Author: Eylon, Partner of Collider Ventures Source: paragraph Translation: Shan Ouba, Golden Finance

Key Points:

Traditional grant programs have problems such as centralization, chaotic management and misuse of funds, and are inefficient and ineffective.

Web2 giant Amazon's AWS Activate program shows how to better support innovation and growth through strategic, specific funding.

The crypto ecosystem should use funds for key needs, such as user support and infrastructure construction, and implement "stakeholder-related" matching investments.

Grants audits like the one Safe recently used prove that “specific and strategic” grants can bring high ROI.

Thriving Crypto Ecosystems

The core goal of a crypto ecosystem is to attract developers and builders, create new products for their protocol or infrastructure, and attract users. Investments in R&D, marketing, and developer relations can all be measured, but grant programs are vague and difficult to quantify their contribution to the ecosystem.

That being said, the potential for success of a crypto ecosystem is directly related to the support it provides to protocols and startups building on top of it. Lack of support can kill an entire ecosystem, and the EOS community is a great example of this. They eventually forked their token for not fulfilling their responsibilities. Or BlueDAO, which forged github promises of millions of dollars in grants and later harassed ecosystem builders.

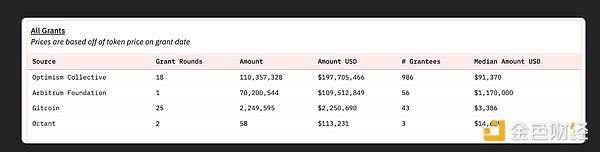

Many "long-term incentive programs" have emerged in recent years, such as Retroactive Public Goods Funding (RPGF), Outcome-Based Resource Allocation (OBRA), etc. But how effective are these initiatives? Take Arbitrum and Optimism as examples. The two largest ecosystems have provided more than $300 million in grants in total. Have these investments paid off?

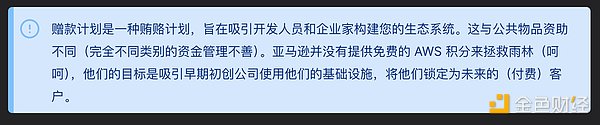

To assess the potential impact of a well-executed ecosystem support program, we can refer to the AWS Activate program of Web2 giant Amazon. The program provided over $6 billion in credits to over 280,000 startups, including now-household names like Airbnb, Netflix, and Uber. This not only boosted Amazon’s reputation, but also ensured a loyal customer base.

How Grants Work

In theory, grant programs are great, and even with their flaws, having one is better than not having one. Grant programs help distribute wealth, increase the number and diversity of stakeholders, and support a variety of open contributions to the underlying protocol. However, today’s grant programs are facing several fundamental problems:

Centralization: Protocol leadership often controls the agenda and resources, opens up “tasks”, hires teams and pays them to work… Isn’t that freelancing? Yes, it’s essentially freelancing, but with the guise of “community support”. While this is not a bad thing in itself, it misses the core benefit of grant programs: permissionless innovation. Allowing any individual or team to come up with novel ideas for the ecosystem.

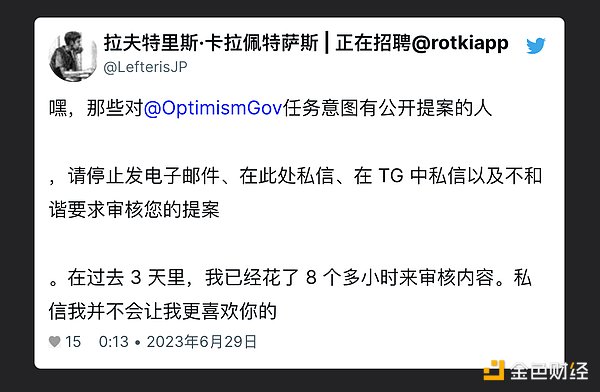

Management chaos: The current grant program is overwhelming. Thousands of applications, vague parameters, and loosely defined goals make it nearly impossible to understand what should and should not be funded. The delegates responsible for reviewing are working almost full-time (mostly unpaid), which affects their ability to make good judgments. This can lead to delegates tending to support projects they are familiar with or have been "promoted" to, rather than researching new proposals.

Misuse of Funds: When you offer “free” money, scammers will flock to it. Grant programs often fund “scammers” - teams that are good at self-promotion but cannot deliver any substantial results. For example, Optimism has found millions of dollars in unused, lost or misappropriated funds, and that’s just the portion that has been detected. Monitoring and holding these grant programs accountable is an extremely difficult task, especially for projects that use pseudonymous identities, such as the lead developer of a protocol who may apply for more grant funds in the name of “work”.

We must stop giving away “free” money, even if it’s magic internet money, and move toward supporting ecosystem builders and contributors while minimizing administrative overhead, Soviet-style bureaucracy, and opportunities for funds to be misused.

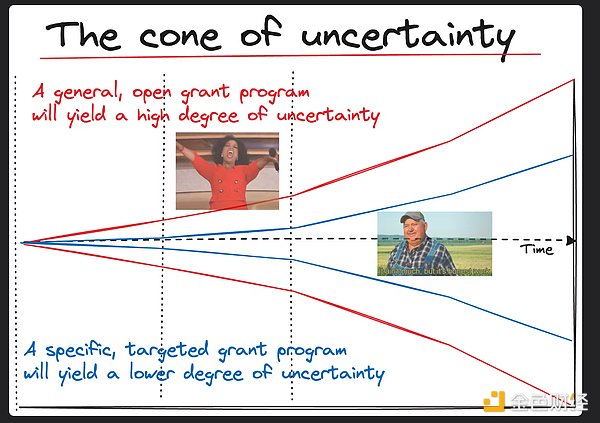

Given these challenges, it’s clear that current cryptocurrency grant programs need to be reimagined. Let’s explore how we can reduce uncertainty in grant programs and increase their effectiveness.

Reducing Uncertainty in Grant Programs

Heisenberg’s uncertainty principle states that the position and momentum of a particle cannot be measured precisely at the same time.

The traditional approach to grant programs is to essentially hand out blank checks to grantees in the hope that they will use the funds effectively, but this combination of hope, the internet, and money often doesn’t end well. We need to change the way we think about grant programs to focus on strategic and specific allocations of funds.

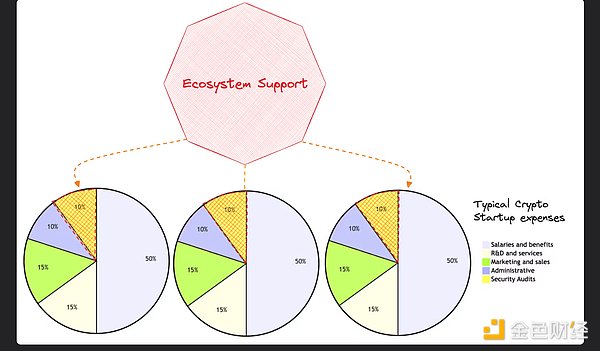

Rather than offering grantees money to "support" or "build" whatever they want, grant programs should focus on supporting key needs of projects building on top of their ecosystem. While "salary" is the easiest aspect to think of, we should avoid funding this type of general expenditure and instead fund specific needs such as:

User Funds and Abstraction Layers: Fund the use of project gas fees to provide a better user experience for their users and incentivize them to try the product for free. Zero-fee USDC transfers on the Base chain are a great example of this, and are an ecosystem utility used by most applications and protocols on the Base chain.

Infrastructure Grants and Sponsorships: Grants for RPC providers, sponsorships for TheGraph/subgraph network usage, and sponsorships for fiat on-ramps. This has been a huge success in Web2, such as cloud computing providers (AWS, GCP, or Azure) and free tier SaaS products.

“Stakeholder” Matching Investments: Helping projects achieve their defined key performance indicators (KPIs) for success, matching every dollar of funding they put in with ecosystem tokens. This could be growth campaigns, token programs to incentivize protocol usage, or security matching (see below).

Strategic and specific allocation of funds will transform grant programs from an inefficient bureaucratic nightmare that encourages ambiguity to a powerful tool that drives critical support, incentivizes innovation, and creates growth within the ecosystem.

Crazy Use Case: Audit Grants

A few weeks ago, the Safe governance forum passed an excellent proposal. Palmera built a module for the Safe internals, and they requested funding for a public audit competition through Hats.Finance, a decentralized security (DeSec) protocol.

This is a great example of a strategic and specific grant. The proposal targets a major pain point for a project, as audits can cost anywhere from $20,000 to $400,000! The proposal is also easier to enforce and monitor, as funds flow directly to the audit competition smart contract, and finally, Palmera itself bears a significant portion of the audit costs and requires additional participation from the Safe ecosystem.

What is an audit competition?

A security audit competition is an event in which security researchers will review a given smart contract or set of smart contracts to find vulnerabilities, inefficiencies, and other potential issues. Auditors will compete to find as many issues as possible, and rewards will be distributed based on the importance and quality of the vulnerabilities they find. Hats Finance has built an on-chain protocol to run these competitions that significantly reduces the need for trust through pre-funded contracts, on-chain reporting, and dispute resolution mechanisms.

Hats co-founder Oliver also added:

“Security grants have the highest ROI of all grants. When an application gets hacked, it’s bad PR for the entire ecosystem. By dedicating grants to security or audits, the ecosystem will benefit and remove the biggest barrier to new project deployment.”

This audit grant is also a direct reflection of the community’s interest in the project’s development.

“This proposal clearly demonstrates the community’s confidence in the impact of this module. Components that are both high-impact and have significant safety requirements present challenges in terms of testing and gathering feedback. Proposals are the most effective way to measure and quantify these aspects.”

The Future of Ecosystem Support

As the crypto ecosystem evolves, so must its support structures. By shifting from a “cast-and-butter” approach to strategic and specific funding allocations, we can drive innovation, support real builders, and create real growth and momentum. That being said, implementing strategic and specific funding allocations is not always possible, especially in a diverse ecosystem with varying resource levels and governance structures.

Since I started writing and discussing this topic a few weeks ago, I’ve received positive feedback from the ecosystem looking to implement similar support structures. A few days ago, Oasis launched a pool dedicated to secondary audits and bug bounties for projects within its ecosystem.

What’s Next?

If you’re involved in the management of a crypto ecosystem or grant program, now is the time to wake up. Evaluate your current processes against the principles above. Are you providing strategic and specific support? Are you solving real pain points faced by builders, or are you just handing out funds?

Beincrypto

Beincrypto

Beincrypto

Beincrypto

The Block

The Block Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph