Author: Ebunker

ETH/BTC exchange rate & on-chain data comparison

Since 10 month, as of 12 month On the 15th, BTC increased by 57.5%, while ETH increased by 48.34%. While the difference isn't huge, ETH's price performance has been worse than BTC's for close to a year.

BTC ’s strong performance mainly comes from the expectations of BTC spot ETF , the approaching production halving cycle, and the recent rise of BTC ecology. Although there are no similar positive expectations for ETH in the short term, the on-chain data still shows relatively positive signals.

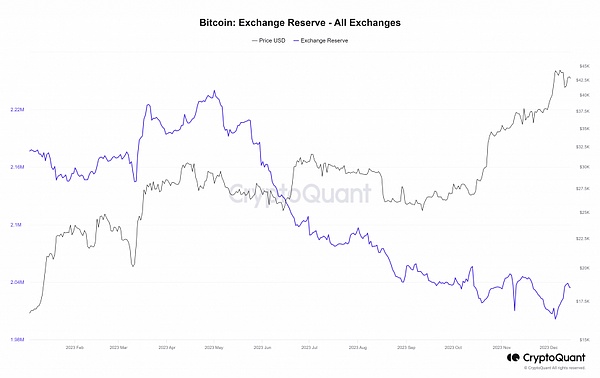

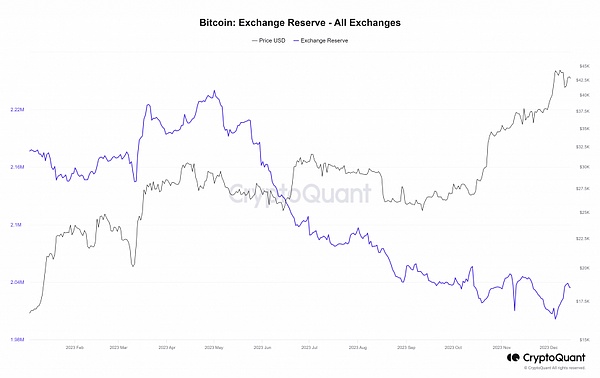

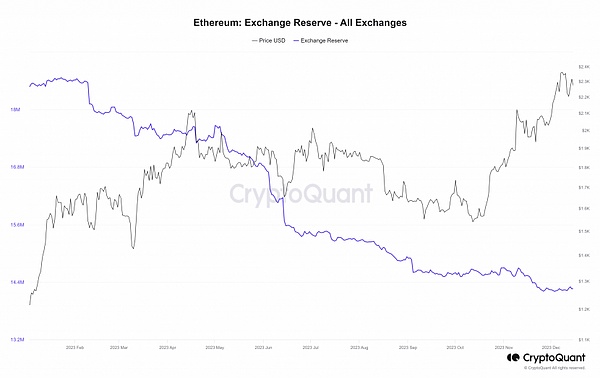

First of all, from the most intuitive perspective of selling pressure, The balance of BTC on the trading platform has been declining since June, but there were obvious signs of rebound from December 5 to December 12. After this peak, the price of BTC fell from as low as $41,000.

Compared to BTC, ETH Balances on the trading platform are less volatile. Since February 2023, the balance of ETH on the trading platform has been in a downward trend. From December 11th to December 13th, the balance of ETH on the trading platform also rebounded slightly, but the rebound occurred during and after the market price fell. This shows that some investors choose to transfer ETH to the trading platform for cash after a short-term market decline.

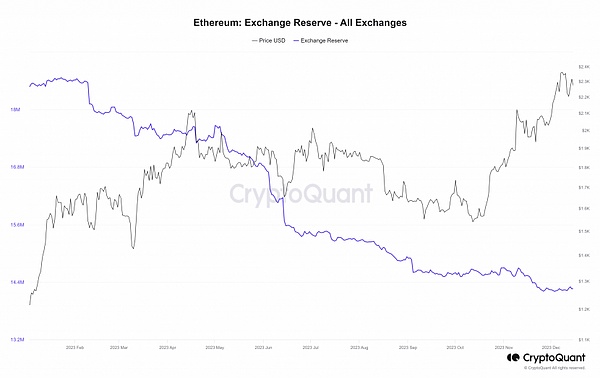

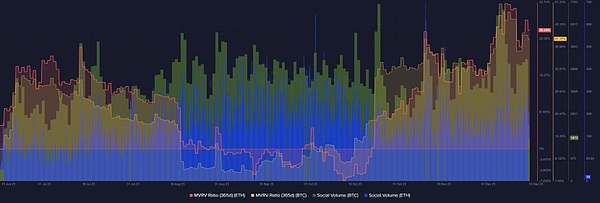

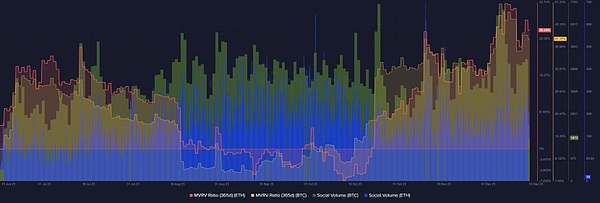

In addition, according to data from the Santiment website, In terms of social popularity, the overall trend of the two is similar, but the popularity of BTC is significantly higher than that of ETH. In terms of MVRV (the ratio of liquid market value to realized market value, often used to evaluate buying and selling pressure), the overall trends of the two are similar, but the magnitude is quite different. As of December 15, BTC was at 41.17%, while ETH was at 26.45%. Both values were at a 6-month high. point.

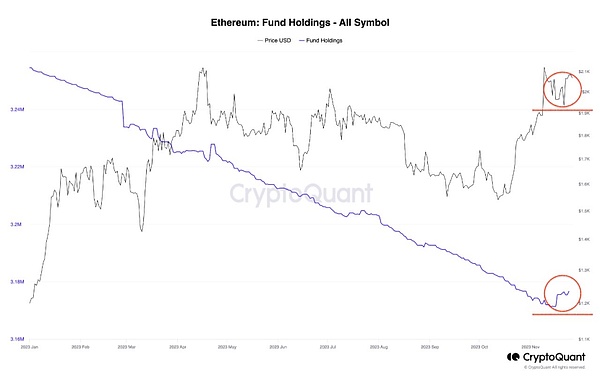

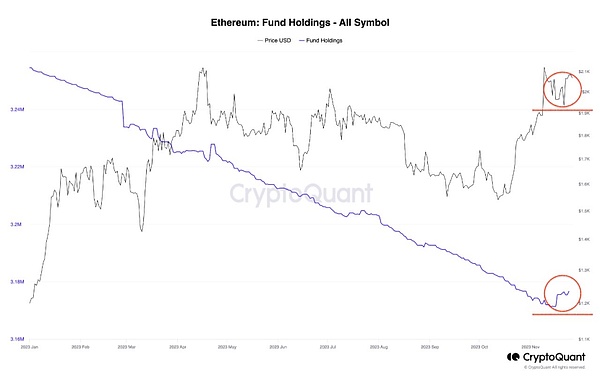

Although Ethereum has not risen as much as Bitcoin recently, Ethereum The trend changes in the retail market in terms of institutional interest are still worth noting, and this phenomenon will become more obvious after November 2023.

According to the chart of the on-chain data website Cryptoquant, some time ago, when the price of Ethereum stabilized at US$1800-1900, there was a significant rebound in the ETH held by institutions. Cryptoquant believes that the recent surge in the number of institutional holdings of ETH indicates the growth of institutional investors' interest and recognition of Ethereum's long-term value and market growth potential. The reason behind this phenomenon is not only the price stability of ETH and the potential expectations of ETH spot ETF, but also the stability of Ethereum's fundamentals and technical upgrades.

JP Morgan made its stance on the cryptocurrency industry clear in its recently released 2024 Financial Outlook report. The report pointed out that although BTC is approaching a production reduction cycle, ETH is expected to perform better than BTC next year. JP Morgan sees the upcoming EIP-4844 upgrade (Proto-dank sharding) as a potential catalyst for its performance, which will improve Ethereum’s network efficiency and scalability, giving it an edge in the market.

On the other hand, the positive factors of BTC production reduction have been realized in advance into the current price. BTC's block reward halving is expected to increase production costs and potentially cause its hash rate to drop by 20%. According to JP Morgan, this could lead to higher operating costs for miners and drive less efficient miners out of the market.

Key steps before Ethereum Dencun upgrade launched

According to the report of the core developer consensus call, end of 2023 , Ethereum developers have finally enabled Dencun, a critical step before the upgrade. Ethereum developers said they will launch the Goerli shadow fork with all clients in the next one to two weeks to test the Cancun/Deneb upgrade.

Testing of the Cancun/ Deneb upgrade on Devnet 12 is ongoing. Currently, all Execution Layer (EL) and Consensus Layer (CL) client combinations (including PRYSM clients) have been loaded into Devnet 12. MEV-BOOST software has been activated for most client combinations (except the PRYSM client combination).

The Dencun upgrade of Ethereum will bring changes to the two main network layers of Ethereum (execution layer and consensus layer). The upgrade of the execution layer is called a Cancun upgrade, and the upgrade of the consensus layer is called a Deneb upgrade, so they are collectively called a Dencun upgrade.

The Dencun upgrade will further expand capacity for ETH and L2 by implementing an improvement proposal called EIP-4844. The Dencun upgrade represents an important milestone in Ethereum's roadmap. After the upgrade is completed, L2's handling fees will be more competitive.

Return L2 functions to L1 by encapsulating zkEVM

Since the L2 network can package transactions together for off-chain processing, and then Bringing transactions back to the main chain, so it's a way to improve Ethereum's scalability, was a focus Vitalik Buterin made at the 2020 conference (when fees on the Ethereum network were skyrocketing).

Recently, Ethereum co-founder Vitalik Buterin believes that as "light clients" become more powerful, returning the functionality of L2 to L1 through encapsulation zkEVM will be the key to Ethereum next step. Vitalik Buterin proposed returning some functionality of the L2 network or rollup to the Ethereum main chain. This method of "encapsulating zkEVM" (zero-knowledge Ethereum Virtual Machine) is consistent with his move of computing load from the Ethereum main chain a few years ago. The opposite view of chain transfer to L2 network.

In a recent blog post, Vitalik Buterin pointed out the importance of light clients, light nodes that strip away client software. These light clients only request data on demand, rather than independently verifying changes to blockchain data by retaining a copy of their data. Typically, light clients or light nodes primarily process block headers and only occasionally download the actual block content.

Vitalik Buterin believes that as their functionality and data increase, these light clients will become more powerful and can even fully verify L1 transactions like L2 networks. At that point, the Ethereum network will effectively have ZK-EVM built-in.

ZK Zero-knowledge proof is a cryptographic protocol that allows one party to prove the correctness of a transaction to another party without providing any specific transaction details. On the other hand, EVM is the virtual machine of Ethereum. Just like a computer is used to execute programs, EVM is actually responsible for executing smart contracts.

Currently, L2 networks (such as Polygon, Scroll, Matter Labs) are using zero-knowledge proofs, and these platforms are the main stakeholders of DeFi. Therefore, Vitalik Buterin's approach to encapsulating zkEVM may take away some steam from these platforms. So, how would the functionality of L2 change if zkEVM were encapsulated and became part of the original Ethereum protocol?

According to Vitalik Buterin, these L2 projects will still be responsible for many important functions. Some of these features include rapid pre-confirmation, MEV mitigation strategies, and extensions to EVM In addition, the method of encapsulating ZKEVM will also address user and developer-oriented convenience. He believes that “the L2 team has done a lot of work to attract users and projects into its ecosystem and make them feel welcome; by capturing MEV and transaction congestion fees in the network, L2 can obtain certain profit compensation . This relationship will continue."

The main highlights of 2024 ETH

The Dencun upgrade will be in Deployed in March or April 2024, through EIP-4844, the gas cost of Ethereum L2 will be greatly reduced, and the scalability of Ethereum will be improved.

Ethereum L2 activity is continuing to grow and has now arrived to an all-time high. According to recent data from L 2B eat the total value of the entire ecosystem is $16 billion.

The current L2 is mainly EVM compatible, such as Arb, OP, Metis and so on. In addition, non-EVM L2s such as Eclipse and Flyent are being launched, which will bring new types of applications and developers. Crypto games will be mainly based on the L2 ecosystem, and wallet user experience will continue to improve, allowing the Ethereum ecosystem to absorb more new users.

Finally, the tokenization of real-world assets has been gaining momentum, bringing more “old world” financial products to the Ethereum blockchain.

Cheng Yuan

Cheng Yuan