Author: James Butterfill, Coinshares Research; Translation: 0xjs@科技网财经

In the field of commodities, a demand shock refers to a sudden and significant change in the demand for basic commodities or raw materials caused by unforeseen events. . A positive demand shock results from an increase in demand, which may be due to technological innovation, policy changes, or changes in consumer preferences, resulting in higher prices.

China's economic boom in the early 21st century, with the acceleration of real estate development, had an impact on demand for commodities, causing steel prices to rise by 793% between 2000 and 2008. The response, in the form of increased production, caused steel prices to fall by 80% over the next decade.

We believe that Bitcoin is currently experiencing a positive demand shock. The U.S. Securities and Exchange Commission (SEC) approves spot-based EFTs, allowing Bitcoin to access more than $14 trillion in assets, although This is known, but its timing is unclear, and the size of the resulting inflows is not widely agreed upon.

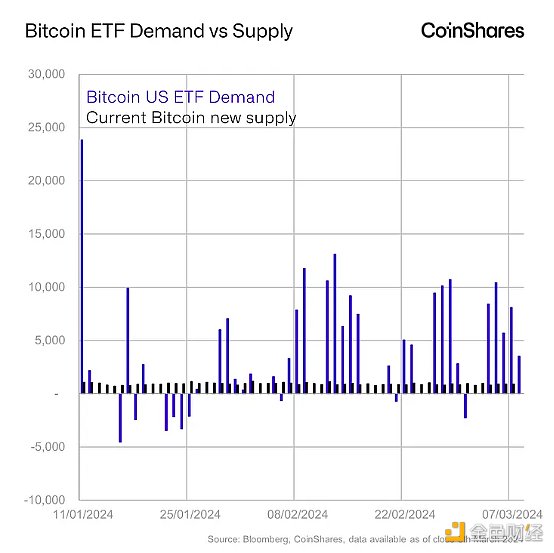

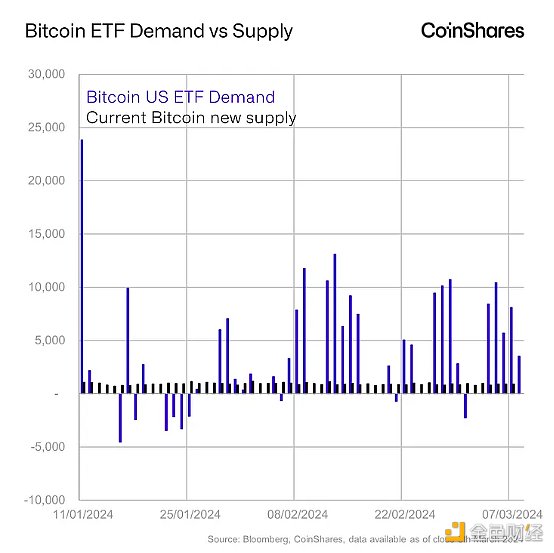

So far, Bitcoin ETFlaunched on January 11 Later, its average daily demand was 4,500 Bitcoins (only on trading days), while the Bitcoin network mined only 921 new Bitcoins per day on average.

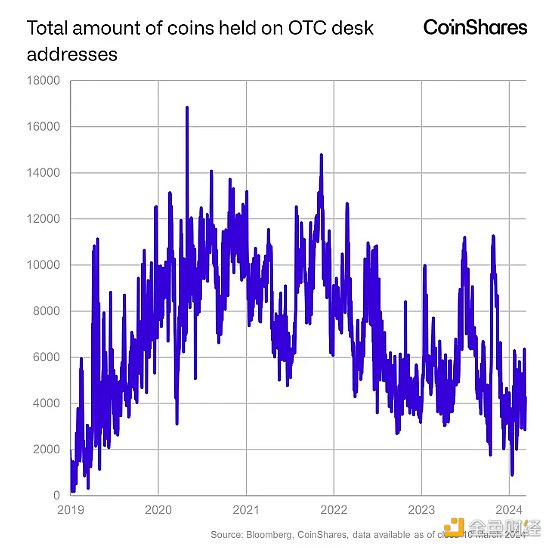

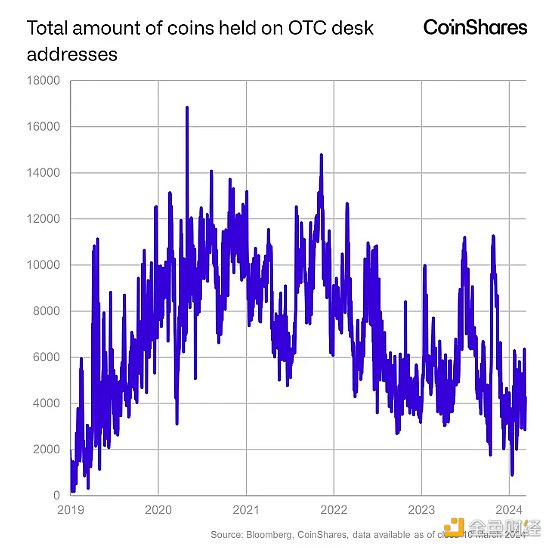

This has led to the massive BTC price increases we have seen in recent weeks, as the supply of newly issued BTC has been unable to keep up with demand, resulting in ETF issuers having to source primarily from the secondary market. We can see this in the data, where token holdings in OTC desks have fallen 74% since their peak in 2020, most likely due to demand for ETFs in recent years.

The first two months , U.S. ETF inflows exceeded a record $10 billion, dwarfing the $288 million in inflows in the first two months of the first gold ETF launched by iShares in 2005. In the first 2 months of 2020, before the halving, ETPs saw $436 million in inflows, accounting for 11% of total assets under management, very similar to today, with recent inflows also accounting for 11%, although in nominal terms today’s inflows Volume is 23 times higher than in 2020.

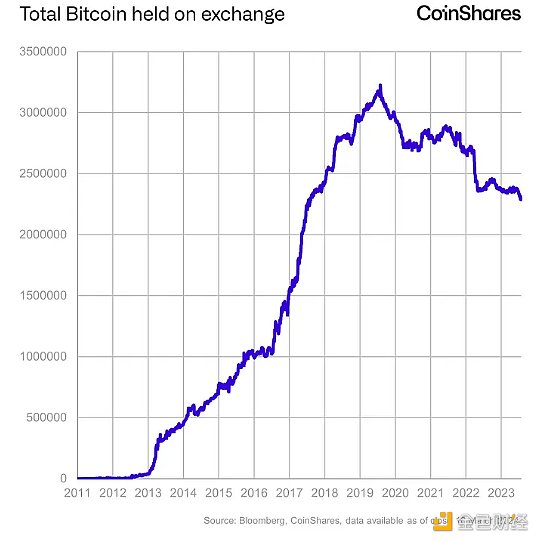

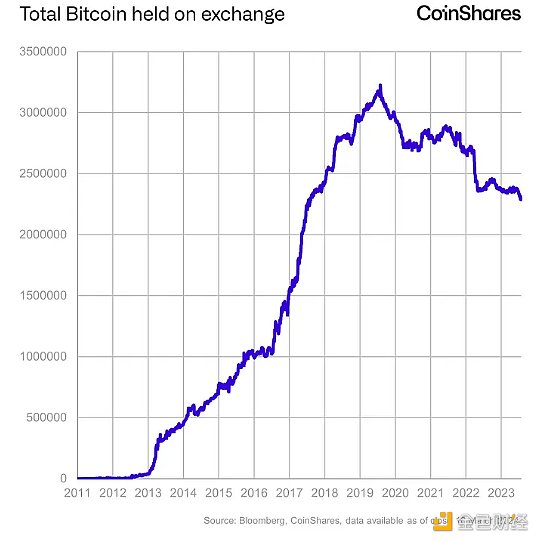

We have also seen a significant decrease in BTC held on exchanges since 2020, as investors increasingly Increased use of ETPs and self-custody of Bitcoin has seen exchange holdings of BTC fall by 29% as they increasingly view Bitcoin as a store of value.

At the current buying rate of about 4,500 BTC per day, it will take 573 days to reduce the exchange's Bitcoin balance to zero - so there is still a long way to go There is a way to go.

After a demand shock occurs in commodity markets, there is usually a supply response. Over time, suppliers adjust production levels to respond to new demand conditions. In the case of a positive demand shock, producers may increase production capacity or seek ways to increase efficiency to meet higher demand. However, This is how Bitcoin differs from commodity markets, as Bitcoin has a fixed, unchanging supply that is programmed to be traded every 210,000 Blocks or approximately every 4 years will halve the newly issued supply.

Ultimately,the market seeks a new balance at the intersection of supply and demand. This adjustment process can be fast or slow, depending on the magnitude of the shock, and given the inflexibility of Bitcoin’s supply, only a rise in price can seek a new equilibrium. This is why we have seen such a sharp increase in the price of Bitcoin in the past two monthsThe demand for ETF issuance and the upcoming halving have exacerbated the problem.

The halving is well-known information and should, at least in theory, be factored into the price. One could argue that the rise in prices after the 2020 halvings is more a result of US COVID stimulus measures than the halvings themselves. Statistically, there is only a sample size of 3 prior events to refer to, so it would be dangerous to draw any conclusions. However, it could have an element of becoming a self-fulfilling prophecy, especially if there is a large number of trades related to the event, despite the current low positioning of futures market traders surrounding the event.

In any case, There are several other price support factors for BTC prices this year, the most important of which is the development of U.S. registered investment advisors (RIA) is able to incorporate Bitcoin ETFs into client portfolios. However, we believe these inflows will eventually diminish, reducing their impact on prices. If these inflows begin to taper off later this year, we expect Bitcoin prices to recalibrate in line with interest rate expectations. With the Federal Reserve expected to cut interest rates later this year, this could serve as additional support for Bitcoin prices.

Cheng Yuan

Cheng Yuan