Author: Tanay Ved, Coin Metrics; Compiler: 0xjs@黄金财经

Key Points:

MicroStrategy is a Bitcoin treasury company and a leveraged proxy for Bitcoin that amplifies both upside and downside price movements of BTC.

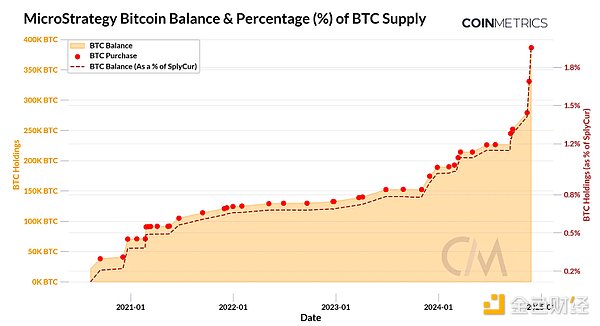

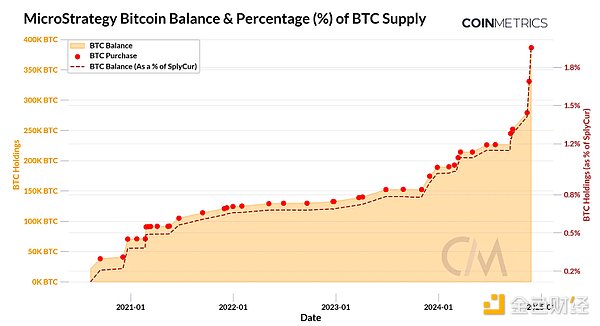

The company currently holds 386,700 BTC (worth approximately $36 billion), or 1.9% of Bitcoin’s current supply, making it the world’s largest corporate holder of BTC.

MicroStrategy financed its Bitcoin acquisitions through convertible bonds, taking advantage of low borrowing costs and high equity premiums during the bull market to expand its BTC holdings.

Introduction

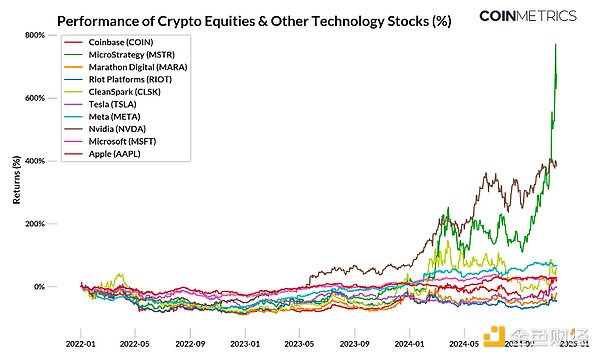

Bitcoin’s post-election momentum has pushed its price close to the $100,000 mark for the first time in its 15-year history. While the majority of Bitcoin’s supply remains in self-custody, Bitcoin’s growing maturity has also opened up more accessible investment avenues, including “crypto stocks” — publicly traded stocks that provide exposure to or proxy for Bitcoin and other digital assets through traditional brokerage accounts. These companies range from Bitcoin miner Marathon Digital (MARA) to full-stack operator Coinbase (COIN) and MicroStrategy (MSTR), the largest corporate Bitcoin holder with 386,700 BTC in its vaults. The launch of spot Bitcoin (BTC) and Ethereum (ETH) ETFs this year has further expanded access for institutional investors.

In this week’s Coin Metrics State of the Network report, we analyze MicroStrategy’s performance, its Bitcoin holdings, and its role as a leverage proxy in the crypto equity space, exploring the risks and rewards of its acquisition strategy and its approach.

Crypto Stock Landscape

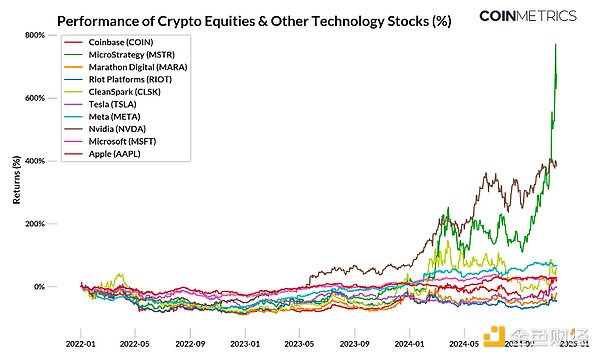

While MSTR is not part of the S&P 500, it has returned more than 700% since 2022 and 488% year-to-date, outperforming other stocks in the S&P 500. Its performance has far outperformed major crypto stocks and tech stocks such as Coinbase (COIN) or Nvidia (NVDA), thanks to its unique role as a "Bitcoin vault company." Therefore, the strategy behind its performance deserves a closer look.

Source: Google Finance

MicroStrategy: Software Company or Bitcoin Hoarding Machine?

Some people may be surprised to learn that MicroStrategy was founded in 1989 as an enterprise software company focused on business intelligence. However, in August 2020, co-founder and then-CEO Michael Saylor made a bold shift and made Bitcoin the company's primary reserve asset as part of a "new capital allocation strategy." This turned MicroStrategy into a Bitcoin hoarding machine. Four years later, it has become the largest single corporate holder of Bitcoin, with 386,700 BTC (worth about $36 billion) and a market cap of about $90 billion. MicroStrategy's Bitcoin holdings far exceed those of other corporate vaults, holding 12 times more than miners such as Marathon Digital (MARA) and 34 times more than Tesla (TSLA).

Source: Coin Metrics Network Data Pro and BitBo Treasuries

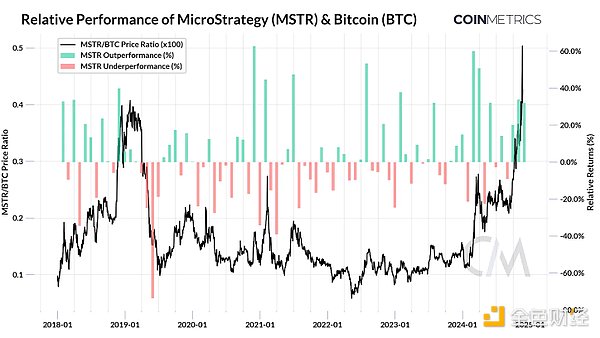

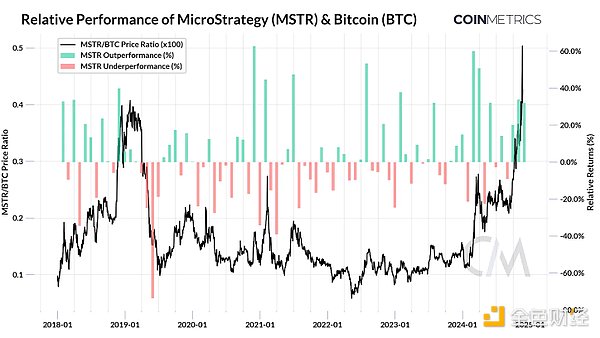

MicroStrategy's most recent purchase was on November 24, when it purchased 55,500 BTC. It currently holds 386,700 BTC at an average cost of $56,761, or about 1.9% of the current supply of Bitcoin. Only Bitcoin spot ETFs exceed this level, and Bitcoin spot ETFs hold about 5.3% of the supply, three times that of MicroStrategy. This strategy effectively transforms MicroStrategy into a Bitcoin investment vehicle as a leveraged investment in Bitcoin. Michael Saylor himself describes the company as a "fund operation that securitizes Bitcoin, providing 1.5x to 2x leveraged equity." As shown in the figure below, MicroStrategy's performance relative to Bitcoin reflects this approach, amplifying gains during rallies and amplifying losses during declines.

Source: Coin Metrics Reference Rate and Google Finance

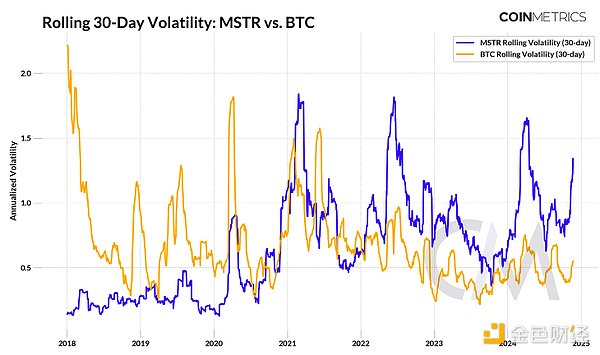

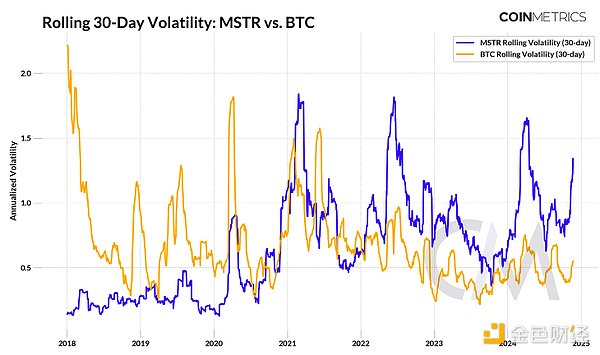

Compared to BTC, this leverage method inherently increases the volatility of MSTR, typically amplifying BTC's price fluctuations by 1.5x to 2x. In addition to its Bitcoin exposure, MicroStrategy’s share price is also influenced by broader stock market trends and investor sentiment toward Bitcoin, making it a high-risk, high-reward proxy for the asset’s performance.

Source: Coin Metrics Market Data Stream and Google Finance

How did MicroStrategy fund its BTC purchases?

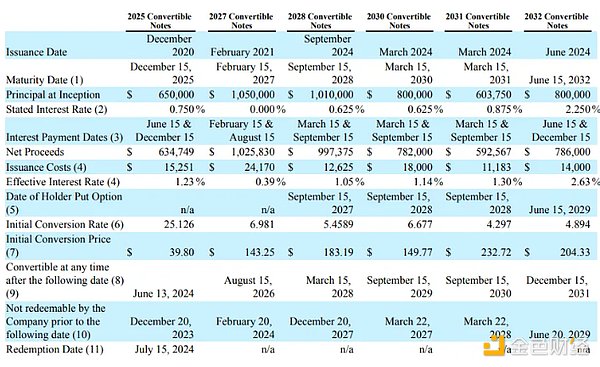

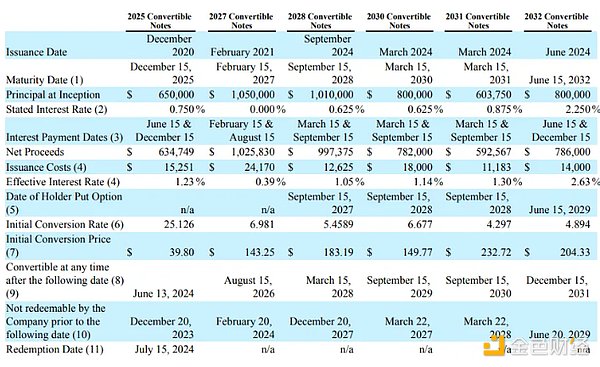

How did MicroStrategy fund its massive Bitcoin purchases? The cornerstone of its strategy is to borrow money to buy Bitcoin by issuing convertible notes. This is a fixed-income instrument that acts as a hybrid of debt and equity and can be converted into a set number of company shares at a predetermined price at a future date. By issuing these convertible notes in the fixed-income market or directly to institutional investors, MicroStrategy is able to raise cash to rapidly expand its Bitcoin holdings, often at very low borrowing costs. These notes are attractive to investors because they offer the potential for equity conversion at a price above the offering price, effectively acting as a call option, which is further amplified by the demand for MicroStrategy's growing Bitcoin reserves in a bull market. This creates a reflexive cycle: Higher BTC prices drive the premium on MSTR shares higher, enabling the company to issue more debt or equity to fund additional BTC purchases. These purchases increase buying pressure, further pushing up the Bitcoin price - and the cycle continues, reinforcing in a bull market.

Source: Microstrategy Q3 2024 Report

The table above highlights MicroStrategy's outstanding convertible notes, which will mature between 2025 and 2032. The company also recently raised $3 billion through another convertible bond issuance due in 2029, with an interest rate of 0% and a conversion premium of 55%, bringing its total outstanding debt to more than $7.2 billion.

Is MicroStrategy's BTC strategy risky?

While their strategy has been wildly successful so far, the question remains: “What could possibly go wrong? Is this another bubble waiting to burst?” With a market cap approaching approximately $90 billion and its Bitcoin holdings valued at approximately $37.6 billion, MicroStrategy is currently trading at a significant premium to its net asset value (NAV) of approximately 2.5 times (250%). In other words, MicroStrategy’s stock price is 2.5 times the value of its underlying Bitcoin reserves. This high valuation premium has raised concerns among market participants, who are questioning how long this premium can be maintained and what the consequences could be if the premium collapses or turns negative.

Participants have also attempted to exploit the premium in MSTR stock by shorting it and buying BTC as a hedge. As some short positions have been closed, short interest in the stock has fallen to approximately 11% from approximately 16% in October. To assess the risk that MicroStrategy could liquidate some of its Bitcoin holdings and the impact of a decline in the MSTR/BTC price and NAV premium, focusing on the health of its legacy software business may provide a better understanding of its ability to repay these debts. Source: MicroStrategy Q3 2024 Report While quarterly revenue from legacy businesses has been relatively stable since 2020, operating cash flow has been on a downward trend. Meanwhile, accumulated debt has grown substantially since 2020 to $7.2 billion, helped by the issuance of convertible bonds to finance Bitcoin acquisitions, with debt growth accelerating during the bull market. This reflects the company's reliance on Bitcoin appreciation to maintain financial stability. Nonetheless, the relatively low interest costs of these bonds are likely to be borne by the software business. If bondholders convert their bonds into equity at a higher share price at maturity, the majority of the debt will be settled without cash repayment. However, if market conditions deteriorate and the MicroStrategy stock premium declines, the company may need to explore other strategies to meet its obligations.

Conclusion

MicroStrategy's bold approach highlights the potential of Bitcoin as a corporate reserve asset. By leveraging its large Bitcoin reserves, the company has amplified its market performance, establishing itself as a unique proxy for BTC.

However, this strategy carries inherent risks associated with Bitcoin price volatility and the sustainability of the stock premium, which warrant closer attention as market conditions evolve.

MicroStrategy’s model could inspire broader adoption — not only among enterprises, but potentially at the sovereign level, further solidifying Bitcoin’s position as a store of value and premium reserve asset.

Kikyo

Kikyo