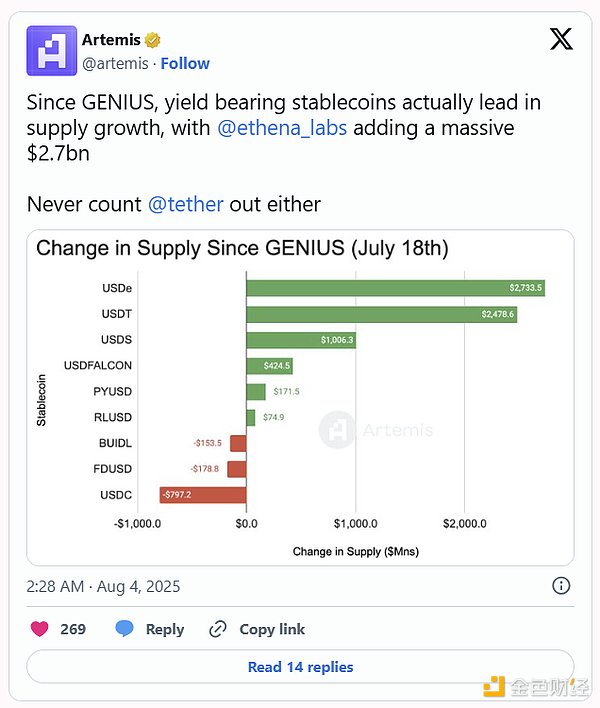

The Ethena (ENA) project garnered significant attention after StablecoinX announced it had raised $360 million and would repurchase $260 million worth of ENA tokens (approximately 8% of the total supply) over six weeks. The protocol has generated strong revenue ($307 million over the past year) by retaining 20% of USDe earnings (derived from perpetual contract funding rates, ETH staking, and US Treasury yields). Positive Factors: An approved fee conversion mechanism could distribute a portion of this revenue to sENA holders, with a baseline yield of approximately 4% and potentially exceeding 10% in a bull market scenario. Other growth drivers include the launch of Converge Chain L2 and the GENIUS Act-compliant stablecoin USDtb. This buyback will also reduce net token emission next year from 41.6% to 34.6%. Risk Warning: Over $1.1 billion in private placement/team tokens will be unlocked over the next year, with over $1.1 billion in "pending" ecosystem funds awaiting distribution. Compared to other DeFi protocols, ENA's token emission-to-revenue ratio is relatively high, and the model has yet to withstand a prolonged bear market. Stablecoins are becoming a pillar of the crypto landscape, supporting the development of payments, trading, and DeFi. With the GENIUS Act providing a legal framework for them in the United States and Circle's IPO demonstrating significant investor demand, the industry is entering a new phase of growth. Against this backdrop, Ethena and its ENA token have taken center stage. The launch of

StablecoinX—playing along the lines of "Strategy" (formerly MicroStrategy)—made ENA one of the hottest topics on crypto Twitter.

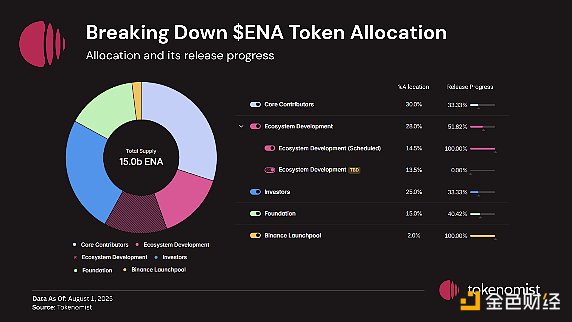

But hype alone doesn’t tell the whole story. This article will deeply analyze ENA's token economics, release mechanism and value drivers - highlighting the opportunities and risks that investors need to pay attention to: Token Economics Overview: Current Supply Dynamics and Allocation Structure Key Catalyst: StablecoinX Funding - $360 million funding and token buyback plan Revenue and Value Accumulation Mechanism: Protocol Economic Model, Fee Conversion Mechanism and Revenue Forecast Risks and Unlocking Pressure: Supply Risk, Release Amount Analysis and Long-term Sustainability Concerns 1. Token Economics Overview Total Supply: 15 billion Circulating Supply: 6.35 billion (42.36% of total supply)

2. Key Catalyst: StablecoinX Fundraising Plan

3.Revenue and Value Accumulation Mechanism

Ethena generates protocol revenue by retaining 20% of USDe earnings. These earnings primarily come from three channels:

Perpetual Swap Funding Rates

ETH Staking Income

Tokenized Treasury Bond Income

The remaining 80% of earnings is distributed to sUSDe holders, making Ethena one of the few stablecoin protocols with a built-in value accumulation loop for both users and the protocol treasury. Please refer to the Ethena documentation for more details.

To date, the protocol has generated cumulative revenue of $405.8 million, with $306.7 million generated in the past 12 months alone. However, it should be noted that Ethena's revenue is highly correlated with market sentiment - funding rates generally rise in bull markets, thereby increasing returns, but may fall or even turn negative when the market turns bearish. This characteristic makes Ethena's revenue model both scalable and closely tied to market cycles. Given that the protocol is still in its early stages and has not yet experienced the test of a long bear market, investors should remain cautious.

(1) Progress on the fee switching mechanism

Another major catalyst for ENA comes from the fee switching mechanism, a governance proposal proposed by Wintermute that has been approved by the protocol risk committee. Once activated, the mechanism will allow part of the protocol revenue to flow directly to sENA token holders, thereby establishing a more direct value accumulation channel.

However, the activation of this mechanism requires the following conditions to be met:

USDE circulating supply exceeds US$6 billion

Cumulative protocol revenue exceeds US$250 million

USDE must be listed on at least 4 of the top 5 centralized exchanges in terms of derivatives trading volume

The size of the reserve fund must reach 1% or more of the USDE supply

The spread between sUSDe's annualized yield and competing benchmarks (such as Aave's USDC) must be widened

As of now, most of the benchmark conditions have been met. The only two remaining requirements are to expand the reserve fund and increase the relative annualized yield spread, thereby consolidating sUSDe's competitive advantage over other stablecoin yield products. Therefore, the activation of the fee conversion mechanism has entered its countdown phase. Once triggered, it will become a key node in unlocking value for long-term ENA holders.

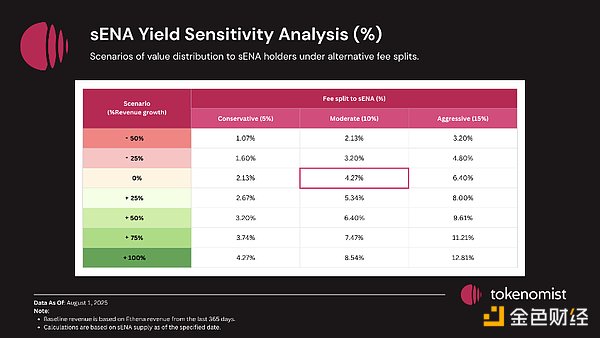

(2) Potential yield of sENA under different scenarios

To evaluate the impact of the fee conversion mechanism on ENA holders, we conducted scenario analysis modeling to simulate different combinations of protocol revenue growth and fee allocation ratios for sENA/sUSDe holders:

Year-on-year revenue growth scenarios: -50%, -25%, 0%, +25%, +50%, +75%, +100%

Fee allocation ratio scenarios: Conservative (5%), Moderate (10%), Aggressive (15%)

![]()

However, it must be noted that these are only hypothetical forecasts. The actual fee allocation ratio has not yet been finalized, and the actual results will depend largely on market conditions and governance decisions.

(3) Strategic Cooperation and Product Expansion In addition to its core stablecoin business, Ethena is expanding its ecosystem to open up new growth channels and sources of value accumulation for ENA holders. First, the team is developing Converge Chain, a second-layer Ethereum network built on Arbitrum. This network will serve as the operating base for Ethereal (a decentralized exchange with native perpetual contracts) and other dApps in the Ethena ecosystem. This initiative not only opens up a fee-based revenue stream beyond USDe but also creates a new path for value capture for ENA. Second, Ethena Labs has entered into a strategic partnership with Anchorage Digital to launch USDtb, the first stablecoin with a clearly designed compliance path under the GENIUS Act. This partnership positions Ethena at the forefront of the next phase of stablecoin adoption in the United States and strengthens its credibility with institutional investors.

These developments together demonstrate Ethena's grand vision - evolving from a single product protocol to an ecosystem with diversified revenue engines and better compliance with regulatory requirements.

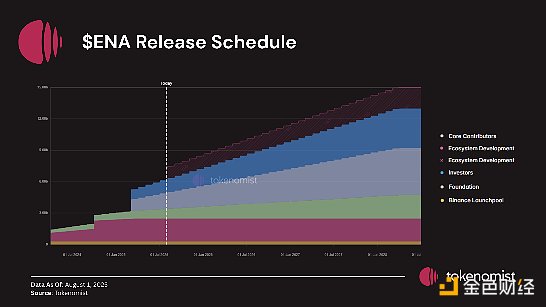

4. Risks and Token Unlocking Pressure

Although recent catalysts such as the StablecoinX buyback have alleviated the short-term dilution effect, investors still need to be wary of Ethena's long-term token supply dynamics. Over the next 12 months alone, over $500 million in tokens will be unlocked to private investors, with an additional approximately $640 million allocated to the founding team and early contributors. This impending release of tokens represents a potentially significant sell-off, cautioning investors against focusing solely on short-term bullish narratives. Further complicating matters, significant uncertainty remains regarding the allocation of Ethena's vast ecosystem development funds. The fourth quarter airdrop campaign is currently underway (beginning in March 2025), with a cumulative total of 2.25 billion ENA tokens distributed over the first three quarters (750 million per quarter). As the fourth quarter progresses, an additional 13.5% of the total supply (approximately 2 billion tokens, valued at approximately $1.1 billion at current prices) is reserved for future ecosystem development, meaning the protocol faces over $1 billion in uncertainty. This fund size far exceeds that of most DeFi vaults, and its potential dilution could overwhelm any fee conversion or buyback mechanisms, making the timing and deployment strategy of these tokens critical to ENA's long-term value proposition. The chart below shows the ratio of token emission to annualized fee revenue (calculated based on the last 30 days of protocol data). A higher ratio indicates that the rate of token emission far exceeds the rate of fee generation—a visual representation of how much token value is diluted for each dollar of revenue generated by the protocol. While this comparison isn't perfect, it provides a useful perspective for analyzing the sustainability of different protocols. Against this backdrop, ENA exhibits a higher ratio compared to other major DeFi protocols, reflecting its large-scale token unlocking and ongoing supply expansion. Investors should prioritize this dynamic when evaluating ENA's long-term investment value. 5. Conclusion Ethena has rapidly emerged as one of the most innovative players in the stablecoin and synthetic dollar space. With strong revenue generation, an expanding ecosystem, and catalysts like the StablecoinX buyback program and the upcoming fee conversion, the protocol offers significant value accumulation potential for ENA holders. However, investors should exercise caution amidst this optimism. Significant internal token unlocking, reliance on market-dependent revenue, and an operational track record that has yet to be proven through a full market cycle remain key risk factors. Ultimately, ENA presents both high growth potential in a favorable environment and significant supply risk that must be carefully balanced—both of which require careful consideration within any long-term investment framework.

Miyuki

Miyuki

Miyuki

Miyuki Alex

Alex Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Joy

Joy Alex

Alex Brian

Brian Alex

Alex Joy

Joy