Bitcoin ETFs were once seen as a passport for institutional investors. Now, they are becoming a trigger for systemic risk.

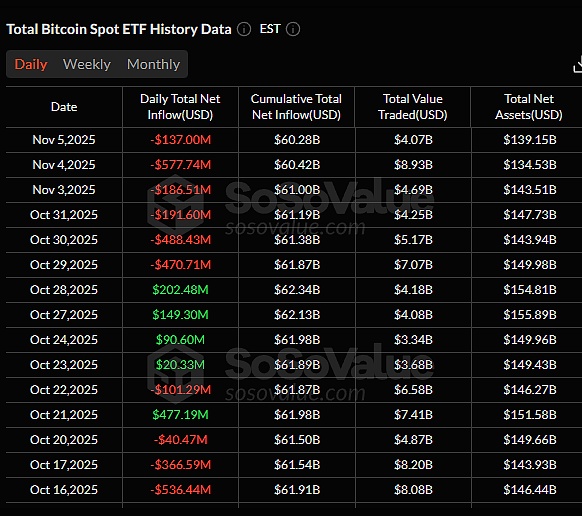

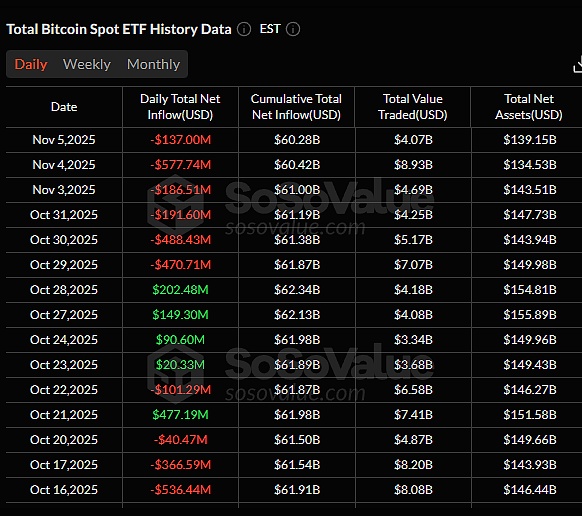

From October 29th to November 5th, there were six consecutive days of capital outflows, with a net outflow of nearly $1.6 billion from Bitcoin ETFs across the market!

This means that smart money is quietly withdrawing.

The essence of an ETF is "holding Bitcoin on behalf of others." When investors redeem their shares, the ETF must sell real Bitcoin for cash, thus triggering a chain of selling pressure.

One round of redemptions → passive selling → price drop → more redemptions. This is the crypto version of the "death spiral." From "decentralization" to "Wall Street-ification" In 2020, Bitcoin was a symbol of decentralized faith; by 2025, Bitcoin has become a risky asset on Wall Street. Bitcoin's 90-day correlation coefficient with Nasdaq is as high as 0.88; when the VIX fear index spikes, Bitcoin falls in tandem. When US stock market investors panicked, they sold not only tech stocks, but also Bitcoin. The so-called "digital gold" has long since become "digital tech stocks" in the midst of the liquidity crisis. The Shadow of 2008: Risks Layered in Packaging The 2008 subprime mortgage crisis taught us that "the greatest risk is not the asset itself, but the leverage that is layered in packaging." The same script is playing out in today's crypto market: The risks are layered and compounded. When the underlying Bitcoin price fluctuates, the upper-level ETFs, leveraged products, and cryptocurrency stocks are like a row of dominoes, ready to collapse at any moment. MicroStrategy: The Limits of Leverage Belief As the largest holder of Bitcoin, MicroStrategy (MSTR) holds over 640,000 Bitcoins. However, almost all of it was borrowed to buy cryptocurrency: It raised approximately $15 billion through convertible bonds and preferred stock issuances; $650 million of its debt matures on December 15, 2025; and it has a B- (junk) rating from S&P. S&P warned: "The company's assets are overly concentrated in Bitcoin, it lacks sufficient dollar liquidity, and its risk-adjusted capital is negative." If Bitcoin continues to fall below $90,000, MSTR may be forced to sell some of its Bitcoin to repay debts—that would be a "nuclear moment" for the entire market. The Fuse of a Time Bomb: Nobody Knows Where the Mine Is The most dangerous thing isn't how much Bitcoin will fall; it's that nobody knows who holds the biggest bomb. ETF Counterparty Risk: Who is Providing Liquidity for These Leveraged Positions? MSTR Debt Chain: Who are the Creditors? Are They Leveraging Again? Cryptocurrency-Equity Derivatives: Leverage on Leverage, How Long is the Risk Chain? Nobody knows. This game is strikingly similar to 2008: risk propagates through the chain until one link breaks—the collapse of Lehman Brothers—revealing a systemic collapse. We are standing at the doorstep of a "death spiral." In the coming weeks, the market will enter a critical observation period: ETF fund flows—whether they have shifted from net outflows to net inflows; MSTR debt situation—whether it faces a sell-off; and the VIX fear index—whether it has fallen below 16. These three indicators will determine whether Bitcoin can stop the bleeding. In 2008, Wall Street said: These CDOs are AAA rated, absolutely safe. In 2025, Wall Street said: These ETFs are compliant products, buy with confidence. History doesn't simply repeat itself, but it always rhymes. Conclusion: True faith is awe of risk. Today's Bitcoin is no longer the grassroots revolution of its early days; it is now a giant cog in the financial system. If you are an investor, please remember: Understanding risk is more important than chasing profits. If you are an observer, please understand: The next crisis in the crypto world may already be counting down in the ledgers of ETFs.

Weatherly

Weatherly