Author: Stacy Muur, Web3 researcher; Translation: Jinse Finance xiaozou

I have been paying close attention to research reports published by some of the smartest Web3 teams. Their articles provide food for thought, present different perspectives, and help you become more convinced of the views you agree with.

Research articles contain professional opinions that can help you better understand different people's views on the Web3 field. Now let's take a look at the summary of the "Crypto Market Outlook in 2025" by the Delphi team.

1. Long Live Bitcoin

Not long ago, many people thought that a Bitcoin price of $100,000 was just a daydream.

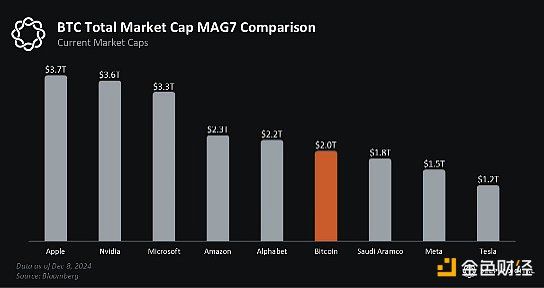

Now, this sentiment has changed dramatically. Bitcoin's market value is about $2 trillion, which is really amazing. If Bitcoin were a public company, it would be the sixth most valuable company in the world.

Bitcoin has attracted a lot of attention, but there is still considerable room for growth.

Bitcoin's market value is only 11% of the total market value of the seven major US technology giants (Apple, Nvidia, Microsoft, Amazon, Google, META, Tesla).

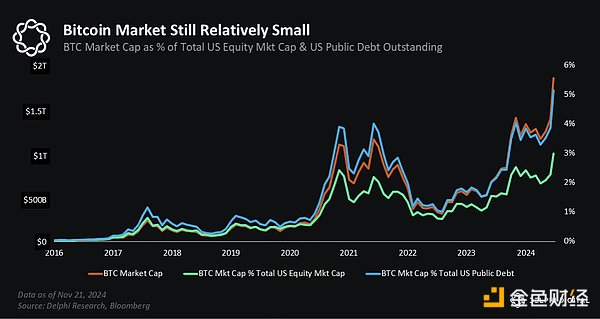

It is less than 3% of the total market value of US stocks and about 1.5% of the total market value of global stocks.

Its entire market value accounts for only 5% of the total outstanding U.S. public debt and less than 0.7% of the total global debt (public debt + private debt).

The size of U.S. money market funds is three times the market value of Bitcoin.

The market value of Bitcoin accounts for only about 15% of the total global foreign exchange reserve assets. Hypothetically, if global central banks reallocated 5% of their respective gold reserves to Bitcoin, it would increase purchasing power by more than $150 billion - three times the total net flow into IBIT this year.

Household net worth has reached an all-time high of more than $160 trillion, more than $40 trillion higher than the pre-epidemic peak. This growth was mainly driven by rising housing prices and a booming stock market, which is 80 times higher than Bitcoin's current market value.

In a world where the Fed and other central banks are devaluing their currencies by 5-7% per year, investors need to target annual returns of 10-15% to compensate for the resulting loss of purchasing power in the future.

So you get the point:

At a 5% annual devaluation rate, the real value of money will drop by half in 14 years.

At a depreciation rate of 7% per year, the real value of the currency will drop by half in 10 years.

This is why Bitcoin and other high-growth industries have received so much attention and traction.

2. Altcoin disillusionment

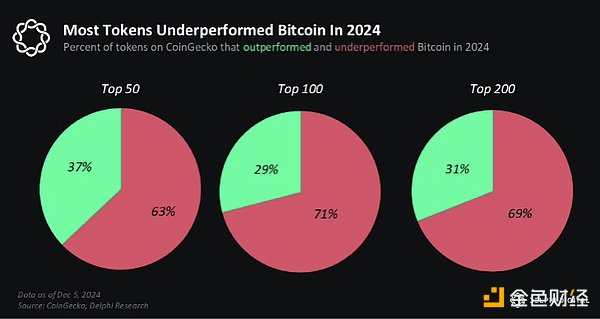

While Bitcoin has hit new all-time highs again and again this year, 2024 has not been a very successful year for most altcoins.

ETH did not reach an all-time high.

SOL hit a new all-time high again, but it is only a few dollars higher than its previous high, which is somewhat insignificant compared to the growth in market capitalization and network activity.

ARB had a strong start to the year but started to underperform at the end of the year.

There are many more examples like this. Just look at the data of 90% of the altcoins in your portfolio and it will be clear at a glance.

What are the specific reasons?

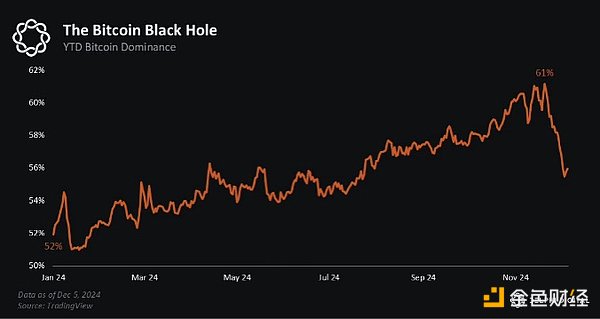

The first reason is Bitcoin dominance. Bitcoin has had a remarkable year, fueled by ETF flows and Trump’s support, leading to a year-to-date price increase of more than 130% and boosting its dominance to a three-year high.

The second reason is market fragmentation.

Market fragmentation this year is a new phenomenon in the crypto market. Previous market cycles tended to trade in sync. When BTC rose 1%, ETH would usually rise 2% and altcoins would rise 3%, with a predictable pattern. However, this cycle is different.

There are a handful of cryptocurrencies that are doing very well, but there are also large swaths of the red.

The rising Bitcoin wave has not benefited everyone, and the classic “Path to Altseason” that many expected has not materialized.

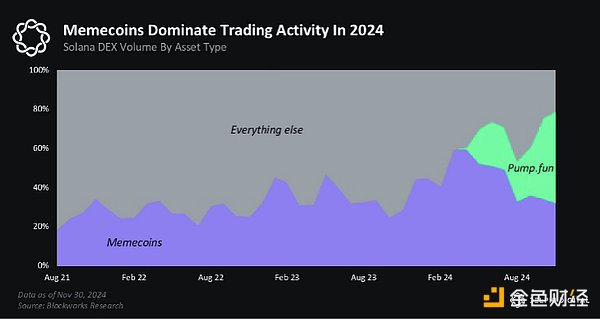

Last but not least, Meme coins (and more recently AI Agents).

Cryptocurrencies have always vacillated between being a “pure Ponzi scheme” and “technology that promises to change the world.” In 2024, the former dominates the discourse.

The Memecoin Super Cycle amplified the notion that cryptocurrencies were just a giant Ponzi scheme. People began to question whether fundamentals really mattered and whether cryptocurrencies were just "casinos on Mars" - and these concerns were legitimate.

I would like to say a few more words in this regard.

When Memecoins are labeled as the top performers of the year, only the largest Memecoins are taken into account - those that have created significant market capitalizations and built communities. People often overlook the fact that 95% of Meme coins issued have failed to maintain their value, but people "want to believe it".

With this belief, many people who previously invested in altcoins turned to buy Meme coins - some succeeded, but most failed. As a result, capital inflows were mainly distributed between Bitcoin (institutional capital) and Meme coins (high risk), squeezing most altcoins aside.

Delphi believes that 2025 will usher in a shift to "world-changing" technologies.

Personally, I am not too optimistic. In 2024, many KOLs who focus mainly on Meme coins have emerged. For example, I created a Telegram folder with some truly valuable channels in it, and it is very difficult to find a channel that is not centered on "ape calls". This is the attention game, and widely discussed narratives can seriously affect market trends.

3. What's next?

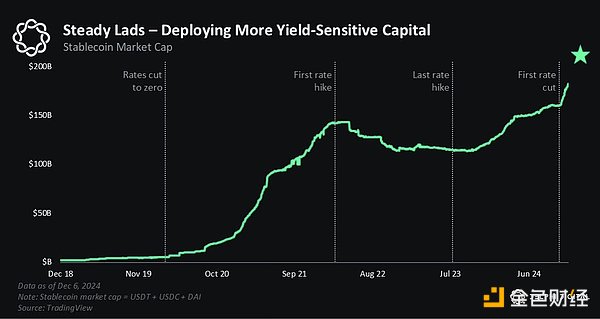

(1) Stablecoin growth and credit expansion

A major obstacle facing the market is the oversupply of tokens. The market is facing a large number of new assets issued by private investment and public tokens. For example, more than 4 million tokens were issued on Solana's pump.fun in 2024 alone. At the same time, the total market value of cryptocurrencies has only increased by 3 times since the last cycle, compared with 18 times in 2017 and 10 times in 2020.

The missing elements—stablecoin growth and credit expansion—are beginning to reappear. Lower interest rates and friendlier regulation are expected to spur speculative behavior and address these imbalances. As stablecoins regain traction, their trading and collateral-based role will be critical to market recovery.

(2) Institutional capital inflows

Until last year, institutional capital was very hesitant to participate in cryptocurrencies due to regulatory uncertainty. However, this is starting to change as the SEC has reluctantly approved a spot Bitcoin ETF, paving the way for future institutional investment.

These institutional investors will look for investment opportunities that are familiar to them. While some investors may dabble in meme coins, they are more likely to be more interested in assets in areas such as ETH/SOL, DeFi, or infrastructure.

Delphi expects the coming year to be similar to the "all-up" phenomenon of previous cycles. This time, projects based on fundamental principles or core goals will regain attention. These may include assets such as OG DeFi, which have a good historical performance and have been battle-tested. They may also be infrastructure assets, similar to the L1 transactions we have observed before. Others may include RWAs (real world assets) or emerging fields such as artificial intelligence or DePIN.

Not every cryptocurrency will rise by triple digits like before, and meme coins will continue to exist. This may mark a new beginning and a broad crypto rally.

Note: Generally speaking, most institutional traders rely heavily on options hedging. Therefore, if there is a "full rally", the assets most likely to attract investor interest will be those with options, mainly traded on Deribit or Aevo.

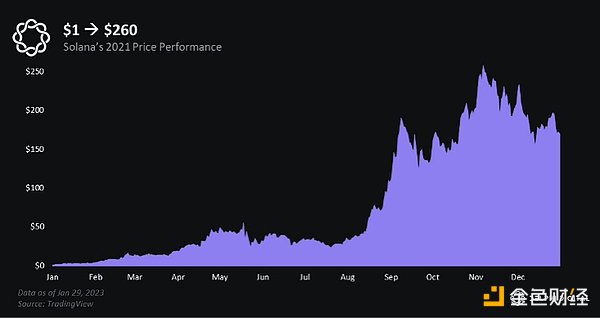

(3) Solana Dominance

Solana demonstrates the resilience of the blockchain ecosystem. After experiencing a 96% plunge during the FTX debacle, Solana staged a stunning rebound in 2024.

Key highlights include:

Developer momentum:Solana’s hackathons and airdrops (such as the Jito airdrop) have reignited the enthusiasm of developers and users to participate, creating a virtuous cycle of innovation and adoption.

Market dominance:From Meme coins to artificial intelligence applications, Solana dominates the 2024 trend. Notably, its Real Economic Value (REV) — a measure of transaction fees and MEV — exceeds Ethereum’s by more than 200%.

Future Outlook:Solana is poised to challenge Ethereum’s dominance in terms of scaling and user experience. Its seamless user experience and centralized ecosystem offer significant advantages over decentralized L2 solutions.

4. Final Thoughts

For many, the current market situation may be reminiscent of 2017-2018, when Bitcoin peaked at $20,000 before the New Year and began to fall shortly after the arrival of 2018. However, in my opinion, comparing the crypto market in 2018 to the market in 2025 is irrelevant. These are two completely different environments.

It is important to recognize that the broad crypto market extends far beyond the timeline of CT and X. People outside of these platforms view the market very differently.

In 2025, I expect the crypto market to be divided into two main verticals:

Web3 Natives: Traders who are deeply embedded in the crypto market. They have a nuanced understanding of Bitcoin’s unique characteristics and are willing to participate in high-risk transactions, including meme coins, AI agents, and pre-sales—elements that are reminiscent of the Wild West.

Regular Investors: Institutional and retail investors often have different approaches to risk management and typically adhere to more basic investing and trading strategies—viewing cryptocurrencies as an alternative to the stock market.

Which vertical will be marginalized? It’s those early stage DeFi, RWA and DePIN protocols that can’t ensure they stay ahead in their niche or at least on-chain. This is just my opinion too.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance decrypt

decrypt Crypto Briefing

Crypto Briefing Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph