Written by: Jaleel Jialiu, BlockBeats

This is Vida’s somewhat provocative self-introduction. He claims to be the richest person born after 2000 on Zhihu, with at least $7 million in spare money (about RMB 51 million). Because of his fast trading speed and huge profits, he has received five investigation notices from Binance’s risk control department.

Seeing this, many people would think that this is another eye-catching speech by Zhihu’s pretentious man. But what if all this is true?

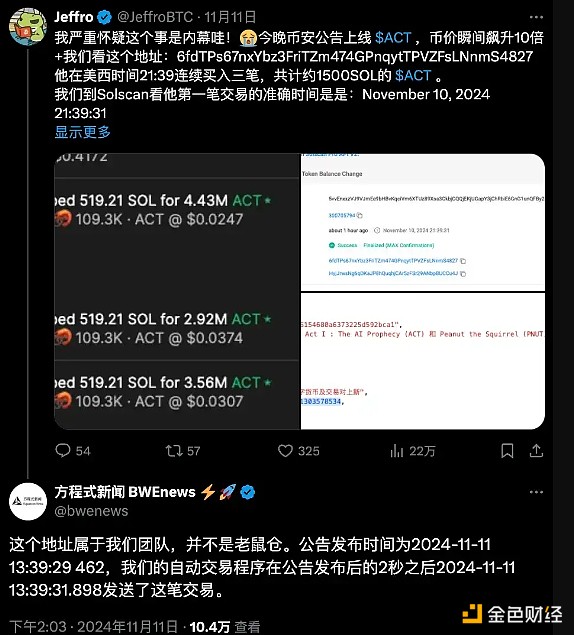

On November 11, Binance launched two small-cap tokens, ACT and PNUT. According to the on-chain data monitoring platform Lookonchain, within just 2 seconds after Binance announced the launch of ACT, one address quickly bought 10.9 million ACTs for $320,000. After ACT rose rapidly, the profit of this investment quickly soared to 3.4 million US dollars (about 24 million yuan).

The purchase time of this address was even 7 seconds faster than the release time of Binance's Chinese coin listing announcement. The purchase speed was too fast and the profit was huge, so some users immediately questioned whether this was "rat warehouse" and insider trading.

Just as the discussion intensified, the "Formula News" team issued a statement and claimed this address. Their transaction relied on the release of the English announcement, which was 7 seconds earlier than the Chinese announcement. The speed of this transaction is due to the precision and speed of programmatic news trading, and the trader behind it is Vida.

3 million US dollars, 21 million RMB, for Vida, the "post-00s rich generation", it only takes 2 seconds.

After becoming a god in one battle, Vida was called the strongest program trading god in this round of bull market by netizens. Vida himself also answered questions from netizens and said that his current net worth is close to 130 million RMB.

Vida's rapid rise to fame has attracted the attention of countless people. Not only because of his wealth accumulation speed and astonishing trading ability, but also because of his legendary background, growth experience and investment philosophy. From the subjective content and public information on Vida's Zhihu account, BlockBeats tried to piece together the starting process of this post-00s genius trader.

IQ 70, always at the bottom

Vida's starting point in life is incompatible with the label of "genius trader" that netizens now call him.

He was born in 2000 in a middle-class family in Jiangsu. His living conditions were not difficult, but his transcripts made people worry.

Since elementary school and junior high school, Vida's science foundation has been very weak. His math scores have always been at the bottom. In addition, he got a result of 70 in an IQ test, which made his teachers and classmates think of him as a "fool".

In the Chinese public education system that emphasizes science and neglects liberal arts, such results make it difficult for him to gain a foothold. "If I continue to stay in public school, I will not be as good as the small town test-takers. They can at least do questions, but I can't do anything."

In the year of the high school entrance examination, Vida handed in a perfunctory answer sheet with a total score of only 194 points, which also completely announced his break with traditional education. In later memories, Vida was very glad that he did not continue to stay in the public education system, but found his own advantages and realized the maximum value realization.

Vida is particularly talented in languages, especially in English. His potential that was suppressed in the traditional education system was finally released after entering an international high school.

"My advantage is that I have a leaping mind, rich imagination, and am very good at discovering business opportunities." This is how Vida described himself. He found that he was good at seizing the information gap between people in a free and relaxed environment and profiting from it. This "financial intelligence" became the core gene of his future success.

Vida's change is largely due to family education. Vida's father has made a lot of enlightenment for him. Since 1996, Vida's father has entered the Chinese stock market. He is a disciple of Buffett's value investment school and also has his own unique method of investing in the Chinese stock market. Having escaped the peaks of 2007 and 2015, and having bought houses in 2000, 2008, and 2015, Vida's father, relying on investment, went from a purchasing manager of a foreign company to a free man who retired early and often traveled.

At the age of 16, the first pot of gold

This also made Vida realize that the latest business speculation will never be taught in school, but needs to be practiced by doing business in person and feeling the fluctuations of the financial market. If a person pursues money, then learning and practicing speculation is more efficient than studying hard.

"Spending a few years learning and practicing speculation may be more useful than studying hard for 100 years."

Therefore, he hardly reads books, but he often browses Twitter and YouTube, and hangs out in high-value English communities with per capita assets of more than 2 million US dollars. He only pays attention to the speeches of the best traders and draws experience and wisdom from them. He prefers to describe himself as a "grassroots general": "I am like Li Yunlong, a general born in the grass. I haven't read many military books, but I know how to fight a business war."

In 2015, 16-year-old Vida tried to put his theory into practice for the first time. He used information asymmetry to engage in light asset arbitrage, and in less than four years, he accumulated his first pot of gold of 1 million yuan.

The light asset, low-cost and high-efficiency arbitrage model has always been his core strategy. Profit from the information asymmetry between markets and between people. This model is not only low-cost and efficient, but also highly fault-tolerant. He admitted that the success rate of the ideas he tried was only 10%-20%, but the investment in each idea would not exceed 1% of the total assets. This low-cost trial and error model allows him to take risks, and even if he fails, he will not be hurt, and once he succeeds, the return is often several times or even dozens of times.

At that stage, his trading intuition and market sensitivity were beginning to show their edge. When his peers were still anxious about the exam, this first pot of gold had become his capital accumulation and source of confidence, and also became the starting capital for his later macro investment stage.

Around 2018, Vida did not go through the college entrance examination, but chose to enter a 3+1 overseas university.

There, he met peers from all over the world, and also set his sights on a larger market - macro investment. He began to use his accurate judgment of the macro economy and market trends to make investment decisions. At this stage, his wealth grew from 1 million yuan to 7 million yuan.

However, he soon realized that the traditional manual trading method could no longer meet his needs. The market is changing rapidly, and it is difficult to stay ahead in a highly competitive environment by relying solely on intuition and manual operations. Therefore, Vida began to delve into quantitative trading and explore how to use programs and algorithms to automate and refine his trading model.

Compared to trading and code, he knows more about resource allocation

"I don't need to master every detail myself. I just need to know the principles and goals of the implementation, and then supervise the team's execution to ensure that the results meet my expectations."

When involved in automated trading, many netizens may think that Vida is very good at code programming and digital coding, but as mentioned before, Vida is not good at science, nor does he know much about code. What he is good at is actually resource allocation and continuous optimization of the configuration.

Vida has formed a small team, including programmers and quantitative analysts, through whom he transforms his ideas into automated trading strategies. "I am responsible for providing ideas, and the team is responsible for execution. In this way, I can use resources in the most critical places."

He never wants to see himself as a simple trader, but prefers to regard himself as "Xiang Yu" - an entrepreneur who charges into battle and knows how to command from behind. "As a manager, I don't need to write every line of code myself, but I have to make sure that my trading strategy can be accurately implemented."

With such resource allocation capabilities, in March 2021, Vida officially incorporated quantitative trading into his investment system. He began to test how to integrate macro investment strategies into quantitative algorithms, trying to use technology to optimize trading efficiency. At first, his understanding of quantitative trading was only theoretical, but through months of practice, the potential of quantitative trading gradually emerged.

By the end of 2021, his quantitative strategy had helped him earn more than 10 million yuan in profits. More importantly, he finally saw the possibility of fully automated trading-transforming trading decisions from "manual mode" to "algorithm-driven" to beat other competitors in the market with speed and accuracy.

Vida also often publicly shares some of his trading strategies on Zhihu, because he knows that his moat is not these trading strategies, but the complexity and difficulty of these strategies, which are difficult for 99.99% of people in the market to copy.

The art of arbitrage at the millisecond level

By 2022, Vida had established a firm foothold in the market through quantitative trading. But like every successful entrepreneur, success does not bring satisfaction, but greater anxiety.

That year, he met a French colleague who made millions of dollars using news trading strategies, and then made tens of millions of dollars in a few months by arbitrage trading through Coinbase's technical loopholes. This model of rapid wealth accumulation made Vida feel "both admiration and anxiety." He realized that there were people in the market who were faster and more perceptive than him.

This sense of crisis drove him to continuously optimize his strategy and determined to rethink his trading philosophy: speed is everything.

"Find a way to get intelligence before others, and place an order to buy before others. Then when others want to buy in later, throw it to them." Driven by this thinking, he began to take root in news trading, and keenly discovered that domestic news media usually lag behind the market rhythm, which is not conducive to trading.

Therefore, in the first year after graduating from university, Vida opened a crypto media Formula News for the overseas Chinese market. Considering compliance reasons, it was only broadcast on TG, Twitter and Discord platforms.

"I make money from retail traders who are delayed in information and market makers whose information channels are not fast enough to withdraw orders. Retail traders often rely on those slow news media or word of mouth in the community to obtain information. The reaction time to a piece of news is often several minutes, so as long as you buy faster than retail investors, you will make a profit." Vida wrote on Zhihu.

In later recollections, Vida felt that this was one of the wisest decisions he made in 2022. He completed the complete transformation from timing trading to fully automated trading, and increased the trading speed to the top level in the industry through automated news trading and latency arbitrage.

That year, the global financial market was sluggish and most investors were helpless, but Vida accurately retained a large amount of US dollar cash and successfully turned 8 million yuan into 20 million yuan by relying on delayed arbitrage and high-frequency strategies on trading platforms such as Binance.

In 2023 and 2024, the market slowly recovered, and Vida's trading model has basically achieved true automation. His fully automatic news trading system can capture news content and execute transactions immediately. The millisecond-level response speed gives him an advantage in strong pull-ups.

As a result, Vida's net worth has achieved explosive growth, soaring from 30 million yuan to 100 million yuan.

It is hard to imagine that Vida, who is worth billions, has just graduated from college for two or three years and is in charge of three main business lines, of which more than a dozen subdivided business lines can be split out.

For the next plan, Vida hopes to have assets of more than 100 million US dollars in 3 years and to establish his own hedge fund in Singapore or Dubai.

In the long-term vision, Vida showed more "idealism" and "heroic temperament": he hopes to create a myth like Bill Gates or Zuckerberg, who has a lot of wealth when he is young, and he wants to record the whole process, so that he can slowly recall his youthful vigor when he is old, and it can also be a reference for those who want to learn from his experience.

"I probably won't retire in 5 years. If I really retire, I want to be a marine biologist, just like Cameron, or be a money-making up master like MrBeast." This is how Vida imagines his life after retirement.

Reject fatalism

"Destiny is random, but randomness does not mean you can't control it." Never believing in fate may be Vida's biggest character trait.

Whether in high school or college, most of Vida's classmates came from wealthy families. Since then, in the second-generation circle, he often heard a voice: "Some things you are born with, and some are not born with." Vida was very opposed to this idea and sneered at it.

When he was 16 years old, the foreign teacher asked the students to write a letter to their future selves. Vida wrote in the letter: "I will definitely become a big boss at the age of 26. He wanted to use his own practice to prove that the saying "It is difficult for a poor family to produce a noble son" is a lie.

In Vida's view, pessimistic people think that randomness is fate, while optimists use randomness to create opportunities: "Good luck will favor those who try enough. The gap often lies in who has fought for more opportunities to try."

Some people think that the money he earns now is given by God, but Vida has a completely different view. "I know clearly where every penny I make comes from: either greedy retail investors or market makers who are not fast enough in getting information, rather than relying on some illusory trend or God's gift."

In the three years from October 2022 to October 2024, Vida's actual trading odds were a very steep straight line, which made him even less believe in metaphysics, feng shui and destiny. He only believed in himself.

"I make money by high awareness + computer technology + resource coordination and team management + understanding retail investor psychology + large enough funds to manipulate the market in a short time."

"Crypto is a paradise for smart people"

If you only have a principal of less than 100,000 yuan, how should you get started?

In Vida's view, the answer is not to fantasize about getting rich through financial investment, but to start with two things:

First, hone a skill. Choose a niche field, train yourself to be an expert in this field, and sell part of your time in exchange for money.

Second, tap the information gap between people. Through Internet business opportunities, buy and sell goods, or become a risk-free arbitrageur between people, and make full use of information asymmetry to make profits.

In the past 20 years, China's wealthy group has shifted from real estate and mineral resources industries to the Internet, new energy and cross-border trade, and more new models and industries will emerge in the future. There is no shortage of opportunities. The key is whether you can be the first to rush up and grab the stall.

And encryption is a new beachhead.

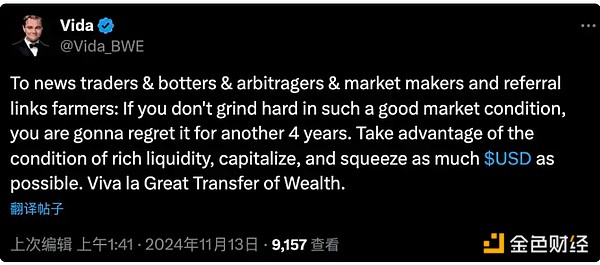

"To news traders, robots, arbitrageurs, market makers and rebate farmers: If you don't work hard in such a good market condition, you will regret it in the next four years. Take advantage of the abundant liquidity to complete capitalization and squeeze as much USD as possible. Long live the great transfer of wealth." This is Vida's latest statement on Twitter.

The encryption market is a paradise for smart people, and Vida is such a smart person. He does not hide his preference for the encryption industry. In his opinion, this is a rare stage in the world for smart people to stand out.

"The biggest role of the crypto market is to transfer wealth from the 95% of retail investors to the 5% of elites." Vida wrote on his Zhihu homepage.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Brian

Brian Brian

Brian Hui Xin

Hui Xin Joy

Joy Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Kikyo

Kikyo Joy

Joy