Source: Blockchain Knight

MetaMask’s monthly active users currently exceed 30 million, a nearly 2-fold increase from 19 million in September 2023.

This uptick could be a huge positive indicator of growing activity around non-custodial activities, including DeFi (decentralized finance) and NFT (non-fungible token) minting .

A Crypto asset commentator on .

It is worth noting that the rise in MetaMask user numbers coincides with the spot price recovery of BTC and Ethereum prices from the end of the third quarter of 2023 to the fourth quarter of 2023.

p>

Ethereum is the second largest Crypto asset by market capitalization and is currently trading at approximately $3,000. Traders and supporters are optimistic and expect more price gains in the coming sessions. Confidence mainly comes from ongoing network enhancements, including the planned mainnet Dencun implementation.

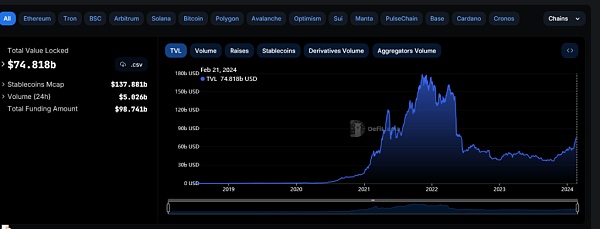

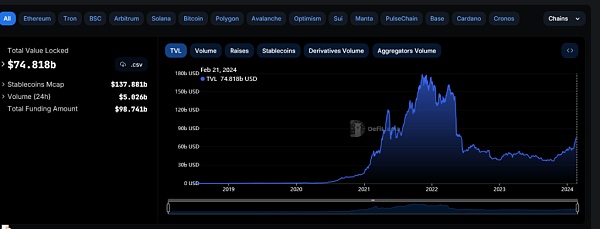

Other factors include the recovery of DeFi activity. According to relevant data, the total value locked has increased from approximately US$40 billion to more than US$74 billion as of mid-February 2024, an increase of nearly 2 times. .

p>

The number of active users of DeFi and NFT remains price-sensitive.

When Crypto asset prices peaked around the fourth quarter of 2021, the number of MetaMask users surged to an all-time high. There has also been an explosion of DeFi and NFT activity on various platforms compatible with MetaMask.

Since the wallet is non-custodial, allowing users to directly control assets, this surge could restore market confidence and potentially lead to more price increases.

In addition to user growth, MetaMask has also taken proactive steps to protect users by launching a new Blockaid alert system.

MetaMask stated that this feature was initially launched for trial in October last year and is now open to all extended users engaged in various activities such as DeFi and games. MetaMask posted on X that they plan to launch this feature to mobile users in the next few days.

Earlier this year, ConsenSys cooperated with MetaMask to launch the validator fixed investment function. The service aims to compete with existing providers including Lido Finance and other liquidity staking providers, allowing users to stake ETH.

However, like services offered by competitors, the service does not require users to have complex technologies related to nodes or management. The staking feature will be available through Consensys Staking, allowing users to lock up a minimum of 32 ETH.

Cheng Yuan

Cheng Yuan