Author: b10c, Bitcoin developer; Translator: AIMan@黄金财经

This article explores the degree of centralization of Bitcoin mining in 2025 by analyzing the hashrate share of the current five major mining pools. A mining centralization index is proposed in the article and updated using proxy mining pools from AntPool and its friends. The index shows that Bitcoin mining is currently highly centralized, with six mining pools mining more than 95% of the blocks.

In the current Bitcoin mining landscape, almost all of the hashrate is controlled by a few large mining pools, which are responsible for generating block templates. These mining pools control which transactions are included in their blocks and which transactions are excluded. As long as these mining pools do not collude and decide to censor transactions, this will not harm Bitcoin's anti-censorship capabilities. However, this also raises the question: how many different block template producers are there? The well-known 51% attack occurs when a single miner or pool controls more than half of the hashrate and can outperform all other miners by mining on their own chain. However, even if a pool only has 40% of the hashrate, there is about a 50% chance that it will outperform all other pools within six blocks. Which pools have 40% of the hashrate today? In general, how centralized is Bitcoin mining today? Especially in the case of hypothetical proxy pools, where smaller pools proxy mining tasks for larger pools while writing their own names into coinbase transactions.

This article explores the issue of Bitcoin mining centralization in two parts. The first part analyzes the mining pool information included in the Coinbase transaction. The second part considers hypothetical proxy pools. Both parts show the current largest mining pools and the mining centralization index.

Measuring Centralization by Counting Coinbase Tags

Mining pools often leave ASCII tags in their coinbase transactions. For example, the mining pool F2Pool contains the tag /F2Pool/. In addition, mining pools often reuse their coinbase output addresses. A dataset of these identifiers can be used to find which mining pool mined a block. In this article, I used the bitcoin-data/mining-pools dataset. To measure hashrate share, I calculated the number of daily blocks for each mining pool divided by the total number of daily blocks. The data shown is averaged using a 31-day moving average.

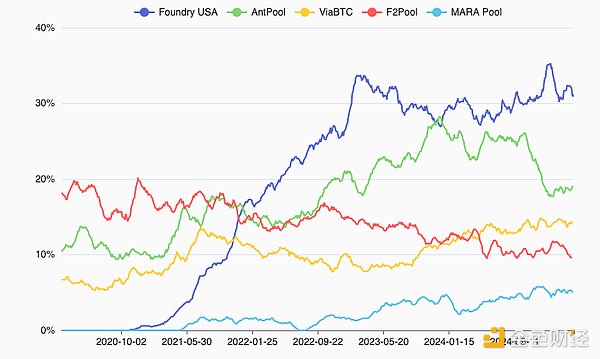

Top five mining pools share

Currently, the top five mining pools are Foundry (30%), AntPool (19%), ViaBTC (14.5%), F2Pool (10%) and MARA Pool (5%). Among them, MARA Pool is the youngest mining pool, which was established in May 2021. In addition, it is also the only private mining pool among the top five. At the end of 2020, Foundry began to mine the first blocks. After one year of operation, Foundry surpassed other mining pools and became the largest mining pool, accounting for about 17% of the computing power of the entire network. More than a year later, in January 2023, Foundry's computing power reached 30% of the coins and has remained at this level. The computing power of AntPool, a mining pool under ASIC mining machine manufacturer Bitmain, rose from about 10% in 2020 to more than 25% in 2024, and then fell again to less than 20% at the end of 2024. Last year, ViaBTC surpassed F2Pool in the competition for the third place.

Currently, the largesttwo mining pools account for more than 50% of the computing power, followed by the third and fourth, which together account for 25%, that is, 75% of the computing power is controlled by four mining pools. To better understand this, the following mining centralization index can help.

Mining Centralization Index

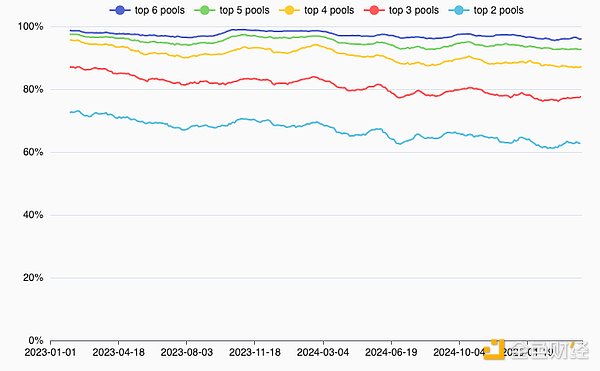

To measure the change in the degree of centralization of Bitcoin mining over time, the Mining Centralization Index shows the sum of the hashrate of the top 2, top 3, top 4, top 5, and top 6 mining pools. The higher the value, the higher the degree of centralization.

For example, in May 2017, the total hashrate of the top two mining pools was less than 30%, and the total hashrate of the top six mining pools was less than 65%. At that time, Bitcoin mining reached the most decentralized level in the history of mining pools. This is in stark contrast to the situation in December 2023, when the top two mining pools controlled over 55% of the hashrate, while the top six mining pools controlled 90% of the hashrate. Compared to the period from 2019 to 2022, when the top two mining pools controlled around 35% of the total network hashrate and the top six mining pools controlled around 75%, the current level of centralization in Bitcoin mining is much higher.

Measuring Centralization in the Proxy Pool Era

It has been observed that AntPool and multiple smaller mining pools emit very similar block templates. It is speculated that these smaller mining pools are proxy pools for AntPool, meaning that they relay AntPool's mining operations but change the coinbase tag and address to their own. This causes hashrate estimates based on coinbase tags and addresses to become inaccurate. AntPool's hashrate share is underestimated because blocks are attributed to smaller miners. However, AntPool and these smaller miners (collectively referred to as "AntPool & friends") can be counted as one large pool consisting of multiple pools. It can only be assumed which pools belong to the "AntPool & friends" group, and it is unclear when they joined the group. As of the time of writing, the following pools are considered part of the AntPool & friends group: AntPool, Poolin, CloverPool, Braiins, Ultimus Pool, Binance Pool, SecPool, SigmaPool, Rawpool, Luxor, Mining Squared. SpiderPool is not currently considered an AntPool proxy due to insufficient evidence.

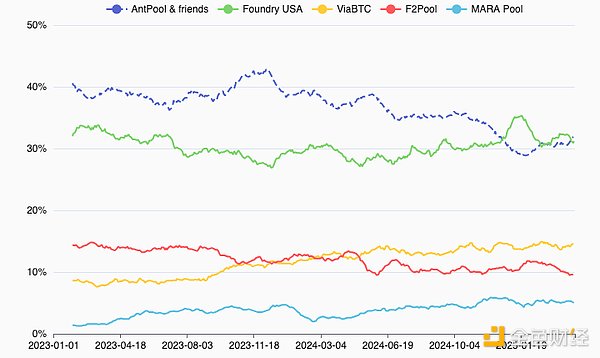

"AntPool and friends" hashrate share

This chart assumes that all mining pools considered "AntPool and friends" belong to the alliance starting in 2023. Since this assumption has not been confirmed, the assumed hashrate share for the whole year of 2023 is a slight overestimate. However, the data for 2024 should be more accurate, with "AntPool and friends" accounting for about 40% of the total network hashrate. While AntPool and friends had a higher hashrate share than Foundry for the past two years, Foundry appears to have grown 5% in early 2025 while AntPool and friends’ share fell 5%. This trend appears to be reversing as AntPool and friends are growing again.

Given that AntPool and friends’ hashrate share is 10% to 15% higher than assumed in the previous Mining Centralization Index chart, it is worth revisiting the index.

Mining Centralization Index Considering "AntPool and Friends"

The mining centralization index including AntPool and friends shows that in the past two years, "AntPool and friends" and Foundry have controlled 60% to 70% of the computing power. However, what's worse is that 96% to 99% of the blocks are mined by only six mining pools. These data show that Bitcoin mining is highly concentrated in a few mining pools that produce templates.

Bitcoin needs small pools like MARA Pool with 5% of the hashrate. Some large US mining companies may leave Foundry and start independent mining with their hashrate. In addition, moving hashrate to pools like Ocean (<1%) or DEMAND (0%), where miners can build their own mining templates, will help increase the decentralization of Bitcoin mining. More individuals and small miners mining at home will also help, however, the current hashrate of home mining is still insignificant compared to industrial hashrate.

Some facts:

How many different block template producers are there?

We have no way of knowing, but we know that six block template producers mine more than 95% of the blocks.

Are there any mining pools with 40% of the hashrate?

No, but it is estimated that AntPool and friends control about 40% of the network hashrate in 2023 and throughout the first half of 2024. Foundry has about 35% of the hashrate in early 2025. Currently, AntPool and Foundry each have over 30% of the hashrate.

How centralized is Bitcoin mining today?

According to the Mining Centralization Index, Bitcoin mining briefly reached its most decentralized state in May 2017. 2019-2022 was also a good period. Starting in 2023, Bitcoin mining has become increasingly centralized, especially driven by large mining pools such as Foundry and proxy mining pools such as AntPool.

YouQuan

YouQuan

YouQuan

YouQuan Jasper

Jasper Jasper

Jasper Clement

Clement Kikyo

Kikyo Hui Xin

Hui Xin Aaron

Aaron Jasper

Jasper Alex

Alex Joy

Joy