Author: Jiawei, IOSG Ventures; Translation: Jinse Finance xiaozou

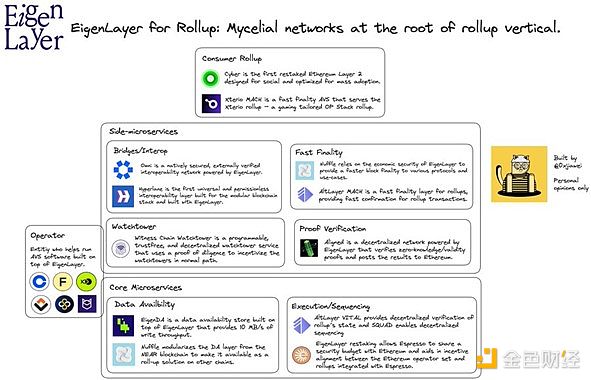

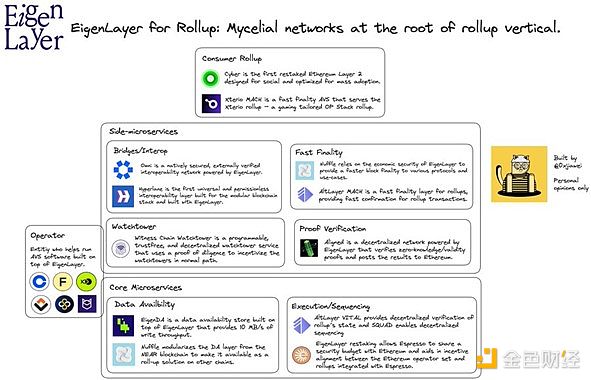

In this article, we will explore how EigenLayer's cryptoeconomic primitives drive the development of the rollup ecosystem and why it is like a mycelium network at the root of its vertical field.

1 Why focus on rollup support?

At the end of 2020, a rollup-centric roadmap was established as the main development direction of Ethereum. In the next few years, most user activities are expected to occur on rollups, with Ethereum acting as a security layer.

Recently, in addition to general-purpose rollups, there has been an increase in the number of application-specific rollups entering the market. (The L2Beats team suddenly has more unexpected work to do!) It is clear that application-specific rollups have become an important trend.

EigenLayer has proposed the idea of building the next 15 unicorns, and rollup services are a key category. It has partnered with AltLayer to incorporate many auxiliary services into a "re-staking rollup" framework. So far, some progress has been made in this area, and Cyber, Xteri, and Dodo have all launched their own rollups based on this framework.

Looking forward, based on cryptoeconomic security primitives, we can actually build a series of rollup services on top of EigenLayer, taking full advantage of EigenLayer's composability. These services can be independently extended according to specific needs, thereby enhancing the overall resilience and scalability of the system.

We believe that with the support of these services, rollups can be launched quickly.

2, Sorting

Sorting is a core component of the rollup system. Currently, most rollups rely on centralized sorters to handle transaction sorting and transaction package submission.

Decentralized sorters are essential as the underlying infrastructure of the rollup system.

For rollups in the early stages, exploring these solutions can be very time-consuming and resource-intensive. Therefore, outsourcing this task to a shared sorter may be the best solution.

EigenLayer provides strong economic security for the sorter.

Espresso uses a re-staking mechanism to build its decentralized sorter for higher security and performance.

By incorporating Ethereum's pledged capital into Espresso, the network can complete transactions in seconds, significantly improving node capital efficiency.

The re-staking mechanism ensures that Espresso's security is closely integrated with Ethereum, while optimizing resource utilization and economic security.

3、Data Availability (DA)

Today's rollup still faces some challenges in competing with L1.

- Data Availability (DA) Costs: The cost of writing data is still high.

- DA Cost Uncertainty: Even though the cost will be reduced with the release of EIP-4844, there is still uncertainty, which may overwhelm the entire bandwidth.

- Rollup Exchange Rate Risk: Due to the potential volatility of the exchange rate of rollup tokens to ETH, rollups using native tokens have uncertainty in fee calculation.

- Token Utility: Unlike L1 tokens, most rollup tokens do not have token utility except for DAO governance.

EigenDA provides solutions to these challenges:

- Lower DA costs: EigenDA’s hyperscale system provides ample data availability at a low cost.

- Long-term retention: Similar to retaining dedicated AWS instances, EigenDA allows users to obtain dedicated DA channels.

- Native token payments: Rollups can use their own native tokens for payments, effectively managing inflation for DA operations.

- Dual staking with rollup tokens: EigenDA’s security is enhanced by a committee of ETH stakers and user tokens.

These solutions are managed by EigenLayer and EigenDA, allowing developers to focus on their core products.

4、Watchtower

The design of the fault proof system includes a challenge period during which anyone can object to the state transition. This mechanism is intended to ensure the integrity of the system and provide incentives for monitoring and challenging improper behavior.

Given that early optimistic rollups may lack sufficient community attention and participation, such rollups rely more on watchtowers to monitor suspicious transactions and issue alerts.

Witness Chain uses crypto-economic trust from EigenLayer to address this need by deploying the watchtower function.

Specifically, it ensures the continuous incentives and fairness of watchtowers through Proof of Diligence, and verifies the geographical location of watchtowers through Proof of Location, thereby achieving physical decentralization.

5、Proof Verification

In recent years, ZKApps (zero-knowledge proof applications) have developed rapidly. Verification of ZKP (zero-knowledge proof) becomes a key component.

However, on Ethereum, proof verification is costly and throughput is limited. In addition to the costs associated with the proof system and precompilation, there is also the impact of Ethereum network gas fees, which makes the cost structure unclear.

Aligned provides a verification network that focuses on reducing costs and increasing throughput. It implements proof verification through two modes: fast mode and aggregation mode. In fast mode, a portion of Ethereum validators re-stake through EigenLayer and use verification code written in a high-level language to verify the proof. After reaching consensus through BLS signatures, the results will be published to Ethereum.

This approach can not only optimize verification speed through parallel processing, but also solve the problem of expensive proof systems on Ethereum, significantly improving verification efficiency and system scalability.

6, Bridging and Interoperability

The multi-layer, multi-chain environment provides a wealth of options, but also leads to fragmentation problems, which brings challenges to users and developers. Current bridge protocols and interoperability solutions face many difficulties when dealing with cross-chain interactions, such as security, efficiency, and user experience issues.

Hyperlane leverages EigenLayer's re-staking mechanism to build its interoperability protocol, achieving a higher level of economic security. By staking and signing messages on the source chain, Hyperlane validators ensure the authenticity of messages and perform fault checks through smart contracts.

This mechanism not only reduces Hyperlane's operating costs, but also attracts more users and protocol fees through higher economic security.

7Fast finality

We need fast finality because Ethereum's transaction finalization time is relatively long, about 12 minutes, so it is not suitable for latency-sensitive applications such as games and social applications. Due to the weak finality guarantees provided by sorters, the transaction receipts they generate are not sufficient to support interoperability between rollups. Fast finality supported by cryptoeconomic security can enhance the reliability and security of these interactions and ensure smooth cross-rollup operations.

AltLayer MACH is an AVS (Active Verification Service) of Eigenlayer, which helps rollup achieve fast finality and guarantees the economic security and fast confirmation of rollup transactions. Each node in the MACH network is an operator that strictly verifies the rollup status and actively challenges any possible deviations within the specified challenge window.

8, Conclusion

RaaS solutions such as AltLayer, Caldera, and Conduit can integrate all these components, help applications quickly deploy infrastructure, and provide a simple one-click integrated development experience, allowing developers to focus on their products and applications.

These infrastructures show a high degree of composability and are supported by strong economic security from EigenLayer.

Ethereum is a verifiable Internet.

Rollup is a verifiable web server.

AVS is a verifiable SaaS.

EigenLayer is a verifiable cloud.

Cheng Yuan

Cheng Yuan