Author: Climber, Golden Finance

Recently, the storage sector of the DePIN track has experienced significant growth. Projects represented by Filecoin, Arewave, Storj, and Siacoin have all reached new stage highs, and the newly raised funds of 800 The $10,000 storage project CESS has also been simultaneously promoted by KOL many times. In this regard, many analysts believe that the market trend is moving to the storage sector, and the battle for the leadership of the storage system has begun.

DePIN has previously been regarded as one of the fields with the most explosive potential in 2024. Messari predicts that the current total potential market in the DePIN field is approximately US$2.2 trillion, which may reach approximately US$3.5 trillion by 2028. Data storage is particularly promising. According to the Fortune Business Insights Report, the centralized storage market will be valued at US$217 billion in 2022 and is expected to grow to more than US$777 billion by 2030.

Regardless of whether DePIN can break out as expected, it is still early days at this stage, and the layout risks at this time are relatively small. Under the segmentation of the track, the storage sector bears the brunt. Therefore, this article systematically sorts out and conducts comparative analysis on the above five popular projects in order to find value points worthy of attention.

1. Basic information

DePIN refers to infrastructure-related projects that utilize blockchain technology and cryptoeconomics, aiming to encourage individuals to allocate capital or unused resources to create a more transparent and verifiable network with the goal of achieving a more efficient scaling trajectory than centralized networks.

In short, DePIN is a collective name for a certain development narrative direction of blockchain, which uses tokens to incentivize communities (rather than companies) to build physical infrastructure networks (such as mobile, electric vehicles) from scratch charging, telecommunications, etc.).

As for the sub-industry of this field, distributed data storage refers to decentralized storage systems running on a peer-to-peer ("P2P") network model, user-driven storage provision Merchants ("SPs") or miners allocate unused computer resources and earn compensation in the project's native token.

The following are 5 representative projects of the DePIN storage system:

Filecoin:

Filecoin is a decentralized storage network that acts as an incentive layer on top of the IPFS network. Filecoin utilizes idle hard drive space and bandwidth to provide data storage and retrieval services in an open market, allowing anyone to participate as a storage provider and profit from the idle capacity of hard drives.

Features: Filecoin is designed to store data in a decentralized manner. Unlike cloud storage companies like Amazon Web Services or Cloudflare, which are prone to centralization issues, Filecoin leverages its decentralized nature to protect the integrity of data location, making it easy to retrieve and difficult to censor.

The Filecoin system involves three parties: client, storage miner and retrieval miner. These groups of users interact closely with each other, completing transactions, exchanging information and making payments using FIL.

Arweave:

Arweave is a decentralized data storage protocol that enables data to be stored permanently and on its permaweb superior. permaweb is a secondary network that makes data accessible in a human-readable way (e.g. via a web browser). Arweave financially incentivizes data storage providers through AR tokens, and the mainnet launched in June 2018.

Features: Arweave allows users to store data permanently on the blockchain for a one-time fee, making it ideal for Metaverse, DeSci and social media project applications that require data preservation.

Arweave’s one-time payment and lifelong use also solves the cumbersome process of users needing to continuously subscribe. Arweave also promised to provide users with storage services for at least 200 years.

Storj:

Storj is an open source, decentralized cloud storage layer that enables developers to Data protection and privacy features are built into the application, and it uses a decentralized network of nodes to host user data. The STORJ token enables coordination between different parties in the network to transfer value at scale in a manner consistent with the goals of the broader network, including immutability, security, and third-party verifiability.

In the white paper released in December 2014, Storj was first introduced to the world as a concept. Two years later, an updated white paper was released. Described here is a decentralized network that connects users who need cloud storage space with those who have hard drive space for sale. The platform was launched in late 2018.

People with hard drive space and a good Internet connection can participate in the network. They become a unit in the network, called a node. Space providers will be rewarded with Storj tokens.

Features: Unlike traditional cloud storage solutions that store data in large data centers, Storj runs on a network of thousands of independent computers. Anyone with a few extra terabytes of space can become a node on the platform by installing Tardigrade. All that is required is a strong and consistent internet connection.

The efficiency of the network means hosts pay much less for data storage than when using traditional cloud storage services.

Siacoin:

Siacoin is a distributed decentralized cloud storage platform based on blockchain, providing decentralized cloud data storage capabilities and a peer-to-peer marketplace. Siacoin connects users who need file storage with hosts around the world that provide underutilized hard drive capacity, guarantees storage transactions through smart contracts, and provides more reliable and affordable services compared with traditional cloud providers. The main goal of the project is to become "the backbone storage layer of the Internet."

Siacoin was originally released in May 2014 and was revised and launched in May 2015.

Features: According to its white paper, Siacoin’s long-term goal is to compete with existing storage solutions. It sees itself in direct competition with major cloud storage providers like Amazon, Google and Microsoft. Due to its decentralized nature, Siacoin is able to offer competitive storage rates.

Files stored on the Siacoin network are divided into 30 encrypted segments, with each segment uploaded to a unique host for redundancy. Agreements between uploaders and hosts are recorded on Siacoin’s blockchain and enforced using smart contracts. Siacoin serves as a payment method on the network. Tenants use SC to pay the host, and the host locks the SC in a smart contract as collateral.

Cumulus Encrypted Storage System (CESS):

CESS was established in 2019. It is a Layer 1 based on DePIN design, compatible with WSAM and EVM smart contracts, and supports encrypted native applications to be launched directly on the CESS chain. It promotes on-chain data sharing, DAPP development and efficient networking through global node deployment.

CESS aims to become the first decentralized cloud storage network for enterprise-level commercial applications, and is developed based on the Substrate open source framework. A total of four layers of network are used, including node types such as storage, consensus, cache and retrieval, to provide users with efficient and convenient cloud storage services.

Currently, users can provide storage space and hardware resources to become nodes, and receive CESS token rewards for mining. After the mainnet goes online, they will receive CESS rewards simultaneously.

Features: CESS supports data valorization and free circulation/sharing of data value within the network, while using a trustless approach to achieve user data privacy protection and absolute data sovereignty. CESS's first decentralized object storage service (DeOSS) is S3 in the field of decentralized storage.

It has an original design of Proof of Idle Space (PoIS), Proof of Multiple Backup Recoverable Storage (PoDR²) and SGX-based TEE Worker.

2. Data comparison:

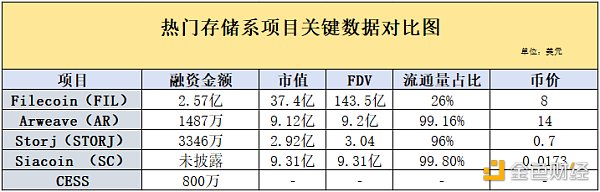

From the content introduction and business characteristics of the above five projects, each has its own merits, but the common point is decentralization Deeply develop products and services on the global storage track with token incentive model. But at this stage, several projects have obvious differences in data performance in multiple dimensions.

First of all, start with project financing Judging from the results, Filecoin has received the most funds, with a total financing round of US$257 million, followed by Storj, with US$33.46 million, which can also be called a big project. Siacoin did not disclose financing information to the outside world, and what is worse is that in August 2022, Skynet Labs, the blockchain company behind Siacoin, closed due to being unable to raise more funds.

It is worth noting that in addition to receiving investments from well-known institutions such as a16z Crypto, Pantera Capital, and DCG, Filecoin also has Sam Altman on the list. CESS recently received US$8 million in funding at the end of last year.

Secondly, from the perspective of market value, Filecoin currently far exceeds other similar projects, leading the second place by more than 4 times. Arweave and Siacoin have similar market capitalizations, and neither has yet broken through the $1 billion mark. Except for CESS, which has not yet issued a currency, Storj ranks at the bottom with a market capitalization of only about US$300 million.

It can be seen from the two data of circulation ratio and FDV that, except for Filecoin and CESS, almost all other project tokens have entered the market circulation, and there is not much pressure to unlock. However, it should be noted that Siacoin does not have a maximum supply, so there may be inflation risks in the future.

Filecoin’s fully diluted valuation (FDV) is 4 times its market capitalization (MC), which shows that there is considerable selling pressure on the project and that value needs to be discovered in the long term.

In terms of currency price performance, as of this writing, FIL has risen from a low of around US$2.7 in June 2023 to a recent high of US$8.482, an increase of 214.8%; AR has risen since The low of $3.68 in October last year rose to a high of $16.5, an increase of 348.3%; STORJ rose from a low of 0.191 last year to a high of 1.233, an increase of 545.5%; It rose from a low of 0.00254 to a high of 0.0193, an increase of 659.8%. CESS has not issued coins yet.

However, the Filecoin 2023 fourth quarter status report released by Messari shows that the project’s multiple data have achieved growth. The specific information is as follows:

Filecoin's storage market continued to grow in the fourth quarter of 2023, with active transactions increasing by 23% quarter-on-quarter and by 414% year-on-year. At the same time, storage utilization increased from 13% in Q3 of 2023 to 18% in Q4 of 2023, while Filecoin’s storage capacity continued to decrease by 15% month-on-month.

As of the end of 2023, more than 1,800 customers have introduced data sets on Filecoin, of which 465 customers have data sets of more than 1,000 TiB, a month-on-month increase of 10% and a year-on-year increase of 196%. Additionally, since the launch of FVM in March 2023, TVL has exceeded $230 million by the end of 2023.

Arweave recently released data showing that it has achieved a number of achievements. According to its official website, the total transaction volume of Arweave’s ecosystem has reached 3 billion, and the overall TPS has reached 300+. In addition, the project's main network has completed more than 140 million transactions and achieved 884.32 GiB storage in a single week.

Storj’s official website shows that there are currently more than 16,000 active storage nodes around the world. Storj achieved a year-on-year revenue growth of 226% in 2023, and the data stored increased by 43% month-on-month and 222% year-on-year. The company expects this acceleration to continue through 2024.

And Storj CEO Ben Golub said: Project customer data will more than double in 2023, performance will also double, billions of objects are stored in the network, distributed in tens of thousands On the node, there are more than 25pb of customer data.

Siacoin has been operating since 2015 and its software has been downloaded more than 1 million times. Additionally, thousands of terabytes of data have been uploaded to the web since its inception.

CESS is currently still in the testnet stage, and has undergone 12 rounds of testnet upgrade iterations. One of the testnet versions has attracted more than 6,300 nodes for collaborative development, and currently more than 40,000 nodes have participated in testing. The ongoing testnet v0.7.5 adds nearly a thousand new storage nodes, providing over 6+ PiB of storage capacity.

3. Project Progress

Since the global economy and the encryption industry as a whole are in a warm trend from bear to bull in 2023, the data of each project is relatively It is not surprising that there has been an increase over the past two years. Judging projects requires more dimensions. How many substantive construction behaviors the project side has performed in the past can better tell whether it has long-term pursuits.

Filecoin:

In February this year, Solana completed the integration with Filecoin. In the future, Solana will use Filecoin to enable infrastructure providers , explorers, indexers, and anyone who needs historical access can more easily access and use their block history.

In October last year, the Filecoin development team Protocol Labs launched the Venture Studio program to develop and support new startups using Filecoin, IPFS, libp2p, Ethereum and other technologies in the Protocol Labs ecosystem. Build breakthrough technologies.

In addition, the Uniswap community’s proposal on “Deployment of Uniswap V3 on Filecoin Virtual Machine” was approved.

In September, the privacy browser Brave, the encryption privacy currency Zcash protocol development company Electric Coin Company (ECC) and the Filecoin Foundation reached a cooperation to introduce new privacy features to the Brave browser and its built-in wallet. And Australia's Victor Chang Heart Institute chose Filecoin to store its research data.

In August, LongHashX, an accelerator owned by LongHash Ventures, announced that it would cooperate with ProtocolLabs and Filecoin to launch the Filecoin Virtual Machine (FVM) Genesis accelerator; in July, Mining machine manufacturer Bitmain announced the launch of Filecoin mining machines.

In the first half of the year, Filecoin launched Filecoin Web Services (FWS), aiming to build open source alternatives to AWS, Google Cloud and Azure.Filecoin Virtual Machine (FVM) was officially launched on the Filecoin mainnet in March, and the network was upgraded to v18. Nicknamed "Hygee", Filecoin has programmability for the first time.

< strong>Arweave:

At the beginning of this year, Arweave launched AO and plans to open the test network on February 27.

However, In December last year, there was internal strife in the Arweave community and founder Sam Williams threatened to file a lawsuit against Irys, the middleware that supports 90% of the Arweave network. The dispute is currently unresolved.

In March, Arweave 2.6 version was launched, mining The mining difficulty and block production speed tend to be stable.

In November 2022, Arweave was integrated into Meta, which uses Arweave to store the digital collections of Instagram creators.

Storj:

Storj’s project updates are rarely seen on media platforms, and most of what is exposed is transaction information, which shows that there is a multi-party capital game behind it.< /p>

However, in November last year, Storj launched Storj Select: a secure and customizable cloud storage solution for compliance-focused organizations. In October, Storj became an Adobe Premiere Pro's storage cloud platform.

In addition, in March, Ankr cooperated with Storj to launch the node deployment infrastructure Chainsnap. Chainsnap integrated Ankr's blockchain data snapshot and Storj's decentralized storage network, reducing the time required for node deployment. .

In February, Storj launched a new version, Storj Next, with added features including staking, permanent storage, etc. The new version aims to monetize underutilized storage space.

It is worth noting that the current largest holding of STORJ is Upbit.

Siacoin:

In January this year, Siacoin launched renterd v1.0.

In addition, in 2023, Siacoin S3 will be integrated with multiple projects, including IPFS, Nextcloud, Duplicati, and S3FS.

CESS:

In January this year, CESS launched the v0.7.6 version of the Incentive Test Network. In December last year, CESS completed $8 million in financing.

In addition, as early as the 2021 Global Web3 Hackathon Competition, the CESS team proposed a solution called FMD-CESS and won the championship project. And has received funding from the Web3 Foundation three times. In February this year, FMD-CESS won the first prize in the “Blockchain Development” section of the Asia-Pacific region of Polkadot Global Hackathon.

Conclusion

At this stage, only from the perspective of currency price increase, Siacoin (SC) is far ahead with 659.8% , Filecoin (FIL) did not rise satisfactorily under the crypto calf market. However, judging from the project team's own performance and the expectations of the outside world, it is obvious that Filecoin is more promising and has even attracted investment from Sam Altman. Arweave’s exposure and discussion on social and media platforms are also increasing, and Storj is even more sought after by hype funds. As for Siacoin, it is a typical example of silent wealth.

Assuming that the DePIN track becomes the mainstream narrative in the future, more capital and new forces will inevitably flock to it. At this stage, there are five early-stage projects in the storage sector. Who will have the last laugh depends on the project party's depth in the storage business and the choice of external users.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  链向资讯

链向资讯