Author: Blockchain evangelist Gulu, DeGate

I think the final outcome of the crypto industry in the financial field is to form a large-scale, efficient, neutral asset platform that serves all mankind. "Internet Financial Center". I will divide it into two articles to explain respectively: 1) Why only a sufficiently decentralized blockchain with sufficient freight volume can build such an Internet financial center; 2) Why an Internet financial center based on blockchain It is particularly needed in our time, and what it will probably look like in the future.

The Internet Financial Center is built on the blockchain protocol and is the infrastructure of global finance. It has billions of direct and indirect users and an asset scale of at least tens of trillions of dollars. A variety of assets are issued on the Internet Financial Center. The assets are on the blockchain, so they naturally have "necessary" attributes. Spending is carried out day and night on the efficient blockchain: transfer (Transfer), transaction (Trade) , because of mortgages, reserve portfolios, dismantling points, issuing derivatives as underlying assets, etc.

Why is blockchain valuable?

Why is blockchain valuable? This is a question that all crypto asset investors have asked. The accepted answer in the crypto industry is: because of decentralization. I think this answer is correct, but when we talk about "decentralization", what exactly are we talking about?

I think that "decentralization" is the means, and the end is "Trustless".

So, what is trustless?

First of all, speaking is trust. When you give others trust, you give them the power to attack you. "Power" (Power), and at the same time have positive expectations for the other party, thinking that the other party will not hurt you. People first deposit gold into the vault in their hands, and the vault gives a depository receipt, promising that as long as you have the voucher to withdraw it, the vault will The gold must be returned to you. You have caused harm to the treasury, and the treasury can now treat you. It has the ability not to return the gold to you, but you think it should be no problem, and the treasury should return it to you. Everyone knows what happened later, and the treasury discovered It was impossible for all depositors to withdraw their gold at the same time, so part of the gold was lent out to earn interest. This eventually developed into a "fractional reserve" gold system. The vaults were built into banks, and then bank run crises were staged again and again. In 1971, the promise of exchange between the US dollar and gold was broken, the "depositary receipts" were directly invalidated, and the "sentence" became the nameless "US dollar". From then on, legal currency became a wild horse and entered the era of wanton issuance of legal currency. The era of credit currency.

What is trustless? Trust-free means that you don’t need to give the other party the power to hurt you. Then "trust-free service" means that you can still get services without giving the service provider the power to harm you. Blockchain provides trustless services. In the blockchain world, as long as you hold your own private key, no one can steal or freeze your BTC or ETH; as long as you pay the blockchain mining fee, you can definitely send the coins to any address. Yes, no one can hurt you. These trust-free value services are realized through decentralized means and are the core provided by the blockchain. Trust-free services are particularly suitable for applications in the financial field. Services include: issuance of assets (BTC, ETH) according to pre-agreed rules; various consumption of assets, such as transfers, transactions, mortgages, etc.

Malaysia’s traditional financial centers, such as New York, London, and Singapore, are all built on a strong foundation without exception, because under the traditional model, only a good foundation can provide sufficient trust: You have money in the bank, and if others take it away or freeze it, they will be punished by law, so you believe that they will not become it. This belongs to the rule of "Don't be evil", which does not mean that they "can't do evil" (Can't be evil). The former financial center can become a "financial ruin" because they are capable of doing evil, just like today Hong Kong is undergoing a transformation.

Trust is naturally fragile. It can go without problems for a long time, but once something goes wrong, the party giving the trust may suffer huge losses, just like in 2013 Those big-money Halloweeners who had their hair cut during the banking crisis; just like the people who held gold exchange certificates (equivalent to) in 1971; just like people who leave Hong Kong now can't get their nationality back, but after all, Hong Kong law stipulates It can be retrieved.

On the contrary, trust-free is naturally anti-fragile and solid, because there is no right to harm the other party from the beginning. Blockchain achieves "the inability to do evil" through decentralization (Can't be evil), what is given is a step further, that is, they "don't know where the cleverness is" compared to them, and an Internet financial center was established while "talking and laughing".

Blockchain 10 times better!

Peter Thiel mentioned in the book "From 0 to 1" that if a new product is more than 10 times better than the old product, then the new product will sweep by like a storm. market, users will migrate on a large scale. In terms of creating an Internet financial center, I think blockchain is more than 10 times better than traditional methods: 1) In terms of providing trust, "trust-free" is more than 10 times better than "trust"; 2 ) Creating an address on the blockchain is more than 10 times easier than flying to Switzerland to open a bank account; 3) An efficient global financial platform established on the blockchain will have a huge "network effect" and bring Huge efficiency, more than 10 times better than traditional financial infrastructure at this point. Have you ever had the feeling that after using blockchain, you will never go back to using a bank? I will expand on why such an Internet financial center is built based on blockchain, and why it is the call of our times, in the (part two) of this series of articles. Next, discuss: Why a blockchain is based on Ethereum.

The blockchain to build an Internet financial center must be: (A) decentralized enough; (B) able to provide sufficient goods and services. These two points must be satisfied at the same time, and one is indispensable. In my humble opinion, Ethereum is the only entrant on the scene.

Must be sufficiently decentralized? Looking back at our discussion above, the attribute of decentralization provides trust-free services, and trust-free services are the basis of why the Internet Financial Center is here. Why is trust, or “trustlessness” so important?

Imagine if the Bitcoin blockchain was not decentralized, but ran on a centralized server, then:

Satoshi Nakamoto needs to open an account on the Bitcoin network for each user. When opening an account, Satoshi Nakamoto needs to review the last uploaded user’s ID, home address proof and other documents.

Satoshi Nakamoto will ask you, where did your BTC come from? Please provide proof of funds!

Satoshi Nakamoto wants to apply for operating licenses from governments of various countries.

Satoshi Nakamoto should report various suspicious transactions to governments of various countries.

Satoshi Nakamoto wants to provide tax-related information to the governments.

Satoshi Nakamoto must accept instructions from various governments to freeze BTC, and sometimes transfer frozen BTC to designated accounts.

Satoshi Nakamoto may receive instructions from the US government - please freeze the BTC of the Russian Central Bank. So what will Satoshi Nakamoto do? After all, Satoshi Nakamoto also applied for an operating license in Russia.

Satoshi Nakamoto received another instruction: Let’s do a “quantification” of BTC. Please help us print 700 billion BTC first. Thank you.

Satoshi Nakamoto realized that a single server could not run the Bitcoin network. So, obviously why would a decentralized network suffice? Because decentralization is an "army", it provides the blockchain network with a similar "sovereign independence" that serves the nature of the country, thereby providing neutral, independent, and predictable security services for the Internet financial center.

Indeed, the blockchain network is much like a country and provides services to the government in some aspects, especially in protecting property rights, which is more than 10 times better.

First, let’s talk about why do people need the government? What should the government do for people? John Locke, the pioneer of the Enlightenment in the 17th century, elaborated in "Treatise of Government": "Everyone has inherent natural rights, including the right to life," the right to survival, the right to liberty, the right to property, etc. These natural rights are not granted by the government. It's something that people are born with. So people want to transfer some of their rights to society, and form a government to protect these natural rights; if a government deprives people of these inherent rights, then it is evil. ”

Are there many governments in the world? A lot! And they have been increasing in the past few decades, especially when it comes to protecting property rights. This is the background of the birth of Bitcoin. The block reads: "Times 03/Jan/2009 Chancellor on brink of Second bailout for Banks", translated into Chinese: "Chancellor on brink of Second bailout for Banks", this sentence is "The Times" in 2009 The title of the front page on January 3.

The independent space built by the blockchain can protect property rights better than the government because centralization provides trust-free decentralization. Blockchain’s group decentralization The nodes form an "army" to build a long-term independent space that lasts for centuries. A large-scale "Internet financial center" for all people will be born here. This independent space, as the name suggests, is independent of the government, but does not undermine the government. And the order it establishes is competitive, providing services and products that are 10 times better in some aspects and establishing a better order.

The government does not like competition because no one likes it. Others compete with themselves. The reason why Switzerland can remain neutral in emergencies is its unique geographical advantages and its powerful army. "Independence" is never obtained by begging, but relies on its own strength to stand firm among the nation-states in the world. The same is true for blockchain. The blockchain where the Internet financial center is located must have a sufficient degree of centralization to realize its own sovereignty and protect an economy worth tens of trillions of dollars. The military must be strong enough to The cost of attacking by potential external attackers (the most powerful governments) is so high that they are willing to coexist. After all, the Internet financial center only provides competitive services and does not threaten the existence of the government itself, nor does it undermine the government. The established order is just like the current offshore financial center.

The second and third-ranked blockchains hide under the halo of the first place, in terms of decentralization and military consumption. Less may be possible, but the economic value of the second and third places will be significantly lower than the first place, because the Internet financial center itself has a network effect, because all applications and all users are willing to collaborate on the same There is harmony on the platform, which is the most efficient for the owners. When I started my business in Shanghai, I could meet four groups of people a day. If I were not in Shanghai, I would not be able to do it. If China’s 1.4 billion people could not be affected by Living in the same city due to physical constraints is optimal for ownership from the perspective of efficiency and collaboration, but the physical world does not have enough "scalability", which is why I think the blockchain High throughput (i.e.: scalability) is crucial to building an Internet financial center, alongside decentralization attributes. The gap between the first and second chain may be the gap between Google and the second search engine .

As a country-like existence, the blockchain’s online public opinion is the country’s constitution. Different from the country, all actions on the blockchain must be subject to "constitutional" review in real time on the consensus points of the entire body. "Unconstitutional" actions will be eliminated from the beginning. From this perspective, fairness and efficiency are also good 10 More than times. As a more efficient order model, blockchain can build the next generation of human systems in some aspects - not relying on the government's "decentralized system" and benefiting all people.

How much decentralization is needed?

If external enemy forces want to attack the blockchain network, the attacker will launch an attack on the public’s “decentralized equity nodes”. For example, the government of a certain country requires the freezing of BTC on a certain address. Therefore, the government wants more than 50% of the voting nodes of the Bitcoin network to reject all "categorically unreasonable" blocks. If these blocks "dare" to contain Any BTC transactions issued by this address. For another example, in order to prevent transactions on Ethereum and thereby combat potential competition, a large cross-border remittance company had to allow more than 1/3 of the mainstream Ethereum nodes to provide denial of service, making it impossible for the Ethereum network to achieve the "ultimate Finality.

There are several ways to launch these attacks, such as: 1) Send a lawyer's letter to the operator of the voting node (well, the law can sometimes be enacted casually); 2) Make the node Internet connection separate; 3) Inject viruses into the devices running nodes; 4) Launch missiles at nodes; 5) Shut down the entire Internet; and so on.

1) The number of nodes is large, and even if a few are knocked down, it will not affect the overall operation of the blockchain network; 2) The nodes are inherently based on the "pseudonym system", looking for the real person behind it, It is not that easy to send a lawyer's letter to them; 3) Nodes are distributed in different jurisdictions around the world, and the laws in each region are different; 4) Becoming and exiting voting nodes are dynamic, and nodes can fight guerrillas.

It can be seen that if there are enough decentralized nodes and the organizational mechanism is good enough, it will not be so easy to defeat this "army". If the attacker's motivation is not strong enough and the attack is important enough, then there is no reason to launch the attack. The motivation for the attack has to do with the size of the blockchain economy itself, as well as the detrimental impact that blockchain has on powerful potential attackers. For the past, the scale of the Internet financial center was larger, which was equivalent to the need for stronger "army" protection; for tonight, blockchain practitioners did not take the initiative to provoke powerful potential attackers. For example, I think that on the blockchain Anonymizing services is unwise for governments, because it will cause a huge impact on the existing national order, so it is likely to trigger a group of government figures to attack.

So, is the degree of decentralization sufficient? Everyone's judgment is different, and this threshold changes dynamically and is related to the statistical degree of the external environment.

We know that the current external environment is not friendly. China has long banned all cryptocurrencies. Many people in the US government do not like the encryption industry. For example, the US Securities Regulatory Commission, in 10 years After being in debt, this year it reluctantly passed the application for a BTC spot ETF.

I think that dozens of nodes are definitely not enough to build an Internet financial center; a few are not necessarily enough; thousands are starting to make people feel reassured. In addition to the number of nodes, the degree of decentralization is also very related to the nature of the nodes themselves. For example, if the hardware requirements for the nodes must be at the data center level, even if there are thousands of nodes, this "army" is still fragile. Yes, because the privacy of nodes is almost non-existent, and the "soldiers" can no longer fight guerrilla warfare. The Ethereum community believes that it is very important to allow ordinary people's computers to run voting nodes, which is an important basis for Ethereum to maintain decentralization.

Another consideration regarding how much decentralization is sufficient is preventing decentralized evil and corruption. If billions of people entrust their inherent property rights to 21 nodes and let them dominate, how can we ensure that they will not corrupt? How can we ensure that "we are not a mine but a people"? Will 21 Nodes cooperate with certain countries to control "capital outflow"? In fact, it is aimed at the greed of your and my blood.

The greed for interests and power is an evolved "initial setting" ", from Louis XIV of the Bourbon dynasty as the "Sun King" of "my country", to the leaders of the revolutionary party who replaced the Bourbon dynasty to maintain Robespierre's personal dictatorship, and then to the realization of personal freedom through the achievements of the French Revolution. The autocratic Napoleon all declares the corruption of human nature. The philosopher king in Plato's "Utopia" does not exist in the "Real State". In the "Real State" there are Robespierre and Napoleon. Therefore, we must sacrifice a certain amount. Efficiency, taking the democratic route of power checks and balances, in the blockchain world is decentralization, so that such a "decentralized system" benefits all mankind.

Throughput is equally important!

To build a blockchain in the Internet financial center, the expansion must be decentralized enough and be able to provide sufficient throughput services. However, before the second-layer technology (Layer2 in Chinese, hereinafter referred to as L2) was proposed, The encryption industry once transcended the popular "Impossible Triangle" argument. This argument holds that scalability, decentralization, and security cannot be achieved at the same time, and only two of the three can be achieved. Obviously, Security cannot be compromised, and one must choose between scalability (ie: high throughput) and decentralization. Therefore, many blockchains have made delay compensation in decentralization in order to achieve performance. For example, now the entire blockchain Blockchain networks only rely on 21 key points of performance disadvantage, as discussed earlier, and I think such compromises have put them out of the race to build an Internet financial center.

Many years ago I believed that this "impossible triangle" statement was wrong because it incorrectly assumed every node Every transaction in the block must be verified one by one, but in fact L2 technology breaks this assumption. There are currently several types of L2 technologies, and they are mixed in concept. Some use bad platforms and deliberately steal concepts, interfere with audiovisuals, and even derive other independent blockchains into Ethereum's L2. In my opinion, the basis for L2’s judgment is very simple: the L2 system is designed to eventually reach the “trust-free” level of L1 (Layer1, the underlying blockchain). L2 is an extension of L1. Whether it together with L1 forms the overall blockchain internal ecology, if it loses the most important "trust-free" attribute after extension, then such an L2 system is not part of the overall blockchain ecology. It cannot provide an independent space for building an Internet financial center, nor can it be called L2. Otherwise, logically speaking, centralized exchanges can also call themselves L2 because you recharge (renamed bridging after changing the concept) to centralization After the exchange, transfers and transactions can also be performed.

Leaving aside those "αL2" systems that call themselves L2, among the real L2 technologies, my most important branch is Rollup technology. The working principle of Rollup technology is that a global transaction resource is compressed into an accounting Rollup transaction and uploaded to the L1 blockchain. There are currently two types of Rollup technologies: Optimistic Rollup and ZK Rollup, both of which break the so-called "Impossible Triangle" in their own ways. Optimistic Rollup ends the verification work that needs to be completed by Ethereum nodes. Anyone can challenge the state of the Optimistic Rollup transaction on Ethereum in a specific period (usually 7 days), and can challenge it in the challenge mechanism. Designing mechanisms to reward those who are motivators for successful challenges properly encourages active public scrutiny and challenges to any mistakes. In ZK Rollup, through the cryptography of zero-knowledge proof, it is mathematically natural that the state after ZK Rollup must be , and zero-knowledge proof technology can also allow Ethereum nodes to spend very little computing resources on A mainstream zipped transaction together for quick verification. I think ZK Rollup technology is magical. In addition to its extremely high compression efficiency, it does a clean and neat job of extending the trustless properties of L1 without adding additional security assumptions that are difficult to evaluate.

“L1+L2” is the future!

In the long run, I think the future of Ethereum will be a combination of "L1 blockchain + L2 system that is equivalent to L1 trustless" (hereinafter referred to as "L1+L2"), especially When ZK Rollup solves the universal smart contract platform technology. This combination not only provides the current degree of decentralization of Ethereum, but also provides high-throughput services, making it the best choice for hosting an Internet financial center with tens of trillions of dollars.

The prospect is bright, but the road is tortuous. There are huge difficulties in the process of reaching the fatal "L1+L2" end point. The most significant challenges are: 1) technical challenges; 2) Abandonment of the “trust-free” philosophy.

L2Beat (L2Beat.com 89) is a very useful website behind a young team with a clear belief in the spirit of decentralization and the concept of "trust-free", which is presented in full detail The situation of various L2 projects (including "true L2" and "pseudo L2") has been analyzed. If you recognize and want to invest in the future of "L1+L2", it is recommended to check out L2Beat frequently, which is very helpful.

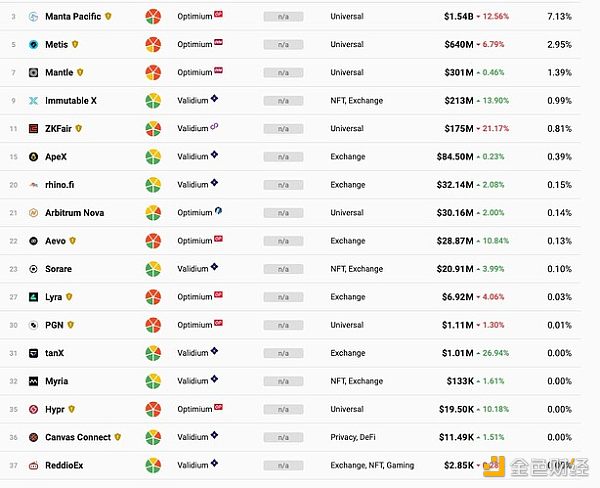

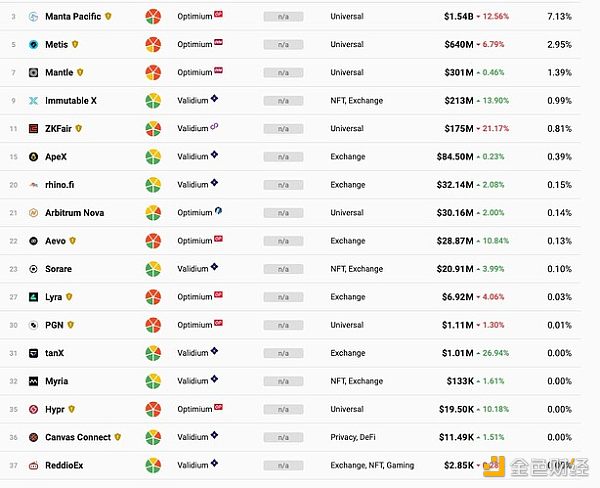

We borrow the information displayed on L2Beat to sort out the huge challenges at this moment. The screenshot below shows all 38 L2 projects currently running on L2Beat, sorted from high to low according to the "STAGE" standard evaluation.

< img src="https://img.jinse.cn/7181179_watermarknone.png" alt="CapturFiles_1927-20" data-base62-sha1="3EFlxlLkcwBNQ2Nxl8kPXQNjLQ5" srcset="https://img.jinse.cn/7181179_watermarknone.png , https://global.discourse-cdn.com/business6/uploads/degate/optimized/1X/199f5a2d29e4b7fab646732eb9d422b4d5bdc091_2_690x750.jpeg 1.5x, https://global.discourse-cdn.com/business6/uploads/degate/optimized/1X /199f5a2d29e4b7fab646732eb9d422b4d5bdc091_2_920x1000.jpeg 2x" data-dominant-color="F1EFEC" loading="lazy">

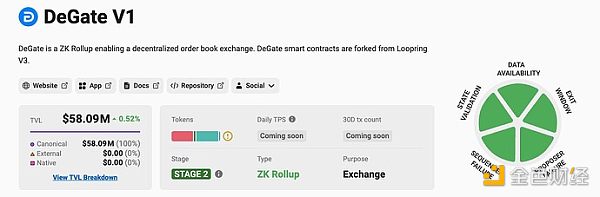

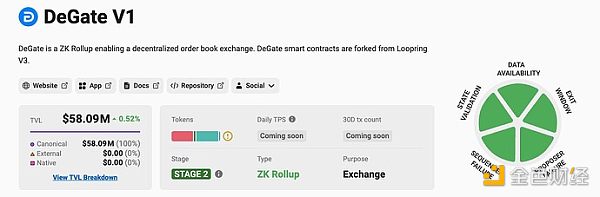

First, let’s introduce L2Beat’s “STAGE” evaluation system. L2Beat judges the degree of "trust-free" completion based on five risk factors, which L2Beat calls "maturity." These five risk factors are (1) status verification (checking of invalid status), (2) sequencer failure (sequencer failure), (3) proposer failure (uplinker failure), (4) exit window ( window period of user attention), (5) data availability (as shown in the figure below, only if all five risk factors are rated green can a STAGE 2 rating be obtained. Currently, only one of all ZK Rollup projects has received a STAGE 2 rating, which is DeGate displayed like this.

In L2Beat's "STAGE" evaluation system, the artwork received The STAGE 2 level must meet the following requirements: provide users with a trust window of at least 30 days. As long as users respond within the window, they can feel the "trust-free" security guarantee of Ethereum L1 level. I think this is The judging criteria are reasonable and in line with the current stage of L2's overall ecological development. I appreciate the L2Beat team's open-air activities, which are conducive to their pursuit of the "trust-free" concept, and also conducive to their adhering to the concept while not being dogmatic or rigid, such as They did not set the evaluation criteria for STAGE2 to have an infinite user period, because this would be too unrealistic and may have a negative impact on the development of the overall L2 ecosystem. After all, the L2 ecosystem is currently in a period of rapid development. For example, Ethereum will implement EIP4844 in 2024, and will introduce a cheaper data type called Blob Data. After implementing EIP4844, I expect the cost of Rollup (i.e. Gas cost) to be reduced by at least 80%, but each In order for the Rollup system to be able to take advantage of the cheaper data services brought by EIP4844, it must be upgradable. Therefore, the user standby period cannot be set to an infinite length. Otherwise, the Blob data of EIP4844 cannot be used through system upgrades and must be re-installed. deployment, then the old Rollup system will be abandoned. After all, the construction that has been invested in the old Rollup system will be abandoned, and the cost for users to migrate all their assets to the new Rollup system is too high and too high. It’s demanding, and I think it’s detrimental to the overall L2 ecological development. Therefore, L2Beat's current evaluation system is reasonable, adhering to the concept, and consistent with reality without being rigid.

Now, let’s discuss the two major challenges in the first challenge: Why is it technically difficult to achieve L2 of “L1 trust-free equivalence”? The core reason is that the L2 system is very complex. The more complex the system, the more difficult it is to achieve safe operation, and the time required to achieve safe operation is quite long. Moreover, both Optimistic Rollup and ZK Rollup are brand-new technologies, especially the zero-knowledge proof used by ZK Rollup, which is very advanced in the cryptography world. In fact, it is the application of ZK Rollup that is rapidly promoting zero-knowledge proof. Development in academia. In the L2 system shown on L2Beat, according to my original system Loopring, which implemented ZK Rollup, it has been at least 5 years since the project was established; it took 3 years to implement DeGate of STAGE 2, and at the same time, 5 rounds of "security audits" and 1 An ongoing "security bug bounty campaign".

Despite the obvious technical difficulties, as I said earlier, I believe the future is bright, because the mature "L1+L2" blockchain system will realize tens of trillions of dollars for the The Internet Financial Center for Human Services currently has 5 projects that have completed STAGE 1 or above on L2Beat. They are DeGate, Fuel, Arbitrum, dYdX, and zkSync. Like them.

The second big challenge is to give up the concept of "trust-free", that is: it is impossible to achieve L1 level "trust-free" in design, which I call "αL2". I guess the biggest motivation here is to reduce gas costs and provide cheaper services. Cost is important, but the core value of "trust-free" cannot be given up as a price. I think such a concession has crossed the bottom line. The price is that these L2 systems cannot become part of the "L1+L2" trust-free system, only "true L2" It has the ability to carry tens of trillions of Internet financial centers together with L1. In addition, "True L2" can also reduce costs in other ways. The biggest cost of "True L2" is the data cost of uplinking to L1. This part will drop significantly after Ethereum implements EIP4844 this year. I expect it can be reduced by at least 80%.

Recently, there has been a discussion on the DA (data availability) layer in the blockchain field. Some people have suggested moving the DA service away from Ethereum and switching to other cheaper data services. If the DA service is moved out of Ethereum, the Rollup system can still maintain the L1 level "trust-free" attribute in design, and I would like to support Baidu. In fact, there is indeed such a solution (see Faust, geek web3's article) 19), there are also excellent teams actively exploring and practicing. However, recent discussions actually require abandoning the "trust-free" level of L1α and downgrading L2 to "L2" for the sake of upfront costs.

I believe that all L2 people who make financial applications aim to be large-scale and eventually become important members of the "L1+L2" system. So, should we abandon the L1 level in design from the beginning? "Trust-free", think clearly, because wearing a "gold necklace" that will rust around your neck is not a gold necklace. I think giving up "trust-free" will seriously hinder "αL2" from scaling up. Among the 38 L2 projects currently running on L2Beat, the funding scale of "True L2" is more than 10 times that of "αL2". It can be seen that the market Yes, everyone cares about it. Everyone wants to eventually become a "human mine".

Summary

To summarize, the paper discusses:

Why blockchain is valuable ? Because of decentralization.

Decentralization is the "army", the purpose is to achieve "trust-free".

Only a strong enough "army" can provide protection for the Internet financial center.

Elaborates how much decentralization is sufficient.

The blockchain to build an Internet financial center must meet (A) sufficient centralization; (B) provide sufficient goods and services. Currently, the only players who are going to Ethereum are online at the same time.

Explains how L2 breaks the "impossible triangle of blockchain".

The judgment scores of "True L2" and "αL2" are given. Money is smart, and the market chose "True L2".

In the next article, I will explain why the Internet financial center based on blockchain is particularly needed in our era and is very marketable. What will it probably look like in the future? Something like that.

JinseFinance

JinseFinance