Author: IGNAS | DEFI RESEARCH Source: Substack Translation: Shan Ouba, Golden Finance

I had planned to write a blog post about emerging trends in cryptocurrency this week, but had to quickly switch to the topic of heavy staking.

The reason is: Eigenlayer's main competitor Symbiotic just went live with a deposit cap of $200 million, and almost reached the cap in one day. Emerging trends can wait, but high-yield opportunities cannot.

Add to that Karak, and now we have three heavy staking protocols. So, what happened? How are they different? What should you do about it?

The motivation behind Symbiotic

The buzz is that Paradigm approached Eigenlayer co-founder Sreeram Kannan with the intention of investing, but Kannan chose rival VC firm Andreessen Horowitz (a16z). a16z led the $100 million Series B round.

Since then, Eigenlayer has grown to become the second largest DeFi protocol with a total value locked (TVL) of $18.8 billion. It is second only to Lido, which has a locked value of $33.5 billion. EIGEN tokens are not yet transferable and traded at $13.36 billion on a fully diluted valuation (FDV).

Considering that Eigenlayer is valued at $500 million FDV in March 2023, this means a 25x increase in paper gains.

It’s not hard to imagine that Paradigm was unhappy about this. In response, Paradigm funded Symbiotic, positioning it as a direct competitor to Eigenlayer. Symbiotic received $5.8 million in seed funding from venture capital giants Paradigm and Cyber•Fund.

It’s not known what the exact valuation is. If you know, please share it in the comments.

Paradigm’s competition with a16z is well known (and joked about), but there’s a second part to this story.

Symbiotic’s second largest investor, Cyber Fund, was founded by Lido co-founders Konstantin Lomashuk and Vasiliy Shapovalov. Coindesk reported in May that “people close to Lido believe Eigenlayer’s re-staking approach could pose a threat to its dominance.” Lido has missed the trend of Liquid Re-staking Tokens (LRT). In fact, stETH’s TVL has stagnated over the past three months, falling 10%. Meanwhile, EtherFi and Renzo have seen a surge in inflows, reaching $6.2 billion and $3 billion in TVL, respectively. Re-staking with LRT is more attractive as it offers higher yields, although most of it is still point farming at the moment.

To strengthen Lido’s position, Lido DAO launched the “Lido Alliance”, whose primary mission is to develop a permissionless decentralized re-staking ecosystem.

By the way, one of the strategic priorities is to reaffirm stETH as LST instead of LRT.

This is great because we have more tokens and more airdrop opportunities.

Just one month after the initial discussions, a key member of the alliance (Mellow) launched LRT deposits on Symbiotic, supporting stETH deposits!

But before we dive into the unique features and farming opportunities of Mellow LRT, let’s take a step back and discuss how Symbiotic differs from Eigenlayer.

Symbiotic vs. Eigenlayer

Symbiotic: Permissionless and Modular

Symbiotic differentiates itself by being permissionless and modular in design, offering more flexibility and control. Its key features are:

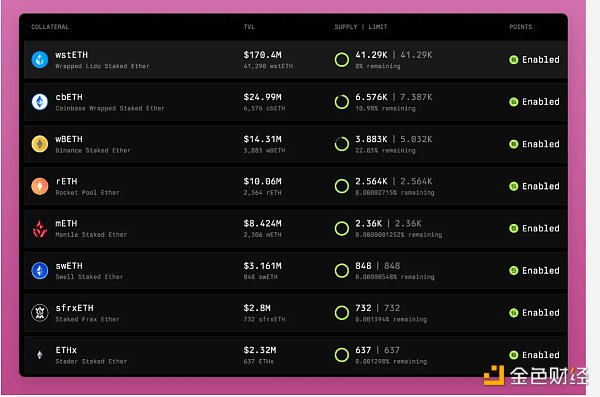

Multi-asset support: Symbiotic allows direct deposits of any ERC-20 token, including Lido's stETH, cbETH... This makes Symbiotic more diverse than Eigenlayer, which focuses primarily on ETH and its derivatives (as far as I know, Eigenlayer may support other assets in the future).

Customizable parameters: Networks using Symbiotic can choose their collateral assets, node operators, rewards, and slashing mechanisms. This modularity enables networks to adjust their security settings to their specific needs.

Immutable Core Contracts: Symbiotic’s core contracts are non-upgradeable (similar to Uniswap), reducing governance risks and potential points of failure. Symbiotic can continue to operate even if the team disappears.

Permissionless Design: By allowing any decentralized application to integrate without approval, Symbiotic provides a more open and decentralized ecosystem.

Symbiotic co-founder and CEO Misha Putiatin told Blockworks, “To be ‘symbiotic’ means ‘to run away from competition like fire and be as selfless and as non-paranoid as possible.’

Misha also told Blockworks, “Symbiotic will not compete with other market participants — so there is no native staking, rollups, or data availability provided.”

When dApps launch, they typically need to manage their own security model. However, Symbiotic’s permissionless, modular, and flexible design allows anyone to use shared security to protect their network.

Misha told Blockworks, “The goal of our project is to change the narrative — you don’t have to launch natively — it will be safer and easier to launch on top of us, on top of shared security.”

In practice, this means crypto protocols can launch native staking for their native tokens to increase network security. For example, Ethena is working with Symbiotic to secure USDe cross-chain with staked ENA.

Ethena is integrating Symbiotic with LayerZero’s Decentralized Verification Network (DVN) framework to bring Ethena assets like USDe cross-chain secured by staked ENA. This is one of the first few parts of its infrastructure and system to leverage staked ENA - Symbiotic blog post.

Other use cases include cross-chain oracles, threshold networks, MEV infrastructure, interoperability, shared sequencers, and more.

Symbiotic launched on June 11th, and the deposit limit for stETH was reached within 24 hours. Oh, did I mention depositors also have points?

Eigenlayer: A Curated and Integrated Approach

Eigenlayer takes a more curated and integrated approach, focusing on leveraging the security of Ethereum ETH stakers to support a variety of dApps (AVSs):

Single-asset focus: Eigenlayer primarily supports ETH and its derivatives. This focus may limit flexibility compared to Symbiotic's multi-asset support. Although more assets can be added.

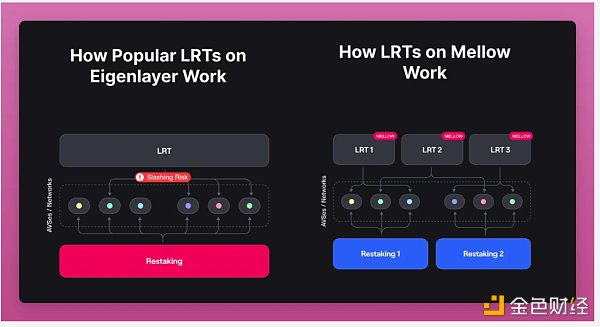

Centralized Management: Eigenlayer manages the delegation of staked ETH to node operators, who then validate various AVS. This centralized management helps simplify operations, but can lead to bundled risk, making it difficult to accurately assess the risk of individual services.

Dynamic Market: Eigenlayer provides a decentralized trust market that allows developers to launch new protocols and applications using pooled ETH security. Risk is shared among depositors in the pool.

Slashing and Governance: Eigenlayer's management approach includes specific governance mechanisms to handle slashing and rewards, which may provide less flexibility.

To be honest, Eigenlayer is a very complex protocol whose risks and overall operation are beyond my understanding, and I had to compile criticisms from various sources to write this section. One of those sources is Cyber Fund.

I don’t take sides, and I’m sure the comparison of Symbiotic to Eigenlayer will spark a lively discussion among DeFi geeks.

Welcome to Mellow Protocol: Modular LRT

What impressed me most about the Symbiotic launch was that the LRT on the Mellow protocol was available immediately. As a member of the Lido Alliance, Mellow benefits from Lido’s marketing, integration support, and launch liquidity.

As part of the agreement, Mellow will reward Lido with 100 million MLW tokens (10% of the total supply), which will be locked in the Lido Alliance legal entity after the TGE.

These tokens will follow the same vesting and cliff terms as the team tokens: 12 month cliff period after the TGE, 30 month vesting period after the cliff period (Edit modified based on feedback received)

Two other benefits mentioned in the alliance proposal:

“Mellow will help spread Lido’s geographical and technical decentralization efforts beyond Ethereum validation.”

“Lido node operators can launch their own composable LRT and control the risk management process by choosing an AVS that fits their needs, rather than facing the imposition of an LRT or restaking protocol.”

The impact of the partnership will take time to emerge, but LDO is up 9% in 24 hours. That’s a good thing!

Interestingly, the $42 million cap on one of the four LRT pools was reached before the Lido partnership tweet was released.

Anyway, if you are familiar with Eigenlayer’s LRTs, such as Etherfi and Renzo, you’ll know that depositing Mellow is double the fun: you get points from both Symbiotic and Mellow.

But Mellow is different from Eigenlayer’s LRTs…

What problems does Mellow solve for LRTs?

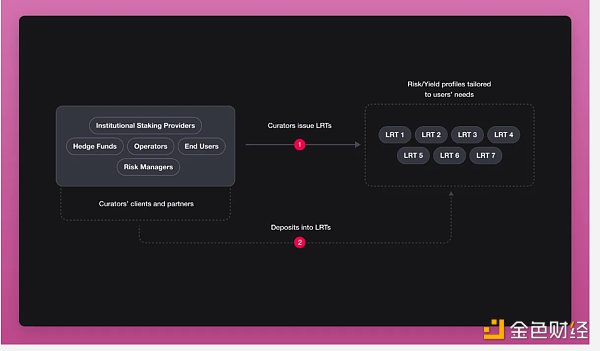

The Mellow protocol allows anyone to deploy LRTs. Hedge funds, staking service providers like Lido can do it. In theory, I can do it too.

This means that the amount of LRT will increase significantly, which will hurt its liquidity and complicate its integration in DeFi protocols.

However, it also has some advantages:

Diversified risk models: Current LRTs often force users to adopt a one-size-fits-all risk model. Mellow allows multiple risk adjustment models, allowing users to choose their preferred risk exposure.

Modular Infrastructure: Mellow’s modular design allows shared security networks to request specific assets and configurations. Risk managers can create highly customized LRTs for their needs.

Smart Contract Risk: By allowing modular risk management, Mellow reduces the risk of vulnerabilities in smart contracts and shared security network logic, providing a safer environment for heavy stakers.

Operator Centralization: Mellow diversifies the decision making of operator selection, preventing centralization and ensuring a balanced and decentralized operator ecosystem.

LRT Cycle Risk: Mellow’s design addresses the risk of liquidity crunch due to withdrawal closures. Current withdrawals take 24 hours.

Interestingly, Mellow specifically mentioned that they could launch LRT on top of any staking protocol, such as Symbiotic, Eigenlayer, Karak, or Nektar. But I would be very surprised to see Mellow working directly with Eigenlayer.

However, I would not be surprised to see a current Eigenlayer LRT protocol working with Symbiotic or Mellow. In fact, Coindesk reported that a person close to Renzo and Symbiotic mentioned that Renzo was already discussing integration with Symbiotic a month ago.

Finally, a cool feature of permissionless Mellow vaults is that we may have LRTs for DeFi tokens. For example, the ENA LRT token is liquid re-collateralized ENA on Symbiotic, securing the USDe cross-chain bridge.

There has been little innovation in token economics this cycle, but Symbiotic may make holding DeFi governance tokens attractive again.

The Heavy Staking War Manual for DeFi Degen

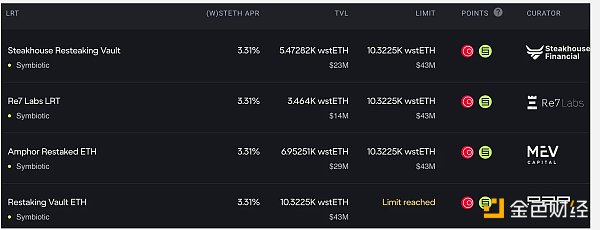

As of writing, there are four LRT vaults on Mellow, with four unique curators. The deposit cap is about to be reached.

The timing of the Symbiotic + Mellow LRT launch is perfect: EtherFi S2 points end on June 30, Renzo S2 is also in progress, and the Swell airdrop will come soon after withdrawals are enabled.

I am almost worried about what to do with my ETH after the LRT farm airdrop expires. Thanks to VCs and whale games, airdrop farmers will also be well fed.

At this stage, the game is pretty simple: Deposit Symbiotic to earn points, or take the risk up a notch and farm directly on Mellow.

Note that since Symbiotic’s stETH deposit is full, you won’t get Symbiotic points, but will get 1.5x Mellow points.

The airdrop farming game will probably be similar to the Eigenlayer playbook: Mellow LRT will be integrated into DeFi, we’ll see leverage farming on Pendle, and across multiple lending protocols.

But I believe the Symbiotic token will probably launch before EIGEN is tradable.

In an interview with Blockworks, Putiatin said that the mainnet could go live “as early as late summer for some networks.” Does that mean the token will go live, too?

Stealing the heat from restaking from Eigenlayer could be a smart move, especially if the market turns bullish soon and considering Symbiotic’s aggressive partnership strategy.

Two of the partnerships that shocked me the most: Blockless and Hyperlane. These two protocols initially partnered with Eigenlayer as AVS for shared security, but are they switching alliances?

Perhaps Symbiotic promised more support and token distribution? I need more answers!

In any case, these restaking wars are good for us DeFi airdrop farmers because it provides more opportunities and may push Eigenlayer to launch a token sooner.

Symbiotic is still in its early stages, but the early deposit inflows are very bullish. I am currently farming on Symbiotic and Mellow, but plan to migrate to Pendle’s YT when the strategy opens.

I believe that Pendle’s Symbiotic YT token expiration date will give us further clues about the Symbiotic TGE timeline.

One last note: Karak

Karak is a hybrid. It is similar to Eigenlayer, but Karak calls them Distributed Security Services (DSS) instead of AVS.

Karak also launched its own Layer 2 (named K2) sandbox for risk management and DSS. However, it is more like a testnet than a real L2.

But Karak managed to attract over $1 billion in TVL! Why? There are two main reasons:

Karak supports Eigenlayer's LRT, so farmers deposit LRT to earn Eigenlayer + LRT + Karak points at the same time.

Karak has raised over $48 million from Coinbase Ventures, Pantera Capital, Lightspeed Ventures. Good name is expected to bring high airdrops.

However, Karak has not announced any major partners, notable LRT protocols launched on Karak, or any exclusive DSS/AVS partners since its announcement in April.

I really hope to see more positive developments on Karak, as Symbiotic is trying hard to catch up with Eigenlayer. Karak needs to step up its game.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist