Author: David Pan, Olga Kharif, Isabelle Lee; Translated by Wuzhu, Golden Finance

Cryptocurrency prices soared on signs that the United States approved exchange-traded funds to invest directly in the second-largest token Ethereum, a sharp departure from last week's more pessimistic outlook.

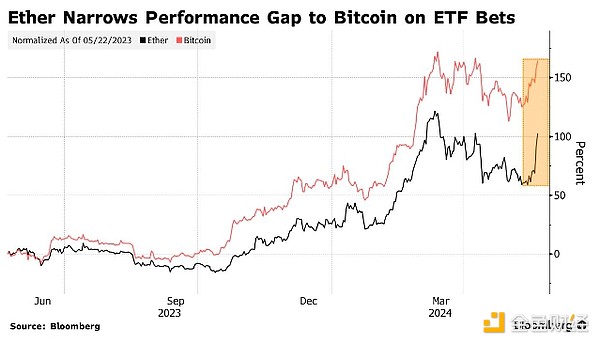

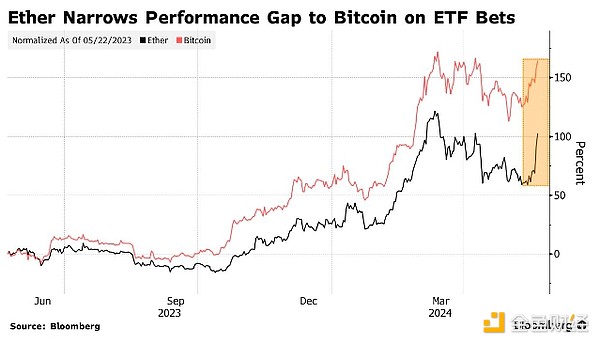

Market speculation about spot Ethereum ETFs is in part due to a recovery in investor enthusiasm for U.S. Bitcoin funds, whose listing in January spurred the largest digital asset's rally to a record high.

Ethereum rose nearly 14% during U.S. trading hours, its biggest gain since November 2022, and then rose further during Asian trading hours, changing hands at $3,666 as of 9:33 a.m. Singapore time on Tuesday. Bitcoin climbed to $72,000 at one point, close to its all-time peak of nearly $74,000 in mid-March.

The U.S. Securities and Exchange Commission contacted at least one exchange and at least one potential Ethereum ETF spot issuer to update relevant 19b-4 filing documents, according to people familiar with the matter. Because the matter is not public, the people familiar with the matter asked not to be named. That suggests the odds of SEC approval may be rising, one of the people said. The conversation was an unexpected turn, but approval is by no means guaranteed, the person added. ETF filing deadlines The 19b-4 filing is just one part of what’s required. Issuers also need the regulator to sign off on an S-1 registration statement before launching a product. A decision on at least one ethereum spot ETF filing is due by May 23. An SEC spokesperson said the agency doesn’t comment on individual filings.

Social media is abuzz with speculation: “The SEC is more likely to lean toward potential approval, and traders are scrambling to get in positions now that many have completely ruled out approval,” said analyst Chris Newhouse.

Ethereum is the native token of the Ethereum blockchain, the most important commercial highway in cryptocurrency. The network is popular in decentralized financial services, where investors trade, borrow and lend through automated software protocols rather than traditional intermediaries.

Approval rate rises

On Monday, Bloomberg Intelligence ETF analyst Eric Balchunas said he and colleague James Seyffart had raised their estimated probability of approval for a spot Ethereum ETF from 25% to 75%.

Some fund companies had expected to be rejected because their private negotiations with the SEC were not going well compared to the run-up to the launch of a spot Bitcoin ETF, Bloomberg News reported on Friday, citing two people familiar with the matter.

The caution of some investors remains evident. Ravi Doshi, head of markets at FalconX, said the firm’s “derivatives desk has seen most of our counterparties downplay the move and expects the SEC to move slower than the market expects.”

The skeptical SEC, which had been cracking down on cryptocurrencies, reluctantly acquiesced to a U.S. spot bitcoin ETF earlier this year after a 2023 reversal. Products from firms like BlackRock Inc. and Fidelity Investments have amassed $58 billion in assets, one of the fund category’s most successful debuts ever.

BlackRock and Fidelity are also looking to launch ethereum funds. The digital asset industry sees U.S. ETFs as a way to broaden the investor base for cryptocurrencies. Retail investors, hedge funds, pension funds and banks have all poured money into bitcoin funds — Millennium Management, Steven Cohen’s Point72 Asset Management and Elliott Investment Management are notable buyers.

Huang Bo

Huang Bo