Article author: Yohan Yun Article compilation:Block unicorn

On March 2, when U.S. President Donald Trump announced plans to form a national cryptocurrency reserve, the U.S. cryptocurrency industry finally got what it wanted. But the decision did not spark much celebration, but instead was met with backlash—not from the usual opponents of traditional finance or regulators, but from within the cryptocurrency world.

The controversy stems from the choice of reserve assets. During the campaign, Trump promised to create a “national bitcoin reserve,” which made the inclusion of bitcoin and, to some extent, ethereum expected. However, the inclusion of Ripple, Solana, and Cardano has divided the industry.

All three assets have their own problems, from centralization issues to questions about practical application scenarios. Supporters emphasize their technological advances and market potential, but skeptics argue that they lack the stability, institutional trust, and global acceptance required for national reserves.

Gemini co-founder Cameron Winklevoss was one of those surprised by Trump’s decision. Source: Cameron Winklevoss

The excitement surrounding the announcement was short-lived. All five cryptocurrencies saw an initial price increase, but quickly fell back to pre-announcement levels and recovered slightly as of the time of writing. XRP and ADA were the exceptions, which did not fall below pre-announcement levels, but were not immune to the wild swings.

Each of the three chosen altcoins brings different characteristics to the table. Let’s break down why they were chosen, and why their inclusion is controversial.

Solana is fast and has low fees, but is known as a meme coin

Ethereum leads in total value locked (TVL) in decentralized finance (DeFi), with about 52% of the market share and $50.59 billion in TVL, according to DefiLlama. This figure does not include its second-layer networks such as Base and Arbitrum, which serve as scaling solutions on Ethereum and remain part of its broader ecosystem.

Solana ranks second with $7.32 billion in DeFi TVL. The network has long been called an "Ethereum killer," a term used to refer to blockchains that aim to challenge Ethereum's dominance. Throughout 2024 and early 2025, Solana appeared to be gaining ground due to its high throughput (it is capable of processing thousands of transactions per second). At the same time, developers have largely resolved its once-long network outage issues, allowing the network to take full advantage of the massive traffic brought by the meme coin craze. Solana ranks second in the industry in DeFi TVL, but is still far behind Ethereum. Source: DefiLlama

Fund managershave applied for exchange-traded funds (ETFs) based on Sol, and the network has also become the platform of choice for politicians to launch or support cryptocurrency projects - mainly through meme coins.

Recently, Solana's meme craze has turned chaotic. Sensational live events designed to drive up token prices, as well as widespread scams, rug pulls, and bot-driven trading, have raised concerns about the sustainability of the industry. As skepticism grows, the number of new token issuances on Solana continues todrop.

Influential figures have raised concerns about Solana’s venture capital influence. NSA whistleblower Edward Snowden criticized Solana’s reliance on venture capital in November, suggesting it harmed the network’s decentralization. He described Solana as “born in prison,” suggesting that its reliance on venture capital funding could limit its autonomy and alignment with blockchain’s fundamental principles.

TYMIO founder Georgii Verbitskii told us: “These assets, like any other token, do not qualify as true reserve assets. Including them in the US cryptocurrency reserves is as arbitrary as including Nvidia shares in the strategic reserve.”

He added: “While sovereign wealth funds, such as Norway’s, invest in equities for long-term returns, their purpose is different from national reserves, which should be built on universally recognized, decentralized assets. Bitcoin is the only reasonable choice for such reserves.”

Slow and steady: Cardano is still in the race

Cardano has adopted a slow and steady strategy. The network is often slammed for its slow feature rollout compared to other major blockchains, but its supporters argue that its peer-reviewed, research-driven strategy will ultimately succeed.

However, this cautious approach has so far left Cardano lagging behind in a fast-moving industry. Users flocking to chains where they feel their funds are secure or see the greatest potential for profit — just as Solana’s meme coin craze has attracted a lot of attention — means Cardano has struggled to keep up.

As of March 5, Cardano’s DeFi ecosystem held just $412 million in TVL, according to DefiLlama. The network is often derided as a “ghost chain,” meaning there is minimal on-chain activity, which is often refuted by its supporters.

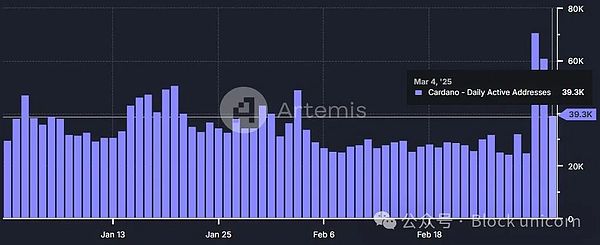

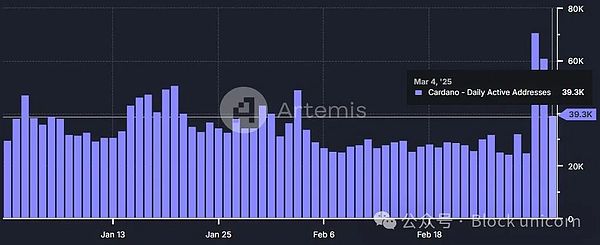

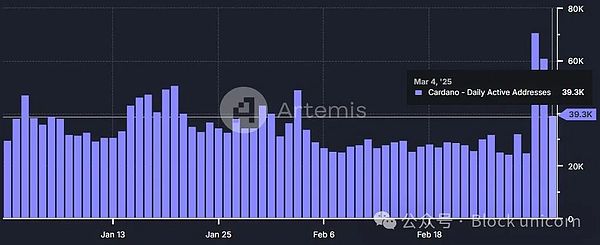

Data from Artemis shows that on March 4, Cardano recorded fewer than 40,000 daily active users, while Solana had more than 5 million daily active users - although Solana has also come under scrutiny for

Cardano’s daily active addresses.

Data from Artemis shows that on March 4, Cardano recorded fewer than 40,000 daily active users, while Solana had more than 5 million daily active users - although Solana has also come under scrutiny for

Source: Artemis

A key advantage of Cardano over networks like Solana is decentralization. While the project initially relied heavily on IOHK, a private entity founded by Charles Hoskinson, it has since transitioned to a community-driven model. January’s Plomin hard fork activated a fully decentralized governance mechanism for ADA holders, followed by the establishment of its on-chain constitution in February.

Cardano was ranked the most decentralized blockchain in 2023, according to the University of Edinburgh’s Decentralization Index. The network leads in the Nakamoto coefficient, a metric used to measure decentralization by determining the minimum number of entities required to control 51% of the network.

Big companies use XRP, but centralization issues remain

According to Vugar Usi Zade, COO of cryptocurrency exchange Bitget, XRP has a strong case for inclusion in national cryptocurrency reserves. “XRP is already the preferred choice for cross-border payments, and many major financial institutions use it to streamline transactions,” he told us.

XRP offers faster and cheaper transactions for financial institutions and individuals compared to the traditional financial system. Several major entities, including American Express, SBI, and Siam Commercial Bank, have already tested or integrated XRP into their cross-border payment solutions. The network has long been criticized for being more centralized than cryptocurrencies like Bitcoin and Ethereum. One of the main reasons for this perception is that Ripple controls a large portion of XRP's supply. When the cryptocurrency was created, 100 billion tokens were pre-mined, and as of March 5, more than 37 billion tokens are still locked in escrow. Source: ZachXBT Still, there are arguments against the centralization argument. Over time, Ripple has reduced the number of its own validating nodes, allowing third-party institutions to play a larger role in the network validation process.

In addition, XRP transactions do not require Ripple's approval, as the network operates independently and transactions are completed in seconds. Ripple has also repeatedly emphasized its legal separation from the XRP Ledger, saying that it does not control XRP.

Bitcoin is the clear frontrunner, but even it has non-believers

The three tokens - XRP, SOL and ADA - each have their advantages and disadvantages, but the common feature they share is that they are all U.S.-based projects. According to Bitget’s Zade: “Let’s be honest: none of them have the institutional trust or liquidity level of Bitcoin. That volatility can be a problem, especially for an asset that is intended to be a stable part of a nation’s reserves.” While Bitcoin is the clear frontrunner for inclusion in the U.S. strategic cryptocurrency reserves, some argue that even it carries significant risks. Joshua Chu, co-chair of the Hong Kong-based Web3 Association, believes that Bitcoin’s value is entirely speculative and that its role as a reserve asset could make it a prime target for hostile nations.

He told us: "If quantum computing becomes a reality, it could break the cryptographic security of Bitcoin, rendering it worthless overnight. This is a real risk given the speed at which technology is developing. What would happen if a hostile nation-state developed quantum computing capabilities and decided to target Bitcoin?"

Although Trump's cryptocurrency reserve plan has been announced, it still needs congressional approval before it becomes official policy. In the meantime, speculation is growing that more details will be revealed at a cryptocurrency summit scheduled to be held at the White House on March 7.

Key figures including Ripple CEO Brad Garlinghouse and Strategy Executive Chairman Michael Saylor have been invited to attend, suggesting the event could shed further light on the government's digital asset strategy.

Anais

Anais