Author: Tariz Source: mirror Translation: Shan Ouba, Golden Finance

Summary

This paper introduces a derivatives market that enables rollups to achieve fast finality, promoting voluntary participation and fair competition among rollups, proposers, and builders. This incentive alignment between Ethereum and rollups in the derivatives market helps mitigate the operational risks associated with rollups. Our unique design enables rollups to act as preconfirmation providers, thereby achieving fast preconfirmation and enhancing their censorship resistance. This capability ensures true scalability for rollup users.

Motivation

Rollups operate by processing user transactions outside of Ethereum and transmitting them in compressed form to Ethereum. This mechanism enables users to experience lower transaction costs and faster transaction speeds. However, fast transaction processing in rollups is achieved through a commitment between the rollup and its users, and is vulnerable to incentive misalignment between Ethereum and the rollup.

Rollups promise to settle a transaction’s post-execution state on Ethereum, based on which users commit to the next transaction. This commitment to a valid state transition is guaranteed by the rollup’s cryptoeconomic mechanisms. However, this does not ensure that the rollup’s transactions will actually be included in Ethereum blocks.

Currently, Ethereum is under no obligation to include rollup transactions in its blocks. More precisely, Ethereum proposers may choose not to include rollup transactions. This situation stems from incentive misalignment, and even if including rollup transactions in Ethereum blocks benefits the entire Ethereum ecosystem, it does not necessarily benefit a specific proposer.

Encouraging Ethereum to voluntarily cooperate to finalize rollup transactions is a difficult task. If Ethereum participants do not cooperate to finalize rollups, then rollups cannot inherit Ethereum’s security for an extended period of time. This situation can lead to delays in finality and service interruptions, causing users to have unnecessary concerns when creating the next transaction, which directly affects the reliability of the service. To ensure that rollup users can enjoy the true scalability of rollup without worry, it is key to align incentives and encourage Ethereum participants to voluntarily participate in the finality of rollup.

Fast Finality Based on Ordering

Fast finality means that the rollup can guarantee that the state after execution will be settled on Ethereum. To achieve this, the rollup must make two promises in advance: 1) ensure that the user's transaction can be included in Ethereum, and 2) verify that the integrity of the state transition is valid.

Based on Ordering, as Justin proposed, the first promise can be achieved by using Ethereum proposers as pre-confirmation providers for rollups. This approach aligns incentives between rollup and Ethereum, allowing users to obtain guarantees about transaction inclusion directly from Ethereum. Pre-confirmation tips and slashing incentives ensure that Ethereum proposers maintain an incentive to fulfill their promises. Three potential methods for implementing this include:

1. Direct Proposer Commitment: This involves designating Ethereum's proposer as a preconfirmation provider, issuing signed preconfirmations directly to rollup users. The advantage is that you can get deterministic guarantees directly from Ethereum and inherit Ethereum's liveness. The disadvantage is that it will cause latency and centralization of Ethereum due to the proposer's overhead.

2. Commitment via Relay: This method increases the likelihood that a user's preconfirmation will be included with the help of a third party. The advantage is that it prevents rollups and proposers from being overloaded with additional roles. The disadvantage is that there may be trust issues with relays, and depending on the method, the commitment may not be deterministic but probabilistic.

3. Blockspace Buyer Commitment: This method allows the rollup to act as a preconfirmation provider and pay the proposer in advance for certain block construction rights. The advantage is that by having a block for finalization, rollup can deterministically commit to users and achieve fast pre-confirmation through its ordering. The disadvantage is that rollup needs to face the operational risk of determining future block prices.

Each approach has significant potential, but the third option has not been widely discussed due to the operational risk of determining Ethereum block prices. This paper proposes a derivatives market that aims to mitigate the operational risk of rollup while promoting active participation of all trading parties.

This derivatives market is associated with the delegated pre-confirmation and fast pre-confirmation implementation mentioned in the ordering.

Forward Contract (Proposer and Rollup)

Rollup can lock in Ethereum blocks in advance by purchasing the proposer's block construction rights on a specific slot, thereby achieving fast finality of transactions. This process is similar to forward contracts commonly seen in financial markets. To understand the operational risk that a rollup faces due to forward contracts, let’s look at a simple scenario involving a proposer’s 32-slot lookahead and a slot auction on the beacon chain.

Forward Contract Overview

In this scenario, a forward contract allows a rollup to lock up a slot from a proposer at a predetermined price, providing the rollup with guaranteed space on the blockchain. Here’s a step-by-step breakdown of the transaction:

At t = 0, the rollup knows the proposer for the next round.

At t = 1, the rollup participates in the slot auction, purchasing a forward contract with the proposer for a specific slot.

Starting from t = 2, the rollup, after obtaining a slot, orders its users’ transactions, provides pre-confirmations to users, and earns revenue from their blocks.

At t = 3, the rollup requests to execute the forward contract, i.e. compress its transactions into an Ethereum block and submit it to the proposer.

At t = 4, the proposer fulfills the contract by signing the received block and proposing it to the Ethereum blockchain.

Operational Risks of Rollup

The above scenario exposes several risks of rollup in terms of operational costs:

Overpayment of Costs: Rollup may not be able to accurately predict the value of Ethereum blocks at the time of the forward contract, resulting in potential overpayment of costs. If the space purchased (e.g., the entire block space) exceeds the required finalization, it will also lead to excessive costs.

Revenue Instability: A Rollup’s primary revenue source is the sale of rollup block space. Failure to accurately forecast revenue when entering into forward contracts exposes the rollup to financial risk when costs exceed the revenue generated.

Increased Labor Costs: Rollups must now engage in activities they did not previously perform, such as predicting the value of Ethereum blocks, competing with builders, and accurately forecasting revenue. This expanded role increases operational pain and costs.

By understanding and managing these risks, rollups can better leverage forward contracts to achieve rapid finality on their trades and ensure the sustainability and efficiency of their operations.

Derivatives Market

To mitigate the operational risks associated with rollups, I propose a derivatives market with specialized participants, called Builders. This market consists of two types of derivatives: forward contracts between Builder and Proposer and swap contracts between Rollup and Builder. The purpose of this market is not only to mitigate the operational risks faced by rollup in the process of achieving fast finality by purchasing block space, but also to improve the efficiency of the product by leveraging the expertise of each participant.

Market Structure

Forward Contract (Builder and Proposer)

At t = 1, Builder enters into a forward contract with Proposer for the right to build a block by participating in the slot auction. This contract allows Builder to secure the block space required to trade with rollup, while Proposer secures a stable source of income.

Swap Contract (Builder and Rollup)

At t = 2, Builder enters into a swap contract with rollup based on Builder’s obligation to include rollup transactions in a block. This contract enables both parties to hedge challenges encountered during the block construction process. Rollup uses its future block construction rights to ensure the finalization of Ethereum blocks, while Builder obtains a portion of Ethereum blocks in exchange for potential profits from building blocks for rollup.

Contract Execution

At t = 3, Builder uses the rollup construction rights obtained from the swap contract to build a rollup block and generate revenue at t = 4.

At t = 4, the rollup enforces its obligations under the swap contract, requiring the Builder to include the rollup transaction in the Ethereum block locked via the forward contract. In doing so, the Builder optimizes the generation of additional revenue on the Ethereum block by placing the rollup transaction at the bottom of the block and the Builder's transaction at the top.

At t = 5, the Builder delivers the Ethereum block to the Proposer, who proposes it to Ethereum in accordance with the forward contract, finalizing the transaction at the predetermined moment.

Incentives to Participate

Rollups participate in block purchases to achieve fast finalization while hedging operational risk. Through the swap contract, the rollup pre-secures the necessary block space to ensure that all pre-confirmed rollup transactions can be included in the Ethereum block. This process allows rollups to avoid the risk of spending more than they earn to secure Ethereum blockspace, eliminating the need for unnecessary labor for price prediction and auction participation. Builders hedge against the risk of overpaying due to slot auctions. By securing top-level space in Ethereum through forward contracts and rollup blockspace through swap contracts, Builders have a dual stream of revenue, diversifying risk and increasing financial stability. Proposers participate to earn rewards associated with the rapid finalization of the rollup. Builders participating in the slot auction adjust their bids to take into account the revenue (MEV) that a rollup block is likely to generate. This alignment of incentives around rollup finalization provides Proposers with additional revenue opportunities. A natural question is: Who are the preconfirmation providers? My short answer is “Rollup,” which is further elaborated in the “Building Blocks in Rollup” section.

Additional Design of Derivatives Market

For financial products to be effectively monetized, the key is to create an environment where all market participants can compete fairly and actively participate. To this end, the product includes three key design enhancements:

Conditional Swap Contract

Swap contracts typically allocate all profit opportunities to builders, and their restrictions may prevent rollup participation. To encourage Rollup participation, a conditional swap contract is proposed.

The contract includes a condition that if the builder's revenue from rollup block construction exceeds the fixed cost paid in the forward contract with the proposer, the rollup will stop providing the builder with the remaining blocks. Rollup can build the remaining blocks on its own or allocate block construction rights to builders through block auctions, thereby generating additional revenue.

If a rollup does not use all Ethereum block space for finalization, builders still retain the opportunity to generate revenue on Ethereum blocks. This balances the risks and rewards for both parties, preserving the revenue-generating potential of rollups while maintaining the incentive for builders to participate.

Fair and Competitive Market

Finalization is a key process for rollups to inherit Ethereum security and requires regular acquisition of Ethereum blocks. This forced purchase creates high pricing power for proposers and can lead to an uneven playing field, harming market efficiency and fairness.

An efficient market combines the variable value of rollup blocks with the fixed cost of building blocks to purchase Ethereum blocks. This consistency can be likened to financial markets where the “par value” of swap contracts is zero, indicating that there is no difference between the agreed value and the market value.

To reduce the pricing power of a single builder and allow Rollup to contract at reasonable prices, competition must be promoted between multiple builders participating in swap transactions. This can be achieved by supporting the participation of multiple builders who have block construction rights at different time periods. In addition, the forward contract market should be expanded; multiple proposers (e.g. 32) who have block proposal rights at different time periods should be encouraged to participate in these contracts.

This structure helps maintain a reasonable cost for Rollup to pay builders because builders will bid at more competitive prices in forward contracts with proposers. Proposers will still maximize revenue from blocks, and Rollup requires Ethereum blocks to be finalized, thus helping fair price setting.

Forecast periods need to be discussed to match par values in swap contracts.

Joint Rollup Strategies: Derivatives of All Rollups

A swap contract is an agreement to exchange a portion of an Ethereum block for the value of a rollup block, subject to an obligation to include the rollup transaction somewhere in an Ethereum block. Builders are unlikely to participate in rollups with relatively low block values. As a result, application-specific rollups may have low perceived block values and may be marginalized in the swap market.

To address this issue, we introduce joint rollup strategies. Joint rollup strategies involve grouping multiple rollups into a collective trading group to support market participation. For example, three application-specific rollups (dex, nft, and games) are grouped together. The group enters into a swap contract with a single builder who has the right to build blocks for all three rollups. When executing the swap contract, the builder is obligated to include all transactions of the rollups in the group into an Ethereum block.

Through strategies such as cross-rollup arbitrage, the value of the block of included builders may be higher than that of a single block. If all participating rollups are zk-rollups, they can reduce verification costs through proof aggregation as in Avail Nexus, effectively ensuring fast finalization capabilities for application-specific rollups.

Do these additional designs weaken the incentive for participants to participate?

On the contrary, these designs enhance the incentive to participate in Rollups, increase revenue opportunities for builders and proposers, and foster a sustainable market ecosystem.

Building Blocks in Rollups

This section explores the block construction method used by builders who obtain block construction rights through exchange contracts in rollups. This design achieves the censorship resistance and fast pre-confirmation that are critical to user-centric rollups.

Censorship Resistance in Rollups

Rollups ensure fast finality for users by signing swap contracts with builders who hold block-building rights in specific Ethereum slots. Under these contracts, builders deliver the most profitable blocks to rollups, which are then executed by the rollups, similar to PBS. However, this structure can expose rollup users to censorship, sandwiching, and front-running attacks by builders.

Rollups use Radius’s ordering engine to provide users with cryptography-based pre-confirmations that ensure transactions cannot be censored. The approach involves users encrypting their transactions using delayed encryption and submitting them to the rollup’s encrypted memory pool. This encryption keeps transactions confidential until a commitment is made to include them in a rollup block, preventing intentional censorship. Once the decision to include is made, transactions are automatically decrypted, allowing the rollup to execute them and provide pre-confirmations. The inclusion of order in this commitment ensures that after decryption, no one can reorder transactions, protecting users from front-running and sandwich attacks.

Fast Pre-Confirmation

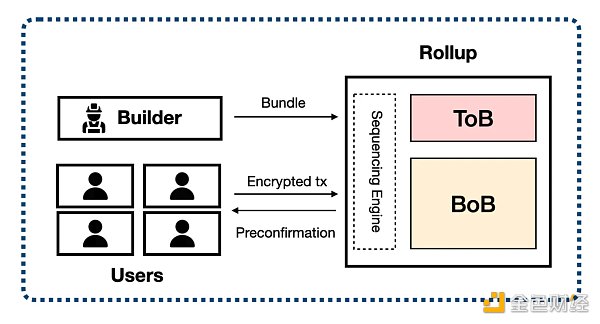

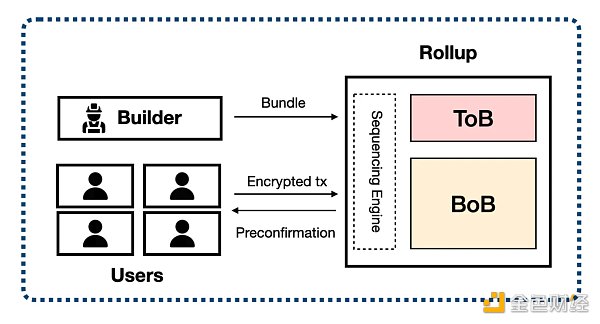

Rollup can achieve instantaneous fast pre-confirmation by specifying a provisioning provider as its sorter and splitting the block space into top of block (ToB) and bottom of block (BoB).

ToB is the most valuable space in the rollup block. The rollup assigns ToB building rights to builders who sign contracts through swap agreements. Builders generate backend run packages based on the state of the previous block of the rollup and deliver them to execute and generate profits.

BoB is designated for regular user transactions within the rollup. It sorts user transactions into the BoB, providing pre-confirmation.

This structure demonstrates the synergy of the Radius sequencing engine, protecting users from intentionally harmful MEV by builders because all user transactions contained in the BoB are encrypted. Even if a single sequencer sequences the BoB, users can be protected from centralization risks such as censorship, sandwiches, and front-running while achieving fast pre-confirmation.

Joint Rollup Strategy

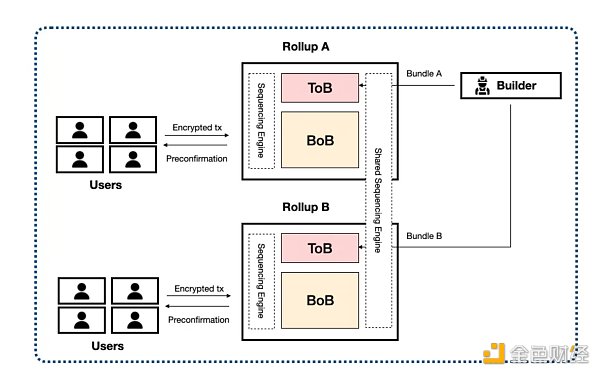

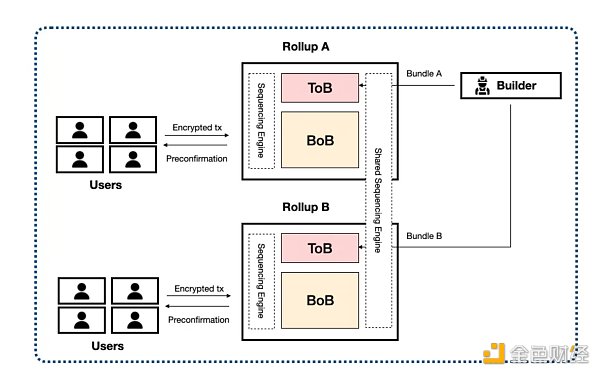

I introduced the Syndicated Rollup strategy above as a way to maintain its custom scalability while effectively achieving fast finalization. This section demonstrates how a builder can construct a Rollup block that selects this strategy.

According to the Syndicated Rollup strategy, Rollup A and B as a whole enter into a contract with the builders to assign ToB (Top-of-Block) building rights to the builders. The builders create cross-rollup bundles to be included in the ToB and submit them to each rollup. The rollup verifies whether the submitted builders are the parties to the contract under the authorization agreement and includes the bundle in the ToB. In this process, the rollups can leverage the shared sorting engine to facilitate the smooth execution of the contract.

In BoB sorting, rollups can choose between independent sorting engines and shared sorting engines. If rollups wish to provide composability between rollups for users, they would choose a shared ordering engine, where the selected orderer acts as a shared pre-confirmation provider. If each rollup chooses its own ordering engine, they can independently provide fast pre-confirmations to users.

Conclusion

I am passionate about the future of Ethereum centered around Rollups, and am particularly committed to moving Rollups in a more user-centric direction. Fast finality is the ability for users to enjoy real-world transaction speeds on rollups, and Ethereum’s voluntary participation in derivatives markets can effectively achieve fast finality. Radius’s ordering engine ensures that Rollups participating in derivatives markets ensure their own censorship resistance and fast pre-confirmations, even in contracts with builders.

What’s next?

Explore the technical requirements needed for derivatives markets. This includes a clearinghouse for settling contracts, monitoring tracking and managing contract performance, and a slashing mechanism to enforce commitments.

Explore rollup designs that leverage Blobspace. Rollups using Blobspace must purchase entire blobs regardless of the space required, which should integrate seamlessly with my proposed market structure. Tamara’s recently proposed Blobspace derivative is also interesting.

Propose other designs that contribute to Ethereum’s decentralization. This market could encourage voluntary participation by proposers through incentives consistent with rollup finality, but this could lead to centralization of Ethereum due to the proposer pooling factor. Designs that separate beacon proposers and execution proposers, as suggested by Mike Neuder (Execution Ticket) and Barnabe (APS-Burn), could be a potential solution.

JinseFinance

JinseFinance