Author: Karl Marx OnChain, Crypto KOL; Translator: Felix, PANews

Curve didn't survive every bear market by luck.

It survived because it was built for one thing: sustainability.

From a mathematical experiment in 2019 to becoming a global liquidity pillar in 2025, Curve's development is an evolution of real returns, aligned incentives, and community resilience.

Let's review it year by year:

2019: The birth of StableSwap (a new AMM concept)

At that time, DeFi was still in its infancy.

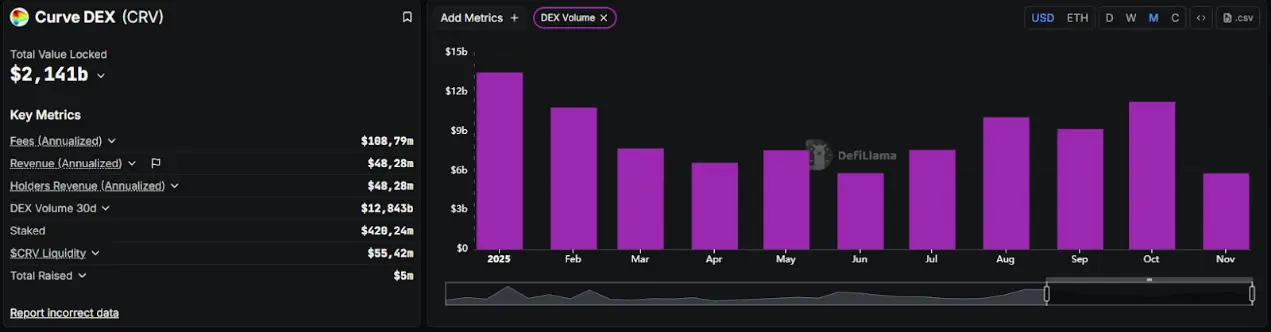

Stablecoins like DAI, USDC, and USDT are popular, but traders face high slippage and low returns for liquidity providers (LPs). Michael Egorov identified this flaw and introduced StableSwap, a new AMM model that combines a constant-sum function with a constant-product function, bringing slippage of stable assets close to zero. This is not just another DEX concept. It's a mathematical breakthrough that brings deep liquidity and real returns to LPs. StableSwap became the DNA of Curve Finance: the first AMM truly optimized for stablecoin efficiency. 2020: The Dawn of Curve Finance and veTokenomics In early 2020, Curve Finance officially launched with a clear mission: to provide stable returns through efficient stablecoin liquidity. However, its true innovation came in August 2020 with the introduction of CurveDAO and the veCRV model (voting lock-up mechanism), a token economic design that redefines DeFi governance. Curve no longer rewards short-term participants, but instead incentivizes long-term collaboration: Locking CRV --> Earning veCRV --> Voting to decide which pools receive rewards --> Earning higher returns --> This structure creates a virtuous cycle, transforming LPs into stakeholders and sparking the legendary "Curve Wars," where DAOs like Convex, StakeDAO, and Yearn fiercely competed for control of veCRV. By the end of the year, Curve's TVL exceeded $1 billion, solidifying its position as a pillar of DeFi liquidity. 2021: Expanding Liquidity, Deepening Community In 2021, Curve proved its scalability. Its daily trading volume reached $1 billion, generating $400,000 in fees daily, all distributed to veCRV holders. The launch of Tricrypto (USDT/WBTC/WETH) elevated Curve beyond the realm of stablecoins. While other projects pursued unsustainable returns, Curve focused on genuine yields and liquidity depth. Every transaction created value, and every LP earned real returns. Meanwhile, as the community matured, governance voting increased and bribery intensified, turning the "Curve Wars" into a masterpiece interwoven with economics and game theory. Curve is no longer just a protocol, but an economic ecosystem. 2022: Bear Market Stress Test As the 2022 bear market severely impacted "DeFi 2.0," Curve's fundamentals were tested, but it remained resilient. Even with a general liquidity crunch in the DeFi space, Curve's StableSwap immutable system and veCRV structure kept incentives consistent: TVL peaked at over $24 billion in January 2022, and by mid-2022, Curve still had over $5.7 billion in TVL. LPs received stable fees from stable trading volume. Due to long-term lock-up, selling pressure on CRV remained low. Curve has also expanded its cross-chain business through Aurora, Arbitrum, and Optimism, solidifying its position as the standard for multi-chain liquidity. While other projects have disappeared, Curve has demonstrated economic resilience through its actions. 2023: Crisis and Community Resilience In August 2023, Curve Finance suffered a loss of approximately $73 million due to a Vyper compiler vulnerability, affecting multiple stablecoin pools. For most protocols, this would undoubtedly be a fatal blow. But Curve pulled through. Within weeks, white-hat hackers, partners, and veCRV holders acted swiftly. Through community coordination and negotiation, 73% of the stolen funds were recovered, a rare feat in DeFi history. Simultaneously, Curve launched crvUSD, a decentralized, overcollateralized stablecoin, providing veCRV holders with real utility and a new source of yield. Curve's community proved it was not only active but also battle-tested. 2024: Expanding the Ecosystem Flywheel Curve evolved from an Automated Market Maker (AMM) into a complete DeFi ecosystem: LlamaLend: A permissionless lending service supporting ETH and WBTC as collateral. Savings crvUSD (scrvUSD): A yield-generating stablecoin connecting DeFi and TradFi. CRV's inflation rate dropped to 6.35%, solidifying the token's long-term value. A partnership with the BlackRock-backed BUIDL Fund connects Curve's liquidity with institutional capital. The veCRV system continues to underpin this growth: integrating users, DAOs, and even institutions around Curve's liquidity engine. 2025: Liquidity, Yields, and Legacy By 2025, Curve will no longer be just a DEX; it will have become a pillar of DeFi liquidity. First-quarter trading volume reached $34.6 billion (a 13% year-over-year increase), with over 5.5 million trades and an average daily trading volume of $115 million. The protocol continues to generate $19.4 million in fees annually for veCRV holders.

crvUSD reached an all-time high market capitalization of $178 million, while Curve ranked second among global DEXs with a TVL of $1.9 billion.

Initially a project as a stablecoin Automated Market Maker (AMM), it has now evolved into a self-sufficient liquidity network based on mathematics (StableSwap), economics (veTokenomics), and community beliefs.

The Secret to Withstanding Cycles: Curve's three pillars are: the liquidity depth provided by StableSwap; the incentive mechanism provided by veTokenomics; and the resilience of its community. As popular projects rise and fall, Curve consistently adheres to its core strengths: transforming liquidity into infrastructure and yield into lasting value. Curve was not created for a fleeting phenomenon, but for long-term development.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Brian

Brian Alex

Alex Kikyo

Kikyo Kikyo

Kikyo Alex

Alex Hui Xin

Hui Xin Alex

Alex Kikyo

Kikyo