Written by: WOO

Background

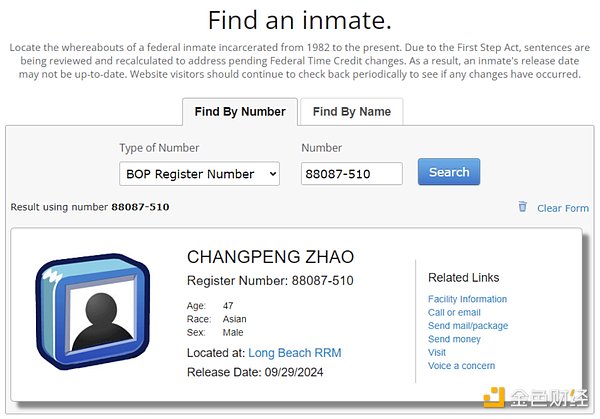

Changpeng Zhao, founder of Binance, was sentenced to four months in prison in the Seattle District Court of the United States on April 30 this year for violating the US Anti-Money Laundering Act. The prosecutor originally requested a 36-month sentence, but the court received 161 letters of support from friends and family. These letters emphasized his good image in family and career, which had a positive impact on the judge's decision. The judge believed that although CZ made mistakes in anti-money laundering, he did not deliberately participate in illegal activities, so he finally decided to give a light sentence of four months.

As time goes by, CZ is expected to be released from prison on September 29, 2024. At that time, there will inevitably be a wave of related concept speculation in the meme market. Putting aside the expectations of future new coin speculation, what currencies did Binance, as a leading exchange, launch during CZ's imprisonment? What are the rules? How is the currency price performance? The most important thing is: what kind of market information does Binance want to convey in the newly launched tokens? WOO X Research Institute will take you to find out.

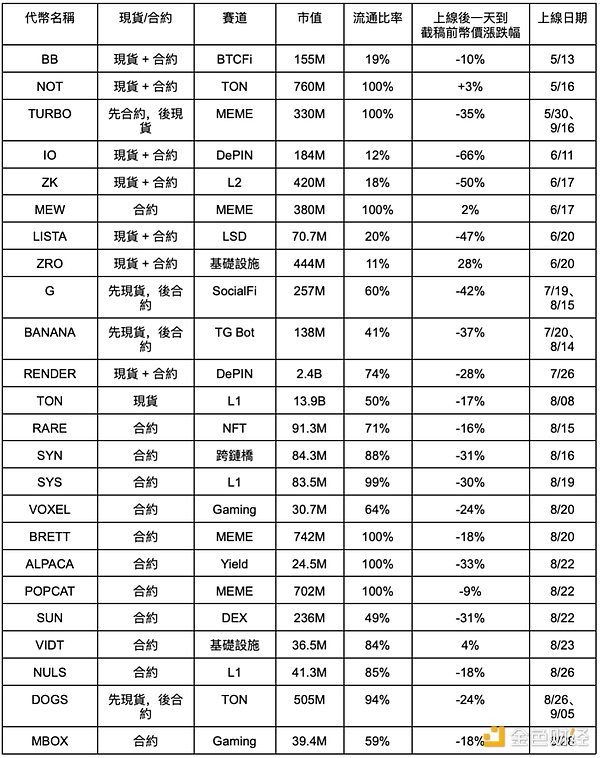

List of newly listed tokens on Binance

How to interpret Binance’s coin listing strategy?

Based on the above data, the following facts can be drawn:

Frequent listing of currencies, mainly contracts: A total of 38 currencies were listed. After the launch of RARE contracts, Binance has been more active in listing currencies, most of which were contracts of currencies that already had spot products, with a frequency of almost one currency per day. On 9/16, three meme contracts (Neiro, Babydoge, Turbo) were launched at once.

Breaking low circulation, high FDV impression: Except for new coins (IO, ZRO, BB, LISTA), the circulation rate of listed currencies is above 40%, generally reaching 70%~100%

Poor market environment: Most new coins have experienced varying degrees of decline after listing, but a few have performed well, such as UXLINK, which rose by 56%. Overall, it has not brought wealth effects to users.

During these four months, the price of Bitcoin continued to sluggish, and the price of the currency fluctuated between 56,000 and 60,000. At the same time, BTC.D rose by 20%, as high as 58%, which also means that most altcoins performed very poorly during this period, and the overall market liquidity was exhausted.

At present, the overall market lacks liquidity, narratives fail, and the market atmosphere is depressed and pessimistic. In past experience, whenever Binance launches a currency, whether it is spot or contract, it can drive the overall market optimism. Since the launch of the RARE contract, Binance has increased the frequency of listing coins, even though most of the coins are "old coins" that no one cares about. This can be interpreted as Binance trying to inject "life-saving needles" into the market again and again, trying to stir up a ripple in a stagnant market.

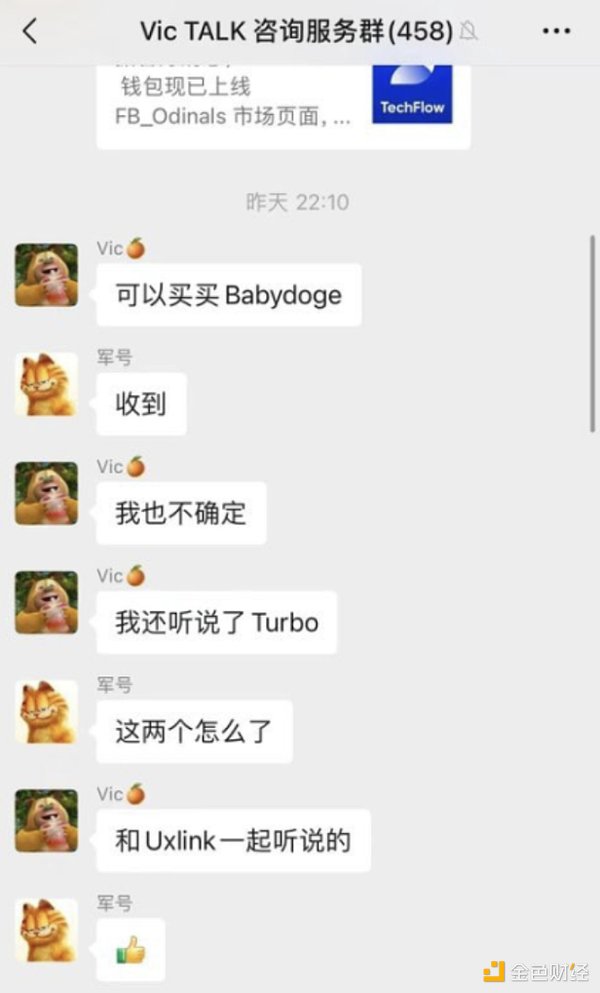

After more than a month of attempts, it is obvious that it can only achieve the function of "short-term excitement". Most of them are still Pump and Dump, and the life cycle is extremely short. Subsequently, Binance launched the uppercase NEIRO contract, which was rarely launched, and was questioned by the community. Then, three meme coins, Neiro spot plus contract, Turbo and Babydoge, were launched.

The reversal of uppercase and lowercase also caused the market value of the original lowercase Neiro to rise from 18 million to 180 million in an instant, completing a 10-fold increase in a short period of time, and then rose all the way to a high point of 400 million US dollars in market value. It is the only coin with wealth effect among the tokens recently launched on the exchange.

Tokens have wealth effect -> Attract more users outside the circle -> Bring in incremental funds -> Market liquidity improves -> Funds drive more different tokens to rise -> Tokens have wealth effect

The above is a positive flywheel cycle.

Binance's active listing of tokens is the first step to start the flywheel, write a myth of getting rich quickly, and attract users.

Recent Controversies Related to Coin Listing

However, Binance has recently launched a large number of meme coins and TON ecosystem-related tokens, which has triggered widespread criticism from the community, including serious insider trading problems and lax auditing of Binance's listings. In response to these accusations, Binance co-founder He Yi issued a statement on September 17.

She pointed out that Binance's principle of listing coins is to meet user needs, and admitted that it did not pay enough attention to meme coins in the past, which led to the platform's slow response when listing meme coins such as Shiba Inu and PEPE. In the coin listing standards, projects that have lived for a long time and have business logic are preferred.

Finally, he also said in the article: "If we have different opinions, then you may be right." She believes that although the world that everyone can see is not connected to each other, everyone can only see their own future, Binance will continue to explore the future, and thank all the communities for their advice.

The whole article is neither humble nor arrogant, and the whole incident has come to an end.

Future market expectations

On September 19, the US Federal Reserve announced a 50 basis point interest rate cut, which is the first two-code interest rate cut since 2020, and it also means that the interest rate cut cycle has started. It can be expected that hot money will gradually flow into the risk market and the crypto market will restore liquidity.

In addition, October has been called "Uptober" in the cryptocurrency circle over the years. According to the history of the cryptocurrency circle over the past 11 years, there have been only two declines in October, and the remaining 9 increases, with an increase probability of up to 82%

The current macro conditions have improved, coupled with Binance's "artificial bull market", the crypto market is expected to get out of the haze in Q4, and Bitcoin will hit a new record high.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance YouQuan

YouQuan JinseFinance

JinseFinance cryptopotato

cryptopotato BNB Chain

BNB Chain Others

Others Numen Cyber Labs

Numen Cyber Labs Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph