Author: DWF Ventures; Translation: Golden Wipe Xiaozou

2024 will be a key year for the crypto world - both in terms of institutional participation and the growth of on-chain activities.

Let's summarize the year with the following data.

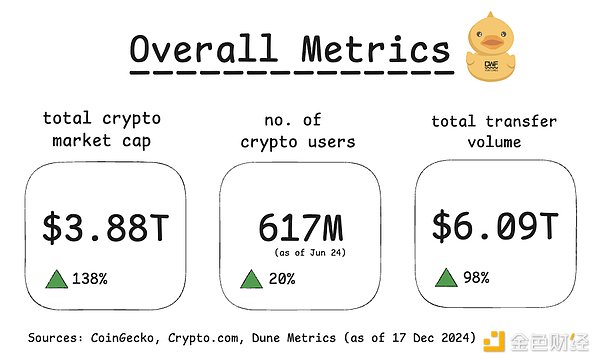

1. Healthy Growth

With the total crypto market value exceeding the historical high in 2021, the market rebounded sharply, reaching 3.7 trillion US dollars. Not only is liquidity increasing, but the number of users and trading volume are also rising, pointing to healthy growth and utilization.

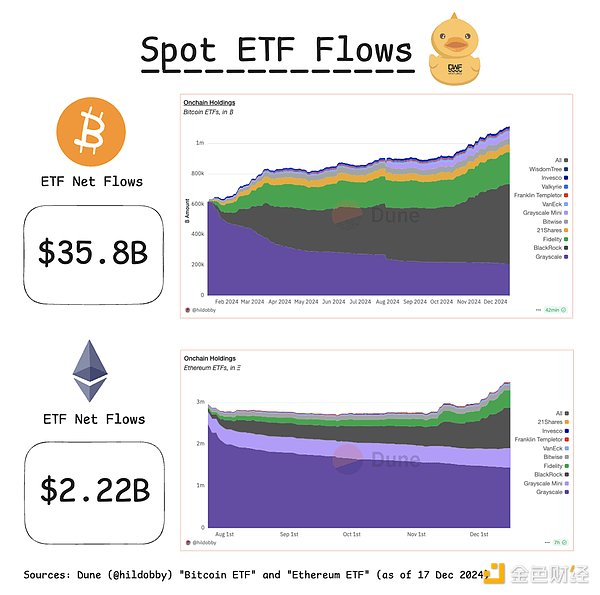

2. ETF & Institutional Inflows

The biggest catalysts this year are the BTC ETF launched in January and the ETH ETF launched in July. In addition to the lower barriers to entry, these inflows also show that traditional investors have a huge and growing interest in crypto assets. The total on-chain holdings of Bitcoin ETFs have also grown to 1.1 million BTC, a three-fold increase from the beginning of the year.

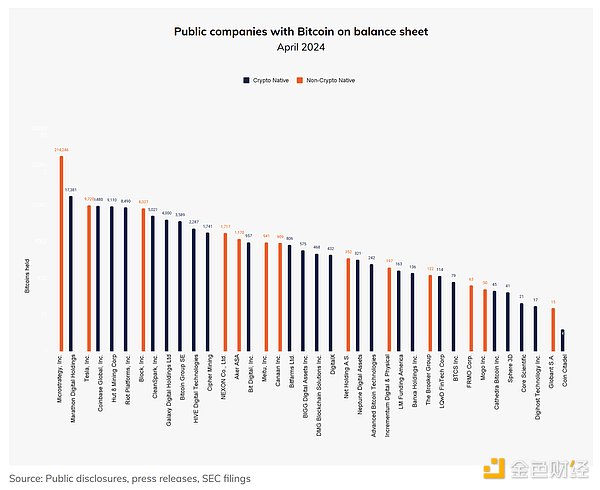

Many large companies (including non-crypto companies) are also increasing their exposure to Bitcoin and other crypto assets. Saylor's MicroStrategy's Bitcoin holdings have continued to double, and its current holdings have increased to 439,000 BTC.

3. Stablecoin opportunities

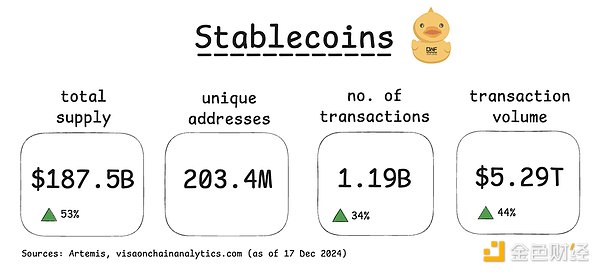

Stablecoins are critical to cryptocurrencies because they enable seamless entry, exit and trading between assets and are often seen as an indicator of new capital inflows. The total supply of stablecoins has reached 187.5 billion, a record high. The number of transactions and trading volume have also increased by more than 30-40%. It is worth noting that trading volume has remained stable in a volatile market environment, indicating that there are strong use cases beyond trading.

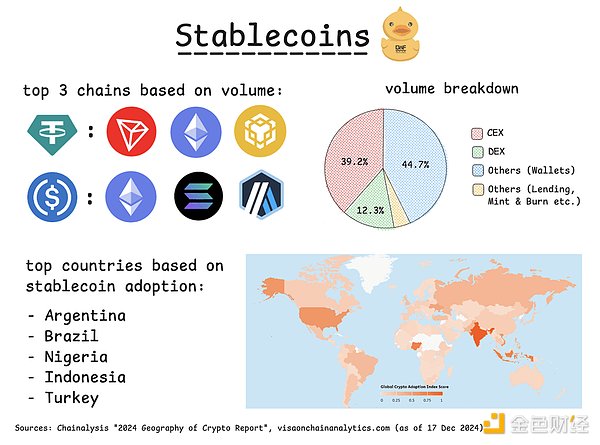

TRON DAO, Ethereum Foundation, BNB Chain, and Solana handle the largest stablecoins by volume on-chain. L2s like Arbitrum and Base are also experiencing huge growth in USDC volume/users. CEXs (centralized exchanges) are more active than DEXs (decentralized exchanges), but this trend may be turning.

The recently launched BlackRock and Ethena Labs USDtb allows traditional funds to easily access DeFi while keeping their funds safe. As access becomes regulated, we can see more funds flow into the chain.

The stablecoin market in Latin America and Africa has grown by more than 40-50% over the past year. In these regions, the stablecoin market is booming due to strong demand for trustless currency hedging. More investment is flowing into these regions, such as Tether launching education programs and Circle expanding its payment business to Latin America. Therefore, we expect this area to show significant growth in the new year.

4. On-chain activities

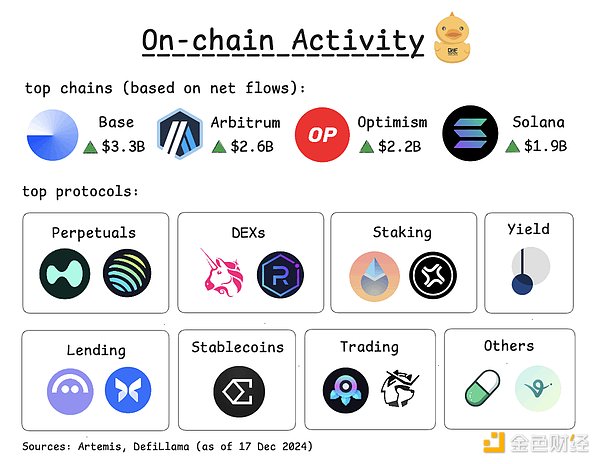

Base, Arbitrum, Optimism and other L2 and Solana and other non-EVM chains have the highest net inflows as users are turning to lower-cost and faster chains. The fastest growing areas are perpetual contracts and decentralized exchanges, with trading volumes increasing by more than 150% and TVL increasing by 2-3 times.

pump.fun ignited the meme coin craze, driving a huge increase in trading volume, which benefited Raydium and had a trickle-down effect on the rest of the ecosystem. This also led to the growth of trading bots, such as Photon and BONKbot, which continue to grow in usage and rank among the highest fee-generating protocols in the crypto space.

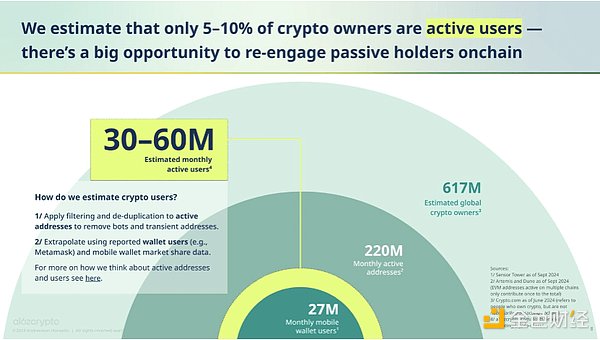

Considering that only 5-10% of cryptocurrency owners actively participate in on-chain transactions, there is still huge room for growth in on-chain activity.

Mobile-friendly interfaces such as the TON mini app have proven to be successful, attracting more than 50 million users to the TON chain. Therefore, user experience and user retention mechanisms will be key to the protocol moving forward.

5. Conclusion

2024 is an incredible year, and we believe that the crypto market will usher in a strong tailwind in 2025.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Beincrypto

Beincrypto Others

Others Beincrypto

Beincrypto

Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph