Author: Yashu Gola Source: cointelegraph Translation: Shan Ouba, Golden Finance

Ethereum's native token ETH has entered the oversold zone several times recently, but it still shows no signs of bottoming out. The current trading situation is similar to a similar situation in history, and the market structure suggests that ETH may repeat this trend in the second to third quarters of 2024.

Ethereum has broken down repeatedly, and there may still be room for downside

On the 3-day candlestick chart, ETH's relative strength index (RSI) is still below 30, which usually indicates a potential rebound opportunity.

However, historical data shows that after ETH entered the oversold zone, it failed to form a clear bottom, but continued to decline, indicating that the market is still dominated by shorts.

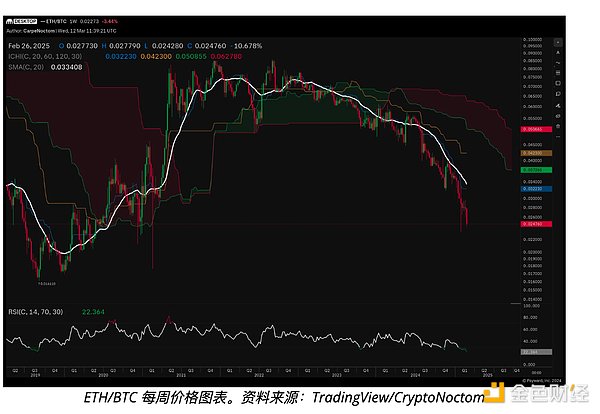

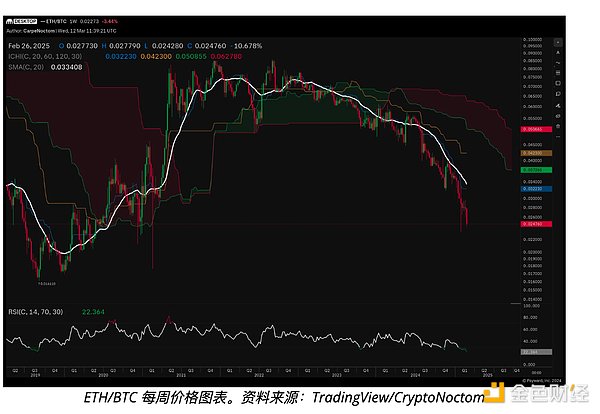

Since mid-2024, the ETH/BTC trading pair has broken down several times, with declines of 13%, 21%, 25% and 19.5% respectively, showing a serial decline trend. In addition, both the 50-day and 200-day exponential moving averages (EMAs) are trending down, further confirming the lack of upward momentum in the market.

X platform market analyst @CarpeNoctom pointed out that the negative price performance of the ETH/BTC trading pair has not yet formed a bullish divergence (that is, the price has reached a new low but the RSI has formed a higher low), further weakening market confidence.

ETH ETF outflows and on-chain data show further weakness

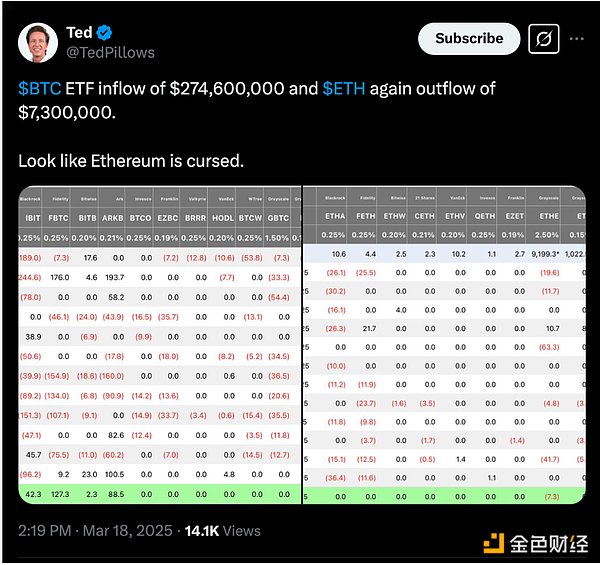

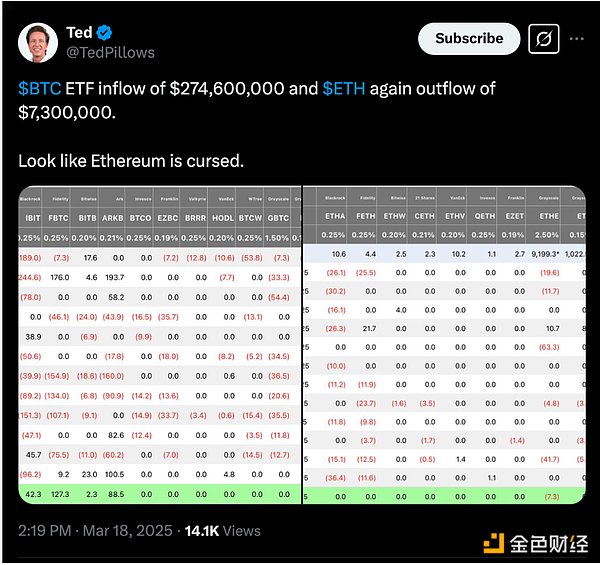

ETH/BTC's "cursed" downward trend is particularly prominent in the entire crypto market, especially in terms of US spot ETH ETF outflows and negative on-chain data.

In March 2024, net inflows into spot Ethereum ETFs fell by 9.8% to $2.54 billion. In contrast, net inflows into spot Bitcoin ETFs fell by only 2.35% to remain at $35.74 billion.

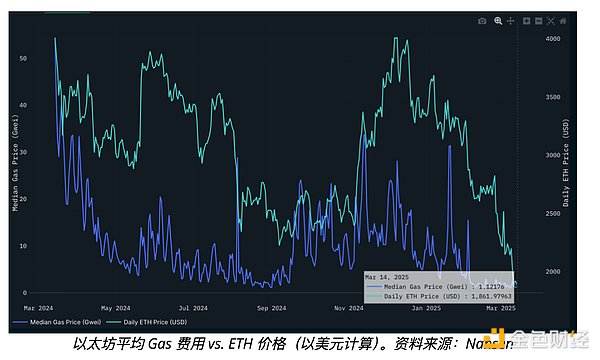

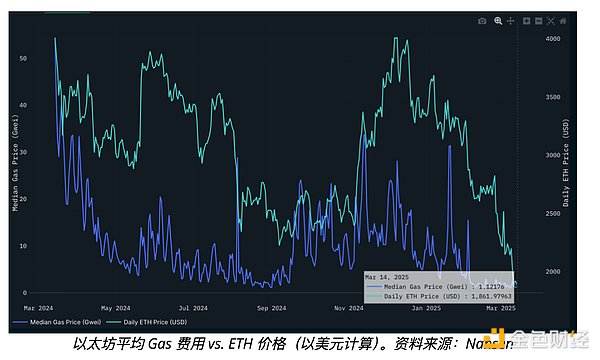

At the same time, the Ethereum mainnet's average daily gas fee (calculated by median) has dropped to 1.12 GWEI, a nearly 50 times drop compared to the same period in 2023.

Data analysis platform Nansen pointed out in its latest report: "Although ETH ushered in a second round of increases at the end of 2024, mainnet activity (measured by Gas consumption) has never recovered."

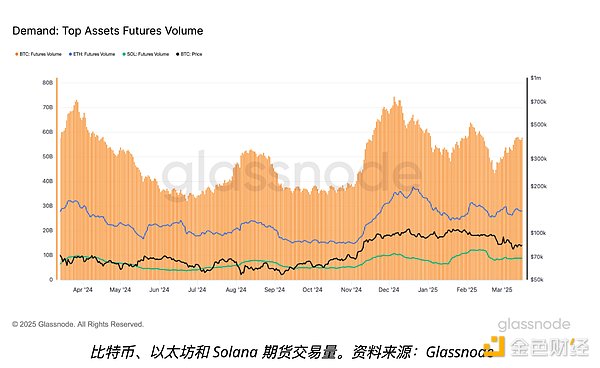

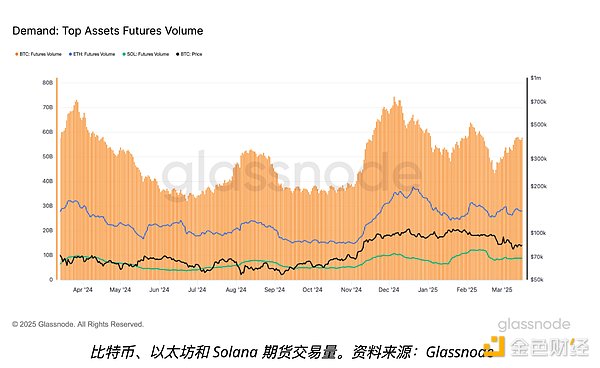

Nansen believes that the decline in mainnet transaction activity is mainly affected by the transfer of funds and users to Solana and the second-layer network (L2s), and said that the risk/return ratio of ETH is inferior to that of BTC In addition, the weak demand for ETH compared to BTC is also reflected in the futures trading volume: Bitcoin futures trading volume rebounded by 32% from the low point on February 23, reaching $57 billion as of March 18. Ethereum trading volume has basically stagnated, with no significant growth (data source: Glassnode).

ETH/BTC may fall another 15%

The ETH/BTC trading pair is forming a bear flag pattern on the daily chart. This pattern usually appears in the consolidation stage after a sharp decline, showing a converging trend line.

From a technical point of view, once the bear flag pattern breaks through the lower track support line, the price usually falls to a height equivalent to the previous decline. According to this rule, the downside target price of ETH/BTC in April is 0.01968 BTC, which is 15% lower than the current level.

In addition, the ETH/BTC trading pair is well below the 50-day and 200-day exponential moving averages (EMAs), and these two key moving averages are still steeply declining, indicating that the market is still in a persistent bear market structure.

Although the risk of downside still exists, if ETH/BTC breaks through the upper resistance of the bear flag pattern and successfully converts the 50-day EMA into support, it may invalidate the current bearish trend and the market is expected to rebound.

Joy

Joy