Author: Michael Nadeau, The DeFi Report; Translation: 0xxz@黄金财经

Before we officially start this article, let's take a brief look at the background.

Our analytical research shows that meme coins have higher L1 asset properties (and are more likely to outperform L1).

We believe that meme coins are leveraged bets on various themes/narratives and ecosystems.

We are only interested in meme coins that have reached a certain escape velocity. This removes 99% of the market share-we focus on blue-chip meme coins with sufficient liquidity. (Note: This article was published before TRUMP was released)

By the way, I remember watching an interview with Paul Tudor Jones in 2020. He mainly talked about Bitcoin. He mentioned that Stanley Druckenmiller told him that 80% of Bitcoin holders held Bitcoin from $20,000 all the way down to $3,000 (after the 2017 cycle). This is an interesting statistic. This gave Paul Tudor Jones the conviction to invest in Bitcoin. We are looking for similar clear statistic when analyzing meme coins and wallet groups.

But please remember that meme coins are very risky and volatile.

Only invest in what you are willing to lose, and always do your research.

Let’s look at the data…

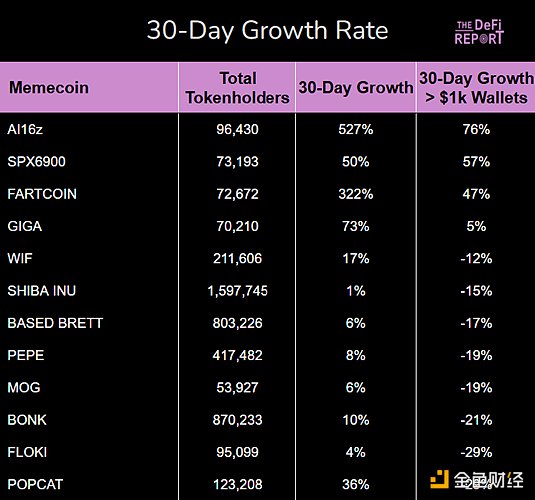

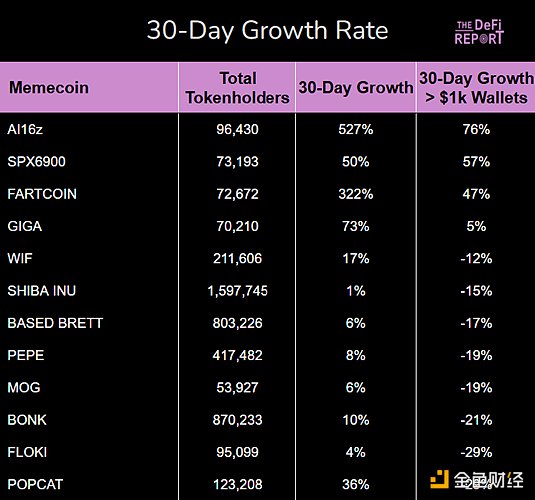

1. Token holder growth

Summary:

SPX6900 is the only meme coin whose $1,000 holders are growing faster than its overall holders.

Note that many assets have seen price declines over the past 30 days, which could distort the data. Fartcoin (up 94%), AI16z (up 81%), and SPX6900 (up 52%) are the best performing assets last month.

GIGA is an outlier in the data as its price has been flat over the past 30 days but has still been able to keep growing among its $1,000 holders.

2. Token holding beliefs

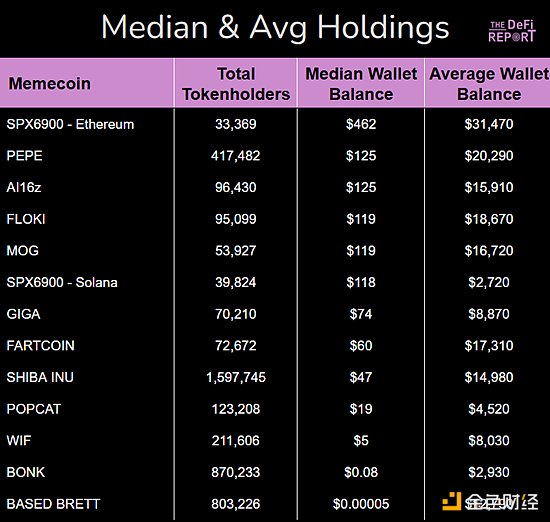

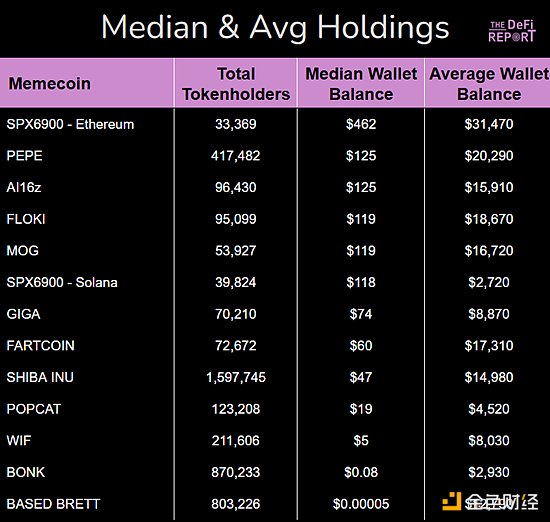

(1) Average and median holdings

Summary:

SPX6900 stands out again as its median holdings among all Ethereum addresses are 369% higher than Pepe, the second-highest meme in terms of median holdings per wallet. It also has the highest average balance.

Solana’s SPX6900 is a different story, as the median holdings are only 25% of what we see on Ethereum. This is consistent with the market’s perception of the two networks: Ethereum tends to attract more TVL and higher value transactions than Solana.

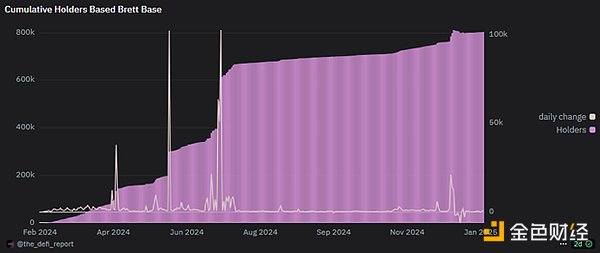

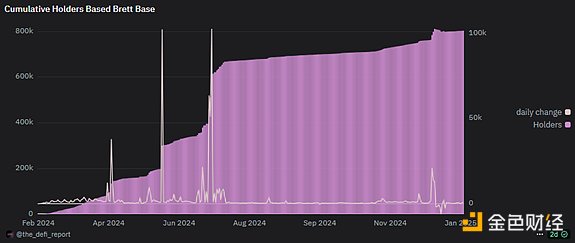

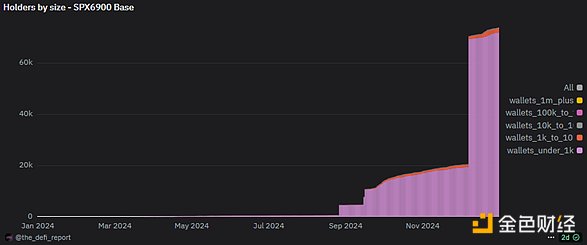

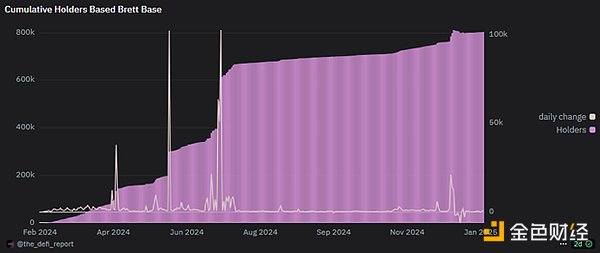

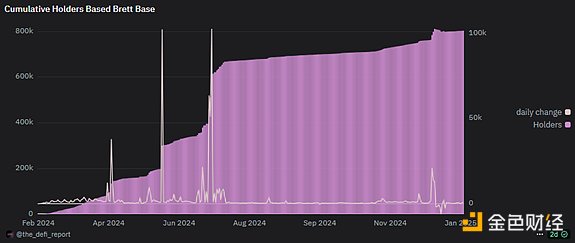

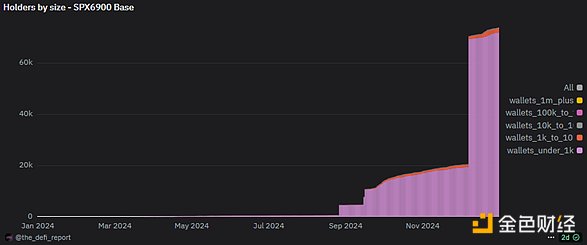

Based Brett on Base L2 is the most “gamified” meme. We are looking into what happened, but from the chart below we can see that there were three large increases in token holders. Insiders appear to have airdropped hundreds of thousands of wallets to promote marketing/community building. This is nothing new, the Bonk team has done this in the past (including airdrops to Solana phone buyers).

Generally speaking, we can see that most memecoin "investors" only operate in the range of a few hundred dollars - possibly investing in multiple projects.

Once again, SPX6900 stands out on Ethereum because its community seems to have more conviction than any other meme.

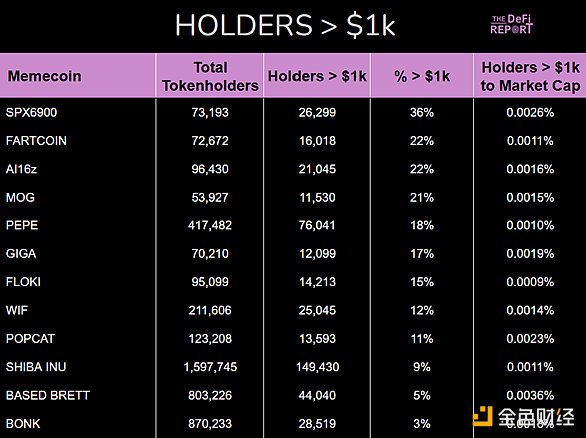

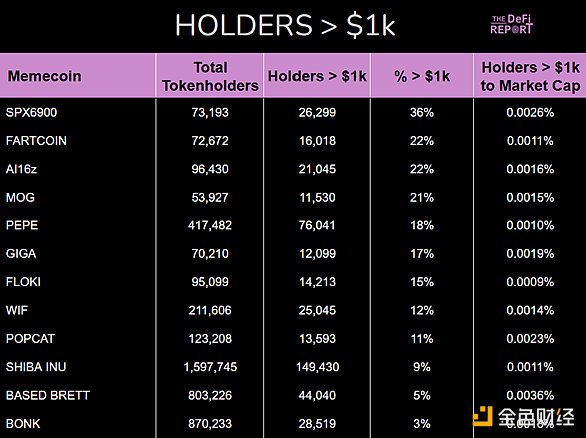

(2) Investors with holdings of more than $1,000

Summary:

Once again, SPX6900 attracted attention. 36% of users held more than $1,000, while the average level of holders of more than $1,000 for other popular memes was only 14.2%.

Pepe stood out among the “big market memes”, with 18% of wallets holding more than $1,000.

Fartcoin, AI16z and MOG also ranked in the top five.

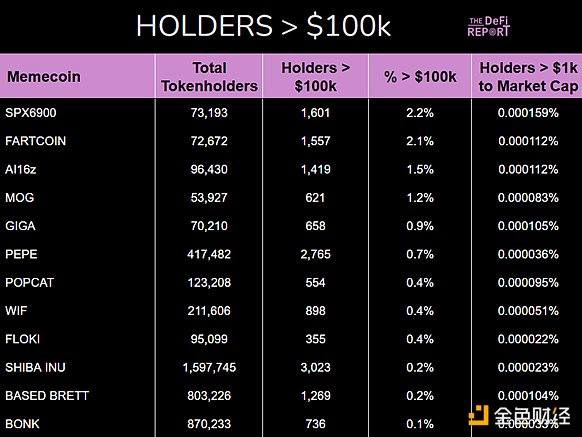

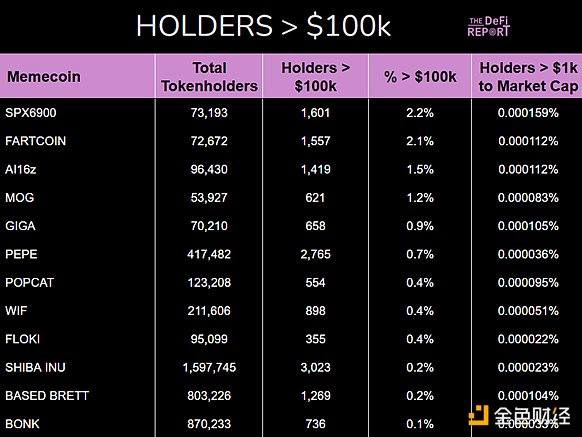

(3) Investors above US$100,000

Summary:

Once again, SPX6900 tops the charts with the highest percentage of wallets above $100k. Some people think this is bad because it indicates that large holders may be "selling" to retail investors. I think the opposite is true. In my opinion, a higher percentage of people holding more than $100k indicates that more people have high confidence in the asset. In some ways, SPX6900 may develop similar properties to BTC in the meme.

Fartcoin and AI16z (both on Solana) show a surprising number of wallets holding more than $100k.

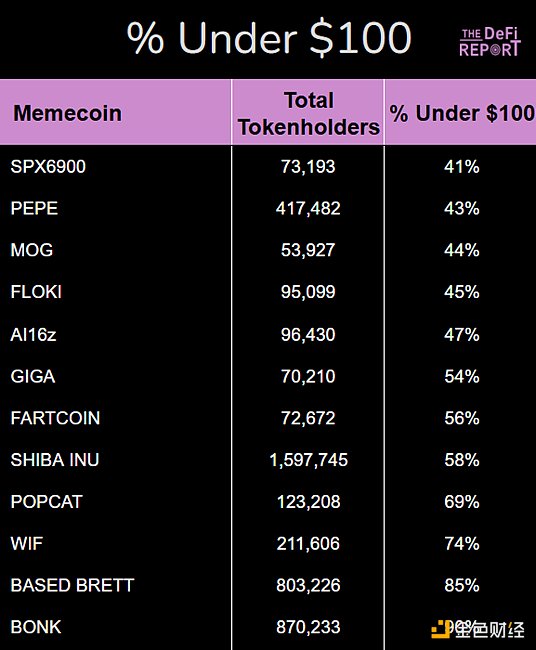

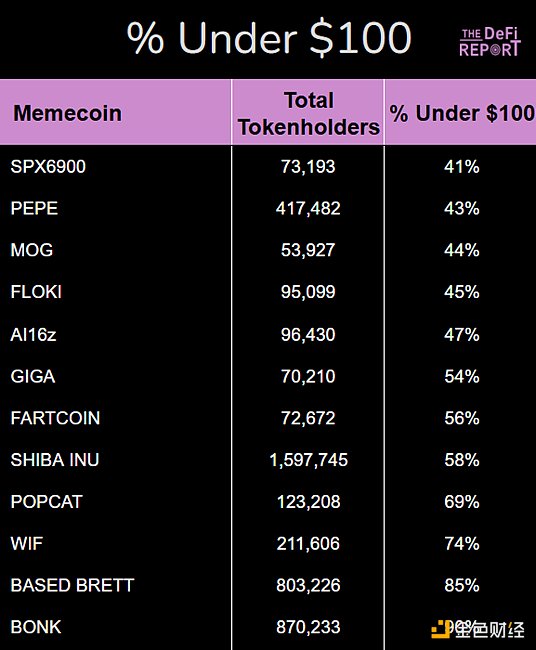

(4) Percentage of wallets with less than $100

Summary:

SPX6900 has more wallets with more than $1,000 (12,914) on Ethereum, while the number of wallets with less than $100 (9,920) is relatively small. Again, this is an outlier. No other meme is close to this metric. In fact, only 29% of SPX wallets on Ethereum hold less than $100. Pepe is #2 with 43% of wallets under $100.

For reference: Pepe (the second largest asset in this category) has 7.6 wallets over $1,000 and 179,000 wallets under $100.

You can see the bottom 4 assets have a high concentration of wallets under $100. We believe these meme coins are more centralized with insider marketing campaigns and airdrops - which gives this category this look.

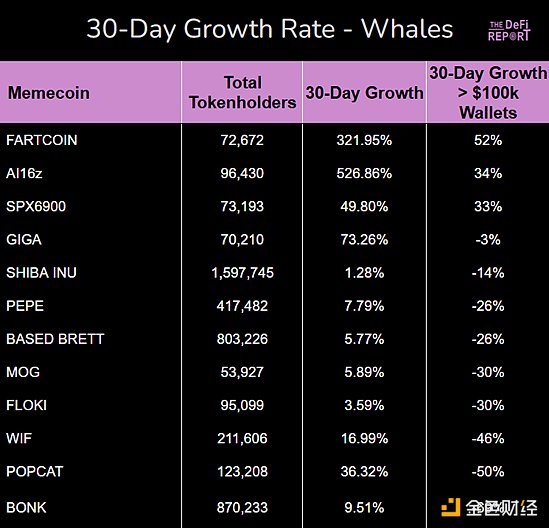

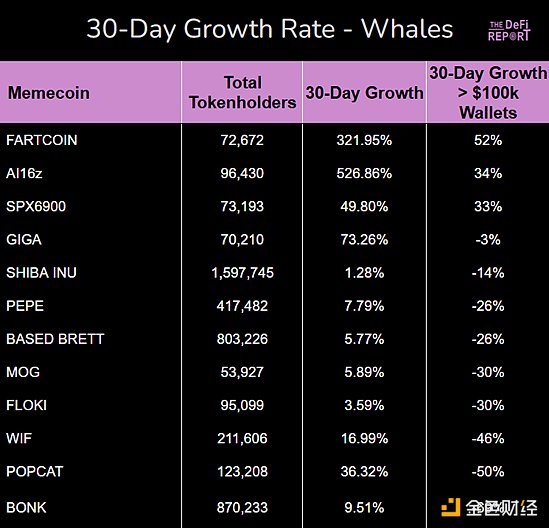

3. Whale Growth

30-day growth rate of whale wallets

Summary:

It is a bit surprising that Fartcoin and AI16z are at the top of the list. Both assets were launched in October last year and have shown significant growth in the past 30 days. Given that prices have risen by 94% and 81% respectively during this period, the growth of wallets above $100,000 makes sense. But both assets are fairly volatile, so it’s interesting to see that there seems to be a fair number of holders that are showing high confidence.

Bonk is down 14% over the past month, but its $100,000 wallet count is down 69%, suggesting that many large holders may have taken profits recently. This could put Bonk’s floor in the $0.000026-$0.000028 range.

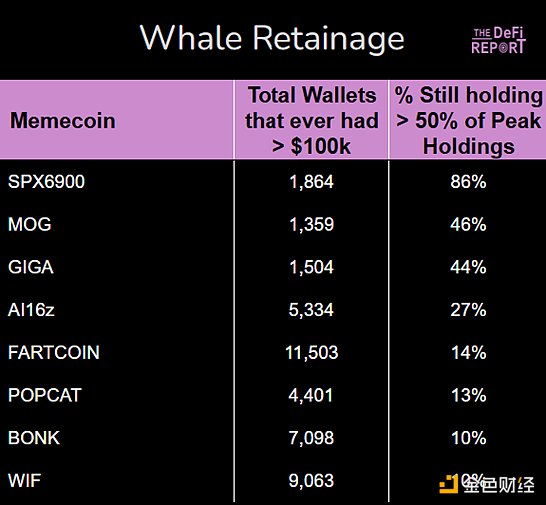

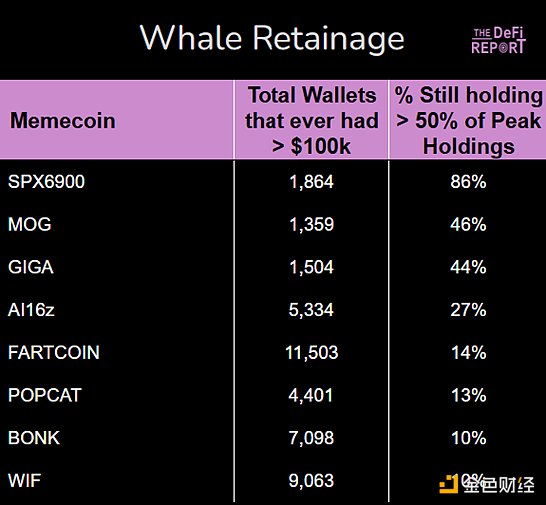

4. Whale Retention Rate

Our goal with this metric is to look at all wallets that have held more than $100,000 over the life of the asset. We then compared this number to the number of wallets that still hold over $100k. We think this metric gives us some insight into the long-term conviction of large holders.

*Note that our current dataset is missing some large Ethereum memes. We will share the data as soon as we get it.

Brief Summary

SPX6900 exceeded expectations in this regard. 86% of holders who once held over $100k still hold at least that level of holdings, even though the token is currently 34% below its all-time high. It's a frenzy.

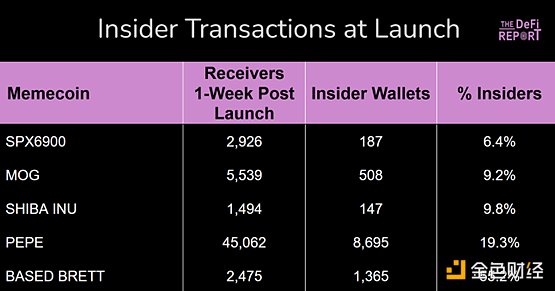

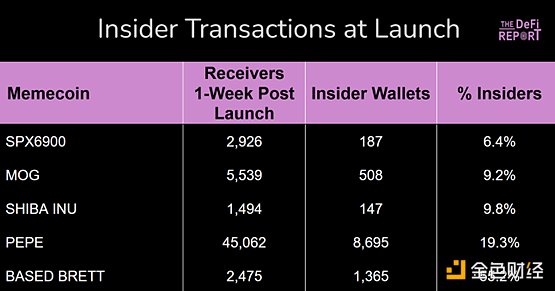

5. Internal Transactions

Our focus here is to identify tokens with obvious "conspiracy" characteristics. To do this, we looked at the total number of wallets that received tokens in the first week after issuance. We then filtered out "internal wallets" based on the condition "wallets that received tokens but had less than 5 previous transactions."

The logic is that crypto users who received tokens in the first week and had less than 5 transactions are unlikely to be internal wallets.

Summary:

Of the 5 assets for which we were able to obtain data, SPX once again topped the list.

Pepe had a large number of token recipients (45,000) in the first week, with a high percentage of “insiders”.

Based on Brett having 55% of internal wallets, this does not surprise us. Of all the memes we analyzed, this token appears to have the highest degree of centralized management.

6. Conclusion

I want to make it clear that we are still in the early stages of gathering insights through the data. Please note that some of the data may be noisy (note that asset prices may distort some indicators).

We believe that we can learn a lot by analyzing wallet groups.

So, what did we learn?

SPX6900 ranked first in 6 of the 9 datasets. It ranked second in one dataset. It ranked third in terms of 30-day growth rate of whale wallets. This gives it an overall score of 9 points.

The second-best asset in terms of overall score is AI16z with 21 points.

Fartcoin ranked third with an overall score of 28 points.

One last thing I want to say:

Note that there are different ways to look at and interpret the data. You could argue that it’s a bad thing that a large portion of holders are still holding onto their coins. You could argue that the percentage of holders under $100 should be higher. I don't think so, I think a higher percentage of wallets holding a large amount of tokens indicates more confidence. But you can question the way I interpret this data and come up with your own opinion.

Our data is limited to on-chain data and does not include centralized exchange data. WIF, Bonk, Shiba Inu, Pepe, GIGA are all traded on platforms such as Binance, Coinbase, etc.

Suppose we did not include the SPX6900 token on Base in the dataset. From what we can tell, it seems that some airdrop event (possibly multiple) distorted the data, so we removed it. The token has 72,012 wallets, but only 1,929 wallets have a holding of more than $1,000 (2.6%). The median balance is $0.000001. The real activity of SPX6900 occurs on Ethereum and Solana.

The conclusions we draw do not imply that these assets will outperform in the future. In fact, if BTC does poorly in the coming months, I would not expect any of these assets to perform well.

But if you believe that BTC will perform well in the coming months, it may be wise to form a data-driven view for the "blue chip meme" in 2025. These datasets can help you do that.

Catherine

Catherine