Author: Marcel Pechman, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

ETH took a hit on February 3 and has struggled to stay above $2,800 since then. Ethereum has fallen 24.5% in the past 30 days, while the cryptocurrency market capitalization has fallen 10% over the same period. This performance has disappointed investors, and some have begun to question whether ETH has enough momentum to return to bullish territory.

The ETH futures market currently shows the lowest level of optimism among professional traders in more than a month. This development has raised concerns about whether Ethereum can recover to $3,400 in the short term.

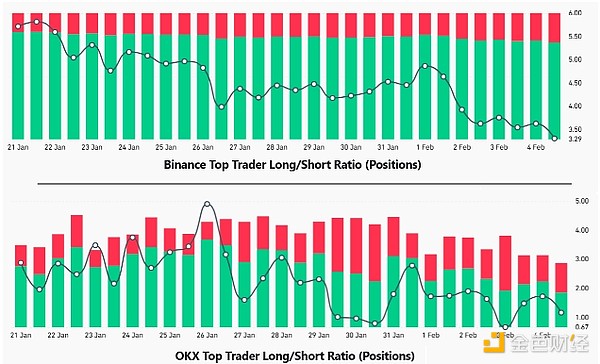

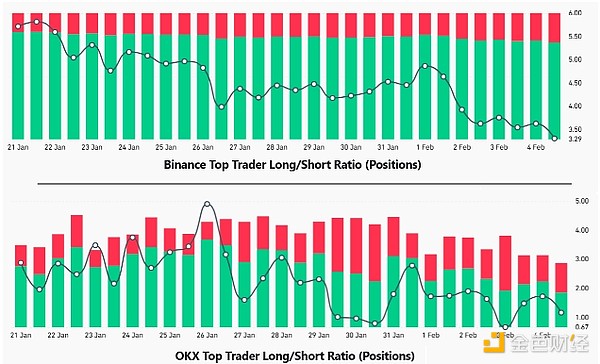

ETH top traders' long-to-short ratio. Source: CoinGlass

A higher long-to-short ratio generally indicates that traders prefer long (buy) positions, while a lower ratio indicates that traders favor short (sell) contracts. Currently, Binance's top ETH traders report a long-to-short ratio of 3.3x, which is much lower than the previous two-week average of 4.4x. On OKX, the ratio is 1.2x, while the two-week average is 2.2x.

Part of Ethereum’s recent underperformance can be attributed to increased competition. However, Ethereum’s monetary policy and ongoing scalability controversy also play a role.

Over the past 30 days, Ethereum’s supply has grown at an annualized rate of 0.5%. The trend reflects low demand for the blockchain space and is driven by the adoption of layer 2 scaling solutions.

The Ethereum Foundation has been strongly criticized for its limited involvement in several key ecosystem projects. Several long-time developers have publicly expressed their dissatisfaction, prompting Ethereum co-founder Vitalik Buterin to assert sole authority over the Ethereum Foundation on January 21.

On the positive side, inflows into spot ETH exchange-traded funds (ETFs) and World Liberty Financial’s recent purchase of ETH suggest that buyers remain interested. Since January 30, U.S. spot Ethereum ETFs have seen net inflows of $487 million, a sharp reversal from the $147 million net outflows seen in the previous four trading days.

World Liberty Financial, a tokenized digital asset project backed by the Trump family, acquired another $10 million worth of Ethereum on January 31, according to Arkham Intelligence. As of February 5, the company's holdings reached 66,239 ETH, worth $182 million, making it its largest position, surpassing Wrapped Bitcoin (WBTC) and other altcoins.

Ether derivatives premium drops to 7% after leverage demand falls

To determine whether whales and market makers are bearish on Ethereum, analysts should look at the ETF monthly futures market. These contracts typically trade at a 5% to 10% premium to the spot market to compensate for the long settlement period. Ethereum 2-month futures annualized premium. Source: Laevitas.ch Ethereum derivatives markets reinforced this sentiment, with premiums falling to 7% from 10% on February 2. Although still in neutral territory, there is less demand for leveraged long positions among professional traders. More notably, even during the February 3 crash, the ETH futures premium remained above the 5% threshold for a bear market.

There is no clear evidence in the ETH derivatives market that whales have turned bearish or given up hope for further bullish momentum. Meanwhile, increased competition from Solana and Hyperliquid has led investors to reassess Ether’s upside potential. Investors also appear reluctant to add to bullish positions ahead of the upcoming “Pectra” upgrade as its direct benefits to regular users remain uncertain.

Ultimately, the current price of $2,800 appears to offer a reasonable entry point given Ethereum’s leading position in total value locked (TVL) and growing institutional demand. The ability to reclaim the $3,400 level depends on clearer interest from ETH stakers and long-term investors.

Alex

Alex