Author: Flip Research, encryption researcher; Compiled by: 0xjs@金财经

Recently, my timeline has been filled with comments that are optimistic about SOL, mixed with memecoin excuses. I'm starting to believe that the memecoin super cycle is real and Solana will replace Ethereum as the major L1.

But then I started digging into the data, and the results were alarming to say the least... In this article I'll describe what I found, and why Solana may be a house of cards.

First let’s take a look at what’s good for Solana, as @alphawifhat put it succinctly:

Compared with ETH plus L2s Regarding the indicators, I have four different views here

1.The number of user transactions is too high p>

2. Fees increased accordingly

3. High DEX trading volume

4. Stablecoin trading volume accounted for a significantly high proportion

Number of users Comparison

The following is a comparison between the ETH mainnet and SOL (only the mainnet is compared, because most of the fees after Dencun come from the mainnet, source: Token Terminal):

Number of ETH users and transactions

Number of Solana users and transactions

On paper, Solona’s numbers look good, with over 1.3 million daily active users (DAU) compared to 376,300 for ETH. However, when we added the number of trades into the mix, I noticed something strange.

For example, on Friday, July 26, the number of ETH transactions was 1.1 million, while the DAU was 3.763 million, on average per The daily transaction volume of one user is approximately 2.92 transactions. However, the number of transactions of SOL is 282.2 million, while the DAU is 1.3 million, The average transaction volume per user per day is as high as 217 transactions .

I think this may be due to lower fees, the ability to trade more, resize positions more frequently, increased arbitrage bot activity, etc. So I compared it to another popular chain, Arbitrum. However, Arbitrum only had 4.46 transactions/user on the same day.

Look at other links and get similar results:

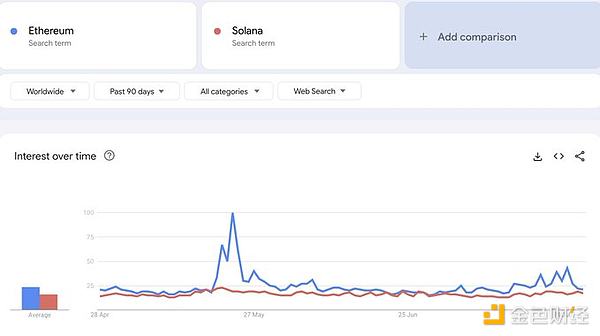

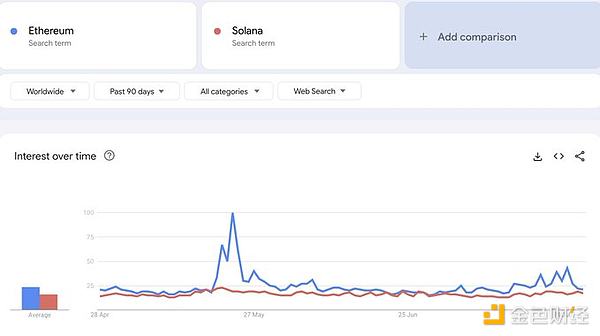

< p> Since the number of Solana users is higher than that of ETH, I checked based on Google Trends. Google Trends should be imperceptible to the value of each user.

< /p>

< /p>

ETH is either on par with or ahead of SOL. Considering the DAU difference, coupled with all the hype surrounding the SOL memecoin trend, this is not what I expected.

< /p>

< /p>

So what happened?

DEX trading volume analysis

To understand transaction counting Differences, looking at Raydium's LP will help. Even at first glance, it is obvious that there are some problems:

At first I thought this Just fake trades with low liquidity on honeypot LPs to lure weird memecoin traders, but looking at the chart it's much worse:

Every low-liquidity pool has left in the past 24 hours s project. Take MBGA as an example. In the past 24 hours, 46,000 transactions occurred on Raydium, with a transaction volume of $10.8 million, 2,845 unique wallets buying and selling, and generating more than $28,000 in fees. (Note that a widely recognized LP of similar size, MEW, only generated 11.2K transactions)

From involved Looking at the wallets, the vast majority appear to be bots on the same network, with tens of thousands of transactions. They independently generate fake transaction volumes, the SOL amount and the number of transactions are randomized until the project is completed and then move on to the next project.

In the past 24 hours, there have been more than 50 running projects on Raydium Standard LP with a trading volume of more than 2.5 million US dollars, generating a total of more than 200 million US dollars in trading volume and more than 500,000 USD fee. Orca and Meteora appear to have far fewer offtakes, while I struggled to find any offbeat projects on Uniswap (ETH) with any meaningful trading volume.

Obviously, there are serious problems with the padding project on Solana, which have multiple impacts:

Considering the unusually high transaction to user ratio and the number of fake/fraudulent transactions on the chain, it appears that the vast majority of transactions are non-human. The highest daily transaction to user ratio on major ETH L2 is 15.0x on Blast (fees are equally low and users are farming Blast S2). As a rough comparison, if we assume that the real SOL transaction-to-user ratio is similar to Blast, that means that over 93% of transactions (and fees) on Solana ) are all non-human.

The only reason these scams exist is because they are profitable. Therefore, users lose an amount at least equal to the fees incurred + transaction costs, which can amount to millions of dollars per day.

Once it becomes unprofitable to deploy these scams (i.e. when actual users get tired of losing money), you would expect most transaction volume and fee revenue to decline.

Therefore, it appears that users, human fees, and DEX volume have all been grossly overstated.

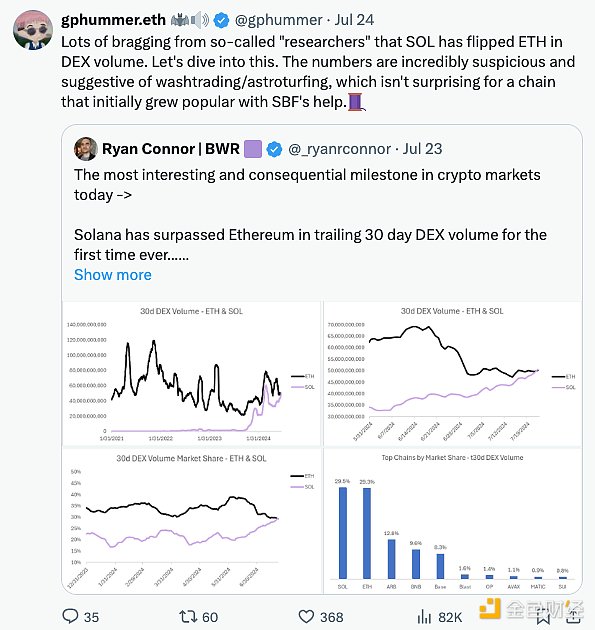

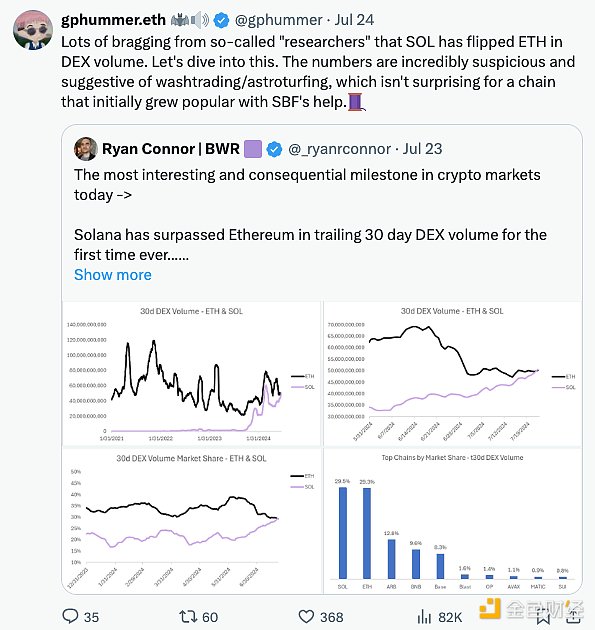

I'm not the only one who has come to these conclusions, @gphummer recently posted something similar:

MEV on Solana

MEV on Solana is in a unique position. Unlike Ethereum, it does not have a built-in mempool; instead, projects like Jito created (now deprecated) off-protocol infrastructure to emulate mempool functionality, allowing MEV opportunities such as front-running, mezzanine attacks, etc. Helius Labs has compiled an in-depth article introducing MEV in detail:

https://www.helius.dev/blog/solana-mev-an-introduction

The problem with Solana is that the vast majority of the coins traded are memecoins, which are extremely volatile and illiquid, and traders often set trade slippage to > ;10% to ensure successful execution of the transaction. This provides a lucrative attack surface for MEV to gain value:

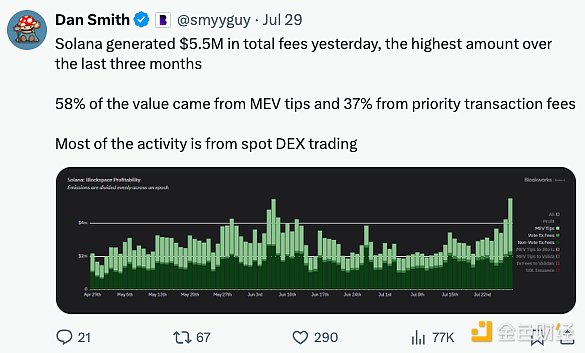

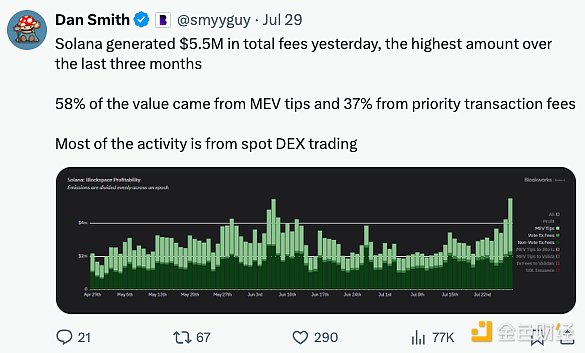

If we look at the profitability of the block space, it is clear that most of the value now comes from MEV:

Although in the strictest sense, this is "real ” value, but MEV will only be implemented if it is profitable, i.e. as long as retail investors continue to come in and play (and net lose) MEME. Once MEME starts to cool down, MEV fee income will also collapse.

I see many SOL papers discussing how infrastructure construction will eventually rotate, such as JUP, JTO, etc. This is very possible, but it's worth noting that they are less volatile, more liquid and simply don't offer the same MEV opportunities.

Experienced players will be incentivized to build the best infrastructure to take advantage of this situation. During the course of my research, several sources mentioned rumors of these players investing in controlling the mempool space and then selling access to third parties. But I can't confirm this information.

However, There are some clear perverse motives - by directing as much memecoin activity as possible to SOL

span>, which allows savvy individuals to continue to profit from insider trading in MEV, memecoin, and rising SOL prices.

Stablecoin

Speaking of stablecoin transaction volume + TVL, there is another strange phenomenon. Stablecoin trading volume is significantly higher than ETH, but when we look at DefiLlama stablecoin data shows that ETH has a stable TVL of $80 billion, while SOL only has $3.2 billion.

I think stablecoin (and more broadly) TVL is a much harder metric to manipulate than volume/fees on low-fee platforms, which only shows how much real money is in the game.

Stablecoin trading volume dynamics highlight this, @WazzCrypto noted Sudden drop in stablecoin trading volume after CFTC announced investigation into Jump :

Retail investor value extraction

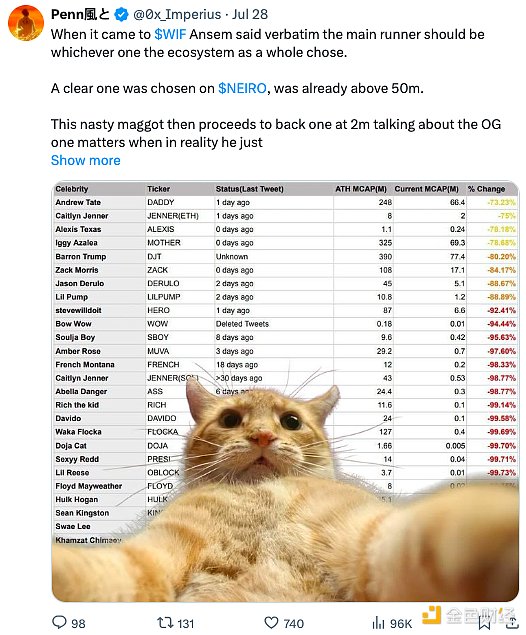

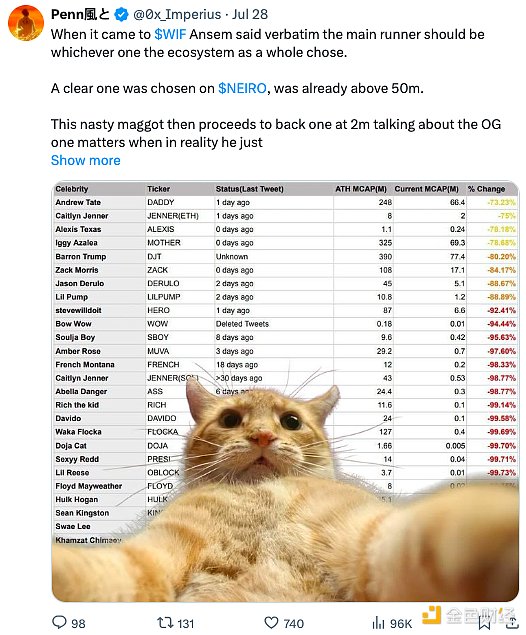

Except for running away and MEV, the prospects for retail investors are still bleak. Celebrities chose Solana as their preferred public chain, but the results were not optimistic:

Andrew Tate’s DADDY was the best-performing celebrity token, with a return of -73%. The situation at the other end is not much better:

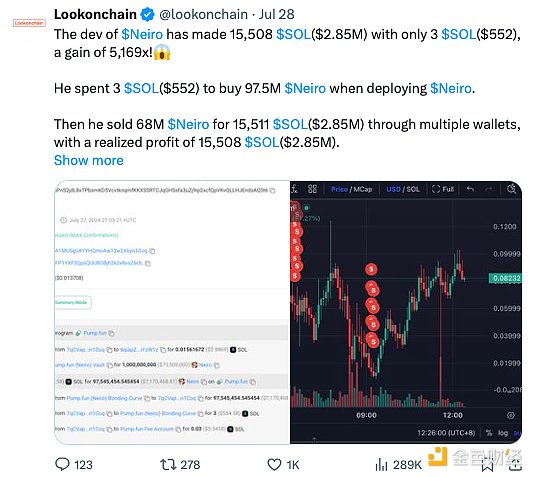

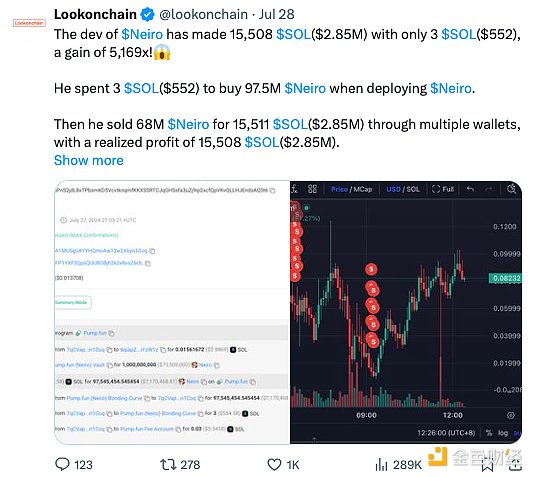

Quick search on X is OK FoundEvidence of rampant insider trading and developer dumping on buyers:

But Flip, I ’s timeline is filled with people making millions trading memes on Solana. What does this have to do with what you're saying?

I simply don’t believe KOL posts on X are representative of the broader user base. In the current frenzy, it would be easy for them to take a position, market their token, profit from their followers, and repeat the process. There is definitely survivorship bias here - the voices of the winners are far louder than those of the losers, creating a distorted view of reality.

To put it in perspective, retail investors seem to be losing millions of dollars every day from scammers, developers, insiders, MEVs, KOLs, and that doesn’t even take into account the amount of money they trade on Solana. Most of it is just memes with no real support. It’s hard to deny that most memes will eventually trend like boden.

Other Notes

The market changes rapidly, and when sentiment changes, factors that buyers once were blind to will become clear:

Poor chain stability, frequent interruptions

High transaction failure rate

Unable Reading browsers

The development threshold is high, and Rust is far less user-friendly than Solidity

Compared with EVM , poor interoperability. I believe it is much healthier to have multiple interoperable chains competing for our attention than to be tied to a single (rather centralized) chain.

From both a regulatory perspective and a demand perspective, the likelihood of an ETF is low. This article highlights why institutional demand will be low for Solana in its current state. @malekanoms also highlighted some points that I think are relevant from a traditional financial perspective (along with @0xmert):

Emissions up to 67,000 SOL/day ($12.4 million)

FTX Estate There are still 41 million SOL ($7.6 billion) locked. Of these, 7.5 million (USD 1.4 billion) will be unlocked in March 2025, and an additional 609,000 SOL (USD 113 million) will be unlocked every month until 2028. Most coins appear to be available for purchase at around $64 each

Conclusion

As always, People selling picks and shovels profited from the Solana memecoin craze, while speculators got wiped out, often without their knowledge.

In my opinion, the commonly quoted SOL indicator is grossly exaggerated. Additionally, the vast majority of organic users are rapidly losing on-chain funds to bad actors. We are currently in a feverish phase and retail inflows are still outpacing outflows from these established players, which is bullish. Many indicators collapse quickly once users become exhausted from continued losses.

As mentioned above, SOL also faces some fundamental headwinds that will come to the fore once market sentiment shifts. Any price increase will add to inflationary pressures/unlocking.

Ultimately, I think SOL is overvalued from a fundamental perspective, and while existing sentiment + momentum may drive prices higher in the short term, the long-term outlook is more uncertain.

Original link: https://x.com/Flip_Research/article/1818216739680710776/

Weiliang

Weiliang

< /p>

< /p> < /p>

< /p>