore, people are full of optimistic expectations for the future of Japan's Web3 market. This article will explore the current status of stablecoin regulation in Japan and analyze the potential impact of yen-backed stablecoins.

1. Regulation drives the Japanese stablecoin market to take off

In June 2022, Japan laid the foundation for amending the Payment Services Act (PSA) to establish a regulatory framework for stablecoin issuance and brokerage. These amendments were officially implemented in June 2023, marking the official start of stablecoin issuance. The new law provides a detailed definition of stablecoins, clarifies the issuing entities, and stipulates the licenses required for related businesses.

1. Definition of stablecoins

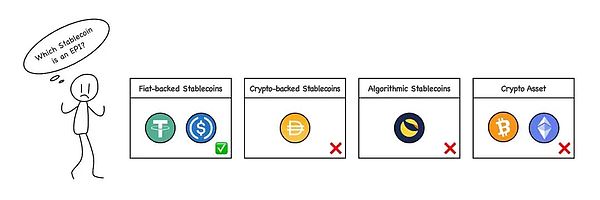

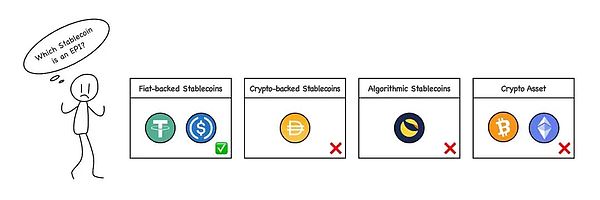

Under the revised Payment Services Act, stablecoins are classified as "electronic payment instruments" (EPI) and can be used to pay for goods or services to an unspecified majority of objects.

However, not all stablecoins fall into this category. According to Article 2, Paragraph 5, Clause 1 of the revised PSA, only stablecoins that are backed by legal tender can be considered electronic payment instruments. This means that stablecoins based on cryptocurrencies such as Bitcoin or Ethereum, such as MakerDAO's DAI, are not considered electronic payment instruments. This distinction is an important feature of Japan's regulatory framework.

(Source: Tiger Research)

Aiying added: Japan’s classification of stablecoins is somewhat similar to the European MICA Act. Stablecoins backed by legal tender are classified as “E-money Tokens” in the MICA Act, while asset-anchored stablecoins such as DAI are “Asset-referenced Tokens”. For details, please read “European MiCA Act 10,000-word Research Report: Comprehensive Interpretation of the Far-reaching Impact on the Web3 Industry, DeFi, Stablecoins and ICO Projects” src="https://img.jinse.cn/7253016_image3.png">

2. Stablecoin issuers

According to the revised PSA, stablecoins can only be issued by three types of entities:

The stablecoins issued by each entity differ in functions, such as transfer limits and recipient restrictions.

Among them, trust-type stablecoins issued by trust companies are the most noteworthy, as they are expected to be most in line with Japan's current regulatory environment and are very similar in characteristics to common stablecoins such as USDT and USDC.

Bank-issued stablecoins will be subject to some restrictions. As banks need to maintain the stability of the financial system, regulators say that bank-issued stablecoins require careful consideration and may require further legislation.

Fund transfer service providers are also subject to some restrictions, with the transfer amount capped at 1 million yen per transaction, and it is unclear whether transfers can be made without KYC (know your customer) verification. Therefore, this type of stablecoin may also require further regulatory updates. Based on these conditions, the most likely form of stablecoin will be stablecoins issued by trust companies.

3. Stablecoin-related licenses

To conduct stablecoin-related business in Japan, an entity must register as an Electronic Payment Instrument Service Provider (EPISP) and obtain a relevant license. This requirement was introduced after the revision of the Payment Services Act in June 2023. Stablecoin-related business includes activities such as buying, selling, exchanging, brokering or acting as an agent for stablecoins. For example, virtual asset exchanges that support stablecoin transactions or custodial wallet services that manage stablecoins for others need to be registered. In addition, these businesses must also meet user protection and anti-money laundering (AML) compliance requirements.

II. Yen-backed stablecoins

As Japan's stablecoin regulatory framework improves, multiple projects are actively researching and testing yen-backed stablecoins. The following will introduce several major Japanese stablecoin projects to help understand the current status and characteristics of the yen stablecoin ecosystem.

1. JPYC: Prepaid Payment Tool

JPYC is Japan's first issuer of digital assets pegged to the yen, established in January 2021. However, JPYC is currently classified as a prepaid payment tool, rather than an electronic payment tool as defined in the revised Payment Services Act, and is therefore not considered a stablecoin. The use of JPYC is restricted, for example, it only supports the conversion of fiat currency into JPYC (listed), but cannot convert JPYC back into fiat currency, which is equivalent to a recharge card, which limits its usage scenarios to a certain extent.

However, JPYC is actively working to issue stablecoins that meet the requirements of the new law, and plans to issue stablecoins for fund transfer by obtaining a fund transfer license and expand its use, such as exchanging with Tochika issued by Hokkoku Bank.

In addition, JPYC also plans to register as an EPISP to operate stablecoin business. In the long term, the company also plans to issue and operate trust-type stablecoins based on Progmat Coin to support business activities related to cash or bank deposits.

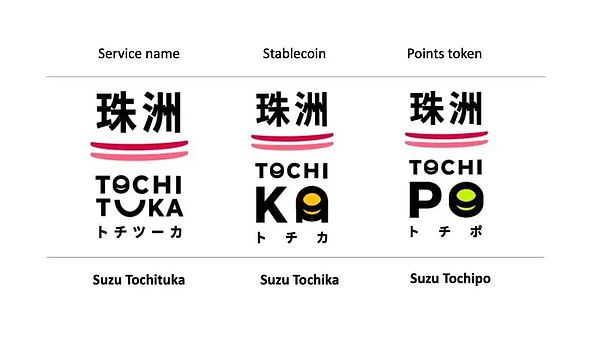

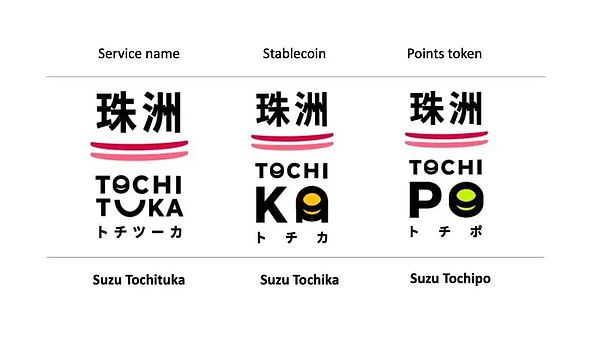

2 Tochika: Deposit-backed digital currency

Tochituka is Japan's first digital currency backed by bank deposits, launched by Hokkoku Bank in Ishikawa Prefecture in 2024. Tochituka is backed by bank deposits and can be easily accessed by users through the "Tochituka" app and used at partner merchants in Ishikawa Prefecture.

Tochituka is characterized by its simplicity and ease of use, and a merchant fee of only 0.5%. However, it is currently limited to use within Ishikawa Prefecture, with only one free withdrawal opportunity per month. A fee of 110 Tochituka (equivalent to 110 yen) will be charged after the number of withdrawals exceeds the limit. In addition, Tochika runs on a private blockchain and has a limited scope of use.

In the future, Tochika plans to expand its service scope, including linking accounts with other financial institutions, expanding geographical coverage, and introducing peer-to-peer remittance functions.

3 GYEN: Offshore Stablecoin

GYEN is a Japanese yen stablecoin issued by GMO Trust, a New York-based subsidiary of Japan's GMO Internet Group. It is regulated by the New York State Department of Financial Services and is on the state's green list. GYEN is pegged to the Japanese yen at a 1:1 ratio, but because it is not issued through a Japanese trust company, it cannot be circulated within Japan.

However, GYEN may be included in Japan's regulatory framework in the future and become part of a compliant stablecoin.

Is the stablecoin business really feasible?

Although stablecoins have been legally passed for more than a year, Japan's stablecoin projects have made limited progress. Stablecoin projects like USDT or USDC are still scarce in the Japanese market, and no company has yet completed EPISP registration.

In addition, requiring stablecoin issuers to manage all reserves as demand deposits poses a significant limitation on business operations. Demand deposits can be withdrawn at any time and have meager profits, making it difficult to generate revenue for stablecoin businesses. Although the Bank of Japan recently raised its interest rate from 0%, the short-term interest rate of 0.25% is still low, weakening the profitability of the stablecoin business. As a result, the market demand for competitive stablecoins backed by other assets such as Japanese government bonds has risen.

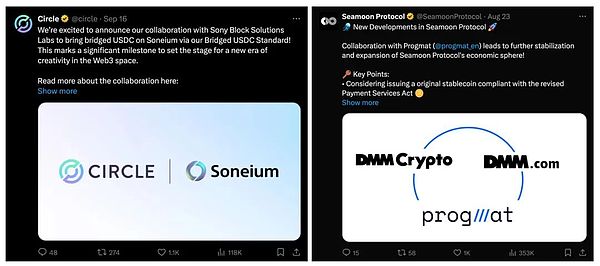

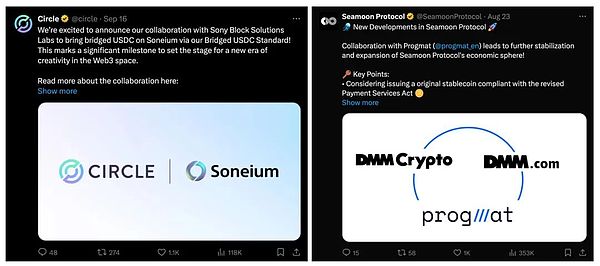

Despite these challenges, Japan's large financial institutions and corporate groups are actively involved in the stablecoin business. This includes large banks such as Mitsubishi UFJ Bank (MUFG), Mizuho Bank and Sumitomo Mitsui Banking Corporation (SMBC), as well as companies such as Sony and DMM Group.

Conclusion

Source: Financial Times, Refinitiv

In recent years, Japan has been grappling with the weakness of the yen and has implemented a variety of strategies to enhance its competitiveness. Stablecoins are part of this as an attempt to enhance the scale and competitiveness of the yen. By adopting advanced stablecoins, Japan is expected to be able to not only apply them domestically, but also open up new application scenarios in the global payment field, which will provide new opportunities for Japan to expand its influence in the international financial market.

Source: rwa.xyz

Although the regulatory framework for stablecoins has been established for some time, the influence of the yen on the stablecoin market is still limited. There are few actual application cases of stablecoins, and no company has completed EPISP registration. The decline in support for the Kishida Cabinet and the Liberal Democratic Party has also made it difficult to promote strong Web3-related policies. Nevertheless, the establishment of a regulatory framework is a meaningful step forward. Although progress may be slow, the changes it will bring are worth looking forward to.

Cheng Yuan

Cheng Yuan