Author: Doğan Alpaslan Source: doganeth Translation: Shan Ouba, Jinse Finance

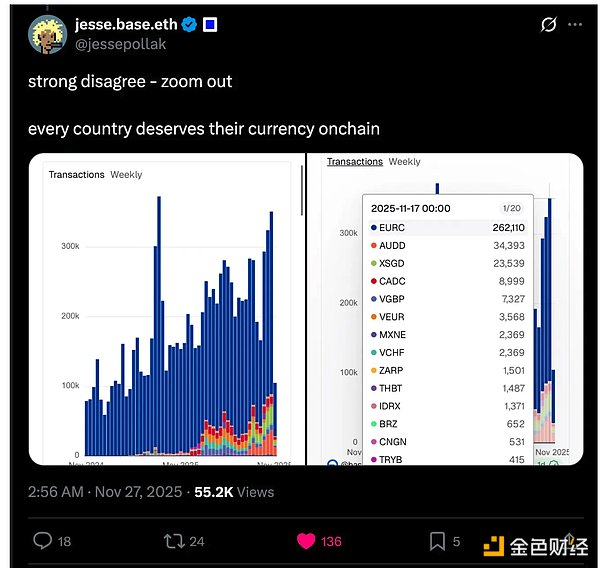

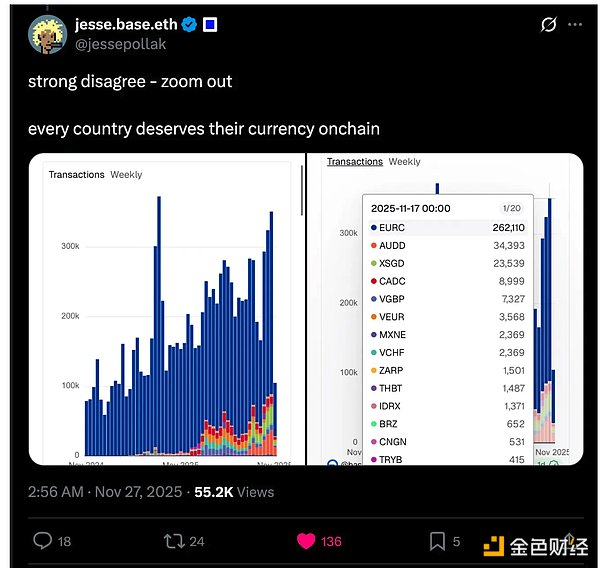

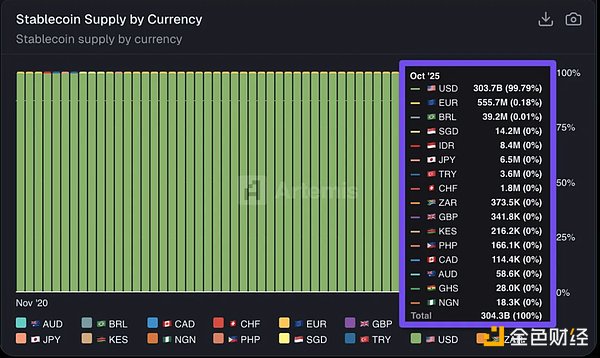

Over the past few days, the cryptocurrency community has been engaged in heated debates about whether non-USD stablecoins are needed, but the various viewpoints seem to lack logical support. Regarding this topic, there are mainly three groups:

Optimists: Everyone has the right to have their assets circulated on the blockchain. This is true, but capitalism is never driven by rosy visions.

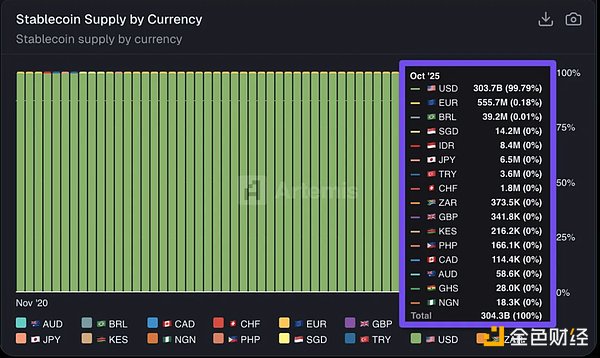

Pessimists: Nobody wants to hold assets that depreciate every year.

Their argument is equally flawed—the value of a domestic currency stems from its use, not its holding. Furthermore, countries must maintain the liquidity of their currencies to preserve economic autonomy. Some blockchain forex enthusiasts believe that putting domestic currencies on-chain can solve all the problems in the forex market. This idea is also not rigorous enough—the core of the forex market is far more complex than simply asset swaps.

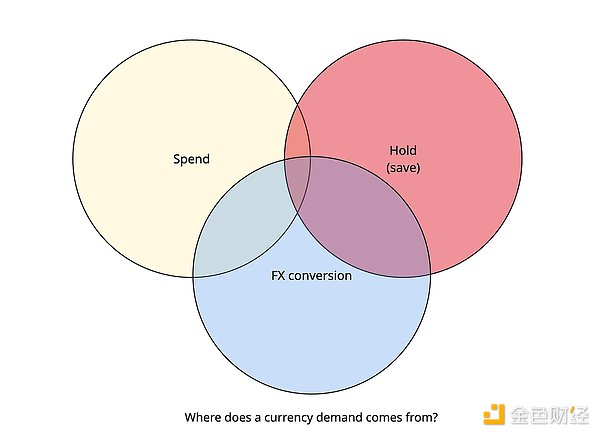

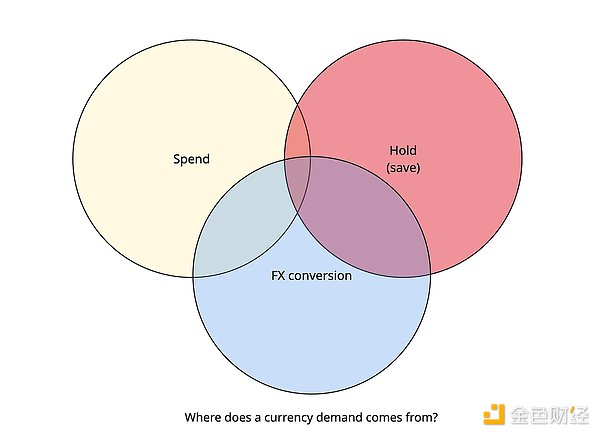

In fact, the above viewpoints all have some merit, and we can use a simple logical framework to organize them:

The core uses of currency are mainly three categories:

Miyuki

Miyuki