Author: Jordan Yeakley, CFA @Delphi Digital Leia Translation: TEDAO

TL;DR

1. Ethena's USDe grew from zero to over $2.2 billion in less than a month, becoming the fastest-growing "stablecoin" in history.

2. USDe is backed by a delta-neutral ETH position, balancing risk by pledging ETH and corresponding ETH perpetual futures short positions.

3. Ethena introduces BTC as additional collateral, enhancing its scalability and yield.

4. This approach makes USDe more capital efficient than traditional stablecoins and takes advantage of the high returns of stETH and perpetual futures.

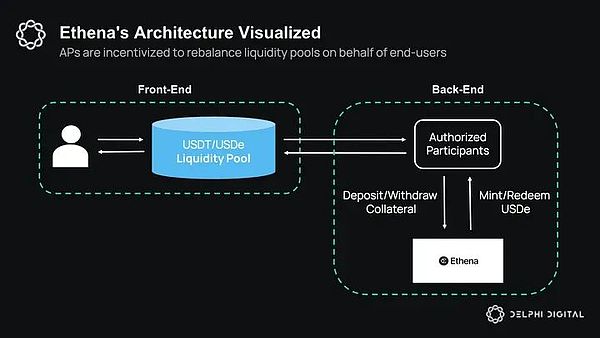

5. Ethena's architecture is minted and redeemed through liquidity pools, and authorized participants (APs) are responsible for balancing liquidity.

6. The main risks include counterparty risk, negative funding rate risk, and automatic deleveraging risk. Ethena takes multiple measures to mitigate these risks.

7. At present, USDe can be expanded to a market size of US$7.2 billion, and in the future it can be expanded to US$12 billion if the prices of ETH and BTC rise.

8. Ethena effectively adjusts the interest rates of DeFi and CeFi and leads a new paradigm of interest rates. In the future, more projects will be integrated with its benchmark yield.

Friendly reminder: The market is risky and investment should be cautious. The content of this article is for reference only and does not constitute any investment advice.

Introduction

The stablecoin duopoly is being challenged. In less than a month, USDe’s supply has rapidly grown from zero to over $2.2 billion, making it the fastest-growing “stablecoin” ever. The fundamental reason for this early achievement is that Ethena takes a completely different approach from the market concept of “synthetic dollars”.

In addition, Ethena found product-market fit early on by popularizing the opportunity of Delta-neutral basis trade, making it seamlessly integrated with other decentralized finance (DeFi) services and products, and meeting the market’s huge demand for yield. At the same time, building USDe as a “synthetic dollar” enables Ethena to fully leverage the network effects inherent in being a monetary asset.

In this report, we will explore the opportunity of Ethena and analyze the working principle of USDe and sUSDe. We will also point out why Bloomberg calls it "the closest to risk-free bet" is not completely risk-free. Finally, we will explore the second-order impact of Ethena on other parts of DeFi.

Opportunities for Stablecoins

Stablecoins are one of the few cryptocurrency use cases that have found meaningful product-market fit. Not only have they demonstrated their advantages as an effective monetary safe haven, they have also played a key role in connecting decentralized finance (DeFi) with centralized finance (CeFi), promoting the smooth integration and collaboration of the two.

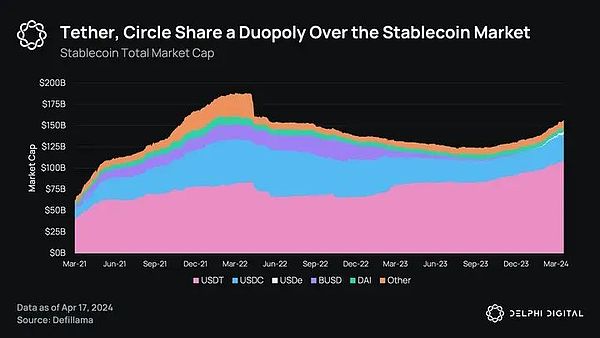

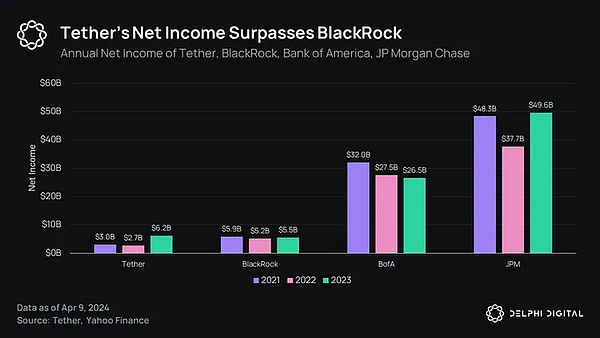

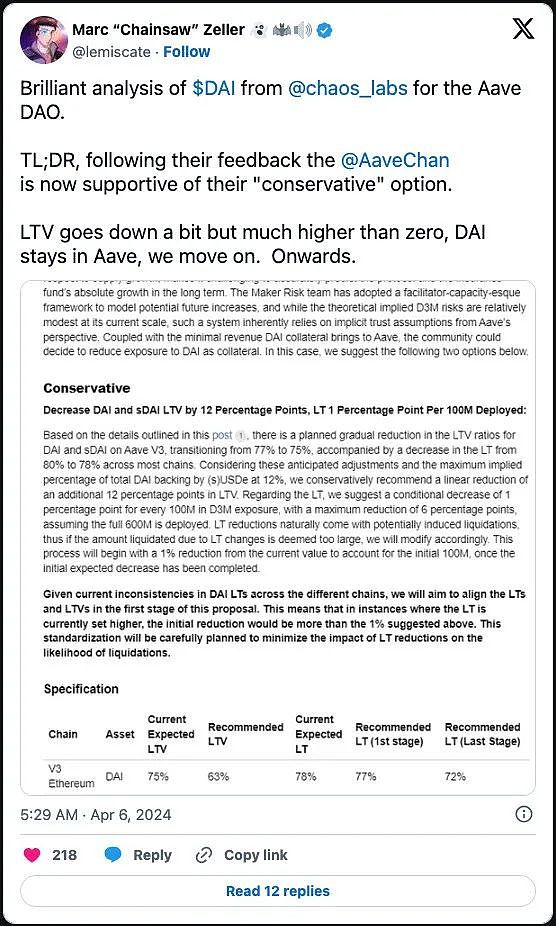

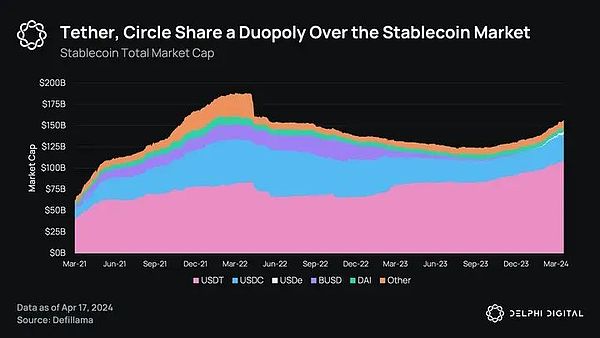

Currently, Tether and Circle dominate the stablecoin market, accounting for a combined 90% of the market share. Tether alone achieved $6.2 billion in net revenue last year, exceeding the net revenue of Blackrock, the world's largest asset issuer. However, it is worth noting that this value has not been returned to stablecoin holders.

While in a more dynamic market structure, new entrants may erode Tether's profit margins by redistributing profits through native returns, the stablecoin market is not a perfectly competitive market. Emerging alternatives face high barriers to entry due to inherent liquidity network effects and the trend of stablecoin standards becoming increasingly embedded in DeFi and CeFi structures.

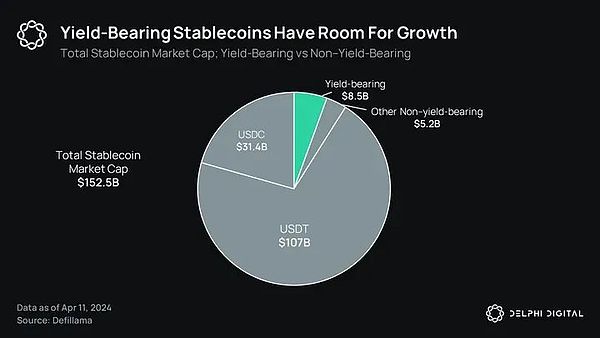

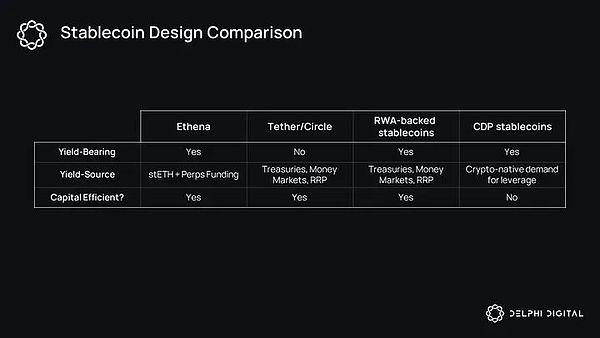

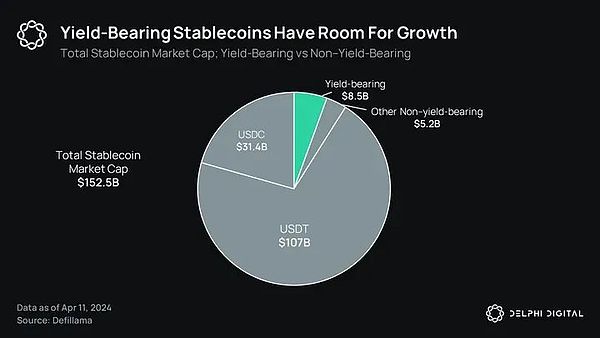

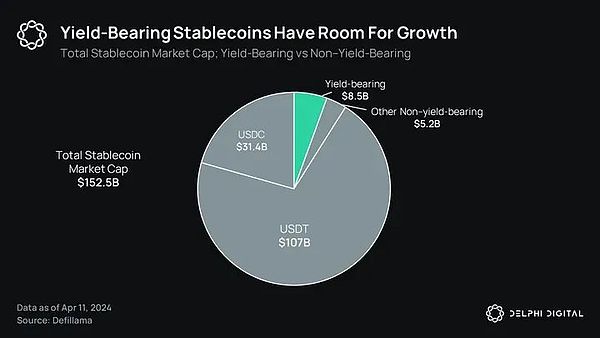

As a result, the market demand for liquid and yield-yielding stablecoins remains unmet.Yield-yielding stablecoins currently account for only 5.6% of the total stablecoin market cap, which clearly shows that the existing stablecoin model is insufficient in meeting market demand.

On the one hand, real-world asset-backed stablecoins (RWA-backed stablecoins) seem to be betting on the wrong horse.During bear markets, bringing traditional finance (TradFi) rates to cryptocurrencies may be an attractive value proposition, but once crypto-native yields exceed Treasury yields, these products will become increasingly unattractive to users.

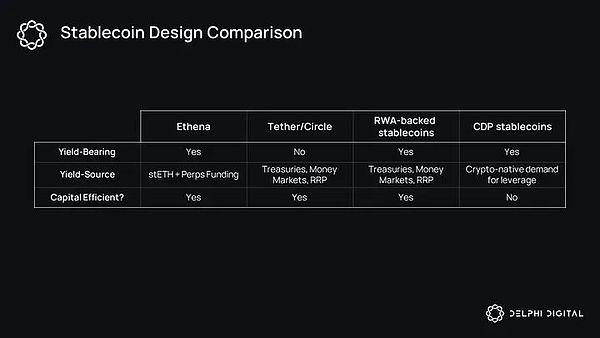

In contrast, Collateralized-Debt-Position (CDP) stablecoins have the opposite problem. While this model leverages “crypto-native” interest rates to some extent, capital efficiency quickly becomes its limiting factor. In other words, the scalability of CDPs like DAI is undermined by the need to collateralize 1 DAI, whose debt is worth far more than $1.

Given the above, now is an appropriate time to explore how Ethena is taking a completely different approach to breaking the Tether and Circle duopoly.

Ethena’s Approach

Unlike existing stablecoin models that use RWA or CDP as collateral, Ethena’s USDe is backed by a “Delta-neutral” ETH position. In other words, each USDe is collateralized by a long staked ETH (stETH) position, while being hedged by a short position in an equal value of Ethereum perpetual futures contracts (ETH-PERP).

Positive Delta (stETH) + Negative Delta (Short ETH-PERP) = Delta Neutral (USDe)

So if the price of ETH moves from $3,000 to $2,500, the short ETH-PERP position will offset the $500 price move accordingly. Similarly, if the ETH price rises to $3,500, the short ETH-PERP position will be reduced by $500 accordingly.

Recently, Ethena also added BTC as additional collateral.Similarly, BTC will be paired with an equal value of short BTC-PERP position to engineer the same delta neutral support. The only difference is that ETH collateral can be staked to earn additional yield, while BTC cannot. Therefore, Ethena may tilt more towards stETH allocation regardless of liquidity constraints.

Given that the Ethena model has fundamentally different risks than CDP- and RWA-backed stablecoins (which we will discuss later), the market quickly labeled USDe as a "synthetic dollar" rather than a true stablecoin. While this classification seems reasonable, it is worth noting that the USDe model has two structural advantages over existing yield-based stablecoin designs.

First, Ethena is more capital efficient than CDPs. USDe's Delta neutrality means that only $1 of collateral is required to mint 1 USDe. As a result, Ethena is able to scale more efficiently than CDP stablecoins like DAI.

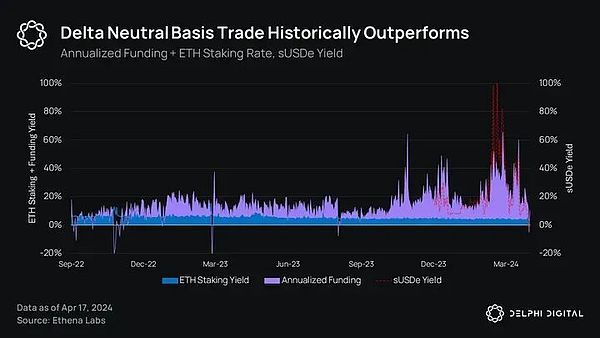

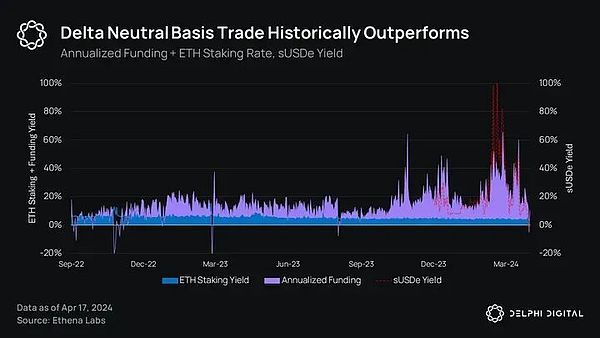

Second, USDe is able to tap into two of the highest-yielding crypto-native yield sources:

Yields on staking ETH

Perpetual Futures Funding Rates

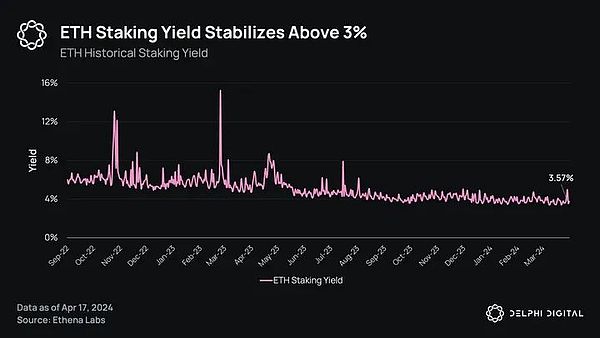

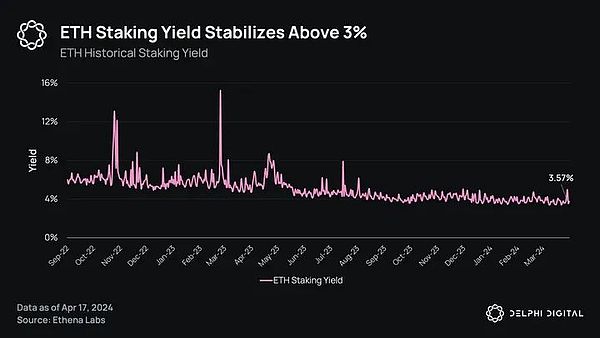

For context, yields on staking ETH have historically averaged about 4-5% annualized, with recent data showing about 3.4%. Ultimately, this return is determined by three factors: (1) inflation rewards at the consensus layer (2) execution layer fees paid to Ethereum stakers and (3) miner extractable value (MEV) paid to Ethereum stakers.

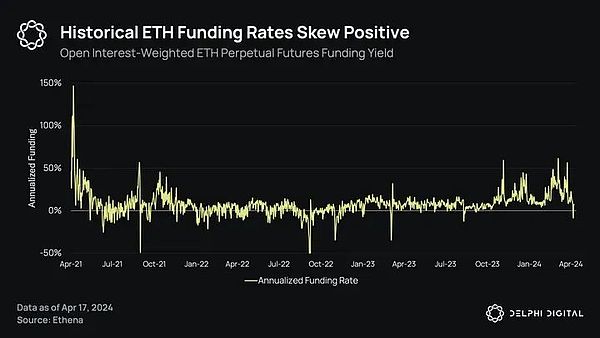

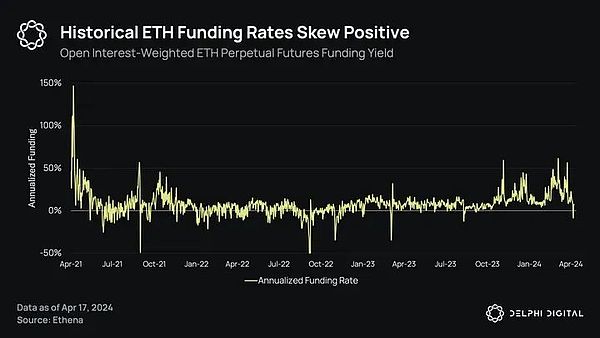

While the returns from staking ETH on its own have historically averaged above Treasury yields, the majority of USDe’s returns come from the second part of the delta-neutral trade. Given that the natural state of funding rates for ETH and BTC perpetual futures has always been long, market participants who short this delta exposure have historically enjoyed generous funding rates.

Ethena ultimately combines the two sources of yield mentioned above into a unified fungible token. Backtesting this strategy shows that USDe will generate significant returns.

It is also worth noting that BTC's funding rate almost directly reflects ETH's funding rate. Therefore, while the yield generated by BTC collateral may only involve the short portion of the trade, this is where the majority of the yield will come from. Therefore, BTC's yield will compete with ETH, especially when the funding rate is high.

Ethena’s Differentiation

So while existing models attempt to overthrow the Tether/Circle duopoly by either bringing traditional finance (TradFi) rates on-chain or leveraging DeFi rates through a less capital-efficient CDP model, Ethena takes a fundamentally different approach.

Essentially, Ethena arbitrages the uniquely high funding rates in the perpetual futures market through a fungible product that can be combined with other DeFi products and services. As such, structuring the product as USD-denominated is intended to leverage the inherent network effects that come with being a “stablecoin”.

In theory, USDe adoption should result in funding rates eventually converging to a level that simply reflects the risk-free rate plus a risk premium, which is the goal. Assuming Ethena can achieve scale, this goal is expected.

Ethena's Architecture

Now that we have a general understanding of Ethena's design, let's dive into the specifics of how USDe and sUSDe work. Architecturally, Ethena can be understood through three core mechanisms: 1. Minting 2. Redemption 3. Staking USDe.

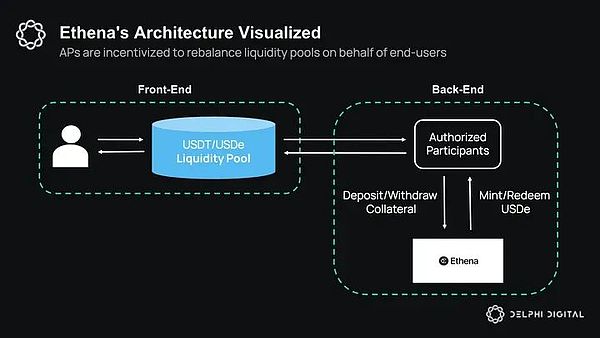

Ultimately, end users will not handle minting and redemption operations directly. Instead, they will do so directly through liquidity pools or indirectly through Ethena's front-end interface, and these transactions will then be carried out through liquidity pools.

Each swap creates arbitrage opportunities for whitelisted authorized participants (APs) to rebalance these liquidity pools. Importantly, only APs can mint and redeem USDe, thereby capturing these short-lived market dislocations.

For example, if someone swaps 1000 USDT for 1000 USDe in the Curve pool, this will cause USDT to trade at a tiny discount relative to USDe. APs are therefore incentivized to mint USDe to buy discounted USDT, thereby rebalancing the pool. In the process, 1000 new USDe will be created.

Behind the scenes, USDe is minted when APs deposit collateral such as ETH, LSTs, BTC, and other stablecoins into Ethena. The protocol then swaps these collaterals for pledged ETH or BTC through an internal swap function and matches an equal amount of short perpetual positions on centralized exchanges. Importantly, while the derivative positions are held on exchanges, the collateral assets are held over-the-counter to reduce counterparty risk (more on this in the “Risks” section).

Conversely, when USDT is trading at a tiny premium to USDe, APs can purchase discounted USDe and redeem it for $1 of collateral, thereby taking advantage of this market dislocation. Behind the scenes, APs will receive stETH from Ethena, and Ethena will unwind the equal value of the short position.

The effect of this dynamic is that the liquidity pool should maintain an efficient 1:1 stable exchange ratio while users do not need to deal with the complexity of minting and redeeming USDe.

Finally, in order to obtain the yield generated by the underlying collateral, users need to stake USDe into sUSDe through Ethena's front-end interface. Unlike other staking token models such as stETH, sUSDe is not a "rebasing" token, but a "reward" token. This means that instead of paying out yields in new tokens, the price of sUSDe increases over time to reflect the value accumulated within the staking smart contract. sUSDe also requires a 7-day unlock period (more on this in the "Risks" section).

Learning from Past Failures

It is worth noting that while the “Delta Neutral” model has been tried before, Ethena appears to have learned from past failures.

Despite directionally correct, projects like UXD and Lemma’s USDL ultimately failed to find meaningful product-market fit for three main reasons:

Limited to scaling on perpetual DEXs - In their pursuit of “decentralization”, these projects overlooked the necessity of centralized exchange (CEX) liquidity for scaling.

DEXs present security risks - The Mango attack that caused UXD to depeg in October 2022 showed that while DEXs may be "decentralized", they still carry inherent risks.

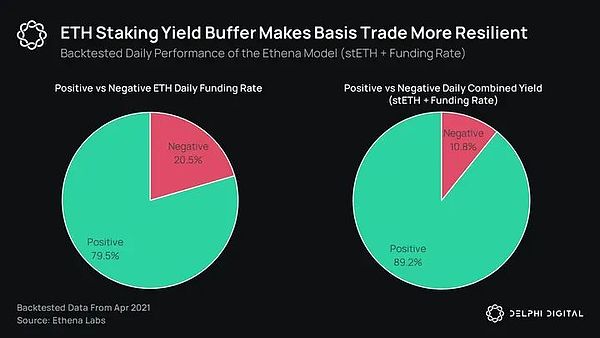

Increased risk of negative funding - UXD and Lemma do not take advantage of the native yield on the long end of their Delta neutral positions. Lacking this additional buffer, these projects are more vulnerable to the risk of long-term negative funding rates.

Ethena circumvents the above pitfalls by: (1) leveraging CEX perpetual liquidity; (2) aligning the incentives of CEXs with shareholders and stakeholders in the Ethena ecosystem; and (3) leveraging stETH as an additional source of yield to offset periods of negative funding.

While the model is an improvement over previous designs, it still has inherent risks. While there are many misconceptions that confuse USDe with Terra, the Ethena team has done a good job of highlighting USDe risks, including those that could easily be overlooked.

The following section will specifically explore these risks, their relative likelihood, and some of the risk management strategies adopted by the Ethena team.

Risks of Ethena

Ethena faces four main risks: (1) Counterparty risk (2) Negative funding risk (3) Redemption and liquidity risk (4) Automatic deleveraging (ADL) risk.

Counterparty Risk

Ethena’s architecture relies on two main counterparties to operate: 1. Centralized Exchanges (CEXs); 2. OTC Settlement Providers (OES providers).

CEXs are responsible for trading Ethena’s perpetual positions, while OES providers are responsible for custody and settlement of Ethena’s collateral. Although the incentives of these counterparties are highly aligned with Ethena, there are still inherent risks in relying on external entities. To mitigate these risks, Ethena has integrated several risk management solutions:

Diversified Exchange Risk - Ethena is integrating with multiple CEXs including Binance, Bybit, Bitget, Deribit, and OKX. Therefore, if one exchange were to become functionally impaired, Ethena’s risk would be spread out. Importantly, these exchanges also have both tangible and intangible vested interests in Ethena’s success.

OTC Settlement - Ethena retains full control and ownership of collateral assets through OTC custody and settlement. Therefore, if certain unique events occur on any of the above exchanges, Ethena would retain full control of the collateral assets and could subsequently redeploy to another exchange.

Additional Custody Measures at the OES Level - Ethena currently uses Copper, Ceffu, and Cobo for OTC custody and settlement. It is important to note that under Copper’s legal structure, user funds are part of a bankruptcy-remote trust. This means that in the event of Copper’s bankruptcy, user funds are not part of Copper’s property.

Frequent P&L Settlement - To further reduce CEX counterparty risk, Ethena is able to settle its P&L on a 8 to 24 hour cycle, depending on the custodian. As a result, Ethena is only exposed to the maximum loss that could occur within this window.

Solution Verification - Ethena enables users to verify the existence of protocol collateral and Ethena derivatives positions. Currently, this is achieved by directly reading the custodian wallet API, exchange subaccount API, and on-chain wallets. This week, Ethena also released third-party certification of collateral by custodians, which will be conducted monthly in the future. Ethena is also in the process of bringing in additional external providers to eventually certify the accuracy of collateral and hedges.

The effect of the above measures is that Ethena’s exposure to counterparty risk is greatly reduced.

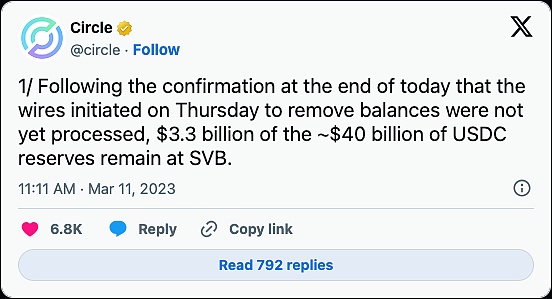

It’s also worth noting that counterparty risk is not unique to Ethena. Moreover, whether you hold USDT, USDC, or USDe, you implicitly trust a counterparty; the question is just who that counterparty is, and how much they should be trusted.

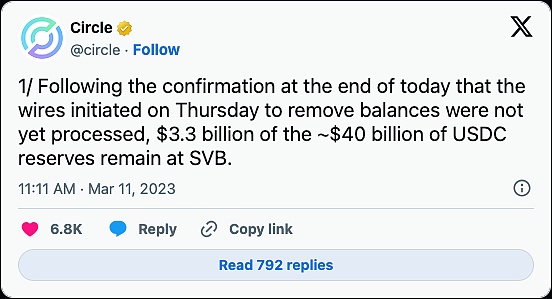

If you hold USDT or USDC, you implicitly trust Tether and Circle and the banks that hold their assets. While this has historically been seen as a “safe bet,” Circle’s exposure to Silicon Valley Bank (SVB) last March highlighted these inherent risks.

In addition, Ethena appears to be shielded from some of the scrutiny risks associated with heavy reliance on the existing banking system. In addition, with no ties to US customers, custodians, or CEX venues, Ethena appears to have some insulation from regulations.

While CEXs are not completely immune to regulatory risk, the U.S. financial regulatory system at least has no incentive to scrutinize Ethena because it does not undermine the fractional reserve banking system like Tether and Circle. Arthur Hayes highlighted these structural incentives in his article, Dust on Crust Part Deux,.

Furthermore, while DAI and other CDP stablecoins may not have explicit counterparty risk in the traditional sense, as an end user, you are still accepting significant trust assumptions. Moreover, by holding DAI, you are implicitly trusting the integrity of the code and the collective ability of the DAO to effectively manage the protocol.

Furthermore, as CDPs continue to increase their RWA and USDC/USDT holdings, you are also making the same trust assumptions as fiat-backed stablecoins. DAI’s RWAs are also managed by OTC entities, some of which are based in the US, and therefore have significant trust assumptions similar to any centralized issuer.

To be clear, this is not about transferring counterparty risk from Ethena. While Ethena has taken some smart precautions, USDe still faces significant counterparty risk. That said, all stablecoins face similar risks. It’s more of a question of what return you get for holding that stablecoin and taking on those risks. Whereas in the case of USDT and USDC, it’s simply better liquidity.

Thus, through the lens of “risk-adjusted return,” USDe may be a more attractive option for some given Ethena’s yield.

Negative Funding Risk

A more relevant question circulating in CT (Crypto Twitter) is,What happens when the funding rate goes negative?

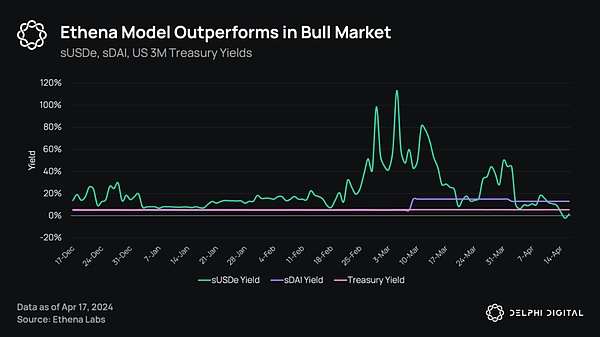

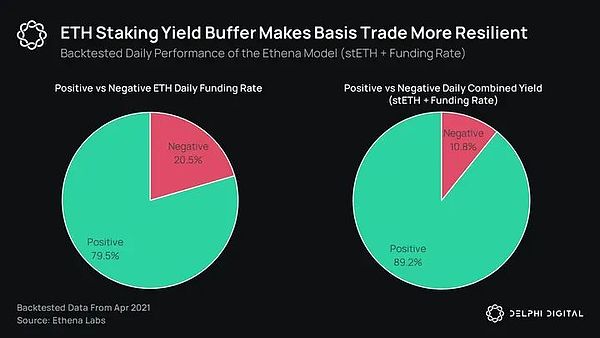

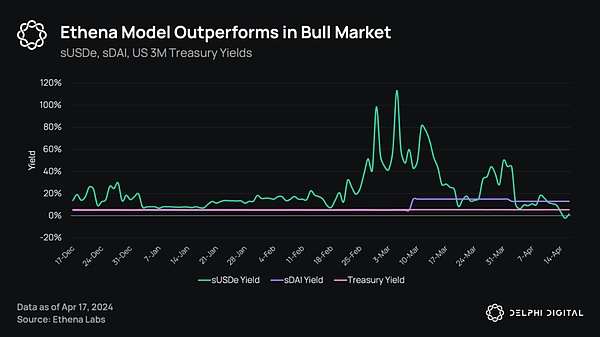

As mentioned earlier, the natural state of perpetual funds has historically been biased towards the long term. As a result, fees have only been negative 20% of the time over the past three years. When the additional buffer provided by stETH returns is taken into account, this number is closer to 11%.

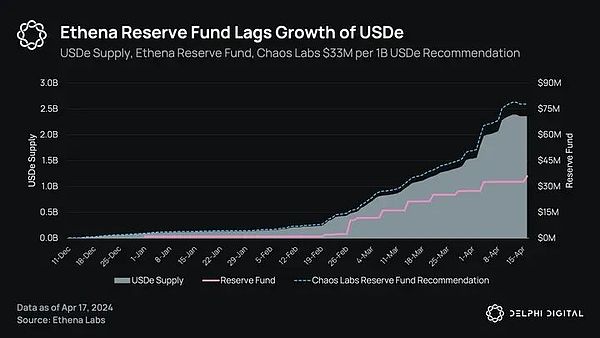

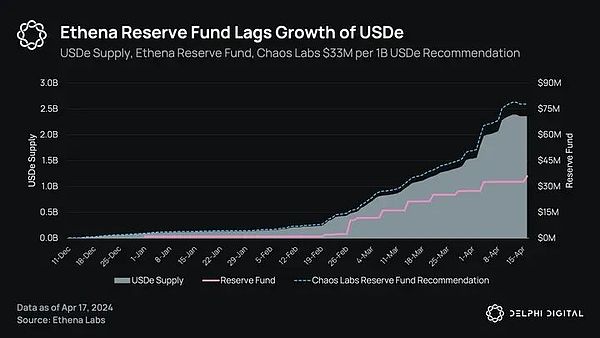

If returns do turn negative, the reserve fund will ultimately serve as a buffer, ensuring that USDe can maintain its 1:1 peg. In addition, both Ethena and Chaos Labs have conducted extensive research on calculating the optimal size of this reserve fund.

Ethena's research found that $20 million is needed for every $1 billion of USDe to survive almost all bear market expectations, while Chaos Labs' recommended fund size is closer to $33 million per $1 billion of USDe.

Currently, the reserve fund is worth just over $32 million relative to the $2.3 billion USDe supply. While this is significantly lower than Chaos Labs's recommendation, Ethena currently allocates 80% of its revenue to the reserve fund. Ethena added $5 million to the reserve fund last week alone. At this rate, Ethena should reach Chaos' target fund size in 9 weeks.

While the Ethena team does exercise caution with regard to funding risk, a more valid criticism of the above analysis is that historical data does not reflect Ethena’s actual future impact on funding rates. As a result, rates could actually turn negative and last longer than the team expects. As a result, a larger reserve fund may be needed.

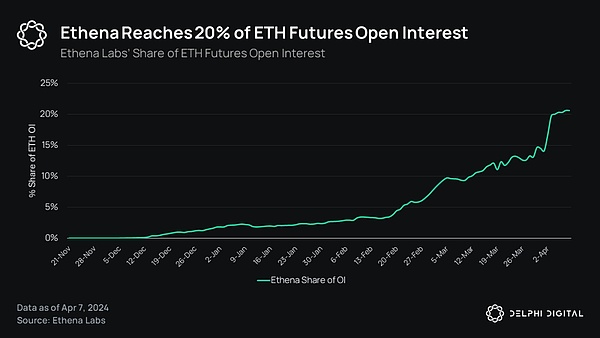

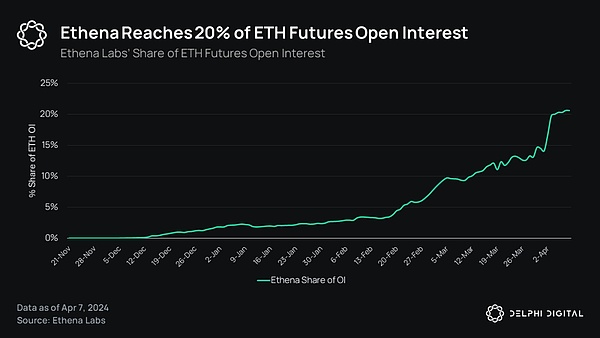

Intuitively, this makes sense. Funding rates are ultimately a function of supply and demand. Ethena inherently introduces more market supply, and if there aren’t enough counterparties to absorb every dollar of new supply, funding rates should fall. Ethena already accounts for over 20% of ETH-PERP open interest (OI).

It is also worth noting that one of the unique things about the cryptocurrency market is that the majority of volume today actually comes from the retail market. Importantly, the retail market has inherently higher demand for long crypto assets than shorts, which may be supporting funding rates to some extent. In other words, there may be a "degen premium" in the structurally higher funding rates on CEXs.

As the launch of the ETH ETF increases participation from traditional finance (TradFi), we may see an erosion of this "degen premium" as more sophisticated market participants dilute the share of existing "long-biased" retail traders. We may see more institutions doing delta-neutral trades themselves to arbitrage the same market dislocations that Ethena identifies. This will cause funding rates, and Ethena, to become increasingly unattractive from a risk-adjusted perspective.

That said, it is worth briefly mentioning one countervailing force that could push funding rates slightly higher. Some CEXs like Binance and Bybit have positive baseline funding rates. This effectively means that funding rates automatically revert to positive by default. Given that these exchanges together make up 50% of CEX open interest, this could push rates slightly higher.

While this does help Ethena somewhat, the net effect of the above headwinds will still be an inherently lower natural state of future sUSDe returns. Therefore, maintaining a 1:1 USDe peg over the long term may require a larger reserve fund than Ethena currently anticipates based on historical data.

However, it is worth noting that Ethena does have a multi-billion dollar treasury that could be used to sell ENA tokens to build additional stablecoin war chests. While this would be a last resort, the treasury could serve as an effective tool to help mitigate the above risks until Ethena can scale up its reserve fund accordingly. This is one of the lesser cited tools available to Ethena.

Redemptions and Liquidity Risk

Another of the most important questions circulating on CT is, what happens if the funding rate remains negative for a long time, causing the reserve fund to be depleted?

The most common response is that there is an “anti-reflexive” dynamic in the Ethena design. In other words, when the rate starts to go negative and the reserve fund starts to run low, redemptions will cause Ethena to unwind the equivalent short position, causing the funding rate to return to a positive value.

While theoretically correct, this logic does have some holes.

Furthermore, assuming that redemptions will cause sUSDe yields to return to positive implies two assumptions: (1) strong demand from other parts of the market to short ETH-PERP will not cause the rate to remain negative, and (2) there is sufficient liquidity in the market to absorb USDe redemptions.

Let’s deal with assumption 1 first.

Yes, USDe redemptions will naturally push up the funding rate, but if demand from other parts of the market to short ETH-PERP is the same or stronger, the funding rate could remain negative long enough to deplete the reserve fund. Therefore, once the reserve fund is depleted, the principal balance of USDe will gradually fall below $1 as funding payments are made from the collateral balance.

It is worth noting that this will be a slow “bleeding” process, rather than a reflexive collapse to zero. Assuming Binance’s maximum negative funding rate is -100%, this would imply a loss of 0.273% per day. Furthermore, there would likely not be many USDe holders left by then. Most users would exit immediately when they can get better risk-adjusted returns elsewhere.

However, this leads to Assumption 2.

While the above dynamics are not a problem when funding rates decline slowly and USDe holders have ample time to exit, this may not be a problem in a left-tail event when funding rates drop dramatically. In the absence of sufficient liquidity to absorb large redemptions, the “reflexive” logic begins to break down.

In this scenario, there would be two categories of users looking to exit: (1) those holding USDe and (2) those holding sUSDe, which are subject to a 7-day unlocking period.

USDe holders would exit first, causing Ethena’s delta-neutral position to be unwound quickly. Once again, USDe holders will be selling their USDe through the liquidity pool, rather than redeeming directly. As such, redemptions will be made by whitelisted APs, who will purchase USDe from the liquidity pool at a slight discount and redeem it for the underlying collateral. In the background, Ethena will unwind these positions by buying back the equivalent short perpetual positions and handing the collateral over to the APs.

While buying back perpetual positions in a liquidity-constrained environment will actually experience some positive slippage, the wave of LST sales entering the market will experience significant negative slippage, especially for the less liquid LST.

It is worth noting that Ethena mitigates this risk by selling its more liquid collateral first, such as ETH and BTC. An event that quickly dumps $1 billion of ETH into the market will certainly cause some short-term dislocation, but the ETH/ETH-PERP spread importantly should not displace significantly enough to undermine USDe's delta neutrality.

Currently, Ethena only holds 12% of LST collateral, given the high proportion of sUSDe returns that funding rates make up. Therefore, Ethena will not face any significant risk of LST illiquidity until more than 90% of the collateral is redeemed. In general, the Ethena team plans to reduce its exposure to LST by holding primarily ETH and BTC.

Nevertheless, as funding rates trend lower, Ethena may begin to increase its LST allocation as LST will make up a larger share of sUSDe returns. If Ethena holds 30-50% of LST, and all ETH and BTC collateral are sold, only illiquid LST is left for APs to redeem. This is where Ethena faces real risk in terms of redemptions.

Furthermore, if the market cannot absorb the sell-off of a large amount of LST, this will cause LST to decouple from the price of ETH, thereby undermining USDe's Delta neutrality. In addition, given that LST is often used as collateral in highly leveraged money markets, LST's decoupling could also trigger a liquidation cascade, further undermining USDe's Delta neutrality.

As a result, APs redeeming USDe will ultimately be given LST collateral that may be trading at a discount on a mark-to-market basis. If APs can only receive $0.90 in collateral per dollar, this will subsequently be passed on to end users in the market. As a result, USDe will decouple to $0.90 or lower.

As USDe decouples, those holding sUSDe must first unstake their sUSDe. As mentioned earlier, this requires a 7-day unlocking period. As a result, most users will likely choose to sell sUSDe directly to the market to hedge this duration risk. If there are not enough counterparties willing to take the other side of this trade and bear this duration risk, this will cause sUSDe to also depeg.

As USDe and sUSDe depeg, the more relevant risk is liquidation. Given that a large number of USDe and sUSDe holders leverage their exposure through high liquidation loan-to-value (LLTV) lending pools through protocols such as Gearbox, a depeg to $0.95 or even lower could result in a major liquidation cascade. Similarly, if there is not enough liquidity to absorb this sell-off, the two assets will depeg further, exacerbating this reflexive dynamic.

However, it is important to note that this will not be a reflexive depeg to zero like UST did. Furthermore, eventually liquidations will clear the remaining leverage in the system and selling pressure will ease. At this point, marginal buyers will enter the market to buy USDe at a significant discount, and eventually USDe will re-peg.

Therefore, the aforementioned scenario will not actually undermine Ethena's solvency as a protocol. Ethena's reputation will only take a hit. It is also worth noting that the preceding scenario ultimately relies on a series of contingent and highly unlikely assumptions:

Funding rates turn sharply negative

All USDe holders redeem at the same time

Ethena held a large amount of LST at the time

Redemptions consumed all more liquid collateral

The market lacks liquidity to absorb LST redemptions

DeFi is leveraged to the limit; a large amount of leverage in the system may leave after shards are liquidly pledged

The Ethena team does not intervene

Therefore, while further risk measures are still theoretically possible and may be worthwhile (e.g., further enriching the reserve fund or allocating only to the more liquid Lido stETH), the aforementioned scenarios would constitute a "left tail" event.

Auto-deleveraging risk

The last major risk is the risk of automatic deleveraging (ADL) on centralized exchanges.

This occurs in a high volatility environment, when an exchange incurs "bad debts" due to violent price fluctuations. ADL is the process of spreading the cost of these "bad debts" across otherwise profitable traders, causing them to be forcefully liquidated at the bankruptcy price of the bankrupt user.

This means that while Ethena's positions may be directly protected from such volatility due to only being leveraged 1x, they may still be affected indirectly through ADL.

For example, suppose a trader takes a 100x leveraged long position on ETH-PERP with a margin of 10,000 USDT. If ETH suddenly drops 4%, there will only be enough margin left to cover the 1% volatility. Therefore, if the trader's position is not liquidated in time, this difference will be considered a "bad debt". In a high volatility environment, this "bad debt" can accumulate quickly.

Normally, these losses will be covered by the exchange's reserve fund. However, if the reserve fund is completely depleted, ADL will occur. The remaining losses will be borne by traders who are more profitable and more leveraged at the time. These traders will then be liquidated at the bankruptcy price of the bankrupt user.

Thus, if Ethena were selected to conduct an ADL, this could force Ethena to take a significant loss, thereby destroying the "delta neutrality" of Ethena's position. This could trigger a panic and begin to catalyze the liquidation cascades described above. While Ethena's trading risks are spread across multiple CEXs, these risks ultimately apply to all exchanges.

That said, it is worth noting that while ADL events should be taken seriously, their probability of occurrence has historically been low, especially for more liquid assets such as ETH and BTC. For example, despite significant volatility, there have not been any major ADL events in the past five years. In addition, most exchanges today have "reserve funds" that serve as an additional buffer against ADL events.

In addition, if an ADL occurs, Ethena will be able to immediately reopen the position on the same exchange or another exchange. Therefore, Ethena’s reserve fund will cover any marginal losses and Ethena will quickly redeploy to keep USDe Delta neutral. In addition, the fact that Ethena settles P&L frequently should help reduce the chances of being selected for ADL.

Other Risks

There are a few other risks worth noting:

LST Depegging Risk - LSTs, especially the less liquid ones, may depeg independently outside of the redemption scenario described above. This could happen due to a haircut event or an exogenous liquidity crunch. In addition to the above risk measures (e.g., holding a smaller proportion of LST collateral), it is also worth noting that Ethena will only begin to phase out liquidations when the value of the collateral falls below the “maintenance margin”. Importantly, as the size of the derivative position increases, the maintenance margin also increases. Therefore, the stETH price must deviate by 65% relative to ETH before gradual liquidation begins.

Oracle Risk - Ethena uses an internal PMS system to determine the price assigned to collateral or received during minting/redemption of USDe. The internal system evaluates pricing from Ethena's trading venues, DeFi exchanges, OTC markets, and oracle providers such as Chainlink and Pyth. Ethena has implemented multiple layers of security to ensure that if incorrect data is ingested or the system produces unreasonable pricing, the protocol will not provide that price to users. Backup oracle data feeds also provide an additional layer of security.

Smart Contract Risk - Smart contract vulnerabilities account for the majority of DeFi and broader cryptocurrency hacks. To mitigate these risks, Ethena has conducted audits with Zellic, Quantstamp, Spearbit, Cantina, Pashov, Code4rena, and recently announced a public bug bounty program with Immunefi. In addition, much of the complexity of Ethena's operations occurs off-chain.

Unknown Unknowns - Finally, as with any deeply complex and interconnected system, there may be hidden tail risks. While these risks may seem obvious in hindsight, they are often beyond the scope of human intelligence at the time.

Ethena Scalability

So, how large can Ethena scale?

Since every dollar of USDe must be backed by an equal amount of short perpetual swap positions, Ethena’s scalability is ultimately limited by the size of the major cryptocurrency perpetual futures markets.

Currently, total open interest for ETH contracts is around $8 billion, excluding CME. The Ethena team believes that holding positions greater than 30% of total open interest introduces liquidity risk and affects the ability to safely unwind these shorts. Therefore, using only ETH as collateral, USDe should be able to safely scale to around $2.4 billion.

This alone would make Ethena the fourth largest stablecoin by market cap, but there are a few things to note.

First, as the price of ETH rises, open interest will grow at a greater proportion. Recent analysis by Chaos Labs found that for every 1% increase in ETH market cap, open interest increased by 1.2%-1.45%. This is likely because traders require more leverage to achieve their target returns. Therefore, at a 30% open interest ratio at a price of $5,000 ETH, USDe could theoretically support a market cap of $4.8 billion. While this alone would give USDe a similar market cap to DAI, it implies that ETH is the only collateral asset backing USDe. As mentioned earlier, Ethena recently added BTC as additional collateral to further enhance Ethena's scalability. While BTC does not have a built-in yield like stETH and is therefore slightly less attractive as a collateral asset, it adds a new $16 billion in open interest for Ethena to exploit.

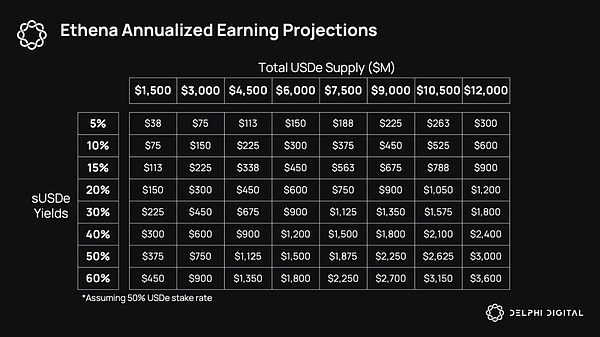

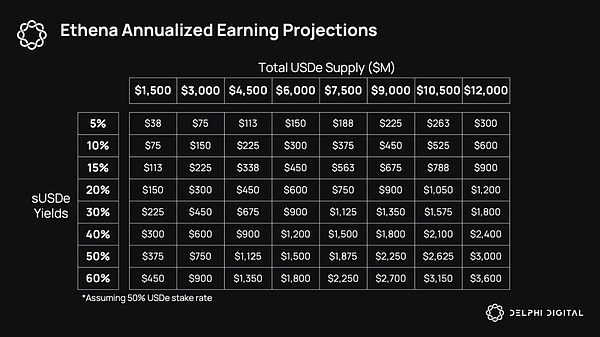

Thus, assuming BTC open interest accounts for 30% of the market, this would allow USDe to safely increase its market cap by another $4.8 billion. Overall, using current open interest data, this would expand USDe's total market cap to $7.2 billion. Assuming sUSDe's annual yield averages around 30%, and 50% of USDe is staked, Ethena's annual revenue would be close to $1.1 billion.

Similarly, as the price of BTC increases, BTC open interest will also expand in tandem. Using similar assumptions to ETH, BTC reaching $80,000 would give Ethena over $26 billion in BTC open interest to exploit. Therefore, with ETH at $5,000 and BTC at $80,000, USDe could theoretically scale to over $12 billion. Once again, assuming sUSDe earns a 30% annual yield and 50% of USDe is staked, Ethena's annual revenue would be $1.8 billion. Relatively speaking, this is 19 times Maker's revenue and 27 times Aave's revenue.

While the above scenario does rely on some optimistic assumptions, it's worth noting that even under more pessimistic forecasts, Ethena would still be one of the most profitable crypto protocols to date. If Ethena can simply maintain the current USDe supply of ~$2 billion and the sUSDe yield remains at ~40%, at a 50% collateralization rate, Ethena's annual revenue is expected to reach ~$400 million.

This alone makes Ethena one of the most profitable crypto protocols ever.

Macro Impact on DeFi

Now that we have a deeper understanding of Ethena, let's look at the broader CeFi, DeFi, and TradFi markets to explore its broader impact.

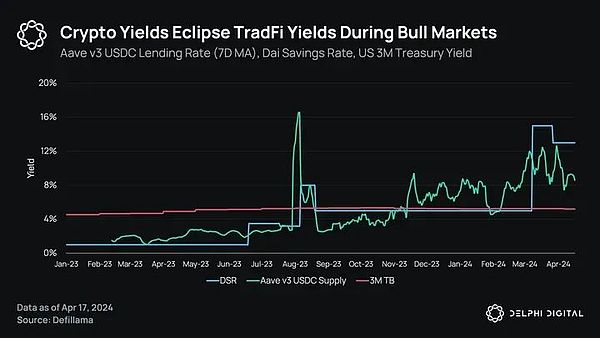

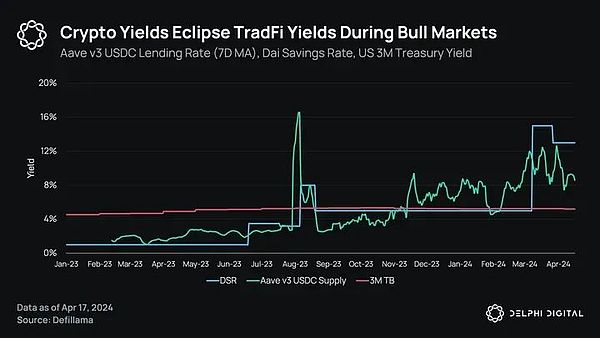

Based on historical performance, there are large differences in the yields of these markets. In an efficient market, all interest rates should theoretically boil down to the risk-free rate plus a risk premium, but this is not the case in reality.

We can use (1) 3-month Treasury bills (2) Delta Neutral Basis Trades (3) DAI Savings Rate (DSR) as alternatives to the “risk-free” rate in TradFi, CeFi, and DeFi, respectively.

While TradFi and DeFi rates are beginning to converge as MakerDAO and other DeFi protocols continue to introduce real-world assets (RWAs), CeFi rates remain significantly different. Since Delta Neutral Basis Trades are riskier than simply buying Treasuries or depositing USDC in Aave, the spread should exist, but sometimes the spread of up to 10,000 basis points seems unreasonable. Rather than reflecting a true “risk premium”, this spread reflects the complexity and inaccessibility of Delta-neutral trades.

In essence, this is Ethena’s fundamental value proposition - Ethena is essentially removing the “inaccessibility premium” embedded in CeFi interest rates by democratizing Delta-neutral trades and allowing them to be combined with the rest of DeFi. Therefore, USDe is actually a tokenized arbitrage tool that reconciles the interest rates of DeFi, CeFi, and TradFi.

Importantly, this reconciliation has second-order effects. Because USDe is essentially recalibrating DeFi’s benchmark interest rate, the rest of DeFi has begun to catch up. This has led to two key integrations worth noting.

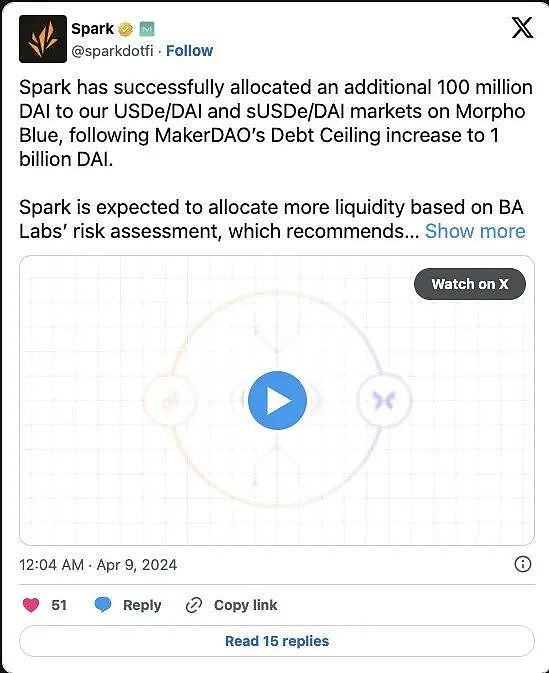

MakerDAO x Ethena x Morpho

While MakerDAO has historically maintained a relatively conservative posture, it has been at the forefront of adjusting to the second-order impacts of Ethena.

Maker’s first move was to increase the DAI Savings Rate (DSR) from 5% to 15%. For those who are not familiar with the DSR, the DSR is effectively the “risk-free rate” that DAI holders receive for staking their DAI. With sUSDe yields averaging 40% higher over the past three months, this move seems like a necessary step to maintain incentives for holding and staking DAI. Other protocols such as Frax have taken similar steps. These are early signs of the aforementioned DeFi/CeFi rate convergence.

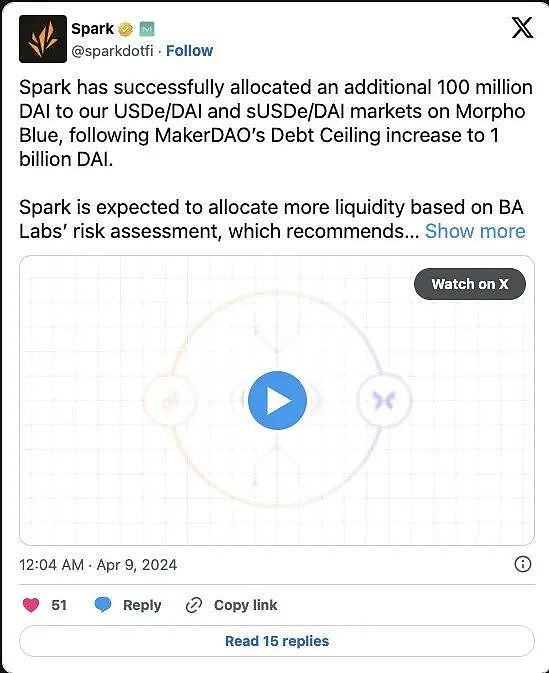

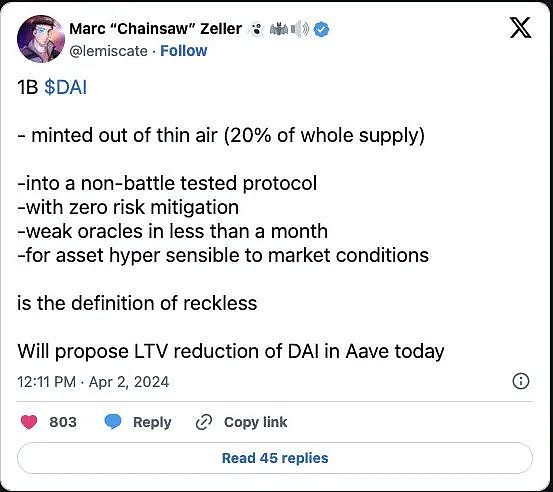

MakerDAO’s second move is more controversial. After deploying 100 million DAI to Morpho Blue’s Spark’s sUSDe/DAI and USDe/DAI markets via the Direct Deposit Module (D3M), Maker recently voted to increase this amount to a maximum of 1 billion DAI (22% of DAI backing). This will be deployed gradually based on the overall health of the protocol and D3M’s cash flow.

For those who are not familiar, Morpho Blue is a modular lending primitive that allows any third party to create and manage their own lending pools. Spark is a child DAO of Maker that manages the sUSDe/DAI and USDe/DAI pools.

The net effect of this integration is that users are able to deposit sUSDe or USDe into these lending pools on Morpho and borrow DAI against it. Not only does this inherently boost demand for DAI, but given that Maker is effectively the “lender” in this scenario, Maker is able to earn the annual percentage yield (APY) paid by borrowers.

Currently, borrowers are paying a 20% APY on the 100 million DAI currently deployed. In theory, this should be slightly lower than the yield on sUSDe, as borrowers are effectively arbitrageurizing this spread. Importantly, this makes this integration very beneficial to Maker - as long as the yield on sUSDe remains high, Maker will be able to take full advantage of it.

To put things into context, if Maker injected an additional 900 million DAI today, and the APY remained the same, this would generate $200 million in annual revenue for Maker, assuming the cap is reached. While this is certainly optimistic, this amount is nearly three times Maker’s current annualized revenue.

As expected, this move by Maker has not been without its critics. While on the surface this may seem like a “risk-free” bet, the reality is that there is no such thing as a free lunch.

The biggest risk ultimately lies with the liquidation and oracle mechanisms. Given the relatively high liquidation loan-to-value (LLTV) ratios for these loans, a brief decoupling or oracle failure could trigger an unwanted liquidation, even though the underlying value of sUSDe or USDe has not actually changed. This could then set off a cascading effect where one liquidation triggers more liquidations.

To mitigate these risks, Spark made the difficult decision to “hardcode” the oracles. This means that the price of DAI and the price of USDe or sUSDe are fixed at the same price. In other words, the two assets cannot decouple as far as the oracle is concerned.

This then begs the question of how liquidations are triggered. Importantly, like any liquidation, liquidations for fixed rate loans are based on the loan-to-value ratio (LTV).

LTV = (Loan Size) / (Collateral Value)

However, unlike variable oracle loans, which typically qualify for liquidation based on changes in the denominator (i.e., collateral value), fixed oracle loans are liquidated based on changes in the numerator (i.e., loan size).

More specifically, liquidations will only occur when the accumulated interest makes the position liquidable. To incentivize healthy liquidations, Morpho has a clever mechanism that doubles the borrowing rate approximately every 5 days when the market is at maximum utilization. This allows positions to be liquidated relatively quickly under a fixed pricing mechanism.

While this model works smoothly in most cases, there are some unique scenarios worth noting that could cause problems.

First, in the event that USDe depegs and its fundamental value falls below the loan’s LLTV, bad debts could accumulate because the oracle does not know the price of USDe. Borrowers would effectively borrow more than the value of their collateral. This highlights the importance of setting a slightly lower LLTV for hardcoded lending pools. As a result, Maker is over-allocated to pools in the 77%-86% LLTV range.

The second risk is in liquidation incentives.

By design, Morpho liquidators receive a “liquidation bonus” to incentivize healthy liquidations. This bonus is a fixed percentage of the liquidated assets in return for repaying liquidable loans. However, the important detail is that when using a fixed oracle, the value of the asset is not based on its market value, but rather on an equivalent price fixed by the oracle price.

Thus, if USDe depegs to $0.85, and the liquidation bonus is only 5% on a 95% LLTV loan, this means that the liquidator will pay $0.95 to repay the loan, but only receive $0.90 ($0.85 + 8% liquidation bonus) in return. Therefore, the liquidator has no incentive to liquidate the loan when the USDe market value is below $0.90, as they would actually lose money.

Therefore, the only party with an incentive to liquidate this position is Maker itself, as they ultimately own the loan. Maker will then repay the loan by minting some DAI and quickly destroying it in a single atomic transaction. In the process of closing the loan, Maker will now hold sUSDe, which, importantly, is no longer worth $1.

Assuming sUSDe is marked to market on the MakerDAO balance sheet, these losses would then be ultimately borne by MKR holders as bad debts. So while on the surface MakerDAO does not appear to be directly exposed to Ethena’s risks, there is in fact some indirect exposure. So the risks that apply to Ethena also apply to Maker, albeit to a slightly lesser extent.

While the above analysis highlights the risks implied by MakerDAO, it is important to ultimately view this integration through a “risk-adjusted” lens. If funding rates remain significantly elevated, Maker has the opportunity to potentially double its revenue. So while these risks may indeed come at the expense of MKR holders, the upside potential appears to have a clear asymmetry.

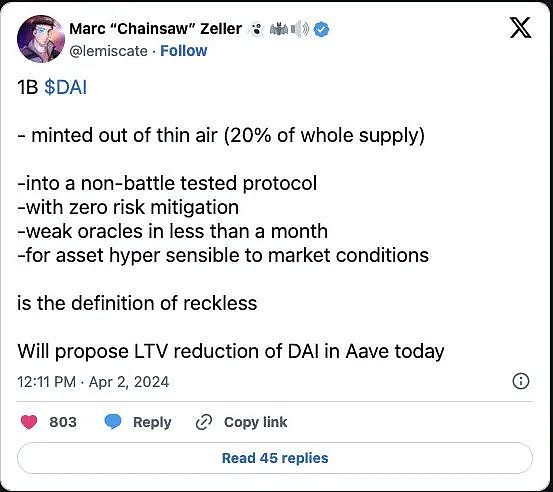

That said, this asymmetry is not necessarily passed on to other lending protocols that use DAI as collateral. Instead, protocols like Aave appear to be bearing the risks of this integration without participating in any of the benefits. As a result, Aave recently passed a proposal to reduce the DAI liquidation threshold by 1% for every additional 100 million DAI distributed through D3M. In theory, this means that as the risk of DAI increases, Aave reduces its risk exposure accordingly.

An important feature of USDe is that it has the potential to build DeFi's first scalable yield curve.

For those who are not familiar with Pendle, a brief introduction, Pendle is a DeFi protocol that allows users to divide yield tokens into principal tokens (PT) and yield tokens (YT). Users can buy PT to lock in fixed returns, or buy YT to speculate on changes in returns.

While Pendle has found initial product-market fit primarily through users purchasing YT to speculate on points liquidity staking opportunities, there appears to be a larger opportunity at the intersection of Pendle and Ethena's architectures.

In addition, if Ethena is able to split sUSDe into different maturities (e.g., 1 month sUSDe, 3 month sUSDe, 1 year sUSDe, 3 year sUSDe, etc.), Pendle can create a yield market on top of it. The net effect will be a scalable yield curve on which users can speculate and lock in future sUSDe returns.

While this integration may seem trivial, the importance of fixed income products to TradFi and DeFi in operating at scale is fundamental. The ability for large institutions to hedge forward rates could unlock idle capital that was previously constrained by DeFi market volatility.

Therefore, in the long run, this integration between Ethena and Pendle may become an inflection point for the institutional adoption of DeFi.

$ENA

So far, the launch of Ethena has become one of the most successful protocol launches in crypto history. This success is largely due to Ethena's carefully planned airdrop event.

Currently, Ethena has divided the event into two phases. The first phase uses Ethena's points, called "shards", which are mainly used to incentivize the liquidity provision of USDe in the Curve pool. At the end of the first phase, 5% of the total supply of ENA was airdropped to shard holders.

The second phase will last until September 2, or until USDe supply reaches $5 billion, and essentially does the same thing, but renames "shards" to "sats." Users can earn "sats" through similar incentive programs, such as USDe liquidity provision (LP) or using USDe to interact with other DeFi protocols such as Maker, Morpho, Gearbox, and Pendle.

While Ethena has not yet announced the exact amount of the airdrop, "sats" holders will receive a certain share of ENA tokens at the end of the second phase of the event. As the post notes, ENA tokens will be used for governance voting on the following:

General risk management framework

Composition of USDe backing

Exchange exposure

Custody exposure

DEX integration

Cross-chain integration

New product priorities

Community grants

Size and composition of the reserve fund

On sUSDe

For the reasons above, ENA is currently primarily a governance token. That said, once the reserve fund is large enough, there may be proposals in the future to implement a revenue split or buyback and burn mechanism to return some of the value created by Ethena to token holders.

Currently, Ethena's annualized revenue is close to $200 million, making it one of the most profitable DeFi protocols today. Given that Ethena pays revenue in sUSDe instead of USDe, Ethena's profitability ultimately depends on the difference between sUSDe and USDe supply.

While Ethena's revenue will certainly be affected after the shards event ends as the incentive to hold USDe will be reduced, this should be much lower than the impact experienced by most projects. This is because stablecoins are one of the few crypto areas with built-in network effects. In other words, as more asset pairs are denominated in USDe and more protocols begin to accept sUSDe as collateral (like MakerDAO), these standards will become more deeply embedded in the fabric of DeFi. As a result, USDe adoption is likely to be very durable.

Thus, from a fundamental analysis perspective, Ethena could become one of the most profitable businesses in the entire crypto space. Not only will they have some of the highest profit margins in DeFi, but more importantly, those profit margins will remain stable because any emerging competitor will have difficulty achieving the same secondary market utility as USDe. In other words, while code may be a commodity in the crypto space, you can't replicate the "moneyness" of USDe at scale.

Looking Forward to Ethena

After launching one of the most successful protocols in history, USDe is now the fifth largest stablecoin with a market cap of $2.3 billion. As the market demand for yield continues to increase, reaching the goal of $10 billion seems to be in sight.

In addition, Ethena's moat continues to expand. By aligning incentive mechanisms with other protocols, Ethena's USDe standard has quickly gained popularity in DeFi. As a result, despite competitive pressure, Ethena's market position remains solid.

However, Ethena's impact on the crypto market is not without side effects. As USDe expands, risks such as negative funding, illiquidity in redemptions, and liquidation cascades are also increasing.

While the Ethena team has done an excellent job of identifying and managing these risks, some risks may change dynamically over time. Therefore, it will become increasingly important to remain flexible and constantly re-evaluate strategies.

Finally, as Ethena continues to coordinate yields across DeFi, CeFi, and TradFi, we appear to be entering a new interest rate paradigm. With protocols like Maker, Morpho, and Synthetix leading the way, expect other projects to find ways to integrate DeFi's new benchmark yields.

JinseFinance

JinseFinance