Background: Ethereum May Have Its Own Highlight in 2025 Is Ethereum worth investing in? If this question were posed in 2024, it would have been an extremely challenging one. However, in 2025, thanks to factors such as the Federal Reserve's second-half interest rate cut, the Trump administration's deregulatory and crypto-friendly policies, and the endorsement of key influencers on Wall Street, Ethereum has overcome its long-standing dilemma of not being recognized as a killer application by the traditional world. It has become a hot topic in the crypto and digital asset world, and a hot topic everyone is eager to learn about. In this article, following "Pandu Insight: Bitcoin's Ultimate Vision and Investment Logic," Pandu continues to share the company's 2025 (Part 3) and medium- to long-term investment logic for Ethereum, providing investors with greater confidence and better judgment on how or whether to invest in Ethereum.

Picture: Coinbase The CEO published a report comparing investment returns across various asset classes, with Ethereum and Bitcoin significantly outperforming the S&P 500 and gold. (Past performance is not indicative of future performance; content is current as of the evening of August 14, 2025.) I. The Origin and Mechanism of Ethereum Ethereum's white paper (note) was originally published by Canadian-based Vitalik Buterin in 2013, and the platform officially launched in 2015. Ethereum founder Vitalik Buterin reportedly spent his youth obsessed with World of Warcraft. Blizzard's update deleted his character's core abilities. After repeated email protests, Buterin realized the hegemony of centralized systems (developers can arbitrarily change rules, leaving players powerless). This prompted him to abandon gaming and focus on decentralized technologies, inspiring his later vision for Ethereum. 1. Ethereum Focuses on Usage, Addressing Bitcoin's Shortcomings Ether, the currency we often hear about, is the native cryptocurrency of the Ethereum blockchain network. Ethereum was created primarily to provide programmers with a more convenient programming environment, enabling more flexible development of various blockchain-based applications through methods such as smart contracts. Ethereum's operating mechanism differs significantly from Bitcoin, and its original purpose was to address Bitcoin's scalability shortcomings. Ethereum was created to support the development and use of applications based on blockchain technology. For example, non-fungible tokens (NFTs), which have garnered widespread attention in recent years, are an application of Ethereum. There are also similar applications such as decentralized finance (DeFi) and decentralized applications (DApps). (See attached page.) It's important to note that all activities related to application development and operation on the Ethereum network require the consumption of Ether. The emphasis here on "consumption" rather than "use" means that once Ether is used, it ceases to exist. Investors can also choose to hold Ether as an asset, hoping for its value to appreciate. This unique property distinguishes Ether from traditional currencies, making it more like a consumable resource, similar to oil in industrial society: oil can be hoarded and traded, but its primary function is to be consumed as energy to drive production.

![]()

Second, Underlying Investment Logic: The Biggest Beneficiary of Blockchain Development

Ether is essentially a consumable commodity, just like oil. Under normal circumstances, you wouldn't see people trading oil for profit. If you do buy oil, you're hoping for genuine economic development, with more and more people using it. This will naturally lead to rising prices, and you'll be able to profit.

Source: Bloomberg Finance, compiled by Pan Du, 2018 to August 14, 2025

Proven stability: Over the years, Ethereum has weathered numerous hacking attacks, splits, and other challenges, yet remains secure and reliable. Its security and trust foundation are solid. Ethereum's authentication mechanism is the most widely recognized of all blockchains. If you want to develop new blockchain applications, you can rely on Ethereum's already established, trusted authentication infrastructure.

In summary, Ethereum is more of a tool for continuous value creation. The more value it creates, the more valuable it becomes. And it creates value by continuously developing new applications and engaging more people. From this perspective, as long as the blockchain industry continues to develop, Ethereum will be the biggest beneficiary, bar none. And Ether is the best investment medium for our overall blockchain development strategy.

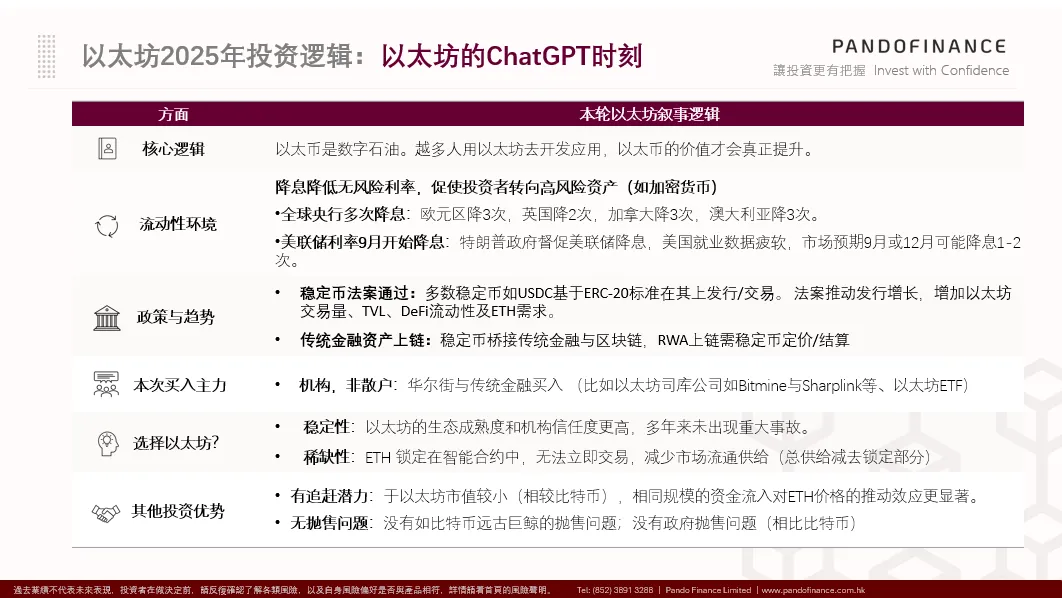

Third, 2025 is Ethereum's Chat GPT Moment

Looking back at this year's market dynamics, Ethereum has performed particularly well. Pan Du believes that despite Ethereum's rapid short-term gains, this is all due to long-term investment logic driven by a combination of short-term policies and grand narratives, including its own Pectra upgrade and the expansion of Layer 2 solutions. More importantly, as mentioned above, Ethereum is often hailed as "digital oil," and its value proposition is built on its growing practicality. Stablecoins and Wall Street's narrative of bringing traditional assets onto blockchains have put Ethereum investments on the table for traditional investors. Investment banks predicting a 70% compound growth rate for stablecoins over the next three years make this an irresistible investment opportunity. Tom Lee, Chief Investment Officer of Wall Street firm Fundstrat, called stablecoins Ethereum's Chat GPT moment, implying that it has finally arrived at its moment of glory. The global macroeconomic environment provides crucial support for this bullish narrative. In 2025, global central banks adopted easing policies, cutting interest rates and reducing the appeal of high-risk assets, steering investors toward higher-risk opportunities such as cryptocurrencies or small- and mid-cap stocks. As of August 15, 2025, the US Federal Reserve is expected to begin cutting interest rates in September. Driven by pressure from the Trump administration and weak employment data, market rumors suggest one or two more rate cuts are possible before December. The passage of the GENIUS Act, a stablecoin bill, is a significant catalyst, significantly boosting the expected growth in stablecoin issuance. Most current stablecoins, such as USDC, are based on the ERC-20 standard, making Ethereum their primary platform. This has led to increased trading volume, a rise in total value locked (TVL), and a corresponding increase in potential future ETH demand. Furthermore, stablecoins bridge the gap between traditional finance and blockchain technology, and RWA tokenization requires stablecoins for pricing and settlement. This fusion of traditional and decentralized finance highlights the continued growth of the Ethereum ecosystem.

![]()

Source: Pandu Finance, August 2025

IV. Investment Risks of Ethereum

V. Conclusion

Overall, the convergence of loose monetary policy, the stablecoin boom, institutional adoption, and technological advancement creates a strong bull market outlook for Ethereum. Many investment banks believe a price target exceeding $10,000 is imminent. Investors should seriously consider whether Ethereum's compelling narrative is the sole criterion for their portfolios. They should also continue to monitor the implementation of monetary policy, stablecoins, and on-chain assets. Pandu will continue to provide investors with relevant coverage of Ethereum.

Anais

Anais