There are several gamification mechanisms here. Each user has a limited number of tweets they can tag (store), but they can increase their storage space by spending wafers points. Users must also spend wafers every 24 hours to keep their account “unlocked” in order to earn more wafers. DIN posts tasks around specific keywords or tags, and community members search for tweets and tag them in real time based on specific tags. The permissionless nature of xData means that any user around the world can participate in data collection and annotation to earn rewards/income, regardless of nationality. Currently, data collection is done off-chain, and tagged tweets are stored on BNB green field, a decentralized data layer on the BNB Chain. (2) Chipper Nodes: Data Verification The next question is naturally: how do we ensure the quality and integrity of the data submitted by users? After all, someone could run an AI bot to randomly tag tweets that do not match the specified tags in order to maximize their profits. Data labeling is not always straightforward either. Tweets often contain nicknames, slang, and cultural references — for example, Bitcoin is often referred to as “大饼” in Chinese tweets.

That’s where data verification comes in.

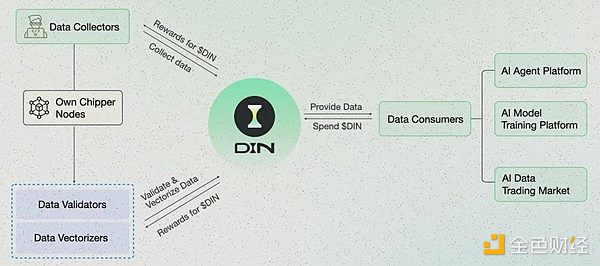

Chipper nodes are DIN’s AI-powered data verification and processing nodes, responsible for verifying and vectorizing data while also enabling users to earn tokens (xDIN and DIN).

Behind the scenes, each user-operated node actually runs a small AI model locally to verify that the content of the tweet matches the attached tags, which is then stored in a decentralized data layer. Users can operate these nodes on a standard PC, with no expensive hardware setup required.

As the amount of verified data processed grows, the AI models used by validators continuously improve, making the network smarter and more accurate over time.

Currently, DIN handles all data verification in-house, but the goal is to decentralize the verification process. Active testing of the nodes is currently underway. Users can run the node software on their local devices to test the network, and DIN is preparing to launch its mainnet and tokens in the coming weeks, with bug bounties already in place.

(3)Computing Nodes

Although computing nodes are not yet in use, they are DIN’s privacy plan for securely storing data in the future. Here is how computing nodes work:

Vector conversion: The computing node converts verified data into vectors.

Privacy processing: Vectors are processed through ZK (zero-knowledge) processors to ensure privacy.

Data finality: Finalized datasets and vectors are stored in IPFS for third-party access.

A new L2 on the BNB chain?

No official announcement has been made yet, but during our research, we found a DIN token on the BNB chain testnet. This hints at future blockchain developments - perhaps a sidechain or L2 solution on the BNB chain.

DINIntroduction:

DIN feels like a new player, but the origins of the project can be traced back to the end of 2021. Originally launched under the name "Web3Go", it is an on-chain data analysis platform in the Polkadot ecosystem that has received funding from the Web3 Foundation and has worked with clients such as Moonbeam and Oak Network.

In 2022, the team expanded its reach to the BNB chain ecosystem, joined Binance Labs’ MVB incubator, and received the investment needed to develop a “multi-chain open source data analytics platform.”

By July 2023, they saw the signs: generative AI was booming, and the need for a strong data infrastructure was more pressing than ever. The team then turned to building a comprehensive “AI Data Intelligence Layer” to align their mission with the data needs of AI innovation. This evolution culminated in May 2024, when Web3Go officially changed its name to DIN, signaling a bold focus on data and heralding that the data layer will be key to the next wave of AI advancements.

4.DIN’s traction -Good momentum so far

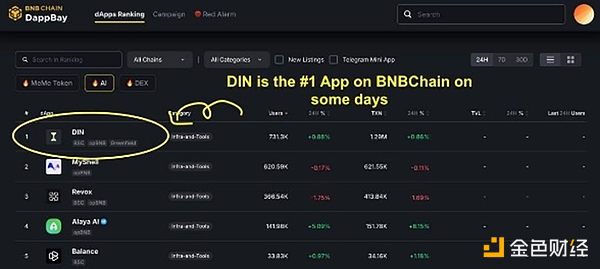

opBNB has about 700,000 daily users. According to DappBay data, DIN performed steadily in October, with an average daily number of users exceeding 700,000 and a daily transaction volume of more than 1.2 million. Most of the transactions are because xData users must make an on-chain transaction every 24 hours to activate their xData app to earn points.

DIN has consistently been one of the top 10dApps on the BNB chain, and at many times, it has been the number one application by users on the network.While I don’t follow the BNB chain ecosystem as closely as I do Solana and Base, this is no small achievement, especially considering the timing of the BNB chain’s launch and the strong support of Binance.

To better understand, I analyzed some of the other top-ranked applications on the BNB chain to see what exactly shapes user stickiness:

Vooi (DeFi) is a perp DEX aggregator.

Particle Network (Infrastructure) is a full-chain protocol in the testnet.

Revox (Infrastructure) is a modular on-chain network with a popular content app - ReadON.

SERAPH (Game) is an RPG game similar to Souls.

MyShell is a code-free AI app store ecosystem.

According to the team, DIN has collected and annotated more than 100 million tweets so far, with a user base of more than 30 million on opBNB and Mantle.

It’s important to note here that DIN is able to leverage its large user base to quickly generate a large, real-time dataset of relevant tweets. This process is completely independent of the X API.

While xData’s current focus is Twitter, the team plans to expand the data collection and annotation platform to other data sources such as Reddit, Facebook, Instagram, and any platform with user data that has high-value information. To me, this is where the real gold is.

Reiki:

Reiki is another product from DIN that ties into the ongoing AI agent meta. In fact, DIN may already be ahead of the curve, given the potential consumer interest in AI agents we’ve seen with Truth Terminal and GOAT in recent weeks.

In January 2024, DIN launched the Reiki platform, which allows users to create AI agents (primarily chatbots) without coding experience. Users can also integrate their own knowledge base to build engaging, personalized chatbots reminiscent of MyShell.

The platform quickly gained traction upon launch, becoming the number one product on Product Hunt.

Reiki also offers creators a variety of ways to monetize their bots, participate in bounty programs, and even turn their bots into NFTs—adding an interesting layer of ownership to the gaming experience. Notably, BNB Chain’s Discord knowledge support bot is powered by Reiki.

While the platform is largely deprecated at this point, the DIN team has not ruled out bringing it back once they release their tokens. If reactivated, Reiki could provide additional utility to the tokens and provide a way for AI agent creators to leverage the data collected by xData.

5. Token Design: xDIN, DIN, and Node Sales

In August-September 2024, DIN held a Chipper node sale and raised $2.5 million from it. These chipper nodes will allow users to run verification software on their local devices, using models to ensure that data is accurately labeled. The sale was very successful, and all 25,112 secondary nodes (priced at $99 each) were sold out.

Supply Side:

Before the TGE, xData users can redeem their wafers points for xDIN - pre-airdrop tokens. However, there will be a 5-30% redemption fee, which will be distributed to Chipper node owners. This redemption mechanism is not yet live, but is expected to start as soon as the node "pre-mine" goes live later this month.

During the TGE, users will receive DIN (tradable tokens) airdrops based on their xDIN holdings, fully released, with no complex lock-up mechanism.

After the TGE, 25% of the total DIN token supply will be reserved for Chipper node rewards. Half of this quota will be released in the first year, and the rest will be released in half each year.

It is important to note that the unlocking speed of this sale is relatively fast compared to other projects that have conducted node sales, where node rewards for other projects are gradually distributed over 3-4 years.

Demand Side:

Validator nodes may need to stake DIN tokens to participate in the network. In return, they will be rewarded for verifying the data, but they will face slashing penalties if their output is inaccurate.

On the other end, data consumers will have to use DIN tokens to access network data. As most Web2 businesses are still hesitant to use cryptocurrencies, the company will need to facilitate these transactions to bridge the gap between traditional businesses and the decentralized web.

We are still waiting for the detailed DIN token economics to be announced, which should be released closer to the TGE.

Team & Funding:

DIN's core team brings together talents from Columbia University, University College London, and University of Stuttgart, with a decade of expertise in AI and blockchain.

DIN's founder Hao Ding holds a Master's degree in Information Technology from the University of Stuttgart. Before diving into cryptocurrency, he served as the Director of R&D at the Suzhou Institute of Artificial Intelligence in China, and later served as Vice President of the identity oracle network Litentry, and later founded Web3Go.

I was very happy to meet Hao in person and we had a good chat about the future of AI. If you ask me what his belief is? It is: data will be at the core of everything. The DIN team currently has 16 members, most of whom are engineers.

DIN participated in Binance Labs' MVB 5 accelerator program and raised $4 million in a seed round in July 2023, led by Binance Labs, HashKey, NGC, and Shima Capital. In August 2024, DIN received another $4 million in financing, with participation from Manta Network, Moonbeam Network, Ankr, and Maxx Capital, bringing its total financing to $8 million.

6. Our ideas

Idea 1: Creating a decentralized Scale AI is fun

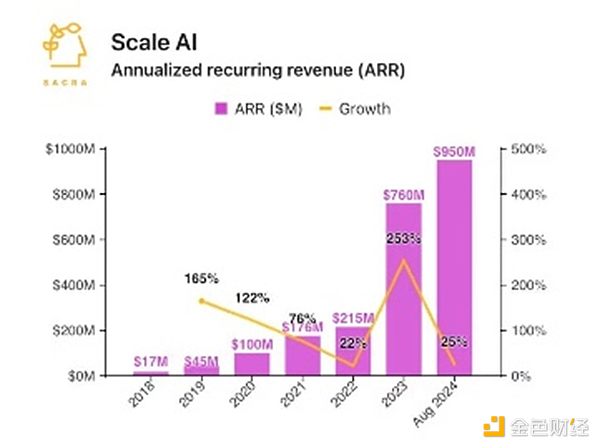

Data collection and annotation is a big business.

Scale AI is the most well-known player in this field, with annual recurring revenue of about $1 billion. This is driven by a lot of demand from basic AI model companies such as OpenAI, Anthropic, and Cohere, which are Scale's main customers. As of May 2024, the company is valued at up to $14 billion.

Let's take a closer look at Scale AI's business model.

Scale’s data annotation tasks rely on a large, distributed workforce, including manually tagging videos, categorizing photos, and transcribing audio.

The company employs about 240,000 workers in multiple countries and actively recruits in areas with high unemployment and low cost of living. Kenya, for example, has become an important recruiting hub in Africa, with a “boot camp” in Nairobi for in-person training and targeted paid advertising to attract workers.

The annotation process typically has two layers: the first is annotators, who annotate the data from scratch; the second is quality controllers, who check the work, add missing annotations, and correct errors. This is labor-intensive, but effective because labor costs are low and clients are willing to pay large sums of money.

Now, imagine scaling this model through a decentralized network. A global network of permissionless workers incentivized by tokens can allow anyone to participate, while a distributed network of verifiers ensures the accuracy and quality of the data. Decentralization can open up new possibilities for scaling data annotation, turning it into a truly global, democratized process.

Idea 2: Large user base = good things

DIN’s main advantage today is its large and sticky community, which has been built through more than two years of focused community building efforts. With such a network, DIN can quickly mobilize data collection based on specific criteria. However, the challenge is to determine where the real data demand is, guide users to collect and annotate the right datasets, and build sustainable revenue streams to support long-term growth.

Idea 3: Incentives are a double-edged sword

Right now, much of the user stickiness is driven by the anticipation of token rewards after the token launch. But if the team cannot generate enough demand for the token after the token launch, token usage may decline as the initial interest fades. Creating this demand requires speculative interest and building a market of data consumers who are eager to buy these datasets.

Idea 4: Data annotation is a competitive field

DIN is not the only crypto team vying for this market share - projects like Sapiens, Grass, and Masa are also in the race. But the pie is huge. Take GRASS, for example. The company is currently valued at $2.5 billion, highlighting how huge the opportunity is in the industry.

One way DIN can differentiate and stand out from its competitors may be to train and deploy proprietary AI models for data verification, reducing reliance on human labor. This automation-first approach can streamline operations, enhance scalability, and give DIN an advantage over competitors that still rely heavily on manual operations.

7. Conclusion

Data networks are one of the most exciting fronts at the intersection of AI and crypto. Unlike traditional centralized models, Crypto-driven data networks leverage decentralized participation and incentives to build high-quality datasets at scale.

DIN is positioning itself as a pioneer in this field, and it will be fascinating to witness the development of this project. This is an opportunity DIN needs to seize. I often tell people: Data networks are one of the smartest areas to build right now.

Crypto is reshaping the way data is collected, verified, and monetized, laying the foundation for a new decentralized data economy.

Miyuki

Miyuki

Miyuki

Miyuki Alex

Alex Brian

Brian Joy

Joy Joy

Joy Weiliang

Weiliang Brian

Brian Brian

Brian Weiliang

Weiliang Miyuki

Miyuki