Author: 0xWeilan, EMC Labs

The global financial market was calm in March.

Both the Nasdaq and the Dow Jones indexes hit new highs without any suspense. The Nasdaq has risen for five consecutive months, indicating that long capital is constantly increasing its tolerance for delayed US interest rate cuts.

There are many factors that lead to delayed interest rate cuts.

The US CPI rebounded slightly from 3.1% to 3.2% month-on-month, and the US manufacturing index PMI rebounded to 50.3%, showing a trend of entering an expansion period. Japan ended the eight-year era of negative interest rates and raised interest rates for the first time.

The probability of a US interest rate cut in April has dropped significantly, and the probability of a rate cut in May has also fallen below 50%.

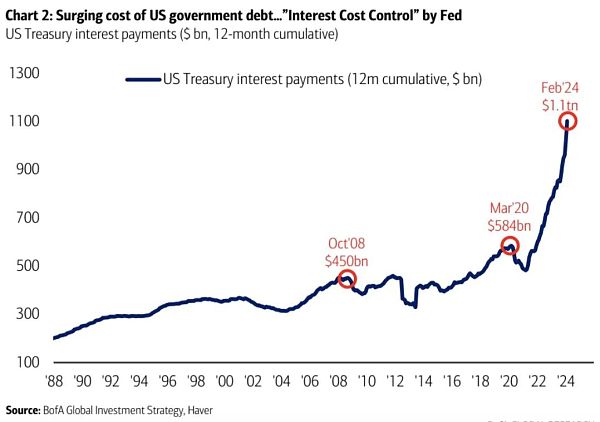

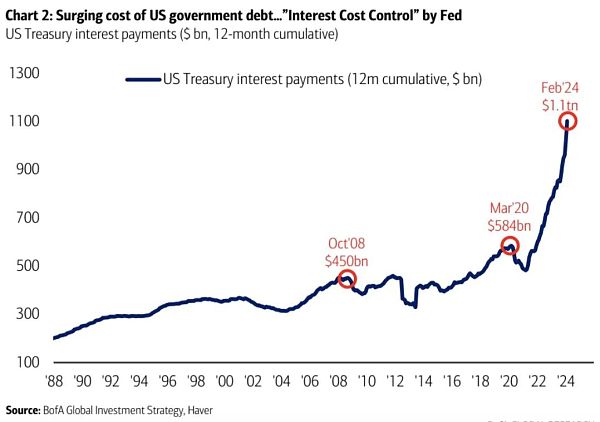

U.S. debt interest rate scale (chart by Bank of America)

The accumulation of capital returning to the United States pushes up the equity and safe-haven markets at the same time.

The United States cuts interest rates, macro-finance enters a period of easing, and the equity market and the crypto market enter a new round of rising cycles.

It starts with long-hand selling and ends with short-hand acceptance. The two maintain a dynamic balance.

In the rising period, when the new influx of funds controls the pricing power, the main buying volume drives the price up and achieves balance.

During the rising period, when BTC sells long hands to control the pricing power, the main selling volume pushes the price down and achieves balance.

There is also an important subdivision of the participating group - short-term profit-taking, which will also become an important reason for driving the price down during the rising period.

Observing the selling in March, we found that long and short hands sold at the same frequency.

On February 26, both began to transfer coins to the exchange on a large scale to start a large sell-off, and both reached the high point of transfer on March 12, and the scale of transfer has continued to decline since then.

On March 12, the scale of transfer of both reached a high point. The next day, the price of BTC began to fall from the high of US$73,835.57, and fell to the low of US$60,771.14 in March on March 20.

After March 20, the long army used buying power to pull the price of BTC back to US$71,288.90, but the selling pressure continued to pour in after March 20, and finally the price collapsed again in the first two trading days of April.

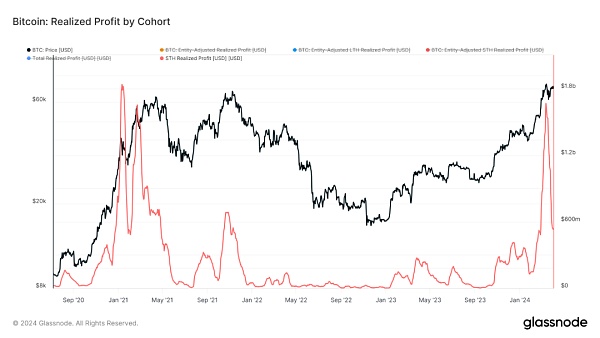

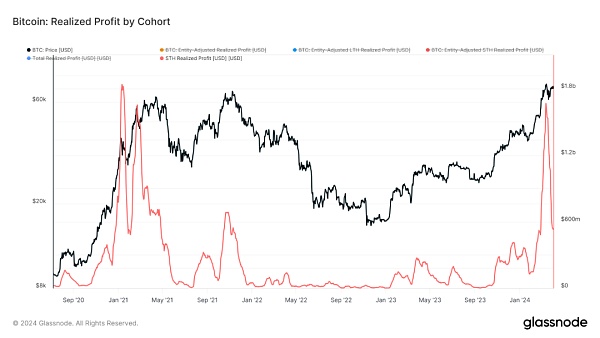

Short-handed groups sell profits

On March 12, the round of selling initiated by the long and short hands was the first wave of large-scale selling and profit locking by the two groups after entering the bull market. On that day, the two groups realized a total profit of 3 billion. From February 26 to March 31, the total profit was as high as 63.1 billion US dollars.

It is worth noting that -

In the first half of the big sell-off from February 26 to March 12, BTC was in the buying momentum-dominated futures price, and the price rose from 51730.96 to 71475.93 US dollars.

In the second half of the sell-off from March 13 to March 31 (not yet over), BTC was in a period dominated by selling momentum, and the price fell from 73709.99 to 60771.74 US dollars.

Although the peak of selling was on March 12, the daily selling volume of long and short hands was still above US$1 billion until the end of the month.

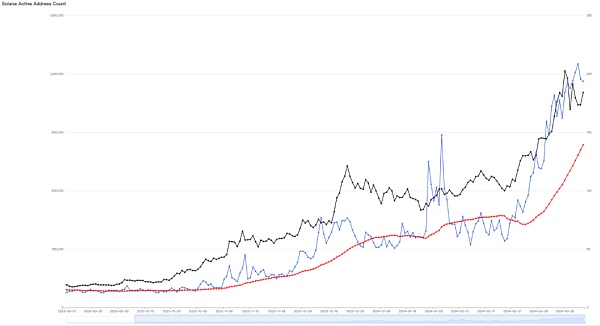

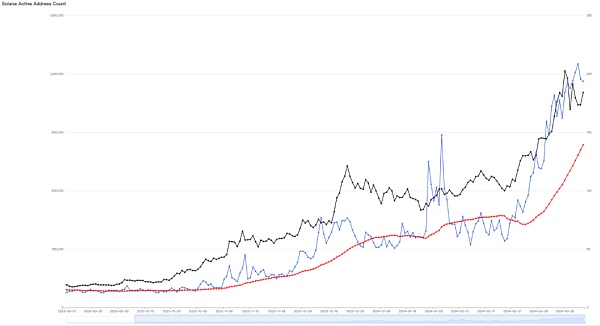

Solana Daily New Addresses

Solana Daily Active User Address

Heterogeneous Etherum's Solana is considered to be the new carrier of DePin and the supporting public chain for the USDC payment narrative.

However, we must see that these adoptions are far from being fully developed. At present, the main use case of the Solana network is the issuance and speculation of MEME coins. Phenomenal MEME coins such as Bonk, BOME, and WIF have appeared one after another, with daily trading volumes reaching hundreds of millions of dollars. A large number of MEME coins that are born and die overnight have completed their lifespans within a week, but speculators are still enjoying it, resulting in more than 1,000 new MEME coins being created every day.

Although Solana is launching remarkable innovations in DePin, DEX, Staking, Oracle, RWA and other fields, the current wave of large-scale adoption of Solana is still MEME speculation, just like the Ethereum ICO craze in 2017.

This is worrying. In previous reports, EMC Labs has repeatedly pointed out that the trend of stablecoins turning from outflows to inflows in October 2023 is cyclical. This trend is the main external factor that triggered the bull market, and it will not end in a short time due to its cyclical nature. Throughout March, the stablecoin channel had a total inflow of $8.9 billion, setting a monthly inflow record since this cycle. This inflow is the basic support for BTC prices to set a historical record this month, and it is also one of the undertakers of selling BTC. The circulation scale of stablecoins has not yet reached the high point of the last bull market, and the subsequent inflow scale and rate need to be closely monitored. Since the United States approved 11 BTC ETFs in January this year, funds from this channel have also become one of the important factors affecting the market. Observation data shows that BTC ETF did not experience large-scale outflows during this round of large-scale selling adjustments, and only recorded a small outflow from March 18 to March 22.

11 BTC ETF Inflow and Outflow Statistics (SosoValue)Based on the inflow and outflow analysis of BTC ETF, we judge that the funds in this channel have only been reduced in a short period of time, with a scale of about US$1 billion. This amount of funds is still small compared with the locked profits of up to US$63.1 billion, so it is not the fundamental reason for this round of adjustments. The funds in the BTC ETF channel are still flowing in, which is one of the important supports for the subsequent recovery and new highs of BTC prices. The growth of fund supply is the direct reason for the upward price, and the continuous growth of fund supply is the direct reason for the start of the bull market.

Conclusion

In this report, we analyzed the first round of large sell-offs in the new cycle by long-term investors and short-term profit-makers after the BTC price broke through the new high.

This round of sell-offs helped sellers lock in $61 billion in profits, causing the BTC price to fall by about 17%.

Based on the market structure, we judge that this kind of selling is a normal phenomenon in the rising period of the market; based on the inflow of funds in the stablecoin and ETF channels and the adoption of application chains, we judge that there will be fluctuations in the future market, but this round of crypto bull market is unfolding in an orderly manner. For long-term investors, they should actively go long on a cautious basis.

JinseFinance

JinseFinance