Author: Marcel Pechman, CoinTelegraph; Compiled by: Deng Tong, Golden Finance

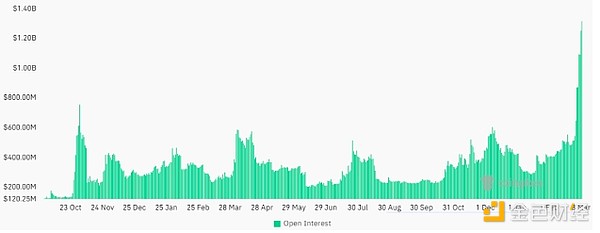

Dogecoin has been at the heart of the meme coin craze for more than a decade and has continued to rise significantly, such as only in the past It rose 95% in 7 days. However, the rise was accompanied by a record $1.4 billion in open interest in Dogecoin futures, fueling speculation that investors were overly optimistic.

Can Dogecoin repeat the 10x gain from previous cycles?

Some analysts believe that There would be no altcoin season without DOGE rising, There is some truth to this statement given its track record and market capitalization of $24 billion, making it a top 10 cryptocurrency.

Technical analysts believe that after 22 months of consolidation, Dogecoin is on track to repeat the explosive rise of “past bull markets.” One example includes a post by user ali_charts on the X social network.

#Dogecoin’s price trend appears to be Reflecting patterns observed in past bull markets. If history repeats itself, we may see $DOGE enter a parabolic breakout around April!

First, one should note that logarithmic scale price charts tend to minimize past price movements, making it easier to "forget" the 120% rise in July 2020 or 145% gains in October 2022, and attribute these to sideways markets. Additionally, the definition of a bull market may be seriously questioned, as some of these periods include a 67% retracement over a 40-day period between June and July 2017 and a 47% retracement in February 2021.

Whether or not the recent 95% weekly gain is the beginning of a bull market, DOGE’s total futures open interest Never exceeded $1 billion. In fact, every previous investment above $550 million in open interest has been accompanied by a significant correction in the price of DOGE. Therefore, either there has been a fundamental change in leverage demand, or retail investors have been too optimistic about the bullish momentum.

Dogecoin futures open interest since 2022. Source: Coinglass

Note that Dogecoin’s current open interest is $1.4 billion, significantly higher than its previous peak, but Dogecoin is trading below its all-time high 77% lower. Essentially, the data shows that interest in leverage has soared to unprecedented levels when measured in the United States. Still, without further details, one cannot attribute the price increase to retail investors betting on higher prices.

The increased demand for Dogecoin futures open interest could explain Use the price of Dogecoin as a proxy for the altcoin market for institutional participants. Likewise, savvy whales may short DOGE, thereby betting on a decline, while taking leveraged long (bull) positions on other meme coins. None of these cases should be considered risky or unhealthy as they are very different from the typical reckless use of leverage by retail traders.

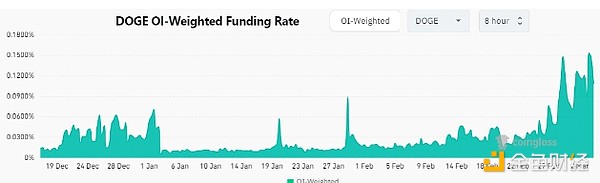

Dogecoin futures suggest bulls are becoming too optimistic

To learn more about the use of leverage, you should Analyze perpetual contracts (inverse swaps), which contain an embedded interest rate that is typically recalculated every eight hours to compensate for excess demand. Positive funding rates indicate that bulls require additional leverage.

DOGE perpetual futures 8-hour funding rate. Source: Coinglass

Data show that the DOGE futures financing rate has risen to the highest level in 18 months, 0.11%, equivalent to 2.3% per week. Typically, a weekly rate above 1% indicates excessive optimism, but one cannot immediately dismiss anything above this threshold as unhealthy.

During a bull market, even market makers and whales may find themselves temporarily starved of liquidity, which may last for weeks. As these entities raise cash, funding rates will eventually normalize, which is not necessarily driven by price adjustments.

Therefore, due to Dogecoin’s current leverage, Thinking of Dogecoin as a memecoin industry has significantly Some form of adjusted leading indicator seems unwarranted.

Huang Bo

Huang Bo

Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Edmund

Edmund Zoey

Zoey Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist