Author: Nick Hotz, analyst at Arca; Sami Kassab, former analyst at Messari and current partner at OSS Capital; Translation :Golden Finance xiaozou

Last weekend, Bittensor became the target of public criticism. Some well-known investors thought it was a useless project, or their tokens were TAO. Only labeled as a meme coin. Arca has been a supporter of Bittensor and an investor in TAO since mid-2023, and we hope to dispel some misinformation while expressing our optimism for the future of the protocol. We invited former Messari analyst and current OSS Capital partner Sami Kassab to complete this article.

In this article, our goal is to deal with the criticism of Bittensor head-on. It is helpful to have some crypto and AI background to understand this article. of.

In short, Bittensor is a launchpad (release platform) for artificial intelligence applications and the underlying infrastructure they require, similar to Ethereum It is the basic platform for smart contracts. Within the Bittensor ecosystem, various specialized networks (subnetworks) are dedicated to specific AI use cases, such as financial forecasting, smart search capabilities, and creative image generation. Other infrastructure-focused subnets extend the application-driven subnet, providing resources and services such as model pre-training, fine-tuning, data collection, and data storage.

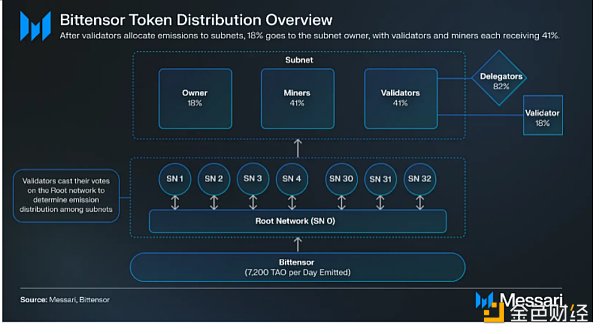

Each subnet is overseen by an owner who is responsible for designing a unique incentive system tailored to the subnet's goals. Within these subnets, there is a dedicated set of validators and miners. Subnet validators all run the same validation software (i.e. incentive mechanism) designed by the subnet owner to direct the focus of miners (model operators and resource providers) to target tasks. Additionally, subnet validators serve as dedicated gateways for external access to subnet services and resources, as only they have the ability to challenge miners.

We see that Bittensor's subnets are divided into two categories: public subnets and verification service subnets.

1. Public subnet accelerates the development of open sourceAI

Open source initiatives have long faced challenges because of a lack of financial incentives to share work freely. This is especially true in the field of open source AI, where reliance on voluntary contributions has hindered the field's growth. Bittensor’s public subnet is a solution that advances the field by allowing open source AI researchers and engineers to monetize their work.

Take the Nous Research subnet as an example. This subnet rewards fine-tuned models closest to GPT-4 performance through a competitive leaderboard framework. In order to compete to win, miners must upload their model to HuggingFace, ensuring it is open source for validators to benchmark. This prevents validators from charging for exclusive access.

This incentive model actively incentivizes contributors to fine-tune open source large language models (LLMs). As a result, a large number of fine-tuned models are generated and shared, becoming a public good that benefits the entire community and promotes the development of open source artificial intelligence.

Other subnets that follow this pattern are:

· MyShell's Subnet 3: Incentivizing the advancement of open source text-to-speech technology

· RaoFoundation’s Subnet 9: Incentivizing the advancement of open source pre-trained models

· Omega Labs' Subnet 24: Incentivizing the Collection of Open Source Multichannel Datasets

While these subnets may not be Validators provide direct revenue generation opportunities, but their contributions enable Bittensor’s application-driven subnet to integrate and monetize their outputs. For example, the Vision subnet plans to integrate the head model of the Nous subnet into its decentralized inference network. This integration will allow validators on the Vision subnet to monetize these models, for example through the chatbot interface provided by Corcel.

In the future, subnets focused on fine-tuning and pre-training may evolve from public goods models. For example, by using zkML, the subnet could allow validators to evaluate the performance of miner models without revealing their ownership weights. This may lead to new monetization strategies and protect intellectual property privacy.

2, Verification service subnet monetization miner"Intelligence"

For those familiar with financial terminology, the public goods subnet is the "backend" and the verification services subnet is the "frontend." The Verification Services subnet uses existing AI models and infrastructure to create monetizable B2B or B2C products or services.

Subnet 8, Title Transaction Network (PTN), belongs to the verification service subnet. This subnet incentivizes miners to offer profitable trading strategies in the digital assets, forex, and stocks sectors. Miners whose transaction proposals are successful will be allocated more TAO, while miners whose transaction proposal success rate decreases by more than 10% will be logged out. Validators can take these suggested “signals” and trade them themselves, or package them up and sell them to other traders or funds. Crucially, validators like Timeless, who understand the miners’ profile, can create a product where one plus one is greater than two – aggregating the best miner predictions to create high-confidence trading recommendations.

Corcel is another example of validators building monetizable products on a subnet. Subnet 18 - Cortex.t - leverages the cost of paid subscriptions from Anthropic, OpenAI and Google for arbitrage and lets miners respond to these centralized models. Corcel offers these models for free but gets value from low latency and access to miners on Subnet 18. As its user base grows, Corcel plans to charge for API access, cutting into the price points of centralized providers while offering the same product.

The Authentication Service Subnet model provides compelling incentives for entities to either become a validator on a specific subnet or to gain access to a validator. API payment. This way, companies can use miners’ intelligence to create and monetize products and services. Other subnets adopting this business model are:

· Manifold Labs’ Subnet 4: Ability to create products using decentralized verifiable inference networks

p>

· Kaito AI's Subnet 5: Provides a foundation for building applications with a decentralized search engine as the core, enhancing data retrieval and analysis capabilities

· Philanthrope’s Subnet 21: Powering applications and cloud storage solutions, leveraging decentralized networks for decentralized data storage

3. Dealing with criticism of Bittensor

Recently, Bittensor has faced criticism regarding its operational efficiency and reward system, which some believe hinders miners from innovating and incentivizes miners to react similarly.

In order to solve the efficiency problem, it is very important to break the myth that all tasks on the subnet are sent to each miner. In fact, only tasks aimed at evaluating miners are distributed across the subnet. User-initiated tasks are selectively sent to a miner or a group of miners based on the validator’s routing strategy. This allows validators to gain insight into the miner ecosystem and create complex routing algorithms for specific applications. Furthermore, tasks are not performed on the blockchain, but on an API layer that is completely independent of the blockchain.

Criticisms of reward systems carry some weight. Incentive mechanisms set by subnet owners directly guide miners’ optimization efforts. This means that the effectiveness of the incentive design constrains the collective intelligence of the subnetwork. Currently, most subnets employ centralized models to judge miner output, which may limit the ability to surpass these models in terms of quality or performance. This approach was sufficient while the open source model was still evolving, but once the open source model reaches parity, an innovative benchmarking strategy will become a necessary element.

This challenge injects competition into the Bittensor ecosystem, incentivizing subnets to surpass each other based on the effectiveness of their verification mechanisms. This has led to the development of better incentive mechanisms and verification frameworks. One example is the proposal by some teams to incorporate human evaluation into the verification process, which can significantly strengthen the output.

Criticisms of the reward system suggest that such a reward system encourages miners to react similarly, when in reality miners are pushed to optimize their subnets by Specific goals to outdo each other. This not only promotes diversity in output but also drives innovation. The Yuma consensus mechanism incentivizes validators to rank miners similarly, ensuring consistent evaluation of outputs.

Amid these criticisms, subnet 1 for text prompts created by the RAO Foundation came under scrutiny for its motivational design. However, these criticisms stem from a lack of understanding of the subnet's goals. Subnet 1 is more than just a chatbot, its real purpose is to reward miners who efficiently retrieve information within its model. Validators use these retrieved files to construct inference answers, allowing a measure of which miner can retrieve the correct information fastest.

Note that subnet 1 only represents one team's approach to solving a specific problem. Criticizing the entire network based on the shortcomings of subnet 1 is like evaluating the Ethereum network based on a single application.

p>

Another concern is that the current system relies heavily on the altruism of validators to function properly. Validators determine the amount of token allocation each subnet receives, but there are no clear incentives for validators to choose subnets that benefit Bittensor’s long-term productivity. Under the current design model, validators can easily adopt a pay-to-play model or exploit nepotism. Contributors from the Opentensor Foundation recently proposed BIT001: Dynamic TAO Solution for this problem, proposing to add a market mechanism to determine the amount of token allocation to a subnet in which all TAO stakers will compete.

Deep integration of4, TAOnative tokens and Bittensor systems< /h2>

Finally, there are those who believe that Bittensor’s TAO native token is a useless meme coin farce that only gains value from the narrative surrounding crypto and AI, and its true value is zero. While we would like Bittensor’s meme value to be comparable to dogwifhat’s meme value, we have to realize that the utility of TAO tokens far exceeds that of meme coins.

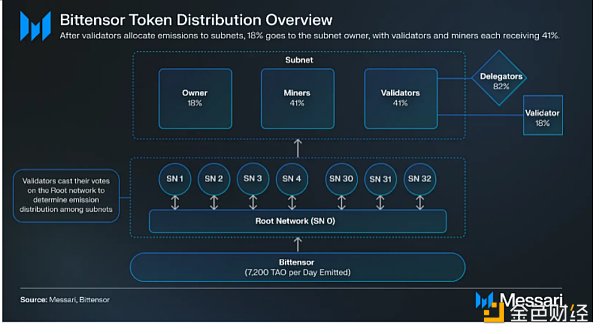

To sum up, TAO is sent by the protocol to the three main stakeholders - miners, subnet owners and verifiers:

· Miners complete specific machine learning tasks, such as inference or fine-tuning, or provide infrastructure such as file storage or computation.

· Subnet owners design the reward model to promote maximum value creation.

· Verifiers use a reward model designed by the subnet owner to determine miner task completion.

p>

In addition, the four main mechanisms for TAO to obtain value include:

· Pledge TAO Validators can distribute token allocations directly to their subnet or another subnet based on the amount of TAO pledged.

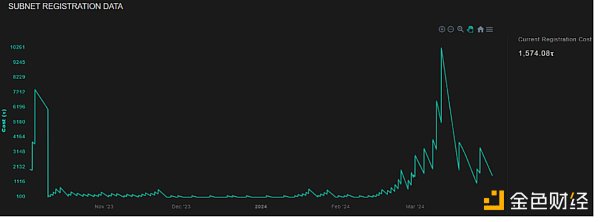

· The subnet owner must lock the TAO to register the subnet.

· Miners and validators must burn TAO to register on the subnet.

· Verifiers must stake TAO to access miners and sell the products and services they produce.

Individual subnets rely on native tokens issued to network contributors to bootstrap supply and future network value, like most decentralized physical infrastructure networks (DePIN) same. For example, file storage networks like Filecoin, Arweave, or Subnet 21-FileTAO require paying miners to store and retrieve information in order for demand parties to see value in the network.

Importantly, TAO tokens also play a unique role in the Bittensor network by distributing token allocations to subnets. In the current network, validators are tasked with determining which subnets are worthy of distributing TAO. The network implements a delegated staking system to select validators, with delegators staking their TAO to validators who vote on their behalf. While validators are relied upon to make decisions in the best interest of the network, the very responsibility of distributing tokens is potentially valuable in its own right. If top validators no longer believe in the future of the network, engaging in nepotism and self-dealing may allow them to profit from their role.

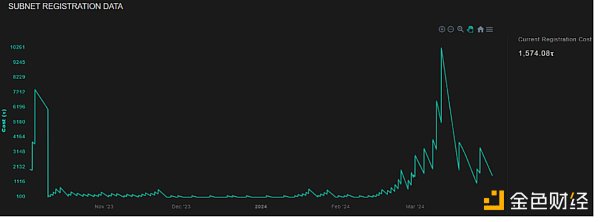

When a new subnet owner registers a subnet, once the subnet limit is reached (currently 32), the system will automatically cancel the one with the lowest token allocation subnet. The point is, this will weed out low-quality projects, allowing new potentially high-quality projects to try to attract token distribution. The system uses an algorithm to determine how many TAOs a subnet owner needs to lock by reviewing previous subnet registrations. This mechanism is designed to balance the opportunities for existing subnet owners to build on Bittensor. The debate surrounding this balance has intensified recently as the registration lock-in cost reached 10,000 TAO, which represents a huge demand for building on the network.

p>

Like many other DePIN projects, miners and validators participate in a Burn Mint Equilibrium (BME) system that adds an anti-inflationary effect to the token. The coin's issuance schedule is similar to Bitcoin, with a cap of 21 million tokens and halving every four years. However, BME temporarily removed tokens from the circulating supply, creating a consistent source of demand for TAO, thereby delaying future allocation halvings. On average, this effect reduces the distribution of new tokens by 11%, delaying the usual 4-year halving schedule by 5 months. As the subnet and reward mechanisms mature, competition among miners will increase, resulting in lower profit margins and a greater proportion of token issuance being burned.

While all of these in-system utility mechanisms are great, the ability of validators to monetize access to miners is the most critical mechanism as it will drive the economics of the token transfer learning systems to real-world value areas. Miners have a financial incentive to respond to validators because it increases their “trust” score. Trust score is a key determinant of how much TAO allocation a miner receives. Therefore, validators act as the only access point for miners.

Different validators achieve different levels of utility by accessing miners. In the PTN example mentioned earlier, validators can view miners’ transaction proposals. A validator can simply forward transactions from the best-performing miner to its own clients for a subscription fee. However, another miner can aggregate miner responses to add credibility to its own recommendations, use the responses to create a diversified portfolio or even conduct analysis on the miner. For example, a miner has a clear advantage when trading Euros, but no advantage when trading Australian dollars. Adding this additional layer of value to the transaction path will allow validators to monetize at a higher level. Therefore, these two validators have very different individual utility in owning and staking TAO.

Importantly, because validators can differentiate through their routing algorithms, the market is not commoditized and over time, profits will tends to zero. This is a kind of monopolistic competition with differentiated skills, brands, and technologies, and each team creates new products based on the commoditized output of miners. On PTN, the value (marginal cost) of each TAO purchased and staked by a validator is equal to the incremental value (marginal revenue) they can obtain by selling their output.

Obviously, Bittensor is still in a very early stage, and most subnets are in the pre-profit or even pre-revenue stage. However, as a general rule, the minimum fair value of a TAO should be equal to the total revenue a validator can earn from forwarding miner outputs plus future discounted revenue from monetized outputs from potential future subnets. We have seen that the rise in TAO prices over the past six months does not reflect memetic speculation but rather rising expectations of validators’ potential future earnings.

Compared to earlier crypto flywheels such as the first iteration of Helium HNT or Axie Infinity AXS, the TAO token is inherently reflexive. Validators, and ultimately token holders, are responsible for determining the distribution of tokens across subnets. As TAO's value rises, more funding value allocations can be directed to different projects, and the proverbial "threshold rate" for receiving token allocations will decrease. Like any market mechanism, this will ultimately create waste and inefficiency, with low-quality projects absorbing a greater proportion of the token allocation, which will ultimately lead to TAO being repriced lower as growth prospects weaken.

As the belt tightens, validators have to re-examine their token allocation decisions and increase the threshold rate for providing token allocations to weed out bad actors and Underperforming subnets. As the price hits lows, only the highest quality subnets that provide the greatest growth value and potential value to Bittensor will receive token allocations, helping to stabilize the system, similar to Bitcoin's difficulty adjustment. More efficient resource allocation will lay the foundation for future growth of the network.

5, Optimism towards Bittensor

We already saw the enthusiasm of the Bittensor community during our first visit to the project's Discord, where community members had in-depth discussions on the technical concepts of machine learning and how to participate in and promote the development of Bittensor, as opposed to many other cryptos. The main debate among projects is just the price of tokens. Bittensor began as a grassroots initiative driven by independent contributors and has grown into a vibrant ecosystem attracting high-profile developers such as Nous, Kaito, MyShell, Wombo and others, all of whom are attracted by the tremendous business value and cost savings Bittensor provides. attracted.

We are both firm believers in Bitcoin, and were initially unsure whether anything else of value would emerge from the crypto space. However, we have seen a strong immune defense displayed by the Bitcoin community, which rejects the Ethereum “scam” while also believing that some useful projects are being built on Ethereum. Later, we saw the same vitriol (“worthless”) with Solana, as Ethereum believers noticed that while DePIN projects were migrating en masse to the only chain capable of supporting processing them, Solana was encroaching their territory.

This weekend reminded us of the difficulties Ethereum and later Solana faced in gaining support from mainstream crypto users, and the criticism they suffered. While some people see a redundant ChatGPT clone attached to a worthless meme coin, what we see is a vibrant community of extremely smart people passionate about using new incentives to Accelerate the development of open source artificial intelligence.

We are still in the early stages of Bittensor, but all signs point to it being on the right track. There's a big difference between a good project struggling under the weight of its own success and a useless one. Ultimately, trusting Bittensor is placing a bet on the power of market dynamics; it is a belief that, given the right economic incentives, the brightest minds will come together to overcome any challenge.

JinseFinance

JinseFinance