Author: arndxt, crypto researcher; Translation: Jinse Finance xiaozou

Why do I no longer advise friends to "learn crypto knowledge first"?

Last month, I once again tried to guide a friend outside the circle into the crypto world. Just ten minutes later, when the process reached "select a wallet" and 'now you need to pay the gas fee with another token', her eyes began to become blank. This made me suddenly realize: we are not facing a knowledge gap, but a design gap.

A cruel reality has become very obvious: speculation brought the first wave of users, but it cannot bring the next wave of billion users. Real popularization begins when crypto products become "invisible" - that is, when people benefit from them but do not seem to realize that they are using crypto technology. From the rise of stablecoins to the popularity of institutional staking, to the increasingly important role of AI in shaping the digital economy, the foundation for mass adoption is being laid. But to achieve this future, we have to stop expecting users to learn about crypto and start building products that make them use crypto without even realizing it.

Here are eight narratives and projects I think are worth paying attention to:

1. The winning formula for the next generation of wallets: Do one thing really well

We are witnessing a major structural shift: users are forming habits around two complementary wallets: one that feels like an "everyday wallet" for fintech apps, and the other that feels like a "vault wallet" for bank apps.

Wallet experiences are fragmenting. Developers who try to cram every feature into a single interface will lose to solutions that focus on a combination of (a) a frictionless onboarding experience and (b) a highly secure storage solution.

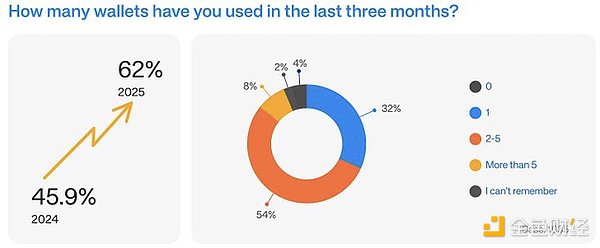

More than half of people currently use 2-5 wallets at the same time, and nearly 48% say this is because each network still lives in its own walled garden.

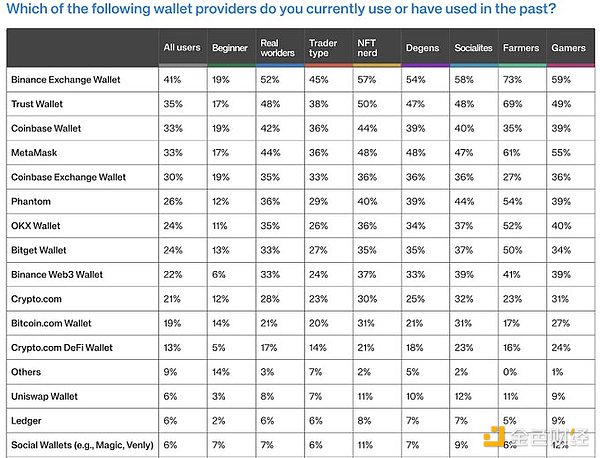

Head concentration is obvious:

Among users with more than 2 years of experience, 54% of users focus on Binance, Coinbase, MetaMask or Trust wallets.

Among the novice group, no wallet has a market share of 20%.

However, self-custody is still daunting for most users. Interestingly, Binance’s own self-custody solution, the Binance Web3 wallet, attracted only 22% of users, suggesting that users are still hesitant even when offered an easier path to self-custody in a familiar branded ecosystem.

Multiple wallets are a move of desperation.

After months of observation, I’ve learned one thing: People don’t want to manage multiple wallets at the same time. They do it because they have no choice.

Clearly, the “seamless multi-chain future” we’ve been talking about has not really arrived yet. 48% of users maintain multiple wallets primarily to access different blockchain ecosystems.

44% of users now intentionally split their wallets for security reasons, up from 33% last year.

This tells me two things: the industry has failed to achieve true interoperability and is shifting operational complexity to end users; at the same time, these users are getting smarter - they no longer blindly trust a single wallet to handle all scenarios.

Phantom - a hot wallet on Solana and Ethereum.

2. Misalignment of behavior and belief

We are still in this space for speculation.

Indeed, 54% of users actually used cryptocurrencies for payments or peer-to-peer transfers in the past quarter. But when asked about their favorite activity, only 12% chose payment.

Instead, trading (spot, memecoins, DeFi) remains the most important weekly activity for all types of users.

Until developers remove these frictions, speculation will continue to grab the attention share that practical functions deserve in the future.

This gap stems from three major frictions: Cost friction. 39% of users believe that high L1 gas fees are still the biggest barrier to adoption, which is the most prominent issue. Experience friction. Only 11% of users think the current onboarding process is popular enough. Network friction. Payments flow to platforms where merchants and friends already exist; fragmented wallet and chain ecosystems destroy this closed loop.

Huma Finance - A pioneering payment finance solution, cross-border payment financing without pre-deposited funds, and real income from real payment flows (10.5% annualized yield). Tectum - Instant, zero-fee cryptocurrency payments. Alchemy PayNOWPayments

3. The public chain will become an invisible infrastructure layer - users don’t even need to perceive its existence

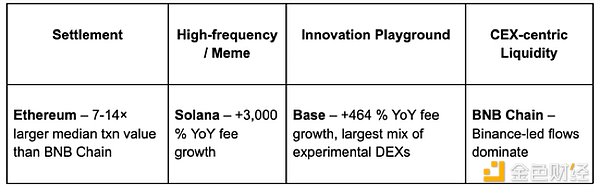

The multi-chain ecosystem is essentially the result of division of labor and cooperation:

The winning user experience model is "chain abstraction" - the wallet session can smoothly route orders, balances and identity information to the backend that provides the best latency-cost-security combination, without the user having to make a choice throughout the process.

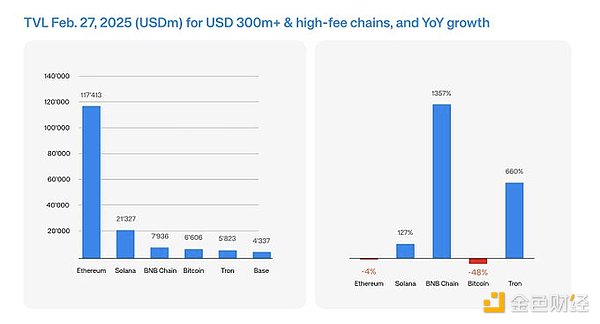

Ethereum is still an institutional-grade settlement layer, but Solana is quickly establishing itself as the preferred public chain for high-frequency, high-engagement retail activities. However, judging by its development momentum, Ethereum is facing unprecedented competitive pressure. Solana achieved an annual fee growth of 3000% and a TVL growth of 127%, the highest growth rate among all L1s. This surge was mainly due to the meme coin boom (especially in the fourth quarter of 2024), but also reflects Solana's structural advantages in speed and transaction costs.

User awareness has been formed: 43% said Ethereum is the most commonly used public chain; 39% chose Solana; only 10% mainly use L2 - this proves that interoperability is still at the theoretical level.

Chainlink -- Leading cross-chain interoperability protocol using CCIP (token LINK)

LayerZero -- Full-chain interoperability protocol using OFT standard (token ZRO)Axelar -- Cross-chain communication network (token AXL)

Wormhole -- Cross-chain messaging protocol (token W)SocketDotTech -- Cross-chain interoperability protocol (token to be issued soon)eOracle -- Ethereum-based secure oracle platform, providing permissionless, specialized data services for smart contracts.

4. False sense of security with increased user confidence

Users claim to feel safer on-chain, but their wallet data tells a different story.

How to explain this contradiction? Users confuse personal protective measures (hardware wallets, multi-signatures) with systemic risks. At the same time, attackers have industrialized "phishing as a service", and the average life cycle of malicious contracts has been reduced to one-quarter of the original.

The focus of product optimization should be: to transform the sinking anti-phishing user experience (clear signature interface, real-time transaction simulation, MPC transaction firewall) from advanced additional features to the default configuration - especially in mainstream "daily use" wallets.

5. NFT as digital cultural infrastructure

The NFT market is undergoing necessary adjustments, from speculative PFP projects to real digital goods and practical-driven experiences. This is the first time that the NFT market has shown a sustainable development trend.

Platforms like Rodeo.Club and the surge in low-priced collectibles on the Base chain mark a shift to an affordable, high-frequency interaction model - a model similar to in-app purchases in games.

NFTs are becoming the interactive infrastructure of the digital economy.

NFTs will become the default interactive layer for consumer applications:Loyalty points, badges, membership privileges—all of these will increasingly be presented on-chain as NFTs. Ownership will be transferable and tradable across platforms, unlocking secondary market value for users and opening up new monetization channels for brands. Imagine Starbucks’ loyalty program running on-chain: points earned in one app can unlock benefits across a network of partner services.

The rise of cultural capital as currency:NFTs are quickly becoming a mechanism for users to display their identity and cultural belonging in digital space. As social platforms integrate on-chain assets, NFT ownership will evolve into a primary form of digital self-expression, just like wearing branded clothing in the real world.

The judging criteria will shift from floor price to user retention:The era of judging NFTs by speculative value is coming to an end. The new metric is user retention and engagement: How often do users interact with the assets? Are these assets tied to ongoing experiences, content, or rewards? Builders should design NFT ecosystems that encourage repeated participation, achieving this goal through unlockable content, dynamically evolving token properties, and real-world rights.

AI+NFT will usher in a new wave of personalized dynamic assets:AI-generated NFTs tied to user behavior, emotions, or community events are coming. These dynamic assets will evolve as users engage, creating deeply personalized experiences and emotional connections that static assets cannot achieve.

Treasure DAO -- NFT infrastructure with MAGIC tokens

Mocaverse NFT -- Infrastructure connecting the Animoca brand ecosystem (MOCA tokens)Rodeo Club -- NFT interactive platformNFP -- AI generated NFT platform (NFP tokens)

Finalbosu -- Popular series on Abstract chain

Good Vibes Club -- Emerging series with active community

Onchain Heroes -- Well-known series on Abstract chain

Hypio -- Series with rapidly growing trading volume

steady teddys -- Popular series on Berachain

Pudgy Penguins -- Leading NFT brand with mainstream adoption (physical toys sold by Walmart, PENGU tokens)

Bored Ape Yacht Club -- Iconic series (strong community and APE tokens)

CryptoPunks -- Original NFT series with historical significance

Azuki -- Japanese anime-style series (ANIME tokens, strong brand influence)

doodles -- Colorful series (DOOD tokens recently launched on Solana)

Milady Maker -- Cultural phenomenon project (CULT tokens, strong community)

6. Bitcoin as a macro asset class

Bitcoin has evolved from a speculative asset to a macro-level financial instrument.

A parallel revolution is unfolding: Bitcoin is quietly becoming the transaction layer for global settlements, driven by the maturity of the Layer 2 ecosystem (especially the Lightning Network and emerging protocols such as Ark and Fedimint).

Bitcoin, as an invisible settlement layer, is powering the next generation of cross-border payments, institutional finance, and sovereign digital reserves.

Bitcoin's Macro Relevance: From Hedging Instrument to Strategic Reserve Asset:Countries facing the challenge of de-dollarization are quietly incorporating Bitcoin into their sovereign reserve diversification strategies. Institutional and even sovereign actors are viewing it as a must-have insurance policy to prevent systemic financial risks.

Layer 2 Protocols Unleash Bitcoin Payment Utility:The Lightning Network has evolved from a technical experiment to a scalable real-world payment layer that enables near-instant, low-cost cross-border transactions. New solutions such as Fedimint and Ark are addressing Bitcoin’s user experience and privacy limitations, making it a truly viable transactional currency in emerging markets. Builders should focus on developing payment solutions and cross-border financial products based on these Layer 2s, especially for remittance corridors and regions plagued by currency devaluations.

Bitcoin as Collateral - The Rise of Institutional Lending and Funding Strategies:Mainstream institutions are beginning to use Bitcoin not only as a passive investment, but also as a productive collateral in structured financial products. Expect a surge in Bitcoin-secured credit instruments, fund management solutions, and derivatives that seamlessly connect to traditional financial markets.

The Global Settlement Network in the Making:As geopolitical frictions intensify, the need for neutral, censorship-resistant settlement channels will grow. Bitcoin is uniquely positioned to serve as a global clearing layer for trade settlements, complementing rather than competing with fiat currencies. Infrastructure that abstracts the complexity of Bitcoin transactions for end users and uses Bitcoin for seamless settlement at the bottom layer will drive Bitcoin adoption outside the crypto-native circle.

Solv Protocol -- The first on-chain Bitcoin financialization and Bitcoin banking solution (SOLV token)

Stacks -- Leading Bitcoin Smart Contract Layer2 (STX token)Alpen Labs -- Bitcoin Layer 2 SolutionBabylon Labs -- Bitcoin Cross-Chain Bridging Solution (BABY token)

Zeus Network -- Cross-Chain Communication Platform (ZEUS token)corn -- Ethereum Layer 2 Bitcoin Solution (CORN token)

Runes ChainaI -- Bitcoin Layer2 Solution (RUNIX token)

7. Institutional Staking: A New Paradigm for Strategic Fund Allocation

While retail investors are still chasing speculative returns through meme coins and high-risk trades, institutional money is quietly and steadily flowing into structured, yield-generating crypto assets - especially through the staking ecosystems of Ethereum and Solana.

Bitcoin may still be the preferred choice for macro hedging, but staking is quickly becoming a bridge for institutional money to enter productive on-chain capital.

New Institutional Strategies:

Bitcoin’s Shift from Store of Value to Productive Capital:With the emergence of native Bitcoin staking mechanisms (e.g., through protocols like Babylon and upcoming BTC Layer 2 solutions), Bitcoin is also beginning to enter the realm of yield-generating strategies without compromising its core monetary properties.

The Real Opportunity Is in Infrastructure, Not Validators:The next billion dollars of institutional inflows will come from platforms that offer institutional-grade custody, compliance reporting, and risk-controlled staking products.

Diversification of Income in an Uncertain Macroeconomic Environment:With interest rates peaking and traditional fixed income products becoming less attractive, staking income has become a new risk-adjusted return category. This is particularly attractive to corporate funds seeking to diversify away from cash holdings and low-yielding bonds while avoiding the volatility of speculative crypto assets.

Core DAO -- Self-custodial BTC staking solution (CORE token)

BounceBit -- Institutional staking platform (BB token)TruFin Protocol -- Institutional-level liquidity stakingArchax -- Regulated institutional-level exchange (supporting HBAR staking)

8. Regulation, stablecoins and AI: the next wave of growth

Compliance will open up the stablecoin channel → cheap, instant global payments create real daily touchpoints → verifiable on-chain traceability becomes the trust layer for AI to generate value. Payment is just the beachhead of this change.

Regulatory optimism:86% believe that clearer rules will accelerate adoption, and only 14% believe that it will hinder innovation.

Stablecoin growth momentum:Holding rate doubled to 37% year-on-year, and has become the default payment channel in more than 30 Stripe markets.

AI synergy effect:64% believe that AI will at least accelerate the development of the encryption industry, and another 29% expect it to form a two-way flywheel effect.

WLFI -- Stablecoin anchored to $1 (WLFI token)

Ripple -- RLUSD stablecoin (using XRP as Gas token)Ethena Labs -- USDe stablecoin (token for traditional finance will be launched soon)OpenEden -- Income-based USDO stablecoinSyrup.fi – SyrupUSDC -- Institutional-level income solution (stablecoin 10% annualized yield)cap -- Stablecoin protocol providing trusted financial guarantees

Conclusion: UX 2.0 era - no evolution or elimination

Users are no longer confused by the halo of "web3". What they expect is: Web2-level ease of use, Web3-level ownership control and AI-level intelligent experience - all three are indispensable.

Teams that can achieve "chain selection without feeling", eliminate the fee pain point, and build in predictive security mechanisms will transform the crypto space from a speculative paradise to a connecting link for the on-chain Internet. The next billion users will not even realize that they are using web3 products - this "no perception experience" will be the ultimate victory of user experience.

Catherine

Catherine

Catherine

Catherine Alex

Alex Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Catherine

Catherine Kikyo

Kikyo Catherine

Catherine Alex

Alex Alex

Alex