Author: Dynamo DeFi Translation: Shan Ouba, Golden Finance

Trends and narratives

Deflation and Cancun push ETH to the forefront

1.4 million ETH has been burned since the merger, causing an ETH supply crunch.

This statement has become more pronounced recently as on-chain activity has increased, with deflation reaching an annualized rate of 1.095% over the past seven days.

< p style="text-align: left;">Although Ethereum fees have surged again in recent weeks, this has not stopped on-chain metrics from rising. Even though Ethereum is by far the largest DeFi network, Ethereum’s TVL has seen the second-largest increase in percentage terms among the major chains over the past month (after Bitcoin).

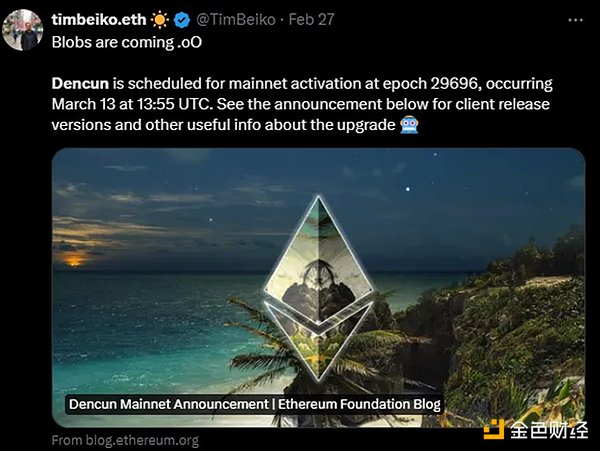

< p style="text-align: left;">Additionally, the Ethereum ecosystem may become more useful to retail users in the near future. The Dencun upgrade implementing proto-danksharding is scheduled to go live on March 13th. This upgrade promises to reduce L2 transaction fees.

< h3 style="text-align: left;">How to profit from it:

Hold Have ETH and look for yield opportunities such as EigenLayer and the larger liquid staking ecosystem.

Invest in ETH beta products such as L2. As Dencun makes L2 fees cheaper, this will likely push more activity to these chains.

MEME Season:

Last Tuesday, Bit The coin surged from 52K to a high of 64K on Wednesday, giving BTC its highest monthly closing price in history.

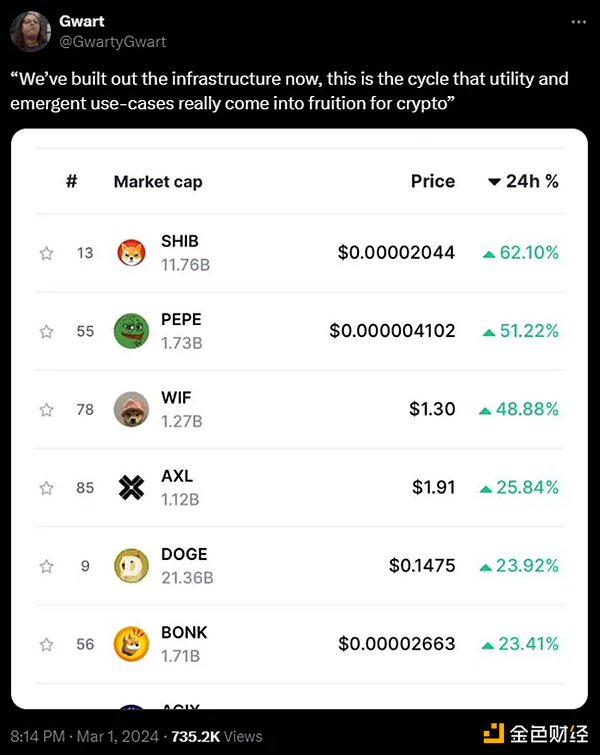

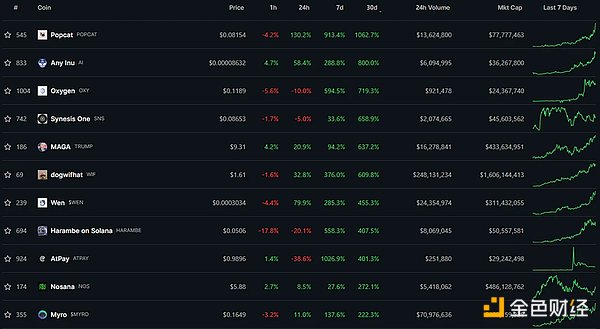

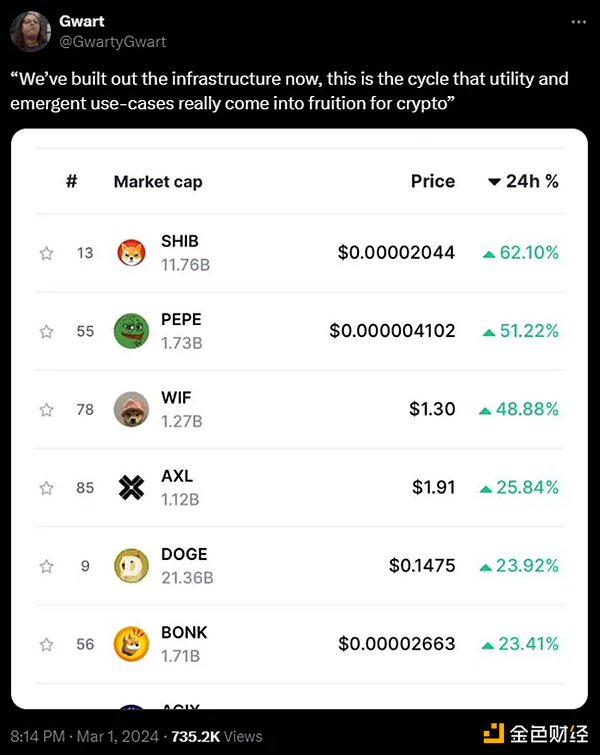

Just as Bitcoin takes a breather, traders are skipping altcoin season and jumping straight into meme season.

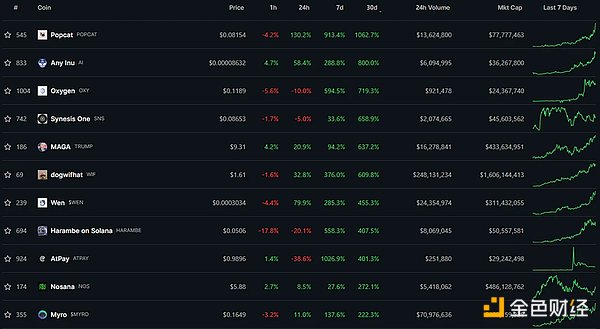

If you held any meme coins on Solana over the past week, this was probably a good week.

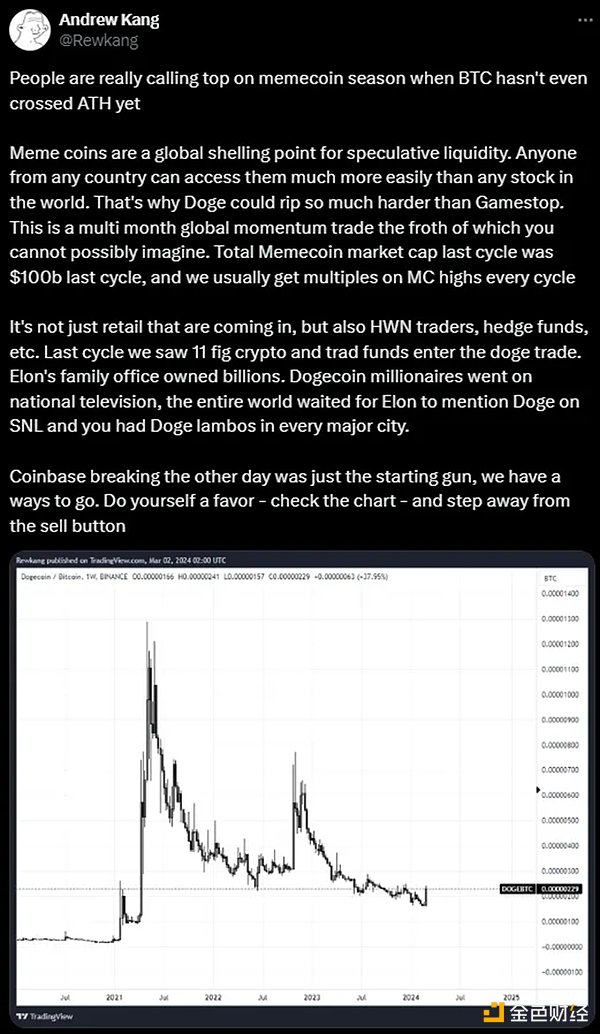

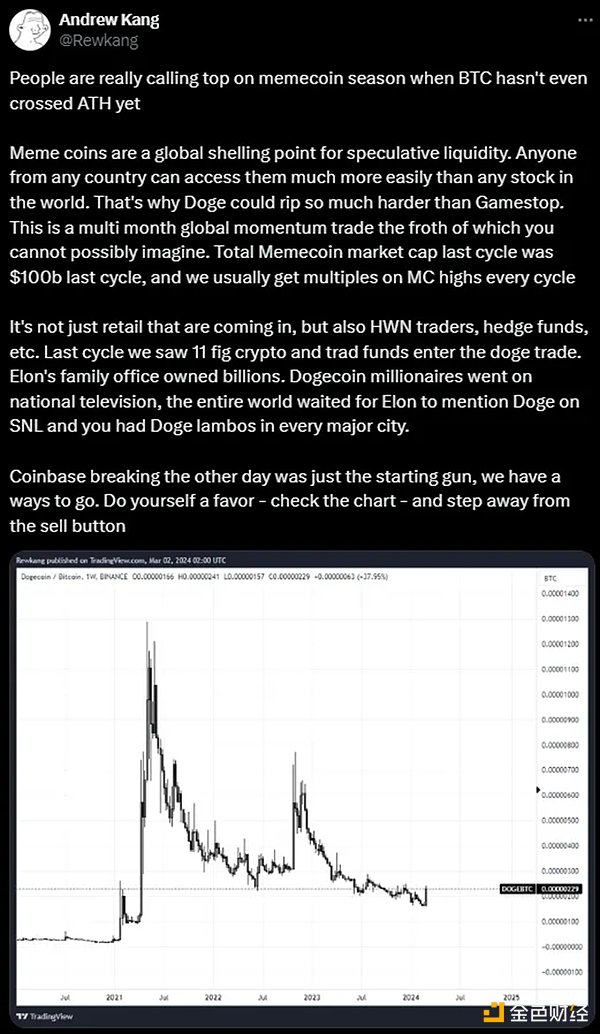

What does the popularity of these meme coins mean? Historically, surges in the price of tokens that have no practical use are often seen as a sign of a frothy, unsustainable market. Should we just call it quits? Some believe that memecoins are becoming an outlet for global speculative liquidity.

< h2 style="text-align: left;">How to profit from it

This may be just the beginning, and the market volatility will be very violent in the future. Opportunities of all kinds are constantly emerging, vying for your attention, which may be the scarcest resource. Keep a clear mind, develop an exit strategy and stick to it, and protect your focus.

On-chain analysis

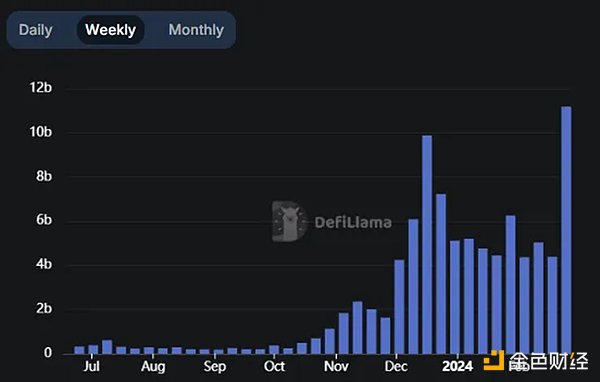

Solana activity rebounds to new highs

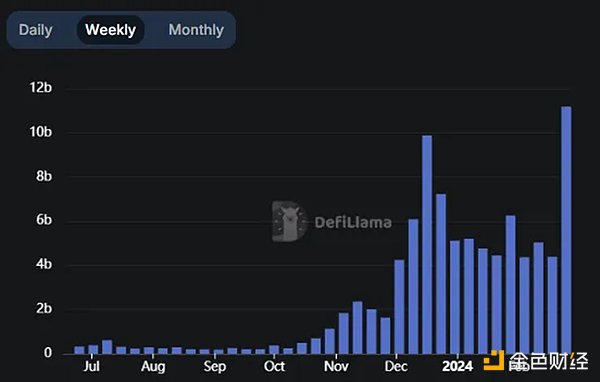

DEX trading volume on Solana more than doubled this week, breaking December's all-time high and surpassing the Ethereum mainnet within days. The surge in activity could reignite the Solana narrative after it lost momentum following its first network outage in nearly a year.

Stablecoin supply rebounds in Base

The number of stablecoins on Coinbase’s L2 Base platform increased by 18% this week, This is a significant increase. Since Coinbase has a huge potential user base, Base is an emerging chain worth paying attention to.

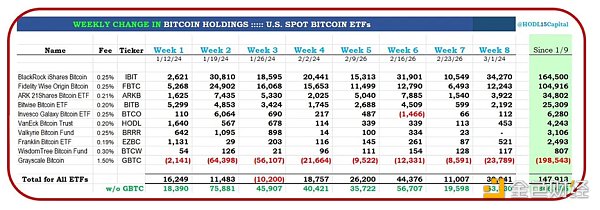

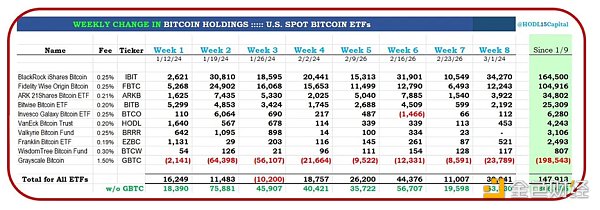

Tracking ETF capital inflows

Institutions are bidding. With every day that Bitcoin ETFs come out, more and more Bitcoin ETFs are being accumulated. The account HODL15Capital publishes data on these fund flows every day. Last week alone, more than 30,000 Bitcoin entered the ETF. So far, more than 147,000 Bitcoin have entered the ETF.

JinseFinance

JinseFinance