Source: AiYing Compliance

As the old saying goes, the same formula, the same taste, this time the U.S. Attorney’s Office for the Southern District of New York and the CTFT brought basic charges against Kucoin and its founders Chun Gan and Ke Tang Almost the same as Binance. For details, please see Aiying's previous article ""Seven Questions" Binance's sky-high price fines: Cryptocurrency exchanges face A compliance perspective on legal challenges and response strategies"》

The main content of the accusation is that it violated U.S. anti-money laundering laws. Illegal operation of an unlicensed fund transmission business and violation of The Bank Secrecy Act failed to maintain adequate anti-money laundering (AML) procedures.

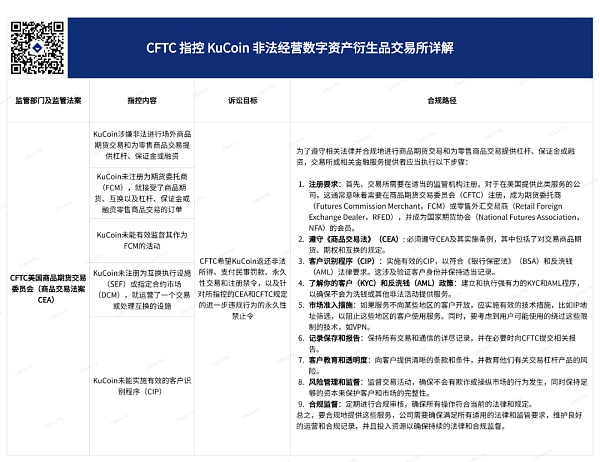

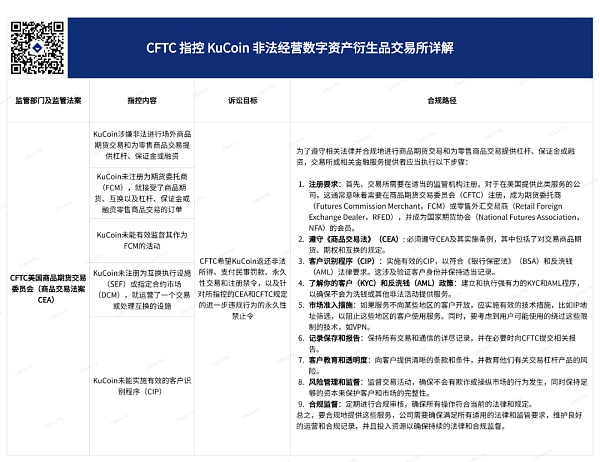

1. Let’s first take a look at the CTFT’s accusations against Kucoin:< /h2>

Compliance path plan:

Registration Requirements: First, the exchange needs to register with the appropriate regulatory agency. For companies offering such services in the United States, this usually means Register with the Commodity Futures Trading Commission (CFTC), become a Futures Commission Merchant (FCM) or a Retail Foreign Exchange Dealer (RFED), and become a member of the National Futures Association (NFA).

Comply with the Commodity Exchange Act (CEA): You must comply with the CEA and its implementing regulations, which include regulations for trading commodity futures, options and swaps.

Customer Identification Procedure (CIP): Implement effective CIP to comply with Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) legal requirements. This involves verifying customer identity and maintaining appropriate Records.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Policies: Establish and enforce strong KYC and AML procedures to ensure that no Providing services for illegal activities.

Market access measures: If services are not open to customers in certain regions, effective technical measures, such as IP address screening, should be implemented to prevent these Customers in the region using the service.Also, consider techniques that users may use to bypass these restrictions, such as VPNs.

Recordkeeping and reporting : Maintain detailed records of all transactions and communications and submit relevant reports to the CFTC when necessary.

Customer education and transparency: Provide customers with clear terms and conditions and educate them about the risks of trading leveraged products.

Risk management and oversight: Oversee trading activities to ensure that no fraud or market manipulation occurs, while maintaining sufficient capital to protect customers and market integrity.

Compliance supervision: Conduct regular compliance audits to ensure that all operations comply with current laws and regulations.

In summary, to provide these services compliantly, companies need to ensure that they meet all applicable legal and regulatory requirements, maintain good operational and compliance records, and invest resources to Ensure ongoing legal and compliance oversight.

2. The content of the charges against Kucoin by the U.S. Attorney’s Office for the Southern District of New York:

Compliance path plan:

1. Establish and maintain a compliant anti-money laundering (AML) ) Procedures:

KuCoin needs to develop and implement comprehensive AML policies and procedures to ensure that it can effectively identify, monitor, and report Suspicious transactions to prevent money laundering and terrorist financing.

AML procedures must be regularly reviewed and updated to ensure they comply with current laws and regulations.

2. Implement thorough customer identity verification (KYC) measures:

KuCoin should ensure that all customers, including current For existing and new customers, we implement strict KYC procedures, collect and verify customer identity information, understand customers' financial behavior, and ensure that we cannot provide a platform for anonymous or unidentified transactions.

Customer account activity should be continuously monitored in order to promptly identify and respond to any suspicious behavior.

3. Register and obtain the necessary licenses:

KuCoin needs to ensure that it It has been legally registered in all operating regions and obtained relevant fund transmission and other necessary financial services licenses (MSB, MTL licenses).

Should maintain transparent and proactive communications with all relevant regulatory authorities and comply with all reporting requirements and regulatory requirements.

4. Establish an effective Suspicious Activity Report (SAR) process:

An effective mechanism needs to be in place to identify, record and report suspicious activity to the appropriate regulatory authorities.

Ensure that all employees receive training on identifying and reporting suspicious activity and understand that this is their legal obligation.

5. Regularly accept compliance audits and risk assessments:

Conduct regular internal audits and compliance assessments to ensure Ensure all procedures and policies remain in effect and comply with the latest legal and regulatory requirements.

3. If the above compliance plan cannot be achieved, is there any way to avoid US legal supervision?

Yes, as long as you do the following:

Not serving US users: Reduce the risk of being governed by US laws by restricting US users from accessing the exchange.

Avoid using USD or USD-related products: USD or USD-related stablecoin trading pairs, such as USDT or USDC, etc. are not provided

Ensure that the company structure and operations are outside the United States: Ensure that the company's domicile, servers, and operations are entirely outside the United States.

Kikyo

Kikyo