Author: Mu Mu; Plain Language Blockchain

Recently, Uniswap Labs officially launched Unichain, an Ethereum Layer2 network based on OP Stack, and launched the test network. As the mainstay of the Ethereum ecosystem and DeFi field, the crypto community has paid close attention to Uniswap's important progress. Vitalik and other KOLs have expressed different opinions, but the most concerned about this matter may be those old Ethereum FUDers, who have begun to analyze the death countdown of ETH after the "defection of the largest DApp in Ethereum"...

01Is Unichain really the "defection" route of Uniswap?

According to official information, the purpose of Unichain's launch is mainly to solve some challenges of DeFi, such as: cost, efficiency and liquidity separation of seamless cross-chain swap requirements. Simply put, the Uniswap project will continue to improve the user experience and competitiveness of its own products by customizing a unique Layer2 network.

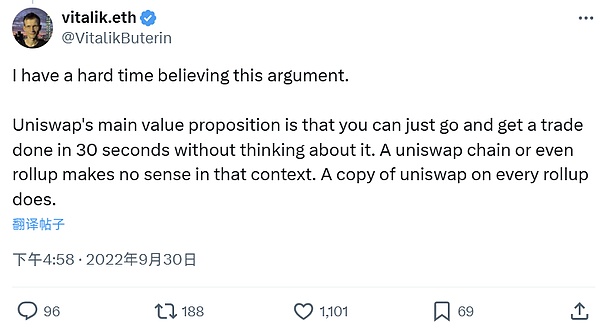

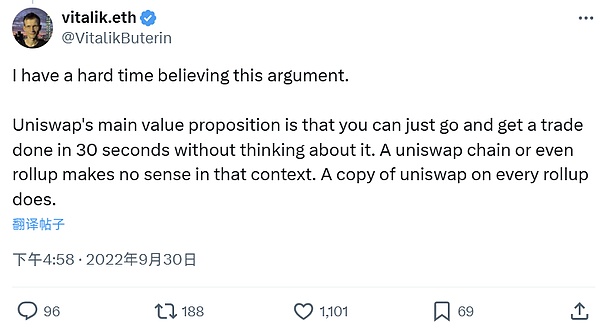

In this regard, the comments made by various KOLs are mixed. In addition to the relatively positive views, the more eye-catching may be the opposition of vitalik and others.In fact, as early as 2022, Vitalik commented on the opposition to the Unichain concept on social networks. He said: "The main value proposition of Uniswap is that you can complete transactions in 30 seconds without thinking too much. In this case, the Uniswap chain and even Rollup are meaningless. It only makes sense to have a copy of Uniswap on each Rollup."

In general, the views of opponents such as Vitalik mainly believe that Uniswap should focus on successful application areas and be deployed on the mainnet and each Layer2 as the most successful DeFi application, rather than distracting attention to developing (reinventing the wheel) a new chain. Of course, the background two years ago was that the Layer2 solution had not yet been implemented. If UniChain was proposed at that time, it would definitely be an independent application chain, not a Layer2 chain. Therefore, Vitalik and other KOLs in the Ethereum crypto community strongly opposed it at that time.

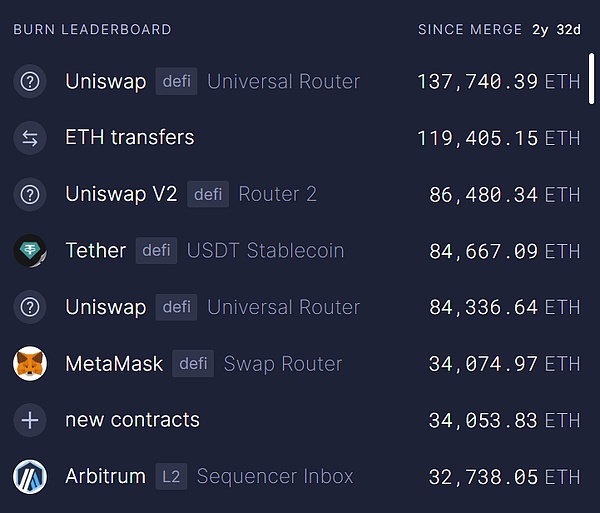

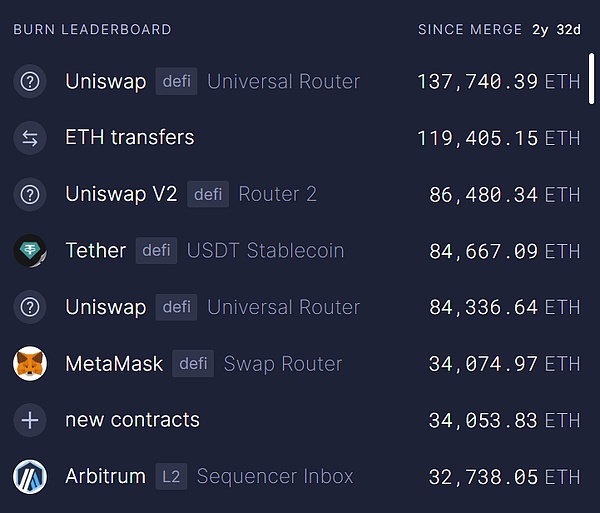

Compared with the opposition within the community, some people outside the Ethereum community who have been pessimistic about Ethereum for many years and often publish ETH FUD analysis seem to have found a new and powerful "argument" here.From the previous point of view that Layer2 sucks blood from Ethereum, they further analyzed that UniChain will be Uniswap's "betrayal" of Ethereum, and believed that the DApp on Ethereum that contributes the most to Gas destruction will take away Ethereum's last income, and Ethereum's Gas fee income will be put on the back burner and finally on the verge of "death".

Ethereum's Burning Ranking since the Merger Source: Ultrasound money

Ethereum's Burning Ranking since the Merger Source: Ultrasound money

Obviously, the launch of UniChain two years later triggered not only extensive discussions within the Ethereum community, but also ran counter to Vitalik's views and was considered a slap in the face of Vitalik by Uniswap. However, compared with the discussions within the community of Vitalik and others, these FUD voices from outside are more likely to be because Ethereum has made too many "enemies" in recent years. The Layer2 route, which was originally not optimistic, has attracted the favor of more and more large companies and institutions. The success of Layer2 has blocked the roads of many cross-chain tracks and some high-performance public chains. Only when the development of Ethereum stagnates can they gain more market space. This is also one of the fundamental reasons why ETH FUD is flying all over the sky.

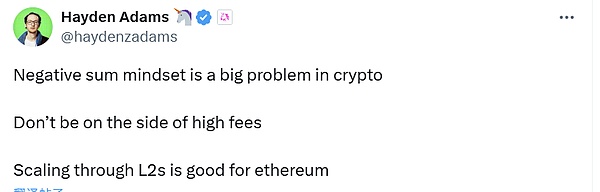

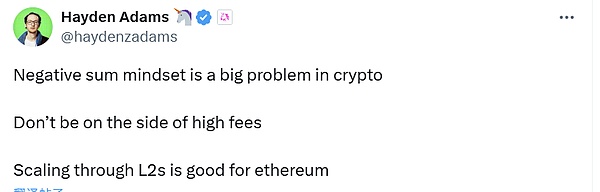

Uniswap founder Hayden Adams recently responded to the controversy and said: "Zero-sum bias is a big problem in the crypto community. Don't stand on the side of high fees. Scaling through L2 is good for Ethereum."

Uniswap founder Hayden Adams recently responded to the controversy and said: "Zero-sum bias is a big problem in the crypto community. Don't stand on the side of high fees. Scaling through L2 is good for Ethereum."

Having said that, the analysis that Unichain is UniSwap's "defection" of Ethereum is a misunderstanding. Although on the surface, a new chain was developed by developing Layer2,but unlike the previous "relocation" of dydx to join the independent application chain camp of the Cosmos ecosystem, UniChain not only stayed in the Ethereum ecosystem, but the Ethereum mainnet is still the most important "battlefield" of Uniswap. Most of the DeFi funds in the entire crypto ecosystem are in Ethereum, and the big funds of big players pursue "security and stability" more. This is one of the reasons why Ethereum is an irreplaceable "wall". The high frequency and timeliness of interaction needs between UniSwap users and dydx users are different. Early deployment of the Ethereum network and rooting in a safe and stable Ethereum ecosystem are also one of the biggest advantages of Uniswap as an important infrastructure of DeFi.

In the foreseeable future, Uniswap on the Ethereum mainnet will still gather more liquidity to meet the large-scale safe Swap of big players, but some small-amount high-frequency transactions need to cross to Layer2 such as UniChain.

To give a simple example, if Ethereum is a huge farmer's market, Uniswap is the most popular vendor with the largest flow of people in a prominent place in the market. As the business is getting better and better, he rented a shop with an independent storefront and a warehouse next to the entrance of the farmer's market. The shop is independent and more spacious, equipped with air conditioning, and customers are more comfortable when shopping. The stalls and shops meet the needs of different customers.

Therefore, the "defection" theory is untenable, and it is impossible to leave. Uniswap still wants to be the most beautiful boy in the Ethereum ecosystem.

02 Why must UniChain be done?

It seems that since someone proposed UniChain two years ago, Uniswap has also made a difficult decision. From the perspective of Vitalik and some people in the Ethereum community, Uniswap is already very successful and does not need to do anything extra. However, from the perspective of the Uniswap community and development team, this may not be the case. At least it has the following sufficient reasons to launch UniChain:

1) Optimize and expand to meet challenges and competition

Although Uniswap is already very successful, it actually faces many challenges and competition in the future of multi-chain (including multi-Layer2). In addition to the advantages of the Ethereum mainnet, in some Layer2 and high-performance EVM chains, for various reasons, many public chains have "local" new DEX brands that occupy the top spot in the DEX track, such as Pancakswap, QuickSwap, etc. At the same time, challenges such as the fragmentation of existing Layer2 liquidity also make it difficult for Uniswap, which is only an upper-layer application, to exert its strength.

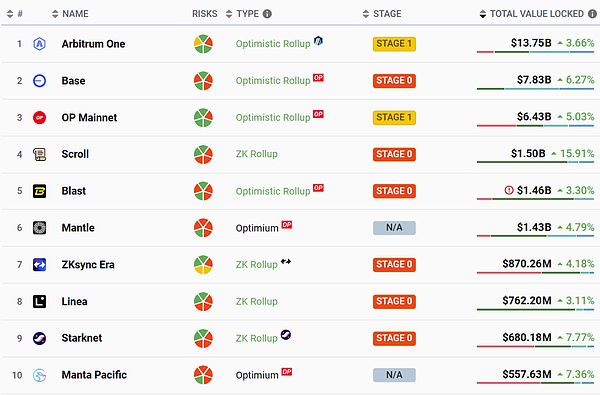

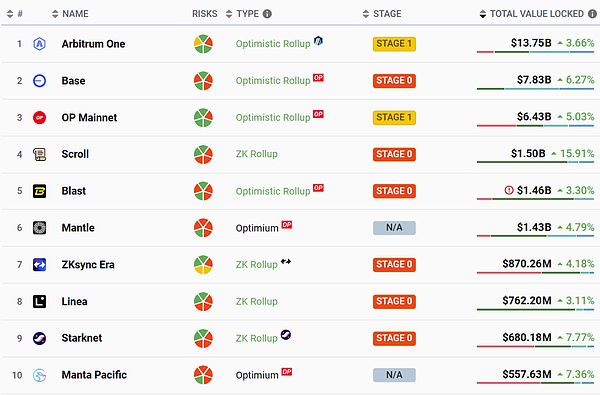

Unichain should have certain considerations in choosing OP Stack as part of the Optimism Superchain. Among the top Rollups in the Layer2 TVL ranking, in addition to OP Mainnet, there are Base and Blast, which have gathered more than 10 billion US dollars in liquidity. In addition, they are deployed and adopted by many crypto-native teams such as SNX, Mantle, and external giants such as Sony. Superchain can be said to have continuous funding and abundant talents. As an "isomorphic" chain, it has consistent R&D paths, shared technologies, and is easier to solve interoperability problems. Currently, UniswapLabs has stated that it is working with OP Labs to achieve native cross-chain interoperability, solve the liquidity fragmentation problem between Layer2, and bring a seamless cross-chain Swap experience.

Source: L2beat

Source: L2beat

In short, by deploying a Layer2 at a lower cost through OP Stack, you can join the Layer2 R&D group, share technical achievements, accelerate the interoperability between Layer2, and solve the big problem of liquidity fragmentation. Of course, problems such as MEV can also be solved through bottom-level customization. These are all things that Uniswap could not control when it was only a Dapp.

2) The inevitable choice after DApp becomes bigger and stronger

DApp deployed on the public chain platform will definitely think about the future development roadmap during its development and growth. In addition to the optimization and expansion mentioned above, there are more demands from the community and pressure from Token empowerment. This is why UNI rose as soon as the news of UniChain came out. In fact, when each DApp grows from a small circle to a huge community, even if the project party does not want to move, the community will push the project party forward. At the same time, the income, talent and technology reserves of high-quality projects are quite sufficient, breaking through bottlenecks and even crossing tracks brings more possibilities, and "becoming bigger and stronger" has become a matter of course.

For example, many offline or online shopping malls will have a large number of brand merchants, such as Uniqlo, Starbucks, KFC, etc. After these brands occupy a certain market share in this track through early settlement, they will often have their own official independent channels, such as independent official malls, official mini-programs, etc., which are different from the form of settlement. Through official independent channels, they have ownership of all data generated by users, flexibility and autonomy, and collect and meet more personalized needs of users through personalized customized marketing activities.

In the future, UniChain may be able to open up differentiated advantages to share the liquidity of the Uniswap protocol, attract more DeFi applications to settle in, and create a unique ecosystem, which is also a beautiful vision.

3) Uniswap: This is my freedom

In the values of crypto openness and freedom, no underlying infrastructure can lock any users and funds like centralized traditional finance, and of course the development team cannot be locked. The multi-chain interoperability ecosystem is still the future.The decentralized Ethereum community will not and cannot force these users and funds to flow freely, and the application ecosystem will flourish, the fittest will survive, and the various products brought by developers will compete freely in the free market.

Whether Unichain is a major strategy of Uniswap or just a "small test", it is the freedom of Uniswap Labs and the Uniswap community, all for the common interests of the community.

03 Is it a good thing or a bad thing for Ethereum?

From the analysis of the wrong interpretation of ETH FUD, Unichain will accelerate the death of Ethereum. Of course, it is actually the opposite. The launch of Unichain is not a bad thing. It can not only promote the solution of the cross-chain liquidity problem of Layer2 in the Ethereum ecosystem and bring prosperity to the ecosystem, but also help the adoption of Layer2 solutions. More big companies like Sony are on the way.

From another perspective, the launch of Unichain is inevitable. Although it brought the opinions of Vitalik and others that it is "unnecessary and not recommended", it directly confirmed the correctness of Ethereum's Layer2 route at that time and the foresight of the Ethereum community development team. Imagine if there are not so many successful and open Layer2 solutions at present, then these Dapps will probably grow up because they cannot tolerate Ethereum's high fees, low efficiency and other problems, and think that there is no future and no development, and directly turn to independent chains to solve the scalability problem by themselves. That is to truly leave the Ethereum ecosystem, and even be forced to go to the opposite side of Ethereum and become an "Ethereum killer".

The current result is the process of self-innovation and transformation of the Ethereum ecosystem. Now is no longer the era of expensive and slow transactions. Applications deployed on the large ecosystem of the Ethereum platform have more and better internal choices. At the same time, they keep their original intentions unchanged, so there is no need to compromise with centralization in exchange for scalability and performance.

04 Summary

In any case, respect the choice of the UniSwap community and hope that UniChain will continue to create a different future for the DeFi track and bring more new possibilities.

ETH FUD often bites the issue of Layer2 reducing and sucking the gas fee of the Ethereum platform. In fact, you only need to figure out this question: Is the value of Ethereum just to collect gas fees? Client wallets and other infrastructure, expansion solutions, application landing, user experience, while always leading encryption innovation, this is the value of Ethereum.

When Ethereum’s gas fee was very high, they said it was bad news; when Layer2 was proposed, they said this route would fail; when Layer2 successfully expanded, gas fees dropped, and they said it sucked Ethereum’s blood, they still said it was bad news... As the founder of Uniswap said, the crypto community is full of zero-sum bias, and some bears don’t even really understand Ethereum, they just stand on different positions. So you must DYOR to avoid being easily misled.

Davin

Davin

Uniswap founder Hayden Adams recently responded to the controversy and said: "Zero-sum bias is a big problem in the crypto community. Don't stand on the side of high fees. Scaling through L2 is good for Ethereum."

Uniswap founder Hayden Adams recently responded to the controversy and said: "Zero-sum bias is a big problem in the crypto community. Don't stand on the side of high fees. Scaling through L2 is good for Ethereum."