Author: Marie Poteriaieva, Source: Cointelegraph, Compiled by: Shaw Golden Finance

Fixed income is no longer just the patent of traditional finance. On-chain income has become a core pillar of cryptocurrency. Ethereum, as the largest PoS blockchain, is at the core, and its economy relies on users locking their ETH to help protect the network and earn income.

However, Ethereum is not the only option. Today, cryptocurrency users have access to a growing variety of yield products, some of which compete directly with Ethereum's staking income, which may weaken Ethereum's blockchain. Yield-based stablecoins offer greater flexibility and easier access to traditional finance, with returns tied to U.S. Treasuries and synthetic strategies.

At the same time, DeFi lending protocols have expanded the range of assets and risk profiles available to depositors. Both can generally bring higher returns than Ethereum staking, which raises a key question: Is Ethereum quietly losing the yield war?

Ethereum staking yields decline

Ethereum staking yields are the income that validators receive for maintaining the security of the network. It comes from two sources: consensus layer rewards and execution layer rewards.

Consensus rewards are issued by the protocol and depend on the total amount of ETH staked. By design, the more Ether (ETH) is staked in the network, the lower the reward for each validator. The formula follows an inverse square root curve, ensuring that the returns gradually decrease as more funds enter the system. Execution layer rewards include priority fees (fees paid by users to have their transactions included in blocks) and maximum extractable value (MEV), which is the additional profit obtained by optimizing the order of transactions. These additional rewards fluctuate based on network usage and validator strategies.

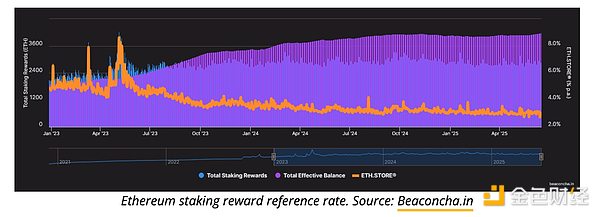

Since the merger in September 2022, Ethereum's staking yield has gradually declined. The total yield (including consensus rewards and tips) has fallen from around 5.3% at its peak to below 3%, reflecting the growth of the total amount of ETH staked and the increasing maturity of the network. In fact, there are currently more than 35 million ETH staked, accounting for 28% of its total supply.

However, only independent validators (i.e. those who run their own nodes and lock up 32 ETH) can receive the full staking benefits. While they can receive 100% of the rewards, they also bear the responsibility of staying online, maintaining the hardware, and avoiding penalties. Most users will choose more convenient options, such as liquid staking protocols like Lido or custodial services provided by exchanges. These platforms simplify the access process, but charge fees (usually between 10% and 25%), which further reduces the user's final return.

While Ethereum's annual staking yield of less than 3% may seem low, it still compares favorably to its competitor Solana. Solana's current average network annual interest rate is about 2.5% (with a maximum annual interest rate of 7%). In terms of actual yield, Ethereum's yield is even higher: its net inflation rate is only 0.7%, while Solana's net inflation rate is 4.5%, which means that stakers on Ethereum have less equity dilution over time. But Ethereum's main challenge does not come from other blockchains, but the rise of other alternative protocols that can provide returns.

Yield-bearing stablecoins gain market share

Yield-bearing stablecoins allow users to hold assets pegged to the U.S. dollar while earning passive income, which is usually derived from U.S. Treasuries or synthetic strategies. Unlike traditional stablecoins such as USDC or USDT, which do not pay users a yield, these new stablecoin protocols distribute a portion of the underlying yield to users.

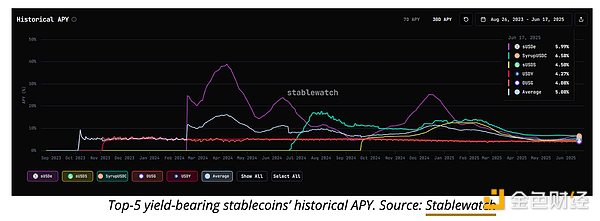

The five major yield-bearing stablecoins - sUSDe, sUSDS, SyrupUSDC, USDY and OUSG - account for more than 70% of the $11.4 billion market and use different methods to generate yield.

Issued by Ethena, a BlackRock-invested company, sUSDe uses a synthetic delta-neutral strategy involving ETH derivatives and staking rewards. Its yields are among the highest in the cryptocurrency space, with historical annual interest rates ranging from 10% to 25%. Although the current yield has dropped to around 6%, sUSDe is still ahead of most competitors, but also has higher risks due to its complex, market-dependent strategy. sUSDS was developed by Reflexer and Sky (formerly MakerDAO) and is backed by sDAI and RWA. Its yield is more conservative, currently at 4.5%, focusing on decentralization and risk aversion. SyrupUSDC is issued by Maple Finance and achieves returns through tokenized treasuries and MEV strategies. It had a double-digit yield at the time of issuance and currently yields 6.5%, which is still higher than most centralized alternatives. USDY issued by Ondo Finance tokenizes short-term treasuries and has a yield of 4.3%, targeting regulated and lower-risk institutions. OUSG, also from Ondo, is backed by BlackRock’s Short-Term Treasury ETF, yields ~4% and comes with full KYC requirements and a strong focus on compliance.

The key differences between these products are their collateral, risk profile, and accessibility. sUSDe, SyrupUSDC, and sUSDS are completely DeFi-native and permissionless, while USDY and OUSG require KYC and cater to institutional users.

The key differences between these products are their collateral, risk profile, and accessibility. sUSDe, SyrupUSDC, and sUSDS are completely DeFi-native and permissionless, while USDY and OUSG require KYC and cater to institutional users.

Yield-bearing stablecoins are rapidly gaining traction, combining the stability of the dollar with yield opportunities that were once exclusive to institutional investors. The sector has grown 235% over the past year, and its momentum shows no signs of slowing down as demand for on-chain fixed income continues to grow.

DeFi lending remains Ethereum-centric

Decentralized lending platforms like Aave, Compound, and Morpho allow users to earn yields by providing crypto assets to lending pools. These protocols set interest rates algorithmically based on supply and demand. When borrowing demand rises, so do interest rates, making DeFi lending yields more dynamic and generally uncorrelated with traditional markets.

The Chainlink DeFi Yield Index shows that lending rates for stablecoins are generally around 5% for USDC and 3.8% for USDT. During bull markets or speculative manias (such as February-March and November-December 2024), borrowing demand surges and yields tend to soar. Compared to banks, which adjust interest rates based on central bank policy and credit risk, DeFi lending is market-driven. This creates opportunities for higher returns, but also exposes borrowers to unique risks such as smart contract vulnerabilities, oracle failures, price manipulation, and liquidity crunch. Paradoxically, many of these products are themselves built on Ethereum. Yield-generating stablecoins, tokenized treasuries, and DeFi lending protocols rely heavily on Ethereum’s infrastructure, and in some cases, even directly incorporate ETH into their yield strategies. Ethereum remains the most trusted blockchain in both traditional and crypto-native finance, and continues to lead in hosting DeFi and risk-on assets (RWAs). As these areas gain popularity, they drive up network usage, increase transaction fees, and indirectly strengthen the long-term value of ETH. In this sense, Ethereum may not have lost the battle for yield - it just won it in a different way.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Hui Xin

Hui Xin Joy

Joy Alex

Alex Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Brian

Brian Joy

Joy