Author / Jeff Wilser Compiler / flumen, Centreless

At the beginning of 2021, Torres, who was unemployed and stuck at home with a lot of time, began to experiment with NFTs. In February 2021, he sold a Nyan Cat NFT for 300 ETH (worth about $590,000 at the time). The sale of 300 ETH meant that the cryptocurrency bull market had gone too far, but for Torres, the sale was a due recognition of ownership. "I wasn't really able to make a living until Web3 came along," Torres said. Now he works full-time as an artist and helps other meme creators monetize their works.

Some believe the sale of the Nyan Cat NFT marked the birth of the cryptocurrency “meme economy,” while others attribute it to Dogecoin. Whatever the origin, Web3 injected energy and money into memes, and memes injected energy and money into Web3.

Nyan Cat

The Nyan Cat NFT is an iconic and popular NFT that became an internet sensation in 2011. The original Nyan Cat was a GIF of a cat—a geometric shape combined with a cat flying through space, leaving a rainbow trail behind it. In February 2021, Nyan Cat’s original creator, Chris Torres, sold it at a Christie’s auction for nearly $600,000.

In 2021, the phenomenon exploded. The price of the original memecoin Dogecoin soared from less than a penny to more than 75 cents and briefly reached a market cap of more than $90 billion. A new breed of yolo investors, more guided by Tik-Tok than financial advisors, invested heavily in imitations like Shibacoin. Old-school memes like Grumpy Cat, Disaster Girl, and Harambe sold for astonishing prices.

Memes became the new stocks. "It's fun, very joyful and exciting," said Gary Lachance, a long-time Dogecoin supporter. Lachance is a well-liked figure in the cryptocurrency space, organizing decentralized global events such as the "Doge Disco Project" to encourage people around the world to show "proof of partying."

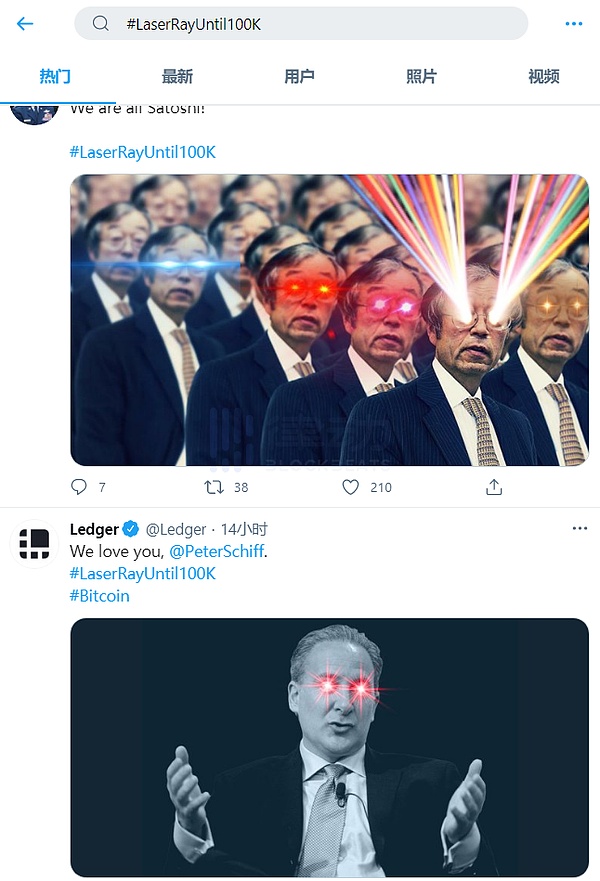

“The meme economy spreads love, the meme economy spreads wealth. And these memes injected rocket fuel into the last bull run. Some memes, like Doge, are obvious, and some are more subtle. Michael Saylor’s laser eyes is a meme,” said Amanda Cassatt, founder of Serotonin. And this meme had an impact.

“One of the things that led us out of the last bear market was MicroStrategy’s institutional approval to put Bitcoin on its balance sheet,” Cassatt continued, and the laser eyes became a symbol of this strategy, and this symbol has been imitated and spread repeatedly, just like the most contagious memes. (As the bull market has lost steam, the “laser eyes” meme has also begun to veer toward mockery.)

It’s likely that none of this would have happened without COVID. “Everyone’s at home watching screens,” Torres said. “It’s helped with the awareness of NFTs.”

Meanwhile, on the Reddit forum for Wall Street Bets, a new breed of investors is cheering to make money on “meme stocks” like AMC and GameStop.

For them, investing is an exciting, even empowering, mix of community, social media, and gambling. Why are only suits and hedge funds making all the money? Magdalena Kala, founder of Double Down Ventures, said Wall Street Bets has a very similar dynamic to crypto memes, a “we’re going to make something explode together” philosophy.Then there’s the macro environment — ultra-low interest rates, stimulus check dividends, easy money from a booming stock market. In traditional finance, Cassatt noted, it’s typical and even logical for investors to go for “risk-on” assets like tech stocks in this low-interest environment. The same psychology exists in crypto. People who make money holding Bitcoin or Ethereum see the “risk-on” potential of riskier bets like meme-coins. So why not seek out fatter returns?

All of these factors help explain the underlying reason behind the rise of meme-assets: the mysterious allure of memes themselves. The New Pop Art Memes are part of cryptocurrency’s earliest days. Early bitcoin users posted “Pepe the frog” on forums, while text memes like “digital gold,” “magic internet money” and “HODL” became shorthand for early adopters. “They’re very loving and nerdy and a way of expressing that it’s normal to be in this geek community,” said Linda Xie, co-founder of Scalar Capital. Memes and cryptocurrency are a natural fit. “Crypto people are almost by definition extremely online,” Kala said, adding that the “crypto community has never taken itself too seriously,” which has created a “cultural consensus point.”

But memes predate cryptocurrency. They predate the internet, and they’ve been around before any of us were born. “Memes have been part of culture since ancient times,” Torres said. “There were memes on hieroglyphs.” Julia Love considers a World War II-era factory poster of a woman with her arms bent to show “We can do it!” a meme.

The word “meme” was coined in 1976 by evolutionary biologist Richard Dawkins to describe an idea (or “entity”) that can be easily copied by others. “‘Meme’ comes from the Greek word mimesis, which means to imitate or reflect,” Cassatt said, arguing that the way people communicate with each other often takes the form of “visual and verbal packages”

that mirror each other. Cassatt sees memes as a “Darwinian evolution” of these visual and linguistic packages, and that “the more contagious they are, the more they spread (she sees stories from the Bible as a meme)”. In her mind, “Darwinism” means that the most viral survive. The things that go global are the most appealing, and the boring ones fall by the wayside. For Cassatt, it makes perfect sense that memes have become so important, “we’re in an increasingly virtual world.” This “Darwinian evolution” even explains the clever power of memes. Ben Lachance, the world’s first “meme agent,” said, “Memes are the new pop art, helping creators monetize their work. Anyone can make a meme and there will be no repercussions. But what about the memes we share with our friends? They rise because of the emotional resonance and intuitive reaction of the outside group to them.”In its heyday in 2021, Lachance considered Dogecoin a “modern-day Mona Lisa.” Now he is seriously and thoughtfully considering memes as art—a modern-day Warhol. He pointed out that the first photo of “Grumpy Cat” was shared by someone who had never posted anything. They were not an influencer and had no platform, and they got thousands of likes overnight. "There's this X-factor when you see something and react to it. It forces you to react. There's no other choice in your soul."

If memes are a valid art form, then why is it seen as wrong or ridiculous for creators to be paid? Why is there shame in collecting art? $590,000 is a lot of money for a pixelated cat. It's also true that "Nyan Cat" has brought joy to hundreds of millions of people, or at least made them feel lighthearted for a few moments. You could argue that Torres hasn't been paid enough. "Art doesn't always have to be serious," Lashes said. "Art can be fun and should be fun."

Lashes is committed to getting these creators paid. The former lead singer and musician for the band The Lashes has helped meme makers get compensated over the past decade. Take the Disaster Girl meme, for example, which shows Zoë Roth photographed at age four (now in her twenties), which Lashes describes as “one of the greatest photos of all time,” but Roth received nothing for it. In 2021, she sold it as an NFT and received compensation to pay for her college tuition.

Disaster Girl

The Disaster Girl meme and others like it have the power to transcend language — whether you’re in San Francisco or Bangladesh, you can understand the joke. This helps strengthen communities scattered around the globe, and as Xie says, “It’s always been a search for community in culture.” During COVID-19, people need that community. “I think people are looking for something to connect to and feel like they have a purpose,” says Julia Love. More people are turning to memes as a way to make money. The meme economy expands the universe of what you can invest in. Before memes and NFTs, the main way to invest in crypto was to buy Bitcoin, Ethereum, or another cryptocurrency. Memes feel different. Less intimidating, more fun. “I like that it makes investing more approachable,” Xie said. “I know a lot of people who have had great success investing in NFT art and collectibles, but they don’t care about DeFi, Bitcoin and Ethereum.” Xie added that the meme economy has brought a more diverse and inclusive group into the space.

For example, Xie mentioned that the “Crypto Coven” NFT community (in which she has also personally invested) is very inclusive and full of playful memes about witches. “It’s almost all women, and the community is very friendly,” Xie said.

The meme economy has made young people interested in finance. Kala sees memes as a continued progression toward finance as a hobby, where “entertainment is now not just about watching movies on Netflix or going to concerts, but about gambling or investing as a shared experience.” Kala says that, like the Reddit users of WallStreetBets, the people who buy memes are mostly “retail traders” — regular people with small accounts, not big institutions like hedge funds. “A higher percentage of people are just coming for the joke,” Kala says. “They come for entertainment, yolo, and digital growth.” Bitcoin, by contrast, has now attracted institutional investors like MicroStrategy and Cathie Wood’s Ark Investments. That’s not the case with cryptocurrency memes. The meme’s value is supported only by the shared belief in a story, and as Kala puts it: “It’s like a casino. Everyone knows that at some point the music stops.”

Memes are resilient:

Julia Love and Gary Lachance (the Doge couple) won a “Dogeclaren” at a cryptocurrency conference, and are currently making a pilgrimage to Japan to meet the real 17-year-old Shiba Inu that inspired Doge (while the Lachances don’t care about prices or speculation, Dogecoin’s value has risen 40% since October).

The emerging memecoin PEPE has (at least temporarily) caused a stir, and there have even been early experiments in using artificial intelligence to generate memecoins.

Not everyone thinks the meme economy has gone too far or become "too" important. Lachance seemed surprised by the idea and thought the rise of Dogecoin made more sense than the "dominant world war currency."

"Ideally, Doge will be the future of all trade and commerce in the world,"

Lachancesaid without humor. He ended with a figurative metaphor: Imagine going to an authoritarian country and looking at the currency there, you no longer see the face of the dictator, but the cute smile of Dogecoin. Lachancesmiled. "Is this too much? We are still a long, long way from 'too much.'"

YouQuan

YouQuan

YouQuan

YouQuan Alex

Alex YouQuan

YouQuan Hui Xin

Hui Xin Alex

Alex Joy

Joy Aaron

Aaron YouQuan

YouQuan Aaron

Aaron Hui Xin

Hui Xin