Disputes, suspicious transactions, cancellations, refunds:

Even with stablecoin-based payments, these issues cannot be solved. As these situations are inevitable in payments, settlement delays are still necessary.

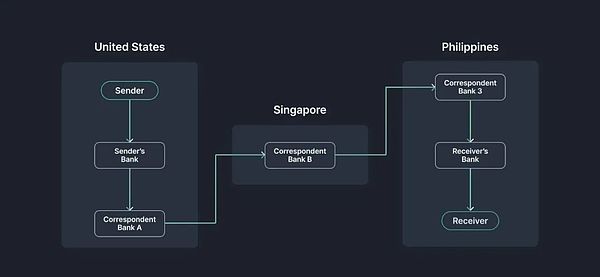

Cross-border payments:When conducting cross-border transactions, funds must be settled via SWIFT, causing further delays. This is an obvious area where blockchain can provide a solution.

3. Stablecoin-based payment systems

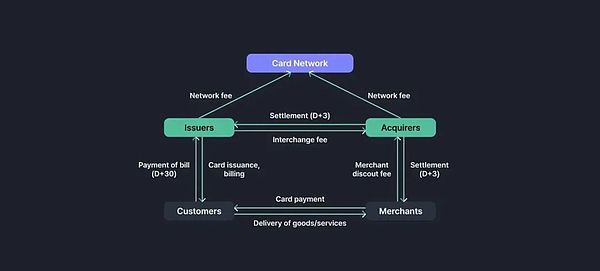

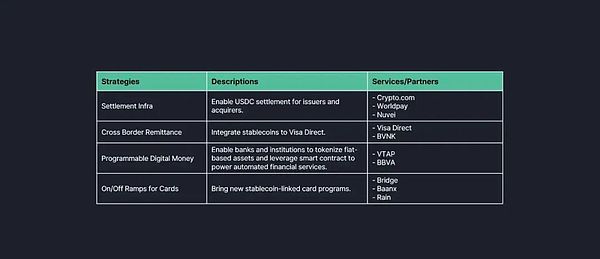

Recently, we have seen various financial institutions and companies begin to move towards stablecoin-based payment systems. I believe this huge shift is happening through twostrategies. The first is the strategy led by card networks such as Visa and Mastercard. The second strategy is to try to bypass the card networks and issuing banks entirely.

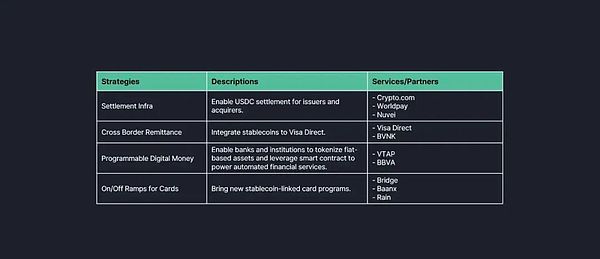

3.1 Card Network-Centric Stablecoin Payments

As I discussed in my article “Visa and Mastercard, Designing the Next Generation Payment System,” Visa and Mastercard are actively exploring ways to integrate stablecoin functionality into their infrastructure.

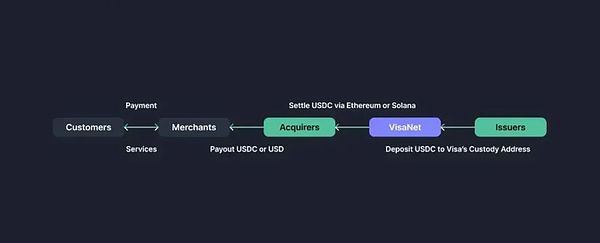

Crypto debit cards:These cards allow customers to pay with stablecoins stored in Web3 wallets or exchange accounts. In this case, the customer's stablecoins are either converted into fiat currency by the issuing bank and processed through existing payment systems, or the card network receives the stablecoins directly through its funding account and then processes them according to the process of traditional card payments.

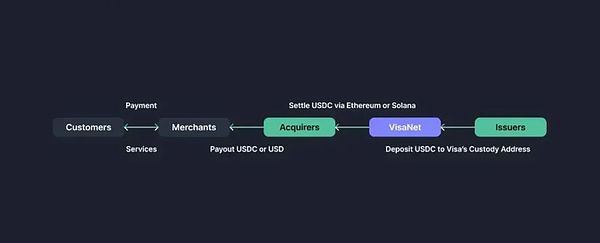

Stablecoin settlement:As mentioned above, the card network can accept stablecoins through a funding account and settle with the acquirer in stablecoins.

Essentially, card network-centric stablecoin payments simply add stablecoin payment and settlement support to the traditional system. The participants and infrastructure remain unchanged. Therefore, the system does not provide significant advantages in terms of cost or time. However, for customers and companies that naturally use stablecoins, such a system can reduce transaction friction by skipping the conversion process between fiat currency and cryptocurrency. In addition, cross-border transactions will have obvious benefits if the entire payment process is settled in stablecoins.

3.2 Initiatives to Bypass Card Networks and Issuing Banks

Meanwhile, some payment service providers (PSPs) are using stablecoins to process payments bypassing card networks such as Visa and Mastercard. These cases include PayPal’s PYUSD payments and the USDC payment program in partnership with Shopify, Coinbase, and Stripe.

3.2.1 PYUSD Payments

PayPal users can use their PYUSD balances to make payments within the PayPal app. These PYUSD holdings are not stored in the user's own wallet, but in the account of Paxos, the issuer of PYUSD. When a PYUSD payment occurs, there is no actual movement of PYUSD on the chain. Instead, the ownership of PYUSD is transferred from the customer to the merchant in the background of PayPal. If the merchant wishes to settle in fiat currency, PayPal will convert PYUSD to US dollars at a ratio of 1:1 and settle the payment to the merchant through a bank network such as ACH.

If the customer's PYUSD balance is insufficient, they can top up through a bank account or card, which may incur fees. Similarly, if the merchant requires settlement in fiat currency, going through the bank network may result in additional fees and time. However, if the entire payment cycle is completed in PYUSD, there is no need to go through the card network or issuing bank, which can significantly reduce time and costs.

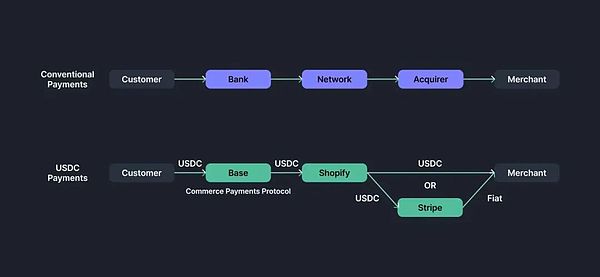

3.2.2 Shopify x Coinbase x Stripe Payment

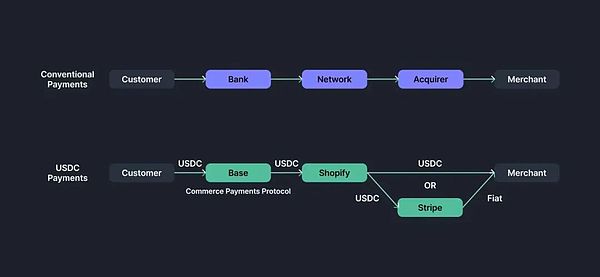

PayPal's stablecoin payment does not directly involve the blockchain network, while Shopify's USDC payment goes a step further.

In June 2025, Shopify announced a partnership with Coinbase and Stripe to integrate USDC payments into Shopify Payments. Customers can choose USDC as a payment method in Shopify stores and connect a crypto wallet holding USDC on the Base network to make payments.

Here, the smart contract "Commerce Payments Protocol" on the Base network uses the traditional "authorize first, capture later" process to authorize payments in advance, and the actual funds transfer will be carried out later. Shopify and Coinbase will aggregate USDC transaction data within a day and clear it on the Base network.

For settlement, the default method is for Shopify to convert USDC into the merchant's local currency and deposit it into the merchant's bank account through bank payment networks such as ACH or SEPA. This conversion is handled by Stripe's infrastructure. Merchants can also choose to settle directly in USDC, thus getting their funds faster.

4. Final Thoughts

The most frequently asked question about stablecoin-based payment systems is:"Since blockchain transactions are inherently irreversible, how are cancellations or refunds handled?"While a fully peer-to-peer payment system between customers and merchants may eventually emerge, issues such as fraud detection,cancellationsandrefundswill always exist, so intermediaries in the payment process will still be necessary. Therefore, the role of card networks and issuing banks, which traditionally perform these functions, will not disappear completely.

However, in the above-mentioned stablecoin payment cases of PayPal and Shopify, intermediaries such as PayPal and Stripe took on the role of payment service providers (PSPs), handling issues such as fraud detection, cancellations, and refunds. In the case of PYUSD, transactions are not processed on-chain, but in PayPal's backend, which leaves room for dispute resolution. In the case of Shopify, the Commerce Payments Protocol smart contract on the Base network introduced a buffer time instead of approving payments immediately, allowing disputes to be handled. In addition, USDC issuer Circle released a refund protocol for non-custodial dispute resolution.

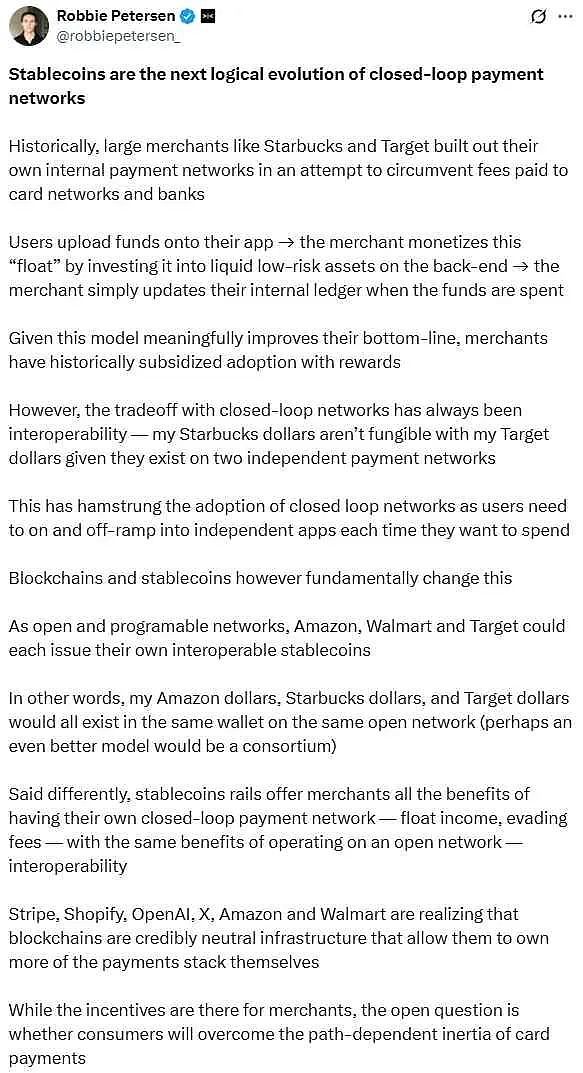

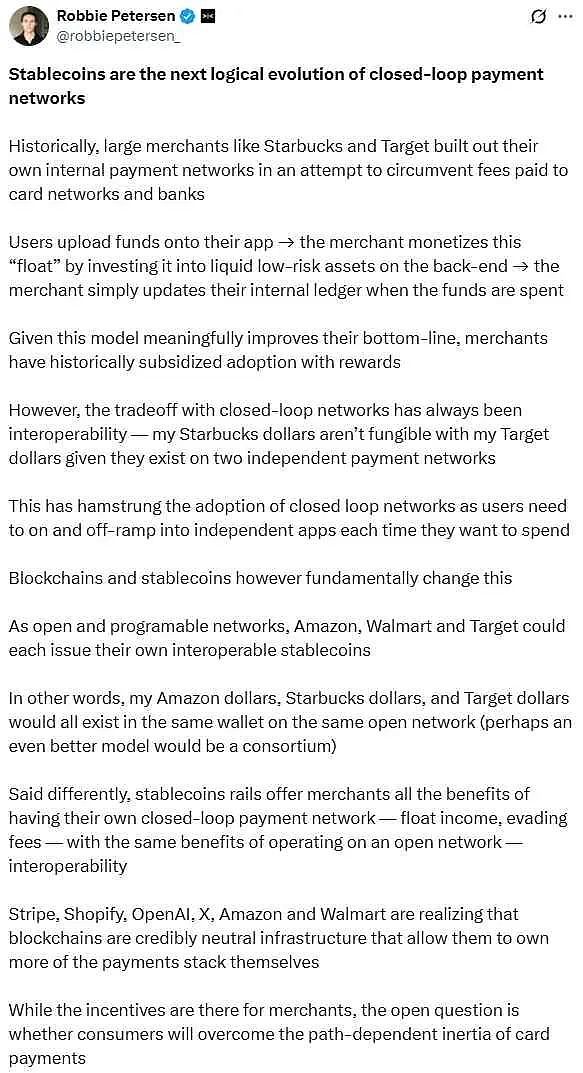

Stablecoin-based payments are the inevitable future. Just as issuance is important, distribution is equally important. As Dragonfly's Robbie Petersen points out, companies with large merchant and customer bases will increasingly adopt stablecoin payments and bypass card networks and issuing banks. Stablecoins may even enable interoperability between these closed-loop payment systems. Given these trends, stablecoins may pose a real threat to card networks and issuing banks, and these institutions need to explore new opportunities in this unstoppable wave of the stablecoin industry.

Kikyo

Kikyo